Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 1 of 72

Starting Your Ohio Adult

Care Facility

Small Business Toolkit

Published August 10, 2017

Disclaimer: This document was prepared by Communities Unlimited in cooperation with

Ohio Mental Health & Addiction Services as a tool in assisting those starting and

operating an Adult Care Facility. This document is informational only and not to be

considered as professional business advice.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 2 of 72

Table of Contents

ABOUT ADULT CARE FACILITIES .................................................................. 4

What is an Adult Care Facility? ....................................................................................... 5

Learn the Adult Care Facility Terminology ...................................................................... 5

The Assistance Required for Residents ........................................................................... 9

Average Business Startup Costs .................................................................................... 10

BUSINESS PLAN DEVELOPMENT .................................................................. 12

GETTING YOUR HOME LICENSED ................................................................ 13

Contact the Department of Building and Zoning Services ............................................ 13

Apply for Your Adult Care Facility License .................................................................... 13

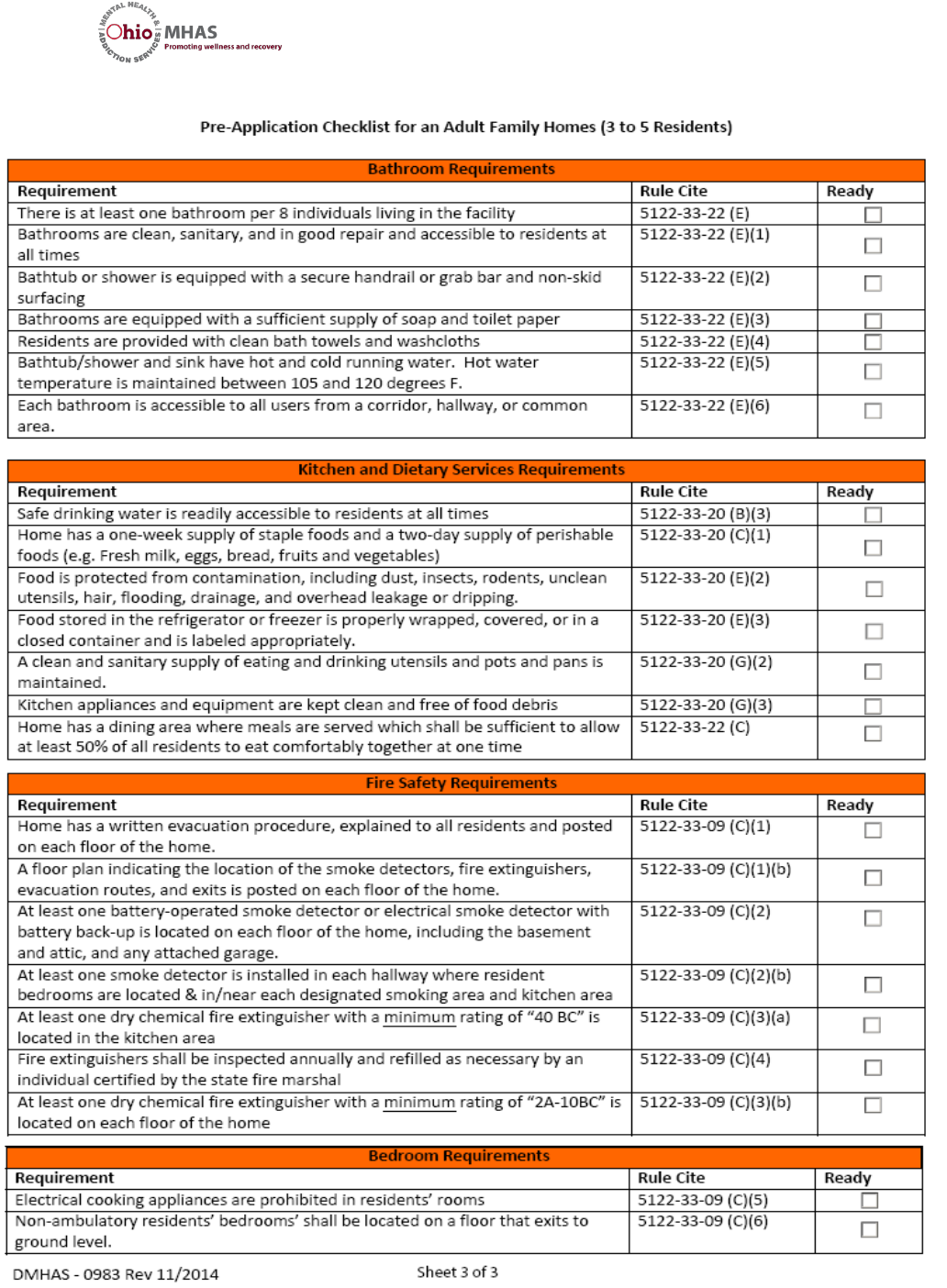

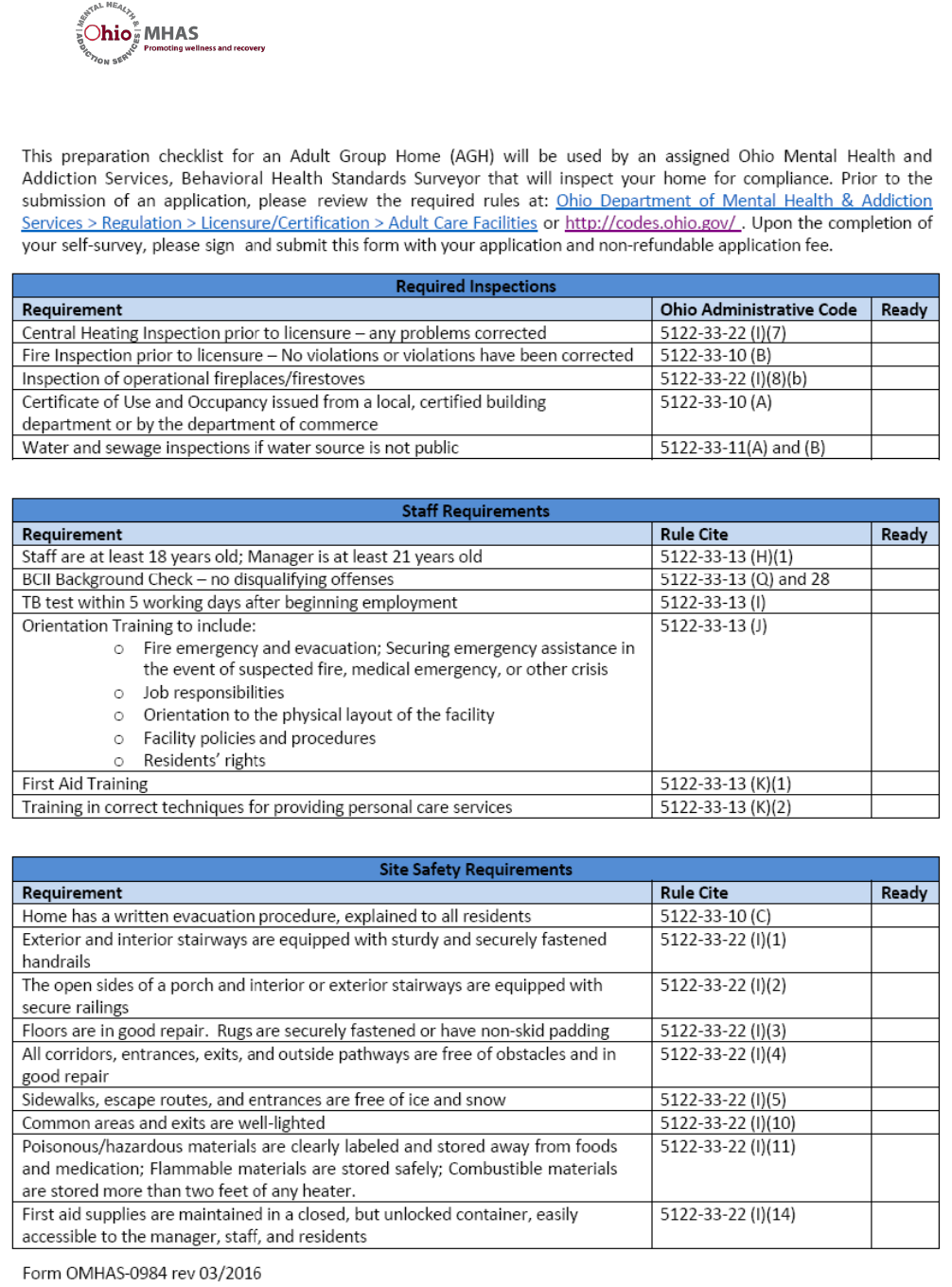

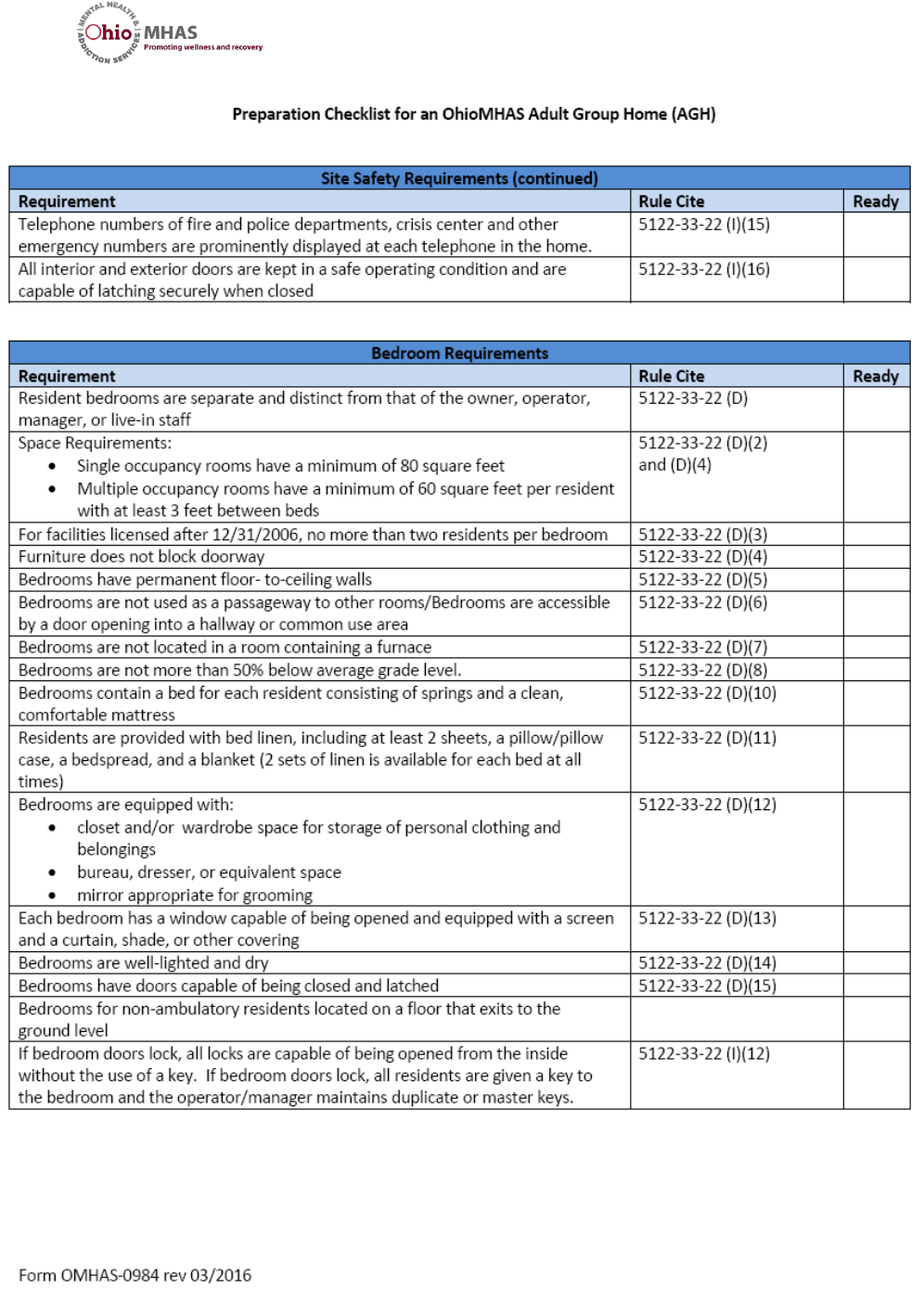

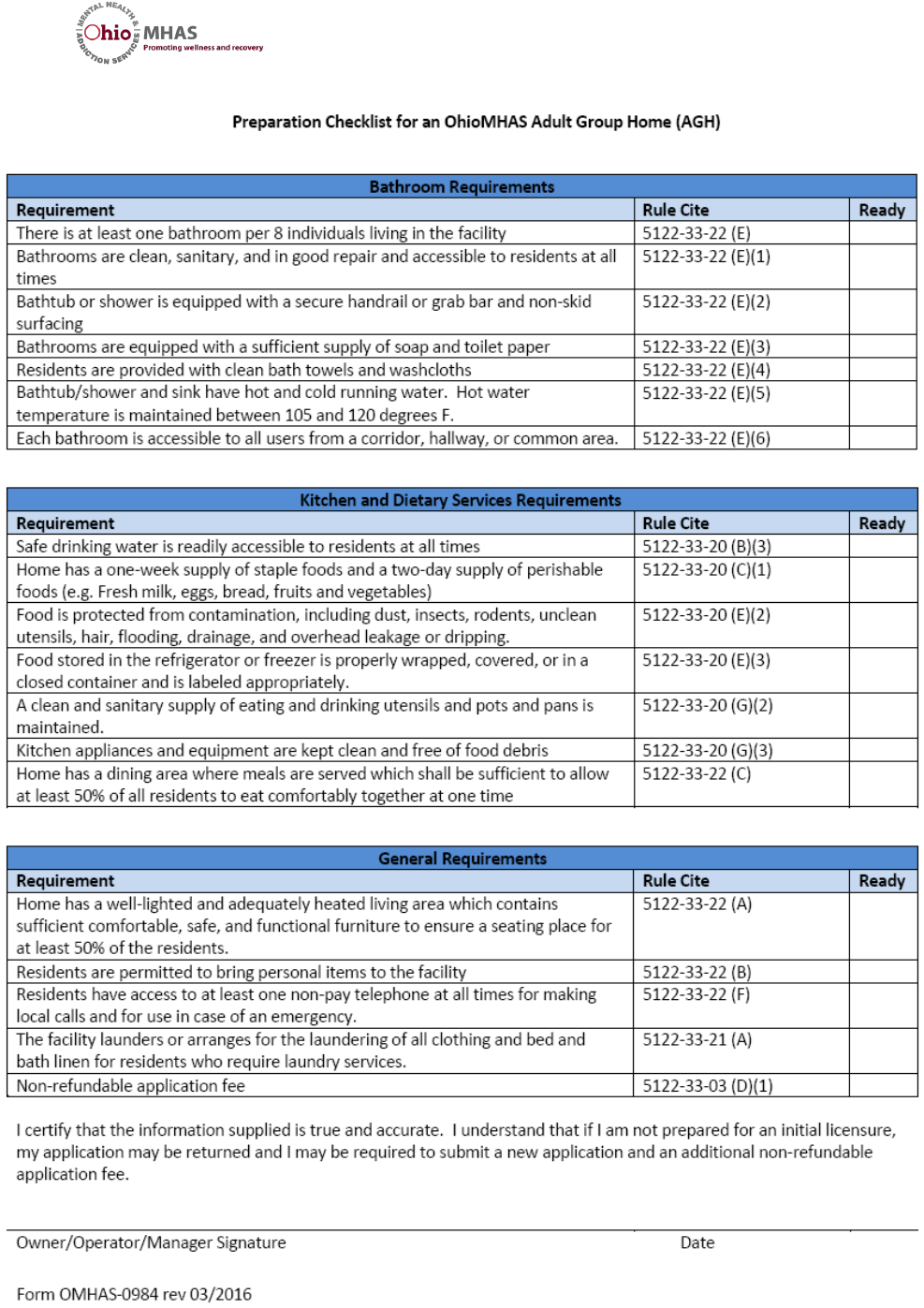

Prepare for Licensing with the OhioMHAS Pre-Application Checklists ........................ 15

.................................................................................................................................. 16

Pre-application Checklist 3 to 5 bed home ............................................................... 16

Pre-application Checklist 6 to 16 bed group home .................................................. 19

LEARN WHO TO CONTACT WITH QUESTIONS .......................................... 22

BUSINESS STARTUP ......................................................................................... 23

Business Legal Structure ........................................................................................... 24

Obtain Your Employer Identification Number (EIN) ..................................................... 27

Register Your Business Name ....................................................................................... 28

Open a Business Bank Account ..................................................................................... 29

Obtain Adequate Insurance .......................................................................................... 30

Automobile insurance ............................................................................................... 30

Homeowner’s insurance ........................................................................................... 30

General liability insurance ........................................................................................ 31

Health insurance ....................................................................................................... 31

