25

Financial Statements

T

in this topic are required by the

Securities and Exchange Commission (SEC) for all publicly traded companies

and are a useful tool for presenting a basic nancial picture of any company. e

four required nancial statements include the income statement, the statement of

changes in equity, the balance sheet, and the statement of cash ows.

e four nancial statements are integrally related. e balance sheet is

connected to the income statement (net income) through the change in retained

earnings shown in the statement of changes in shareholders’ equity. e balance

sheet change in cash and other changes in nancial position are presented in the

statement of cash ow. Changes in capital received in the balance sheet are shown

in the statement of changes in shareholders’ equity.

e way in which various nancial transactions a ect the elements of each of

the nancial statements and the proper classi cation of the various nancial trans-

actions is covered in Topic 2: Recognition, Measurement, Valuation, and Disclosure.

e nancial statements shown in this topic are all for a ctitious organi-

zation, Robin Manufacturing Company, for a given year, and linkages between

the various statements are illustrated with notes and by the amounts themselves.

e footnotes to nancial statements, which present required disclosures, are

also covered.

Most entities provide prior years’ nancial statement information next to

the current year’s information for comparison. For example, income and cash

ow statements usually show the results of three consecutive years, which allows

analysts to compare past performance to present performance and make a deter-

mination of future success.

LOS

§1.A.1.g

LOS

§1.A.1.e

READ the Learning Outcome Statements (LOS) for this topic as found in

Appendix A and then study the concepts and calculations presented here

to be sure you understand the content you could be tested on in the CMA

exam.

TOPIC 1

c01.indd 25 30-05-2015 13:53:19

COPYRIGHTED MATERIAL

26 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

is topic ends with a discussion of the needs of external users and how nan-

cial statements satisfy some of those needs.

Income Statement

e income statement, commonly called a prot and loss (P&L) statement, measures

the earnings of an entity’s operations over a given period of time, such as a quarter

or a year. e income statement is used to measure protability, creditworthiness,

and investment value of an entity, and along with the other statements, it helps

assess the amounts, timing, and uncertainty of future cash ows.

Income and Other Comprehensive Income

e nancial statement elements reported on the income statement are revenues,

expenses, gains, and losses. Financial Accounting Standards Board (FASB) Accounting

Standards Codication (ASC) Topic 220, Comprehensive Income (formerly SFAS No.

130), requires rms to report certain unrealized gains and losses outside of net income

as components of other comprehensive income. Comprehensive income is the sum

of net income plus (or minus) the items of other comprehensive income.

Firms have the option of presenting the calculation of comprehensive income

either as part of an income statement (appended at the end) or as a separate

statement of comprenhensive income. Comprehensive income can no longer be

presented as a part of the statement of shareholders’ equity.

Format of Financial Information

e two most common formats are single-step income statements and multiple-

step income statements.

Single-Step Income Statement

A single-step income statement subtracts total expenses and losses from total rev-

enues and gains in a single step. No attempt is made to categorize expenses and

revenues or to arrive at interim subtotals. However, despite the inherent simplicity

of the single-step income statement, the multiple-step income statement is cur-

rently more popular.

