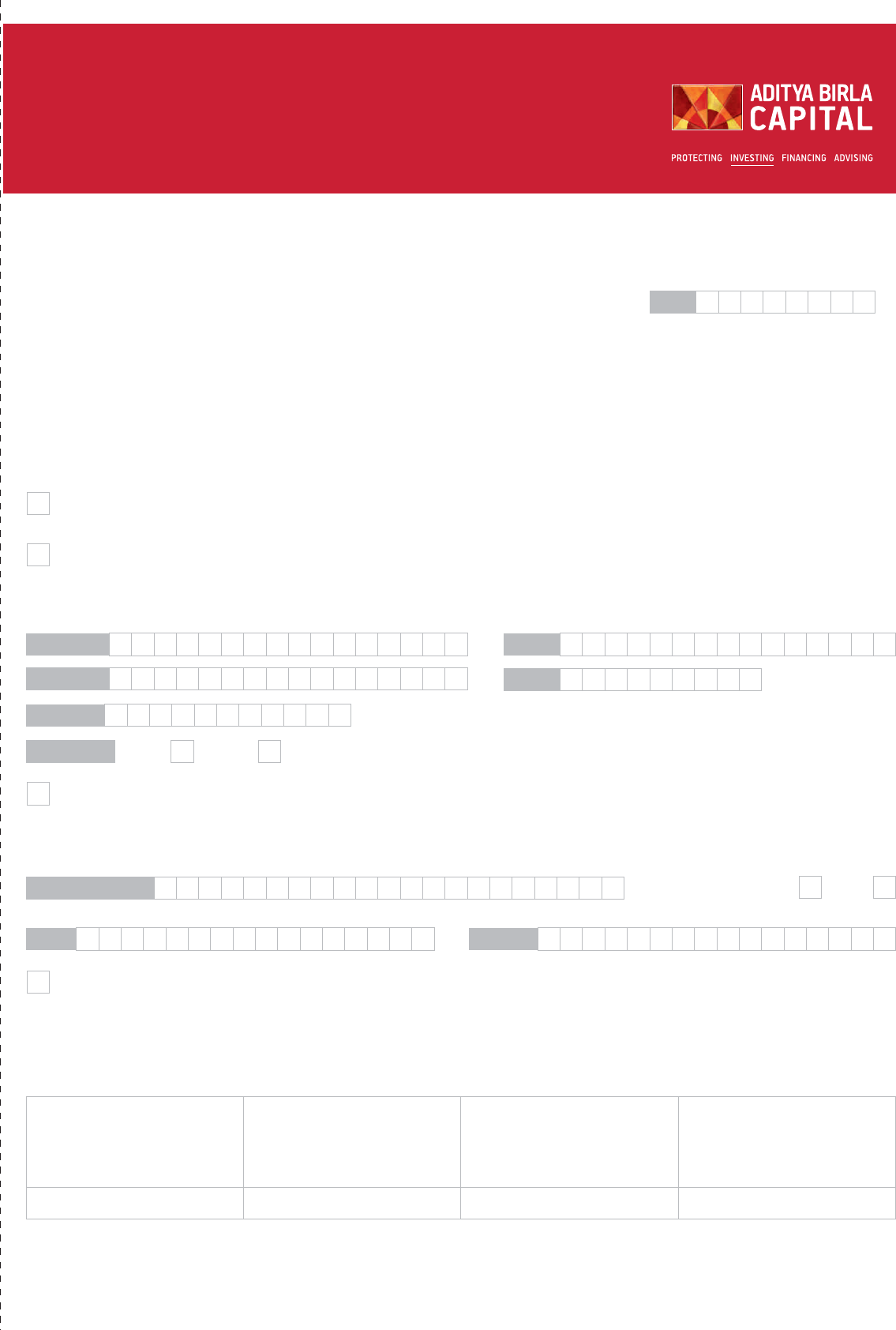

REDEMPTION TRANSACTION FORM

Ref: PMS Client Code: ________________________________ Client Name: _____________________________________________________

PMS Scheme: ____________________________________________ Distributor Name: ___________________________________________

Bank Name

Type of A/c.:

Date:

Dear Sir / Madam,

PARTIAL REDEMPTION: I/We wish to partially redeem Rs. _________________________ from the aforesaid portfolio. Kindly credit the

proceeds to my/our account registered with you.