Workers’ compensation insurance ........................................................................... 32

Obtain your OhioMHAS OAKS Vendor ID Number ....................................................... 32

ORGANIZE YOUR BUSINESS .......................................................................... 33

Setup a Filing System .................................................................................................... 33

Develop Your Business Forms ....................................................................................... 35

Resident Information Form ....................................................................................... 35

Resident Agreement ................................................................................................. 36

Resident Care Plan .................................................................................................... 36

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 3 of 72

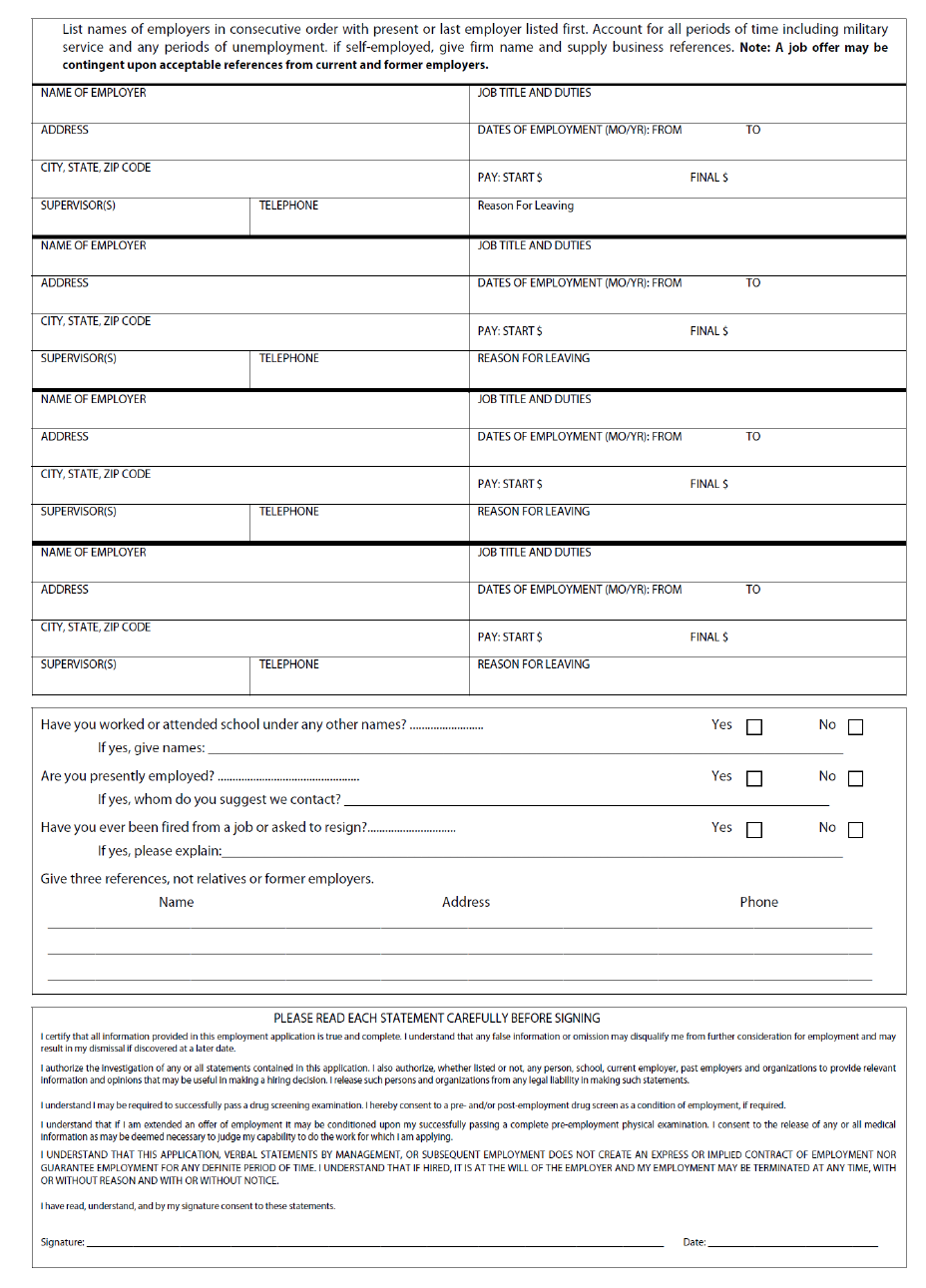

Employment Application........................................................................................... 37

Caregiver Job Description ......................................................................................... 37

Resident House Rules & Policies ............................................................................... 37

Manual Entry Bookkeeping Tool ............................................................................... 38

Resident Invoices & Payments Summary ................................................................. 38

STAFFING YOUR BUSINESS ........................................................................... 39

Hire the Right Skills ....................................................................................................... 39

Conduct a Background Check ....................................................................................... 40

Employees versus Independent Contractors ................................................................ 43

IRS form 1099-MISC .................................................................................................. 45

PAYING YOUR STAFF ...................................................................................... 46

What Is Payroll? ............................................................................................................ 46

How Much Should I Pay My Employees? ...................................................................... 47

What Are Payroll Taxes? ............................................................................................... 49

Federal payroll taxes ................................................................................................. 49

State of Ohio’s Payroll Taxes ..................................................................................... 50

IRS form W-4 ............................................................................................................. 50

Other Employer Taxes ................................................................................................... 51

Workers Compensation ............................................................................................ 53

When Do I Pay Myself? ................................................................................................. 53

Register Your Business for Required Business Taxes .................................................... 54