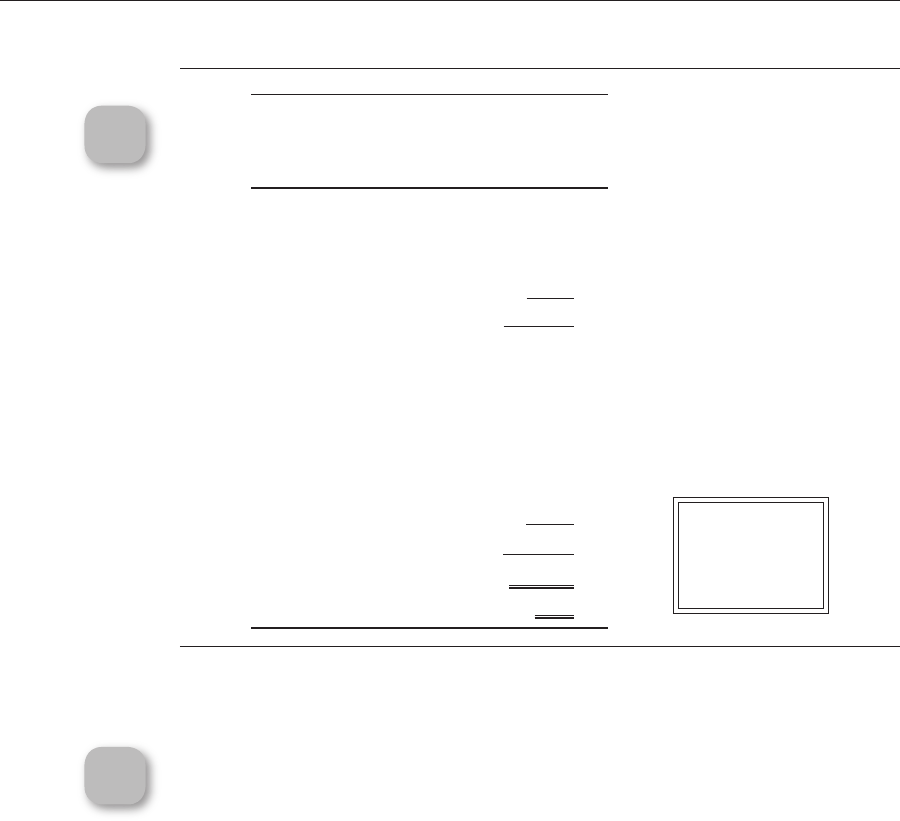

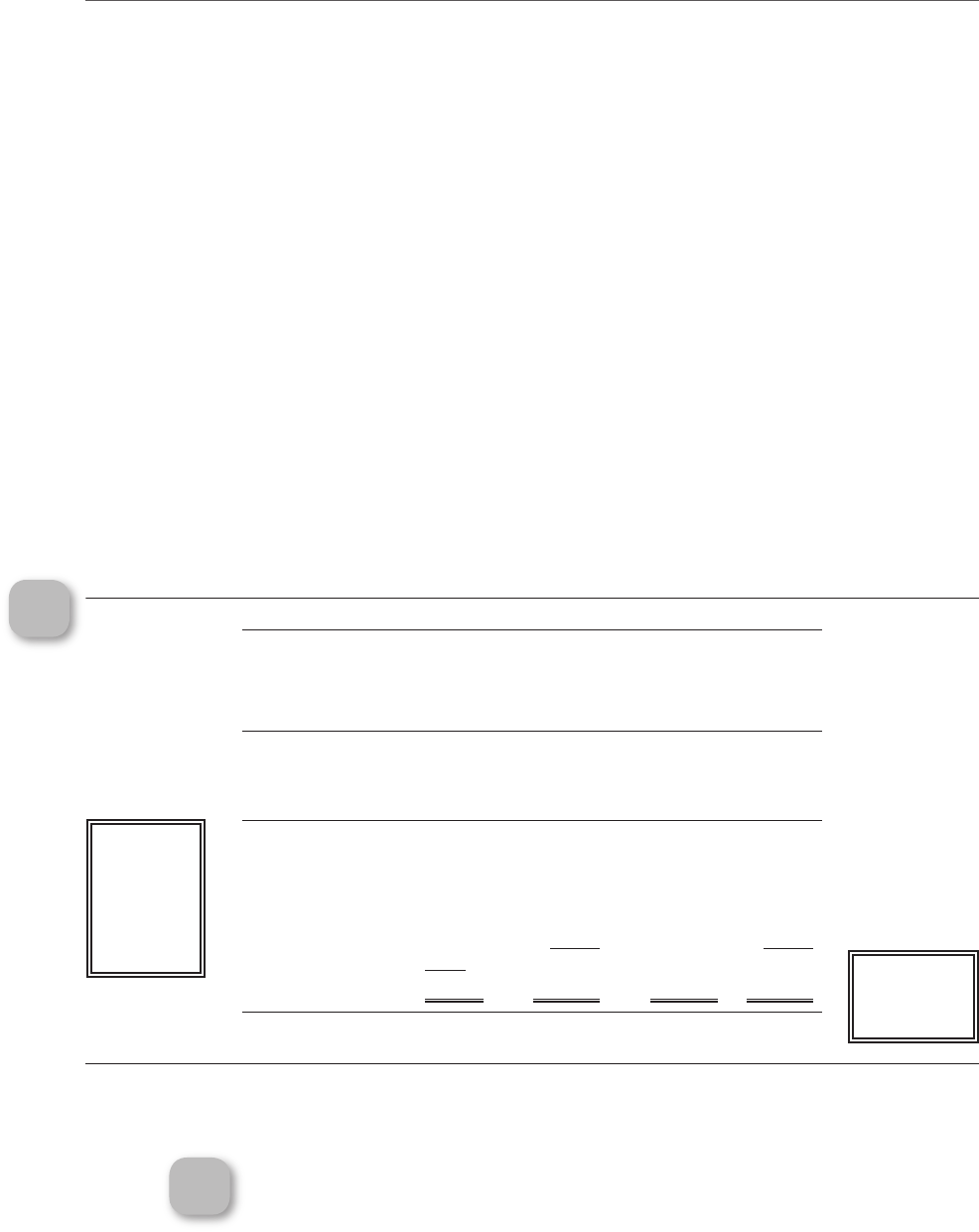

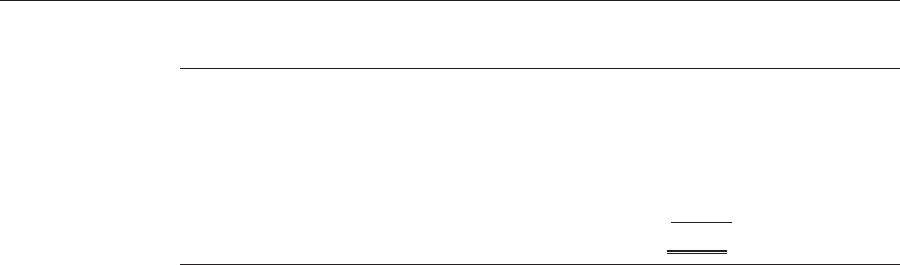

Figure 1A-1 shows a single-step income statement for Robin Manufacturing