FULL REDEMPTION (Liquidation of Portfolio): I/We request you to liquidate the aforesaid portfolio and transfer the proceeds to

my/our Registered Bank account with you.

The details of my / our new bank account are as below:

Branch

A/c no

MICR no:

IFSC Code:

Saving Current Others (Please Specify): __________________________

FULL REDEMPTION (Transfer of Securities): I/We request you to transfer the securities from my/our existing depository account

registered with you towards full redemption of aforesaid portfolio to my/our below mentioned depository account:

The details of my / our depository account where the stocks to be transferred are as below:

Depository Name: Type of Depository:

NSDL CDSL

DP ID: Client ID:

I / We have read and understood the instructions & Checklist attached along with this form and confirm details filled are true and authentic.

I / We understand that the above request would be executed on best effort basis and at the prevailing market price.

Signature / ASLStamp

Name

First Applicant Second Applicant

Third Applicant

(Refer Instruction & Checklist)

Aditya Birla Sun Life AMC Limited

PORTFOLIO MANAGEMENT SERVICES

I/We wish to remit the entire redemption proceeds towards my Mutual Fund investment in Aditya Birla Sun Life

_____________________________________________________________fund, under _______________________________________

Scheme Name

Option

1. All Redemption request submitted at the local ABSLAMC branches till 3.00 p.m. would be considered for processing on next business day

(T+1). Similarly, requests received post 3.00 p.m. IST will be considered for processing on T+2 working days. (T being the reporting day).

2. In case of Lien Marked cases, Redemption requests should be accompanied by Margin Recovery Requests and NOC from Finance Company.

3. Client details alongwith Type of Redemption and other details should be clearly indicated in the Request Form.

4. In case of partial redemption, if the capital (due to redemption request) falls below the minimum threshold limit of INR 25 Lakhs, the

redemption request will not be considered for processing.

5. In case of change in Bank details, Bank Proof should be compulsorily provided to avoid delay in redemption payout.

6. In case of joint holders, all the holders are required to sign as per mode of operations. In case of a Non-individuals (Corporates, Partnership

firms, LLP, Registered/Unregistered Trust) the authorized person is required to sign as per Board Resolution/ ASL along with the stamp of

the entity.

7. Redemption proceeds would be paid after realization of sales proceeds and after receipt of all pending documentations. Any residual

income in the form of dividends / corporate actions will be paid on realisation.

8. In case of Full redemption (Transfer of Securities) after charging of all the expenses the securities will be transferred to the Demat account

shared by the client and the balance Funds thereafter would be paid to the bank account registered with the Portfolio Manager

9. Exit load (as applicable) will be charged on both Full and Partial Redemptions.

10. In case of remittance of redemption proceeds into Mutual Fund Account on payout date, will be made on best effort basis before cut off

time.

INSTRUCTIONS & CHECKLIST

DOCUMENTATION CHECKLIST:

Type of Redemptions

Requirements

For all types of Redemptions 1. Filled Request form

2. Amount to be filled clearly.

Full Redemption via Stock Transfer 1. Client demat details to be filled, where stocks to be transferred.

2. Clear Self attested CML copy/Demat Statement of counter

depository, where stocks to be transferred.

3. First holder should be a holder in the Target Demat.

4. Duly signed Demat Closure Form (For Full redemptions)

Redemptions (Along with Change of Bank Mandate) 1. New bank details to be filled in form.

2. Original Personalised Cancelled Cheque OR

3. Banker Attested Statement copy.

Aditya Birla Sun Life AMC Limited

PORTFOLIO MANAGEMENT SERVICES

Aditya Birla Sun Life AMC Limited(Formerly known as Birla Sun Life Asset Management Company Limited) CIN:U65991MH1994PLC080811

One IndiaBulls Centre, Tower 1, 17th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Investments in securities are subject to market risk and there can be no assurance or guarantee that the objectives of the Product(s) offered

under the Portfolio Managemnet Services of Aditya Birla Sun Life AMC Limited will be achieved.