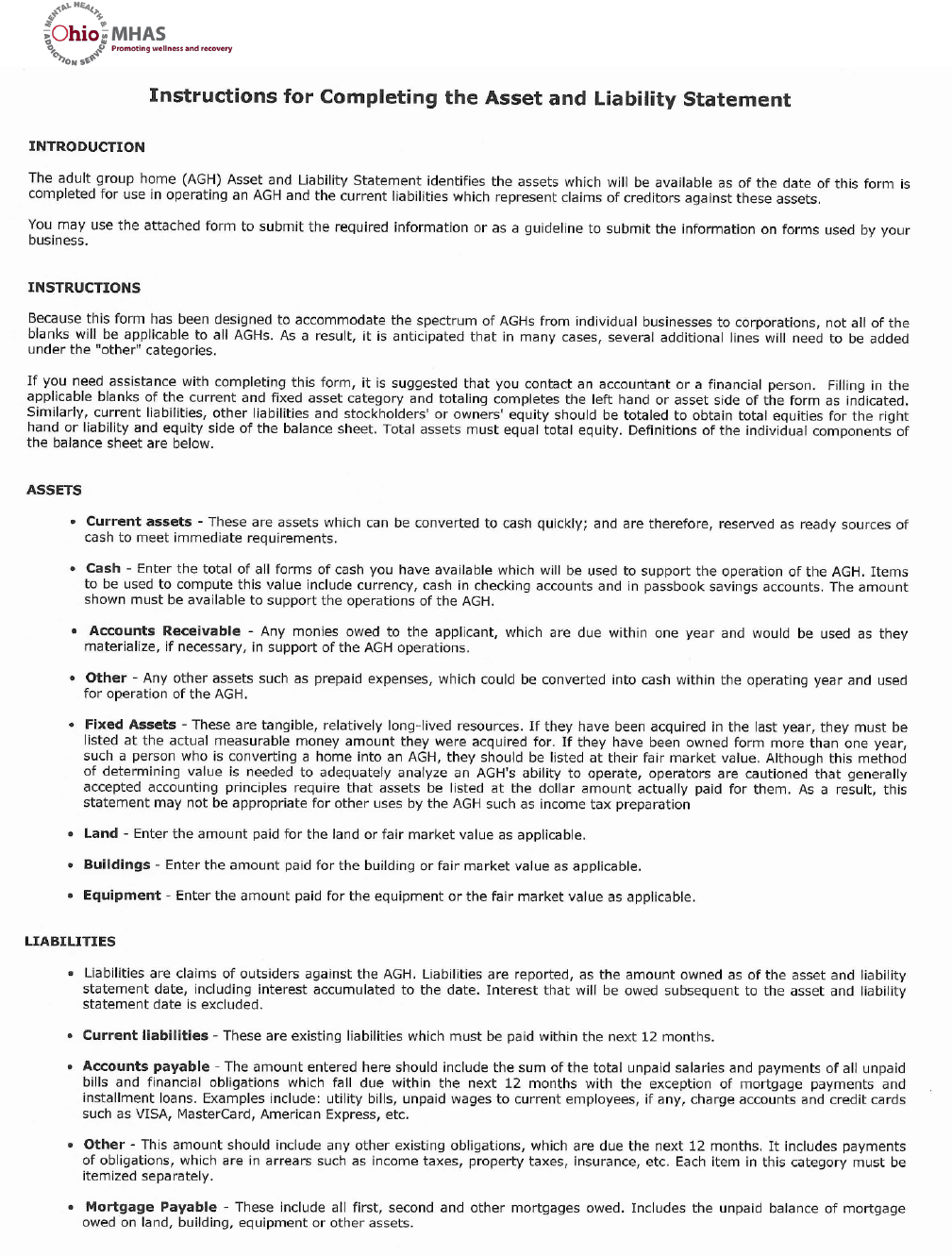

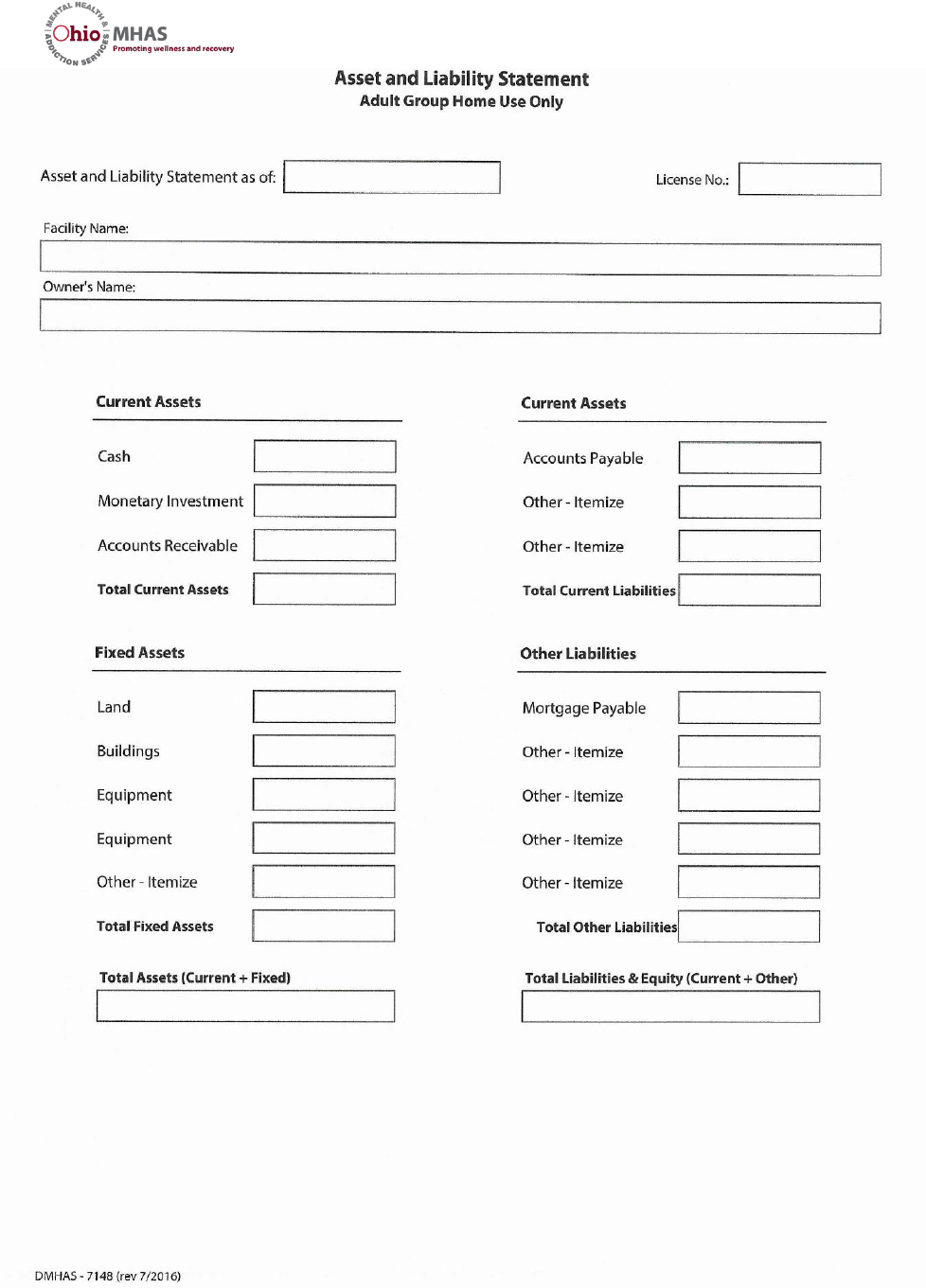

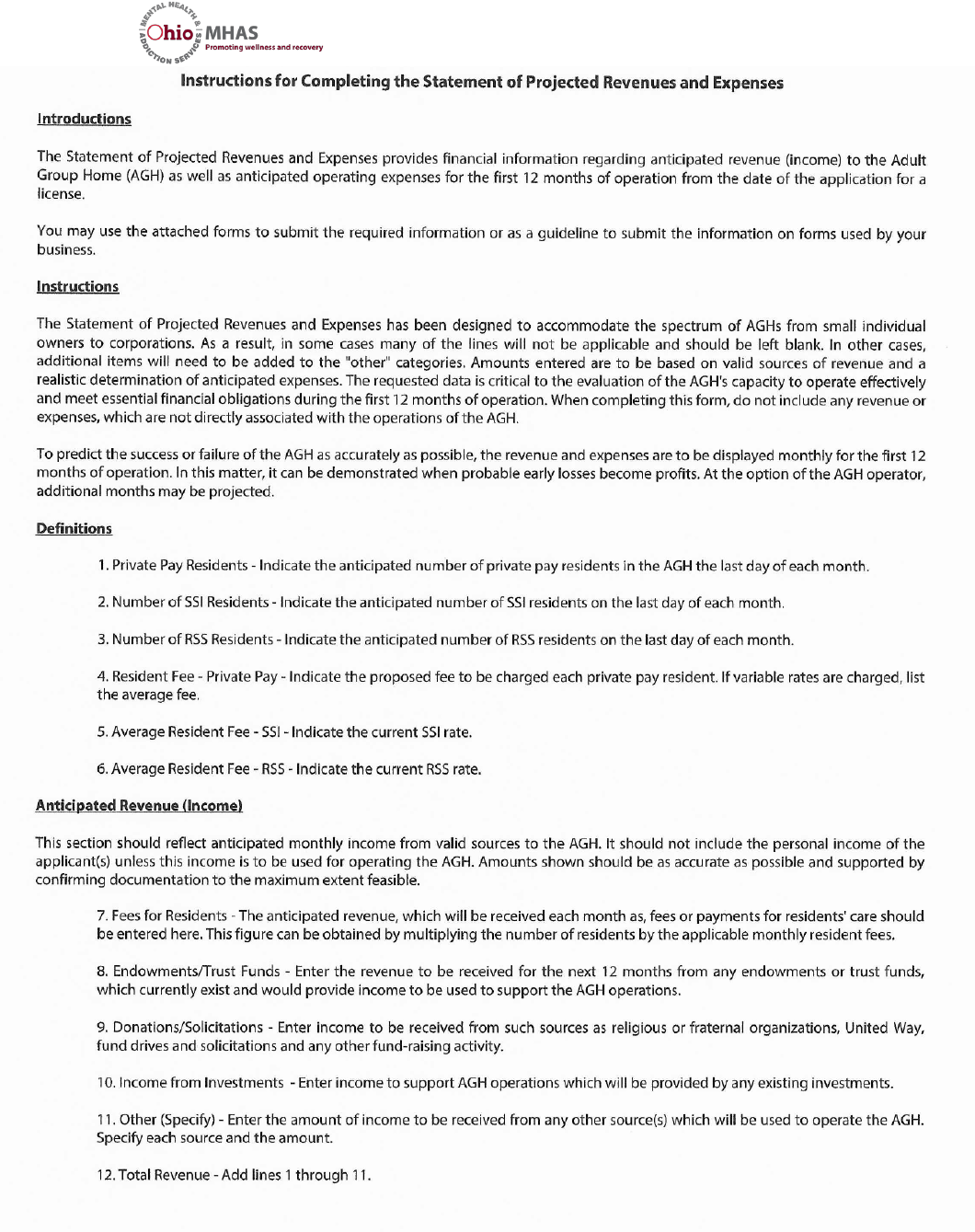

BUSINESS FINANCES ....................................................................................... 54

Collecting Resident Payments ....................................................................................... 54

Ohio Residential State Supplement (RSS) ..................................................................... 55

Supplemental Security Income (SSI) ............................................................................. 55

Social Security Disability Income (SSDI) ........................................................................ 56

Verifying Resident Income ............................................................................................ 56

Example of Potential Profit or Loss from Owning An Adult Care Facility ..................... 57

MARKETING YOUR BUSINESS ...................................................................... 58

Where Do I Find Clients?............................................................................................... 59

TOOLKIT SAMPLE BUSINESS FORMS .......................................................... 59

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 4 of 72

Congratulations…You’re Starting Your Own Business!

Welcome to becoming an owner of an Adult Care Facility in the state of

Ohio. The Ohio Department of Mental Health and Addiction Services

(OhioMHAS) is a great place to get started with the process of becoming

a licensed home. The primary purpose of this toolkit is to aid you in

becoming a good business owner and to get you started in the licensure

process. This toolkit should provide the necessary skills to help you

along the way.

Adult Care Facilities in Ohio range from 1-2 beds, 3-5 beds, and 6-16

beds. Owning and operating an Adult Care Facility takes time, lots of

preparation, and a commitment to serving the unique needs of your

clients.

If the primary goal is anything other than to help vulnerable people ,

then owning, operating and running

an Adult Care Facility probably isn’t

for you.

The job requires hard work, long

hours, and significant expense. So

you need to be able to find your

reward in the good you’re doing for

others. While it is impossible to list all of the operational and legal

requirements for any business, this toolkit serves as a guide for

business owners launching their venture.

Business research should be thorough and ongoing to keep up with

regulatory changes as they occur. In the sections below we provide you

with information that is helpful in planning for this new business.

ABOUT ADULT CARE FACILITIES

Let’s start by saying that getting licensed to operate an Adult Care

Facility means that you want to be a business owner. You need to

understand what is involved in starting, owning, and operating this type

of business.

Consider This…

Obtain a copy of the

Administrative Rules & Adult

Care Facility application! Visit

http://mha.ohio.gov/Default.aspx?

tabid=128

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 5 of 72

What is an Adult Care Facility?

Adult Care Facilities (ACFs) and Adult Foster Homes (AFoHs) are

residential care homes licensed by OhioMHAS for the purpose of

providing accommodations, supervision and personal care services to

unrelated adults. Residents of these facilities typically require a 24

hour level of support and assistance with daily living skills. The

population that resides in these homes consist of individuals who

without this level of support would be homeless, inappropriately

residing in nursing homes, have extended hospital stays or would be

incarcerated.

Facilities receive a two-year license to operate after complying with

the statutory requirements prescribed in the Ohio Revised Code and

the rules set forth in the Ohio Administrative Code. Homes must have

a license prior to accepting residents.

Operators must undergo a comprehensive onsite inspection of the

home in which inspectors verify the safe and sanitary condition of the

facility, the capability of the operator and staff to meet their

responsibilities in providing supervision and personal care services and

the appropriateness of the placement of each resident in the adult care

setting.

You must understand and follow the Ohio laws for owning and

operating an Adult Care Facility so that you can be sure you are

providing your new residents with the care, support, and supervision

required by law.

Learn the Adult Care Facility Terminology

Before you start your business, it is vital to understand some of the

common terminology and definitions used by those involved in Adult

Care Facility, what an Adult Care Facility is, and the basic licensure

requirements for operating an Adult Care Facility. The complete list of

definitions are cited in the Ohio Administrative Code, Chapter 5122-33-

01:

(A) “Accommodations” means housing, meal preparation, laundry,

housekeeping, transportation, social or recreational activities, maintenance,

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 6 of 72

security, and similar services that are not personal care services or skilled

nursing care.

(B) “Activities of daily living” means walking and moving, bathing, grooming,

toileting, oral hygiene, hair care, dressing, eating, and nail care.

(C) “ADAMHS board” means a board of alcohol, drug addiction, and mental

health services

(D) “Adult” means an individual eighteen years of age or older.

(E) “Adult care facility” or “ACF” as defined in section 5119.70 of the Revised

Code means an adult family home or an adult group home. For the purposes of

this chapter, any residence, facility, institution, hotel, congregate housing

project, or similar facility that provides accommodations and supervision to

three to sixteen unrelated adults, at least three of whom require personal care

services, is an adult care facility regardless of how the facility holds itself out to

the public.

(G) “Adult family home” means a residence or facility that provides

accommodations and supervision to three to five unrelated adults at least three

of whom require personal care services.

(H) “Adult group home” means a residence or facility that provides

accommodations and supervision to six to sixteen unrelated adults at least

three of whom require personal care services.

(I) “Boarder” means an adult as defined by paragraph (C) of rule 3701-20-01 of

the Administrative Code who does not receive supervision or personal care

services from the adult care facility and resides within a separate and discrete

part or unit of the adult care facility under section5119.71 of the Revised Code.

(N) “Local health department” means the board of health, or entity having the

duties of the board of health as authorized by section 3709.05 of the Revised

Code, for the health district that has jurisdiction over the location of the adult

care facility.

(O) “Manager” means the person responsible for the daily operation of an adult

care facility. The manager and the owner of a facility may be the same person.

(P) “Mental health agency” means a community mental health agency, as

defined in section 5119.22 of the Revised Code, under contract with an

ADAMHS board pursuant to division (A)(8)(a) of section 340.03 of the Revised

Code.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 7 of 72

(Q) “Mental health board” means an alcohol, drug addiction and mental health

services board, or a community mental health board authorized by Chapter 340

of the Revised Code.

(R) “Mental health resident program participation agreement” means a written

agreement between an adult care facility and the ADAMHS board serving the

alcohol, drug addiction, and mental health service district in which the facility is

located, under which the facility is authorized to admit residents who are

receiving or are eligible for publicly funded mental health services.

(S) “Mental health services” means those services specified in section 340.09 of

the Revised Code and certified by the department of mental health in

accordance with Chapter 5122-25 of the Administrative Code.

(T) “Mental illness” means a substantial disorder of thought, mood, perception,

orientation, or memory that grossly impairs judgment, behavior, capacity to

recognize reality, or ability to meet the ordinary demands of life. “Mental

illness” does not include dementia, as defined by the most recent edition of the

“Diagnostic and Statistical Manual of Mental Disorders.”

(U) “Mental health plan for care” means the individualized plan required by

rule 5122-33-18 of the Administrative Code and entered into by the adult care

facility owner or manager, a prospective resident and the lead mental health

agency.

(W) “Owner” means the person who owns the business of and who ultimately

controls the operation of an adult care facility and to whom the manager, if

different from the owner, is responsible.

(X) “Part-time, intermittent basis” means that skilled nursing care is rendered

for less than eight hours a day or less than forty hours a week.

(Z) “Personal care services” means services including, but not limited to, the

following:

(1) Assistance with activities of daily living;

(2) Assistance with self-administration of medication, in accordance with

paragraph (C) of rule 5122-33-17 of the Administrative Code; and

(3) Preparation of special diets, other than complex therapeutic diets, for

residents pursuant to the instructions of a physician or a licensed dietitian in

accordance with paragraph (B) of rule 5122-33-20 of the Administrative Code.

“Personal care services” does not include “skilled nursing care.” A facility need

not provide more than one of the services listed in this paragraph for a facility to

be considered to be providing personal care services. Nothing in this paragraph

shall be construed to permit personal care services to be imposed upon a

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 8 of 72

resident who is capable of performing the activity in question without

assistance.

(BB) “Respite care” means temporary or periodic care provided in an adult care

facility, nursing home, residential care facility, or other type of long-term care

facility so that the usual caregiver can rest or take time off.

(CC) “Skilled nursing care” means procedures that require technical skills and

knowledge beyond those the untrained person possesses and that are

commonly employed in providing for the physical, mental, and emotional needs

of the ill or otherwise incapacitated. “Skilled nursing care” includes, but is not

limited to, the following:

(1) Irrigations, catheterizations, application of dressings, and supervision of

special diets;

(2) Objective observation of changes in the patient’s condition as a means of

analyzing and determining the nursing care required and the need for further

medical diagnosis and treatment;

(3) Special procedures contributing to rehabilitation;

(4) Administration of medication by any method ordered by a physician, such as

hypodermically, rectally, or orally, including observation of the patient after

receipt of the medication; or

(5) Carrying out other treatments prescribed by the physician that involve a

similar level of complexity and skill in administration. Nothing in this paragraph

shall be construed to permit skilled nursing care to be imposed upon an

individual who does not require skilled nursing care.

(DD) “Special dietary needs” include, but are not limited to: low or no salt

added foods; reduced fat foods; reduced cholesterol foods; reduced or no sugar

added foods; frequency and/or portion size of meals; liquid only or clear liquids

only for a period designated by a physician or dietician; and simple modification

of food textures, such as pureeing.

(EE) “Sponsor” means an adult relative, friend, or guardian of a resident of an

adult care facility who has an interest in or responsibility for the resident’s

welfare.

(FF) “Supervision” means any of the following:

(1) Observing a resident when necessary while he or she engages in activities of

daily living or other activities to ensure the resident’s health, safety, and

welfare;

(2) Reminding a resident to do or complete such an activity as by reminding him

or her to engage in personal hygiene or other self-care activity; or

(3) Assisting a resident in keeping an appointment.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 9 of 72

(GG) “Unrelated” means that an adult resident is not related to the owner or

manager of an adult care facility or to the owner’s or manager’s spouse as a

parent, grandparent, child, stepchild, grandchild, brother, sister, niece, nephew,

aunt or uncle, or as the child of an aunt or uncle.

Effective: 02/17/2012 R.C. 119.032 review dates: 11/30/2011 and 02/17/2017

The Assistance Required for Residents

As an owner of an Adult Care Facility, you must provide the residents

in your home with more than just a safe place to live and sleep. Here is

list of some of the things you need to do for the residents that live in

your home:

Each resident must have a bed and area for personal belongings

Home must be neat and clean

Arrange transportation

for those residents that

need to go for shopping

and errands

Prepare 3 nutritious,

well-balanced meals and

2 snacks daily, according

to the dietary needs of

each resident,

Make laundry services

available

Help with walking and

moving, bathing,

dressing, and undressing,

going to the toilet,

brushing teeth, hair care,

nail care, and eating

Provide reminders to

take medications and assistance with self-administration of

medication

Assistance with Activities of Daily Living (ADLs) and/or

Independent Activities of Daily Living (IADLs)

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 10 of 72

While you can own an Adult Care Facility and also be the manager, it is

very likely that you will need to hire others to help you provide the

level of care and supervision required by your license.

Average Business Startup Costs

The amount of money needed to start an Adult Care Facility varies

greatly depending upon many factors such as the number of beds you

decide to offer for residents, the cost of repairs that will be needed for

the home you choose, the cost for applications, the cost for obtaining

permits and zoning approvals, and the amount for essential items you

need to purchase to get started.

Here is a sample list of expenses to help get you started in thinking

about how much money you might need prior to opening your Adult

Care Facility opened:

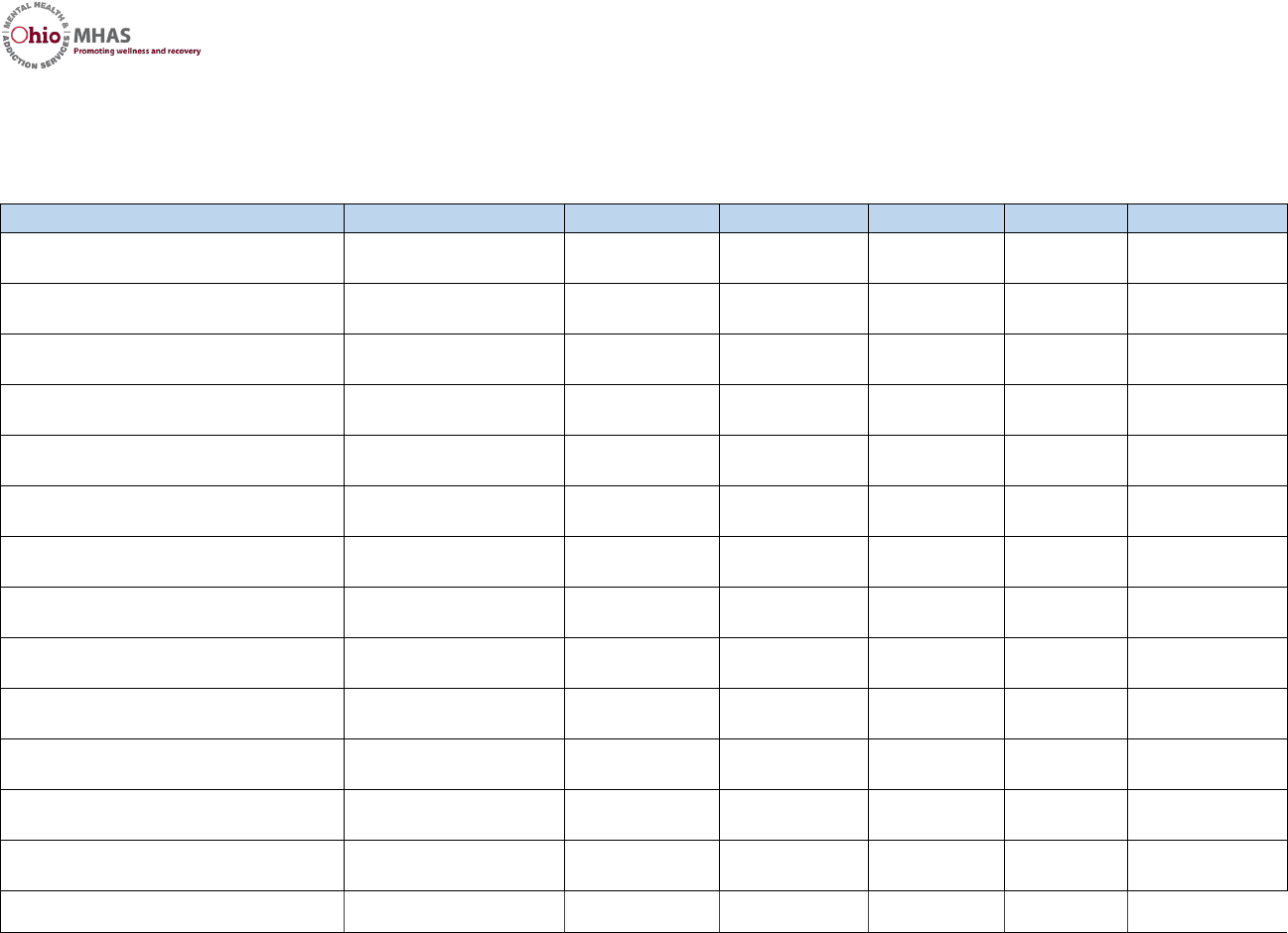

POTENTIAL STARTUP EXPENSES

(assuming a 3 bed home)

Adult Family Home License Fee

$25-$50

Business checking account, initial deposit plus cost

of checks

$25-$75

Certificate of Use & Occupancy

$60

Zoning or Permit applications and requirements,

such as fire inspection costs, adding smoke

detectors, adding fire extinguishers

$1250-$2000

Supplies for your home (2 bed linens/resident,

blankets, pillows, towels, toiletries, cleaning

supplies)

$300-$450

Bedroom furniture for 3 new residents (bed,

nightstand, dresser)

$1200-$1800

Mortgage or rent payments (varies greatly)

$600-$900

Utilities, gas, electric, water (varies greatly)

$175-$300

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 11 of 72

Supplies for your home office (copy paper, note

pads, pens, file folders)

$25-$50

2-drawer filing cabinet

$35-$50

Initial food supply for 3 residents

$75-$100

Computer

$400-$600

Printer

$50-$75

Internet

$30-$60

Microsoft Office or Excel, if not already installed on

computer

$75-$100

Estimated total startup costs:

$4,325-$6,670*

*We are estimating economical brands and quality for the above estimates. Our mortgage or rent

estimates are average estimates. Your costs will be higher or lower based upon your personal tastes

and shopping savvy.

As you see in our example above, it could take a minimum of $4,325 to

start an Adult Care Facility business. Our example above assumes that

you won’t need any improvements to the home that you are using for

the Adult Care Facility. This does not include any costs to renovating

the residence to meet licensure standards.

Consider This…

If it takes a month or more for you to locate paying residents,

can you pay your monthly required bills?

If you don’t have the maximum number of residents

that you have capacity for in the home, can you pay

your monthly required bills?

If the home you are using as the Adult Care Facility

needs improvements in order to get licensing approval

or maintain licensing, do you have the funds to cover

the cost of improvements plus the minimum amounts

listed above for startup costs?

If you answer “NO” to any of the bulleted items list above,

then you are probably not ready to open an Adult Care

Facility.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 12 of 72

We suggest that before opening this business you make sure that you

have enough money to cover your estimated startup costs and several

months of your personal expenses.

BUSINESS PLAN DEVELOPMENT

One of your first steps in deciding to start a new Adult Care Facility

should be to develop a business plan along with a 3-year financial

projections. The business plan is a roadmap for your business growth

and success. Your business plan does not need to be a long and formal

document. It needs to include the steps required to establish and grow

your business over a specified period of time.

The financial projections help you to figure out a realistic amount of

money needed to start your business, the income you should expect,

and the related expenses. When you estimate your potential income

and potential expenses, then you can see under what circumstances

you can expect to have a profit or loss. These financial projections will

also be a good budget that you can use in operating your business each

month.

This toolkit is written

with the assumption

that you will complete a

business plan and 3-

year projections prior

to or following review

of this toolkit.

We will provide a

sample Business Plan

for your review and a blank business plan template that you can use to

develop a business plan.

Consider This…

Small Business Development Centers

located across the state of Ohio have

various types of business workshops with

staff that can assist you with developing a

business plan, including financial

projections. In many cases they offer free

assistance.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 13 of 72

GETTING YOUR HOME LICENSED

Contact the Department of Building and Zoning Services

While the home you’ve chosen for your Adult Care Facility may seem

like the perfect location, this home may not be approved for operation

as an Adult Care Facility business. So, before you can use your home or

any other home for an Adult Care Facility, you’ll need to get

governmental approval to do so from your local Building and Zoning

Offices. Contact YOUR LOCAL Building and Zoning Services to:

1. Obtain a certificate of zoning clearance or zoning letter for the

home you want to use as an Adult Care Facility. A certificate of

zoning clearance is required prior to the construction, alteration,

or change in use of any building or structure.

2. Request a certificate of use and occupancy of the home you want

to use as an Adult Care Facility. In some counties this may be

called a certificate of use or certificate of appropriateness.

Essentially you need to obtain written confirmation that the

home you have selected can be used as an Adult Care Facility.

Your local Building and Zoning Service is responsible for enforcing state

and local building and zoning codes to help manage the safety and

quality of life of Ohio communities. You’ll need to find the office that

services the area where your Adult Care Facility will be located.

Apply for Your Adult Care Facility License

After you have obtained your building and zoning certificates, you

should apply for your Adult Care Facility license. Prior to opening an

Adult Care Facility, you must complete the licensing process through

OhioMHAS. Some states require you to obtain a business license.

Basically, a business license is a document from the government that

gives you authorization to start a business. For Adult Care Facilities,

your OhioMHAS license is your business license. When applying for your

Adult Care Facility license, you must complete a separate application

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 14 of 72

for each home that you will operate as this type of business. The

licensing process involves the following steps:

1. Submit a complete Initial Application for licensure, including the

application fee. The application fee is $25 for Adult Care

Facilities applicants of 3-5 beds and $50 for Adult Care Facility

applicants of 6-16 beds. You must submit a fully complete

application with payment included or your application will not

be reviewed.

2. The licensure department will review your application to confirm

that you have submitted all required documents.

3. The licensure department will contact you to conduct an initial

on-site inspection of the home that you propose to use for

residential care. Inspectors verify the safe and sanitary condition

of the facility.

4. The licensure department will interview the proposed facility

operator to confirm the capability of the operator and employees

to meet their responsibilities in providing supervision and

personal care services as well as the appropriateness of the

placement of each resident in the adult care setting.

5. Residential facilities that serve residents with serious mental

illness have an additional obligation to have employees and

managers oriented to the care and supervision needs of these

residents and to require specific training on an annual basis

relevant to persons with a diagnosis of mental illness residing in

the facility.

In order to be prepared for the licensure process, we recommend that

you use the OhioMHAS’ Pre-application Checklist that was created to

assist you in obtaining licensure.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 15 of 72

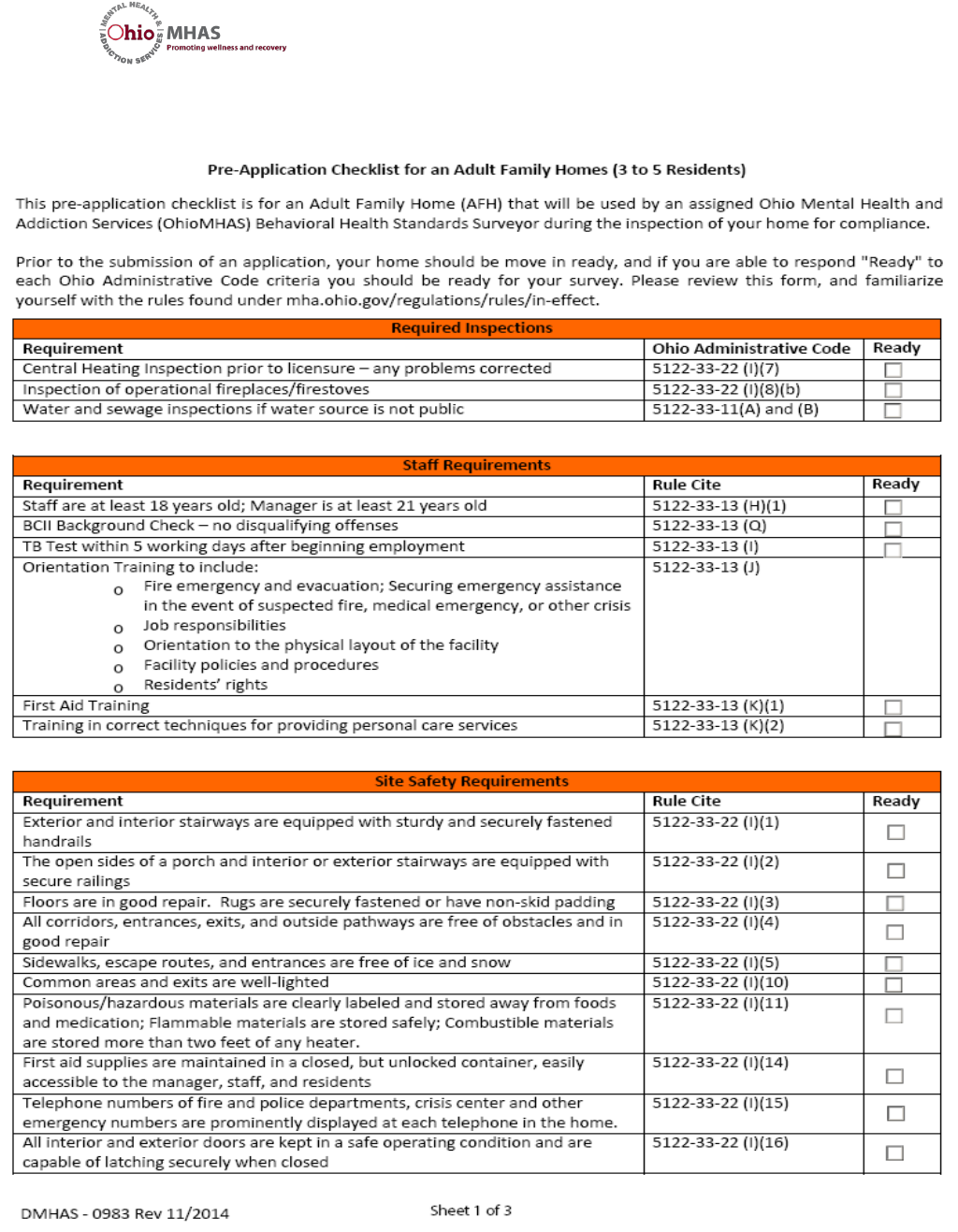

Prepare for Licensing with the OhioMHAS Pre-Application

Checklists

OhioMHAS staff have created two pre-application checklists to assist

you in preparing for the licensing process. There is a pre-application

checklist for a 3 to 5 bed home and a pre-application checklist for a 6

to 16 bed facility. We have both pre-application checklists listed below.

Consider This…

You can obtain copies of the pre-application

checklist for 3 to 5 bed homes from the OhioMHAS

website at:

http://mha.ohio.gov/Portals/0/assets/Regulation/Lice

nsureAndCertification/Residential-Facilities/Pre-

Application-Checklist-for-Adult-Family-Homes-

3to5-Residents.pdf

You can obtain copies of the pre-application

checklist for the 6 to 16 bed homes from the

OhioMHAS website at:

http://mha.ohio.gov/Portals/0/assets/Regulation/Licensur

eAndCertification/pre-application-checklist-for-agh.pdf

If you have trouble opening either website pages

above directly, then copy and paste into your browser

to open the page.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 16 of 72

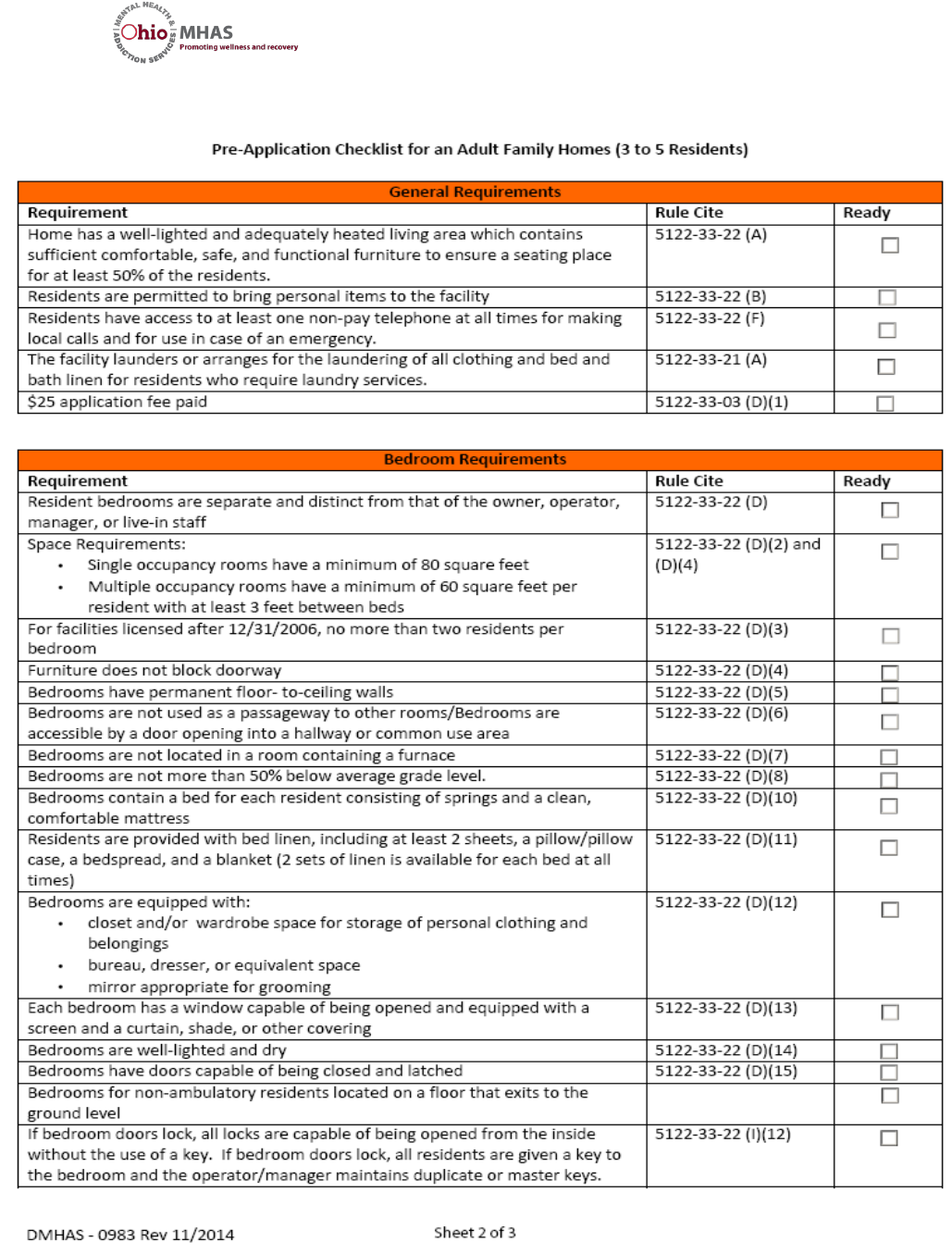

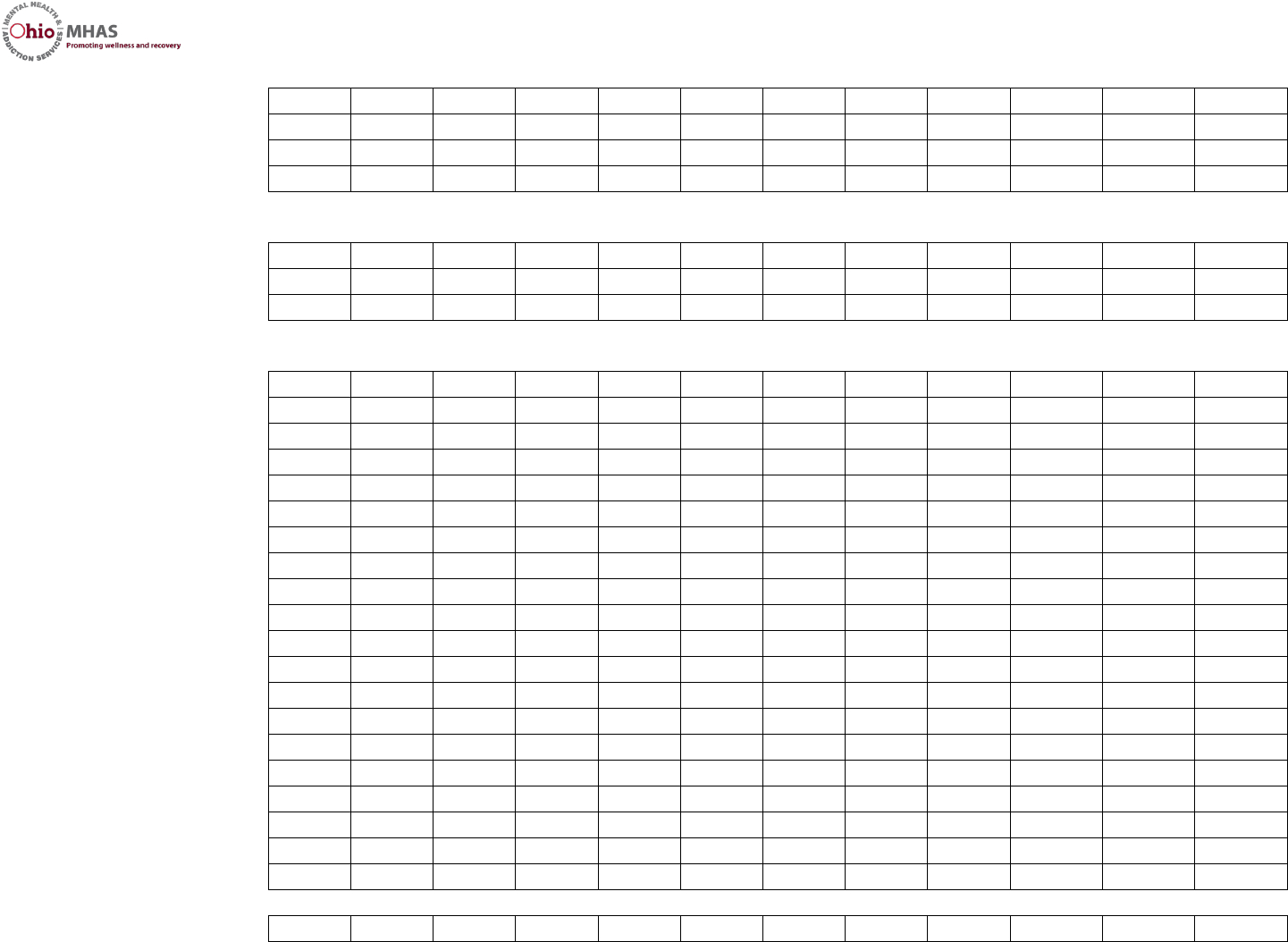

Pre-application Checklist 3 to 5 bed home

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 17 of 72

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 18 of 72

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 19 of 72

Pre-application Checklist 6 to 16 bed group home

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 20 of 72

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 21 of 72

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 22 of 72

LEARN WHO TO CONTACT

WITH QUESTIONS

You are likely to have many questions about the startup, launch, and operation of

your Adult Care Facility. OhioMHAS staff can answer many of your

questions. Prior to contacting them you should understand your role

and the role of others involved in the operation and management of an

Adult Care Facility: the OhioMHAS, the Adult Care Facility Manager, and

the Adult Care Facility Owner.

OhioMHAS

The OhioMHAS is responsible for licensing Adult Care Facilities. In order

to be licensed and remain licensed, OhioMHAS must make sure that the

Adult Care Facility is operating according to the statutory requirements

of the Ohio Revised Code and the rules set forth in the Ohio

Administrative Code. OhioMHAS is also responsible for receiving and

investigating any reportable incidents that occur to residents of Adult

Care Facilities.

ACF Manager (also called Operator)

The Manager/Operator of the Adult Care Facility is the person

responsible for the daily operation. The Manager/Operator and the

Owner of a facility may be the same person. The Manager/Operator

runs the facility each day, makes sure the facility residents receive

proper care, makes sure the facility has proper staffing, and makes sure

the facility operates consistent with the law.

ACF Owner

The Owner of the Adult Care Facility can serve in the role as the

Manager/Operator. The Owner is the person who owns the Adult Care

Facility business and ultimately controls the operation of an adult care

facility. The Manager/Operator reports directly to the Owner.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 23 of 72

ADAMH Board

The Alcohol, Drug Addiction and Mental Health (ADAMH) Services is a

statewide county-based board to admit, treat and discharge individuals

in need of acute care and community supports. The Board is a quasi-

independent part of county government, governed by a volunteer

Board of Directors. The Board contracts with provider agencies to

deliver services that assist clients on the road to recovery.

BUSINESS STARTUP

When you have your license to open your Ohio Adult Care Facility, you

will need to follow the important next steps below in order to get your

business operational:

1. Select Your Business Name

While your business name can be whatever you want it to be,

you should select a name that is easy for customers to say, easy

to remember, and one that speaks positively to the community.

Your business name should represent the types of services that

your business will offer.

2. Determine Your Business Legal Structure

You will need to determine whether your business will be formed

legally as a Sole Proprietor, Partnership, Limited Partnership,

Limited Liability Partnership, Limited Liability Company, C-

Corporation, or S-Corporation. The legal formation of your

business has legal and tax consequences. There are advant ages

and disadvantages of each type of legal structure. You should

really do your homework to see which structure is best suited for

your needs.

Here are the business legal structure options for businesses

organized in the State of Ohio.

Sole Proprietorship

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 24 of 72

Partnership

Limited Partnership

Limited Liability Partnership

Limited Liability Company (LLC)

C-Corporation

S-Corporation

Nonprofit Corporation

In the section that follows, we give you a short description of each form

of legal structure. You should set up an appointment with a qualified

accountant or attorney to discuss these options before you finalize your

decision.

Business Legal Structure

Sole Proprietorship

The OhioMHAS is responsible for licensing Adult Care Facilities. In order

to be licensed and remain licensed, OhioMHAS must make sure that the

reportable incidents that occur to residents of Adult Care Facilities.

A sole proprietorship essentially means a person is operating business

as a sole owner. When you operate as a sole proprietorship the legal

name of the business defaults to the name of the sole business owner.

If you want your sole proprietorship business to have a different name,

then you must register your business name using an Assumed name,

Trade Name, or Fictitious Doing Business As name that is different from

your personal name.

For Example…

If Jane Doe starts an Adult Care Facility and chooses to name

her business, “Jane Doe Adult Care Facility”. This name is

considered a Doing Business As name and Jane will need to

register it with the appropriate local government agencies like

the Ohio Secretary of State.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 25 of 72

Pros: No partnership agreements. The owner makes all decisions.

Easy to form this type of business. Federal taxes pass through to

the business owner’s personal tax return.

Cons: The business owner’s personal assets are open to attack if

the business is sued.

The legal name of your business is required on all government forms

and applications, including your application for employer tax IDs,

licenses and permits.

Partnership

A partnership is a business that is formed and operated by two or more

people. When you operate as a partnership the legal name of the

business defaults to the name of the partners. However, you can choose

to file an assumed name, trade name, or Doing Business As name. Each

partner contributes to running the business. The partners are

responsible for the actions of all partners and employees. Partners

report their share of profit or loss on their individual tax return.

The assets of the business are owned on behalf of the other partners,

and they are each personally liable, jointly and severally, for business

debts, taxes or tortious liability. For example, if a partnership defaults

on a payment to a creditor, the partners' personal assets are subject to

attachment and liquidation to pay the creditor.

Pros: The partnership business is not taxed, only the partner’s

share of profit is taxed.

Cons: Personal assets of each partner are open to attack in a

legal case.

Limited Liability Company (LLC)

A limited liability company (denoted by L.L.C. or LLC) is a legal form of

business offering limited liability to its owners. It is similar to a

corporation, and is often a more flexible form of ownership, especially

suitable for smaller companies with a limited number of owners. The

owners of the LLC are referred to as “members”. In most states a

member can be a single individual, two or more individuals,

corporations, or other LLCs. You must register an LLC with the Secretary

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 26 of 72

of State. There are several additional legal documents that must be

prepared and/or filed for this type of business.

Pros: Legal protection for the owner because business assets are

subject to any legal action. These businesses are taxed only once.

Members report their share of business income on individual tax

returns. Personal assets are generally less open to attack in a

legal case.

Cons: Usually you must have approval of all members before

management duties are transferred.

C-Corporation

C corporations (or "C corp") is a legal form of business that is owned by

its shareholders. Shareholders can be made responsible for their own

actions and actions of the business. Corporation’s owners can be an

individuals, other corporations, or other LLCs. Shareholders pay taxes

on their earnings dividends. The Corporation also pays taxes on

corporate earnings. C Corporations must register with the Secretary of

State. There are several additional legal documents that must be

prepared and/or filed for this type of business.

Pros: Legal protection for the shareholders. Easy to transfer

shares.

Cons: Double taxation because shareholder pays taxes and the

business pay taxes. Personal assets of shareholders can be

attacked but business assets are taken first. You must hold

annual shareholder meetings and record minutes from those

meetings, adoption and updates to bylaws, stock transfers and

records maintenance.

S-Corporation

An S corporation or S corp, is a C-corporation that makes a valid

election to be taxed under Subchapter S of Chapter 1 of the Internal

Revenue Code. The added benefit of S corporation status is that the

corporation does not pay federal income taxes. Shareholders pay

income taxes on their earnings.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 27 of 72

You must register an S Corporation with the Secretary of State. There

are several additional legal documents that must be prepared and/or

filed for with this type of business.

Pros: Legal protection for the owner because business assets are

subject to any legal action.

Cons: You must hold annual shareholder meetings and record

minutes from those meetings, adoption and updates to bylaws,

stock transfers and records maintenance.

Nonprofit Corporation

In Ohio you can file a Nonprofit Corporation when your business is

focused on activities that benefit society with a goal that is not

primarily for profit. No one owns shares or interest in the property of

the nonprofit. Many ACF are structured as 501c3 Nonprofit

Corporations. IRS Publication 557 describes 501c3 and the many other

501c types of Nonprofit Corporations.

Pros: Earnings are usually exempt from taxation and the business

can receive grant money.

Cons: Income from a Nonprofit Corporation is put back into the

business whereas for profit businesses can distribute profits to

shareholders or the business owners.

Obtain Your Employer Identification Number (EIN)

The EIN is a unique nine-digit number assigned by the Internal Revenue

Service (IRS) to small businesses operating in the United States for the

purposes of identification. When obtaining an EIN, you will need to

have decided on a type of legal structure.

Most businesses need an EIN. An employer needs an EIN if it has

employees, operates a partnership or corporation and/or withholds

wages on income.

Contact the IRS to obtain an EIN. You can visit the IRS website online

at www.irs.gov to apply for an EIN on its website. The IRS uses the EIN

to identify taxpayers who are required to file various business tax

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 28 of 72

returns. Banking institutions might require an EIN for you to open a

business bank account even if you do not have employees.

Apply for Your EIN Online

Applying for an EIN number online is the easiest method for many

business owners. The application for an EIN is free. Once the

application is completed, the information is validated during the online

session, and an EIN is issued immediately. The online application

process is available for all entities whose principal business, office or

agency or legal residence (in the case of an individual) is located in the

United States or U.S. Territories. The principal officer, general partner,

grantor, owner, trustee etc. must have a valid Taxpayer Identification

Number (Social Security Number, EIN, or Individual Taxpayer

Identification Number) to use the online application.

Apply for Your EIN by Mail or Fax

Taxpayers can apply for an EIN by MAIL or FAX by sending their

completed Form SS-4 (Search IRS website) application to:

If your principal business, office or agency,

or legal residence in the case of an

individual, is located in:

Mail or Fax Form SS-4 to:

One of the 50 states or the District of

Columbia

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

If you have no legal residence, principal

place of business, or principal office or

agency in any state:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Fax: (855) 215-1627 (within the U.S.)

Fax: (304) 707-9471 (outside the U.S.)

Register Your Business Name

You are required by law to register your business with the Ohio

Secretary of State when you decide to use one of the following legal

business structures:

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 29 of 72

For-Profit Corporation

Nonprofit Corporation

Professional Association

Limited Liability Company

Partnership

Limited Partnership

Limited Liability Partnership

Sole proprietors and general partnerships operating their business

under what is called a fictitious or assumed name may also need to

apply for a “Doing Business As” certificate with the county

administrator in which the business is physically located. A fictitious

name or “Doing Business As” name is a business name which is different

from your personal name, the names of your partners, or the officially

registered name of your LLC or corporation. The contact information

for the Ohio Secretary of State is:

Ohio Secretary of State

Continental Plaza

180 E Broad St, Columbus, OH 43215

Phone: 877-767-6446

Website: www.sos.state.oh.us.

You can register your business on the Ohio Secretary of State website

or you can print the filing documents off their website and mail the

completed forms to the address listed on the forms. You can contact

the Ohio Secretary of State, Business Services division with any

questions.

Open a Business Bank Account

Keeping your personal finances separate from the operations of the

facility is good business practice. You should open a business bank

account for the income obtained from your Adult Care Facility

residents. You should use this business bank account for paying any

expenses that are related to your business such as food, rent, and

utilities for the residents. Any personal transactions, like your

automobile payment, mortgage or rent for where you live, should be

paid out of a personal bank account. This separation of funds will help

you when filing your annual business and personal income tax returns.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 30 of 72

Obtain Adequate Insurance

As a business owner, you don’t want to wait until something horrible

happens to find out if you and your Adult Care Facility are properly

protected from a potential lawsuit. You are starting a home-based

business so it is important to confirm that you have insurance that

protects your home, auto, and business from any damages. You can

limit your liability by purchasing insurance to help protect you and your

business.

Here are some of the common types of insurance that you should

consider purchasing to protect you and your business:

Automobile Insurance

Homeowner’s insurance

General liability insurance

Worker’s compensation insurance

Automobile insurance

If you will be transporting residents of your Adult Care Facility around

in an automobile owned by you, your staff, your family, or friends, then

you might be liable for any negligence if there is an accident that results

in injuries to that resident. To protect yourself and the resident, be

sure you only transport the resident in a vehicle that is adequately

insured. It is also important that the person driving have a valid driver’s

license.

Homeowner’s insurance

You should contact the agency that insures your home and be sure you

understand the coverage that you have already in place. You should

explain that you are opening an Adult Care Facility that will have

residents paying to live in your home. Find out from your home

insurance agency specifically what your insurance covers.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 31 of 72

For Example…

If you have a grease fire in your kitchen your

homeowner’s insurance should cover the cost to

repair resulting damages to your home.

Your insurance might require you to pay a deductible prior to the

insurance agency covering any damages.

General liability insurance

General liability insurance can protect your business from claims of

bodily injury and property damage such as if a resident or their family

claims that you provided negligent care. You should contact different

insurance companies and thoroughly explain what Adult Care Facilities

are so you can obtain a quote for coverage.

For Example…

If you have a grease fire in your kitchen and one of

your residents gets injured as a result, then this

insurance should cover the cost for your resident’s

injuries.

You need to understand specifically what the general liability insurance

will cover.

Health insurance

When you own your own business, you should consider whether you

need to purchase health insurance for yourself or offer health

insurance for your employees. Health insurance premiums for you and

your employees is considered a business expense. If you were to offer

health insurance for your employees, you can have the employee s pay

their premium or a portion of their premium.

The U.S. Department of Health and Human Services (HHS) is operating

the exchange for the Affordable Healthcare Act for small business

policies. They have created the Small Business Health Options Program

(SHOP) which is a marketplace for small employers who want to provide

health and dental insurance to their employees.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 32 of 72

To use the SHOP Marketplace, your business must have 50 or fewer full-

time employees. You can start offering SHOP insurance to your

employees at any time of the year.

You can contact the Small Business Health Options Programs Call Center

weekdays from 9am to 7pm Easter Time at 800-706-7893 (TTY: 711).

The website address is: https://www.healthcare.gov/small-

businesses/provide-shop-coverage.

When contacting any insurance agency, you should ask questions to be

sure you understand the coverage that you are purchasing. Obtain

information on your insurance deductible and other requirements in

case you need to file a claim in the future.

Workers’ compensation insurance

Workers' compensation insurance that provides wage replacement and

medical benefits to any of your employees that are injured while

working for you. All Ohio employers with one or more employees must

have workers' compensation coverage. This is a type of insurance

required only when you have employees. This type of insurance is

discussed in greater detail in the section, Paying Your Staff.

Obtain your OhioMHAS OAKS Vendor ID Number

If the state (OMHAS or

other state agencies)

have grant or funding

opportunities to be

paid directly to the

operator, owner or facility, you must have an Ohio Administrative

Knowledge System (OAKS) vendor ID number. In order to receive the

payments from OhioMHAS. You must register with the Ohio

Administrative Knowledge System (OAKS). OAKS is the state’s

centralized system for financial management.

Consider This…

In order to receive funds from the State of Ohio,

you must have an OAKS ID number.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 33 of 72

To register a new account to obtain an OAKS Supplier Number, go to

the Ohio Shared Services (OSS) Website

http://www.supplier.obm.ohio.gov/.

If you need help in completing the application, there are step -by-step

instructions to Register as a New Supplier at:

http://www.supplier.obm.ohio.gov/download/JobAid/OBM_Registerin

gNewSupplier_JA.pdf.

You may want to print these instructions before getting started. To

verify if your information has been processed or where it is in the

process, or if you have questions about completing the required forms,

please contact OSS at 1-877-644-6771 (Monday – Friday 8am-5pm EST).

ORGANIZE YOUR BUSINESS

Setup a Filing System

To get you started with organizing your business operations, you need

a good filing system. Remember to keep all of this information in a safe

and confidential place away from residents and guests. We suggest you

start by purchasing a small 2 drawer filing

cabinet that locks like this one:

Once you have purchased your filing cabinet,

here is a filing system that we think will work

well for you:

1. CREATE A RESIDENT FILES CATEGORY.

Create a file folder for each resident.

Inside each resident’s file folder include these documents:

Resident Information Form

Resident Agreement

Resident Care Plan

House Rules & Policies, signed by the resident

2. CREATE EMPLOYEE FILES CATEGORY.

Create a file folder that includes the following information for the

employee your hire to help you take care of your residents:

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 34 of 72

Completed Employment Application

3. CREATE COMPANY BLANK FORMS CATEGORY.

Create a file folder that includes copies of these documents:

Resident Information Form

Resident Agreement

House Rules & Policies

Resident Care Plan

Application for Employment

Caregiver Job Description

Invoice & Payments Summary Report

Monthly Manual Bookkeeping Tool

4. CREATE COMPANY FINANCIAL RECORDS CATEGORY.

Create a file folder that includes the financial information for your

business.

Manual Entry Bookkeeping Tool, upon completion each month

Client Invoices & Payments Summary, upon completion each

month

File for bills due to be paid

Bills paid, note the method of payment

5. CREATE REGULATORY INFORMATION CATEGORY.

Create a file folder that includes all the important regulatory

information that you need to provide training to employee s or

information that you place in binders in your Adult Care Facility or

information that you post for your residents.

You should obtain a copy of the Rules for operating an Adult Care

Facility and place a copy in a 3 ring binder to make it easily

accessible. Here is an example of regulatory information you might

include:

Copies of license

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 35 of 72

Copies of application

Required Inspections Schedule (electrical, fire, heating systems)-

Required Trainings Schedule- and copies of CEU’s for each

employee

Emergency Evacuations Policy

Patient’s Rights

HIPPA Consent Form

Certificate of Use and Occupancy

Personnel Policy

Employee Screening & Training

Policy on Providing 3 Nutritious Meals Daily

Any of the required regulatory information can be obtained from

OhioMHAS.

Keep in mind that as a licensed Adult Care Facility you are responsible

for being aware of all the legal and regulatory requirements to maintain

your license. You need to properly train yourself and your employee to

make sure you are following these regulations.

Develop Your Business Forms

When owning an Adult Care Facility, it is important to have a process

in place for smooth business operations and management. In this

section we will give you some suggestions on how to get yourself and

your business organized, including several business forms that you

should use to help operate your business efficiently. All of your

business files containing any resident information must be stored in a

locked filing cabinet.

Resident Information Form

You should capture your new resident’s information in writing and keep

it in a file folder for easy reference.

Our sample” Resident Information Form” requests the resident’s

contact information, Social Security Number, legal guardian

information, emergency contact information, and monthly income

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 36 of 72

information. You can use this form to verify the applicant’s sources of

income prior to accepting the applicant into your home.

Resident Agreement

The resident agreement is a written contract between you, the

resident, and/or the resident’s legal guardian. This document provides

specific information regarding the resident’s obligations for living in

your home and your obligations to the resident for them living in your

home. This contract should include the specific amount that you are

charging the resident each month, the due date for payments each

month, the date of any late charges or security deposits, and what

income sources will be used to make the payments each month. This

contract should also be signed by the owner or manager of the Adult

Care Facility. For complete information on information that should be

included in the Resident Agreement, refer to the Ohio Administrative

Code Chapter 3701, Rule 5122-33-16 Resident Agreement; Other

Information to Be Provided Upon Admission.

Resident Care Plan

The owner or manager should complete a Resident Care Plan. The

Resident Care Plan captures information about your residents, such as

their daily routine, daily activities, level of assistance needed,

nutritional needs, supervision needed, etc. This plan will help you be

prepared to provide the best care.

Understanding the needs of your new residents can help you confirm

that you have adequate and appropriate staff to continue providing

quality services to all your clients.

Consider This…

You need to interview each resident on an individual basis to consider

their dietary, physical, mental, and other health needs and how this

resident’s needs will mix with the needs of your existing residents.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 37 of 72

For Example…

If you have all senior-aged residents in your home then you should strongly

consider the impact of adding a really young resident.

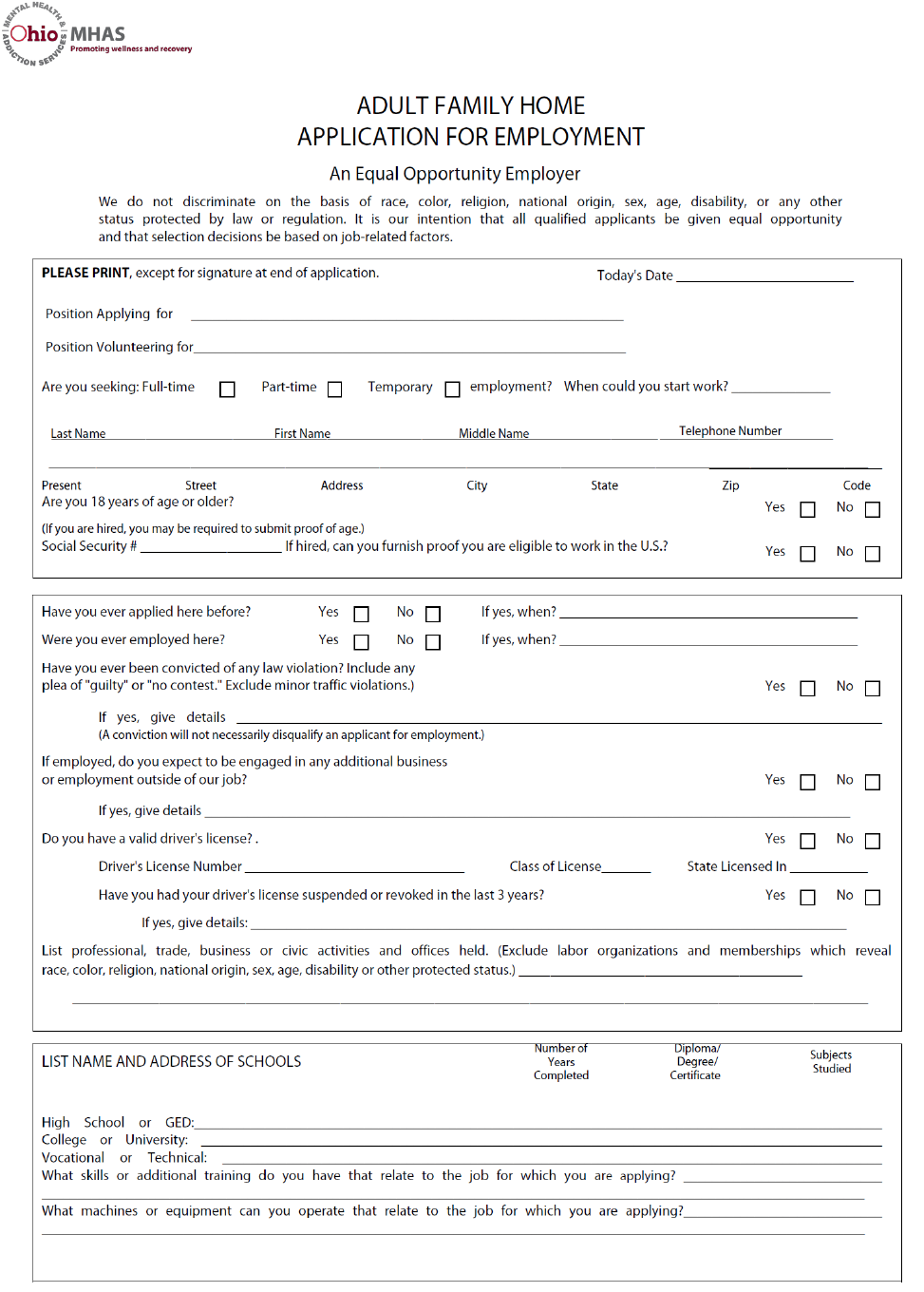

Employment Application

You should have each individual that you consider allowing to work for

you complete an employment application. You should also have

volunteer workers complete an employment application. Once an

employment application is completed, thoroughly review the

completed application in advance of making your hiring decision. Make

phone calls and do your research to confirm information on the

employment application. You can ask the applicant for references that

you can call and confirm their professional experience and character.

In the “Staffing Your Business” section below you will find suggestions

on the types of skills you should be seeking in an employee for your

Adult Care Facility.

Caregiver Job Description

You should have a job description for each employee position in your

Adult Care Facility. The job description will include the duties, purpose,

responsibilities of the job, the job title, and the name or designation of

the person to whom the employee reports. Use this job description

when you conduct any employee interviews.

Resident House Rules & Policies

The Resident House Rules & Policies explains important rules and

information for those accepted as residents in your home. You might

include information about how resident clients are expected to pick up

after themselves, how resident clients should respect each other’s

privacy, how resident clients should keep the noise levels respectful for

others residing in the home.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 38 of 72

Manual Entry Bookkeeping Tool

There is a sample of this manual entry bookkeeping tool provided with

this toolkit. Instructions are included. You can use this tool to capture

the income and expenses of your Adult Care Facility. Capturing income

and expenses is really important in helping you to monitor how much

money you have coming into the business versus how much money you

have going out of the business.

You should track how much money you collect each month and the

money you spend on business related expenses. You will need to

calculate whether you have a profit or loss each month.

Resident Invoices & Payments Summary

On a monthly basis, you should keep a list of the amount of money you

invoice third-party agencies for payments for your residents. We have

included a sample form for this tracking purpose. On our sample form,

we have a place for you to record the resident’s source of income

payments to you, the amount they owe you each month, and the dates

you expect to be paid. If you are required to send an invoice or make a

payment request each month, then you need to document each month

the date you make your request. Once you receive payment each month

for each resident, you should document the date payment was

received. Keep this information in your files.

Consider This…

All your residents should have Payees because the Adult Care Facility is not

allowed to manage resident’s money.

As part of this toolkit, we have included a sample of each form listed in

the sections above. You can use them as is or make modifications as

you see needed.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 39 of 72

STAFFING YOUR BUSINESS

Hire the Right Skills

Adult Care

Facility Jobs

Essential Skills

Additional Skills Desired

Manager

CPR certified

Hire, train, and monitor staff

Be able to pass a background

check as required by the Ohio

Mental Health & Addiction

Services

Be able to pass a drug test

Ensure background checks

completed on any new hire

o Confirm employee has no

criminal record in

violation of OhioMHAS

rules

o Confirm employee that

transports residents has

valid driver’s license

Advocate for residents

Maintain accurate resident and

staff files

Manage invoicing and collection

of resident payments to ACF

Ability to perform all the duties

of the Resident Caretaker

Ability to assist the owner, if not

the manager, in marketing the

business for additional residents

when needed

Experience caring for

adults with developmental

disabilities

Experience caring for

adults with chronic mental

illness

Prior management

experience

Resident

Caretaker

CPR Certified

Be able to pass a background

check

Be able to pass a drug test

Provide care to residents

including but not limited to:

o Assistance with bathing,

grooming, and other

personal care

Experience caring for

adults

Experience caring for

adults with developmental

disabilities

Experience caring for

adults with chronic mental

illness

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 40 of 72

Adult Care

Facility Jobs

Essential Skills

Additional Skills Desired

o Household chores like

washing clothes, cleaning

the home, and cleaning

the dishes

o Cooking for residents

o Maintaining a safe

environment for the

residents

o Promoting dignity and

independence for the

residents

o Showing care and

compassion to residents,

their families, and other

staff

Available to work a flexible

schedule

Must have valid, active driver’s

license, if hired to drive residents

around

Conduct a Background Check

Another important aspect of owning an Adult Care Facility is protecting

your residents and protecting your business. It is a good idea to do

background checks on any individual you intend to employ in your

business with residents

When you own an Adult Care Facility, you must make sure any paid or

volunteer staff are eligible to work for you. There are certain offenses

that disqualify an individual from being an owner or staff person of an

Adult Care Facility.

Some of the permanent disqualifications include offenses like murder,

assault, and abuse crimes. The complete list of disqualifications can be

found in Ohio Administrative Code, Chapters 5122-33-12, 5122-33-13,

and 5122-33-28.

Keep in mind that any person working with your residents must meet

all the Ohio Mental Health and Addiction Services’ licensing

requirements:

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 41 of 72

Any person working in your home must be at least 18 years of

age.

Managers must be at least 21 years of age.

All staff must have first aid training.

The manager and each staff person must complete a general

orientation in caring for persons diagnosed with mental illness

as well as complete instruction on how to access local mental

health crisis and emergency services related to mental illness.

The manager must arrange for all necessary inspections,

approvals, and licenses.

The manager is responsible for hiring, and supervising staff, and

for making sure resident’s rights are protected.

Think of the residents that you take into your home as extended family.

Be sure you hire staff that you would allow to take care of your family

members.

When conducting a comprehensive background check, the screening

process gathers information from multiple sources and provides a

clearer understanding of the applicant's qualifications and reduces

your risks as a business owner.

If you are using this background check to make your hiring decision,

there are federal laws that protect the applicant from discrimination

based upon race, color, national origin, sex, or religion, disability,

sexual orientation, genetic information and age. The Equal Employment

Opportunity Commission (EEOC) enforces these laws.

Consider This…

Licensure requires that a background check is completed on each staff person

that you hire. Be sure to research the company that you use to complete your

background checks and make sure they are a reputable company.

When you run background checks through a company that provides

background information, you must comply with the Fair Credit

Reporting Act (FCRA). The Federal Trade Commission (FTC) enforces the

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 42 of 72

FCRA. Typically, the company that you hire will provide you with the

instructions to make sure you comply with these laws.

According to the Ohio Administrative Code, Chapter 5122-33-28, an

Adult Care Facility owner must contact the Ohio Bureau of Criminal

Identification and Investigation (BCI) to conduct a criminal records

check on any applicant being considered for work in the home.

Here are the locations:

BCI Main Office

1560 State Route 56 SW

P.O. Box 365

London, OH 43140

Toll-free: 1-855-BCI-OHIO (1-855-224-6446)

Phone: (740) 845-2000

Email: [email protected]

BCI Richfield Office

4055 Highlander Parkway

Richfield, OH 44286

Phone: (330) 659-4600

BCI Bowling Green Office

750 North College Drive

Bowling Green, Ohio 43402

Phone: (419) 353-5603

BCI Youngstown Office

20 W. Federal Street

Youngstown, OH 44503

Phone: (330) 884-7555

BCI Athens Office

86 Columbus Circle, Suite 202

Athens, OH 45701

Phone: (740) 249-4378

BCI Cambridge Office

1225 Woodlawn Avenue

Cambridge, OH 43725

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 43 of 72

You can use the employment application that applicants and volunteers

complete for you to contact their previous employers for references.

In order to prove someone has Cardiopulmonary Resuscitation (CPR)

Certification, you can request a copy of their CPR Certification card. If

he/she has lost his/her CPR Certification card, he/she can ask the

certifying agency for a new card. In some instances you can verify the

certification by contacting the American Heart Association:

Data Inquiry Address

American Heart Association

ECC - International

7272 Greenville Avenue

Dallas, Texas 75231-4596

Email: CPRVerify@heart.org

Employees versus Independent Contractors

An employee is a person who is hired to provide services to your

business on a regular basis in exchange for an hourly rate or salary.

Employees do not provide services as part of an independent business.

An individual working in your Adult Care Facility would be considered

an independent contractor if (s)he is paid an agreed amount of money

to take care of your residents but you are not deducting any payroll

taxes from the payments you make to this person. Unlike an employee,

an independent contractor usually works for many businesses.

Deciding whether the people that work for your Adult Care Facility are

employees or independent contractors is a very important decision.

This decision can greatly affect the amount of money you spend to

cover the cost of the staff you hire in your business.

Here are some common differences between classifying a staff person

as an Employee versus classifying a staff person as an Independent

Contractor:

EMPLOYEE

INDEPENDENT CONTRACTOR

Usually works for only one employer.

Usually works for more than one company.

Works the hours set by the employer.

Sets his or her own hours.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 44 of 72

EMPLOYEE

INDEPENDENT CONTRACTOR

Usually works at the employer's place of

business.

Works out of his or her own office or home.

Works under the control and direction of

the employer.

Works relatively independently.

Accomplishes tasks in the manner the

employer has requested.

Has the authority to decide how to go about

accomplishing tasks, and does so without

the employer's input.

Costs associated with the job is covered

by the employer.

Costs associated with the job is covered by

the independent contractor.

Has a general education and experience

background, and receives special training

from the employer in order to do the job

better.

Has acquired very specialized skills and

comes to the work relationship with a

particularized education and experience

background.

Receives net salary after employer has

withheld income tax, Social Security and

Medicare tax under the Federal Insurance

Contributions Act (FICA).

Is not subject to tax or FICA withholding, but

pays his or her own self-employment tax.

Receives a flat rate of pay with no tax

deductions.

Eligible to receive unemployment

compensation after lay off or termination.

Is not eligible for unemployment

compensation benefits.

Eligible to receive worker's compensation

benefits for any workplace injury.

Is not eligible for worker's compensation

benefits.

Is covered by federal and state wage and

hour laws such as minimum wage and

overtime rules.

Is paid according to the terms of the

contract, and does not receive additional

compensation for overtime hours worked.

Information taken from Findlaw.com

IRS Publication Topic 762 discusses the difference between an

independent contractor and an employee. There are three tests that

determine whether your employee is a contractor or a n employee. If

the person is found to be an employee under any one test, (s)he must

be treated as an employee and the employer must withhold and pay

payroll taxes for the employee as described below.

Behavioral Control: If the employer directs or controls how the work is

done, through instructions, training, or other mean s the hired person

is a common law employee for which payroll taxes must be paid. An

independent contractor is given a task to perform, (s)he provides his

own tools and equipment, schedules his own work and performs similar

services to other employers.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 45 of 72

Financial Control: If one or more of the following conditions applies to

the hired person, (s)he is treated as a common law employee:

The person is reimbursed for business expenses

The person does not makes his or her services available to

other businesses in the relevant market

Type of Relationship covers facts that show how the parties perceive

their relationship. The hired person is a common law employee if:

The business provides the worker with employee-type benefits,

such as insurance, a pension plan, vacation pay, or sick pay

The position is permanent and the services performed by the

worker are a key aspect of the regular business of the company

Based on our assessment, a person hired to care for clients in an Adult

Care Facility should be treated as common law employees unless they

provide similar services for other small businesses like home health

care agencies, nursing homes or other Adult Care Facilities.

However, if you choose to treat any new hire as an independent

contractor, be sure you provide them with a contract that spells out

the expectations that make him/her a contractor. Independent

contractors are responsible for paying their own income taxes and their

own self-employment tax.

IRS form 1099-MISC

When you pay an Independent Contractor $600.00 or more for working

for your Adult Care Facility, you will be responsible for preparing and

mailing that independent contractor an IRS Form 1099-MISC by January

31st of the year following the payment. The Form 1099-MISC is used to

report to the IRS and to report to the independent contractor the total

payments you made to them.

The IRS has detailed information about the distinction between an

employee and independent contractor and how to report payments

made to employees and independent contractors. You may want to

consult with your CPA, attorney, or other small business professional

on this matter before making a final decision.

Small Business Toolkit for Adult Care Facilities Ohio Mental Health & Addiction Services Page 46 of 72