Company, Year 1.

LOS

§1.A.1.b

c01.indd 26 30-05-2015 13:53:19

Section A, Topic 1—Financial Statements 27

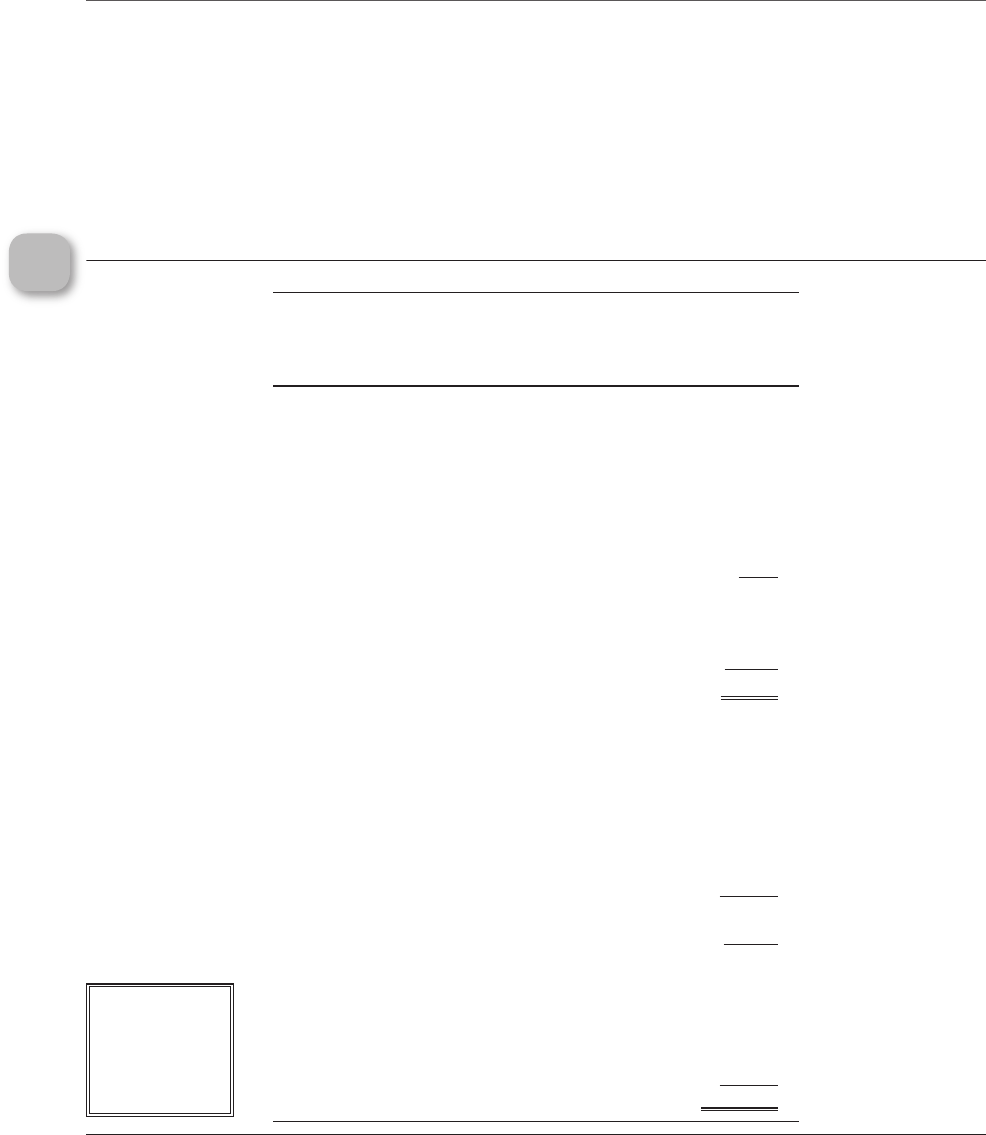

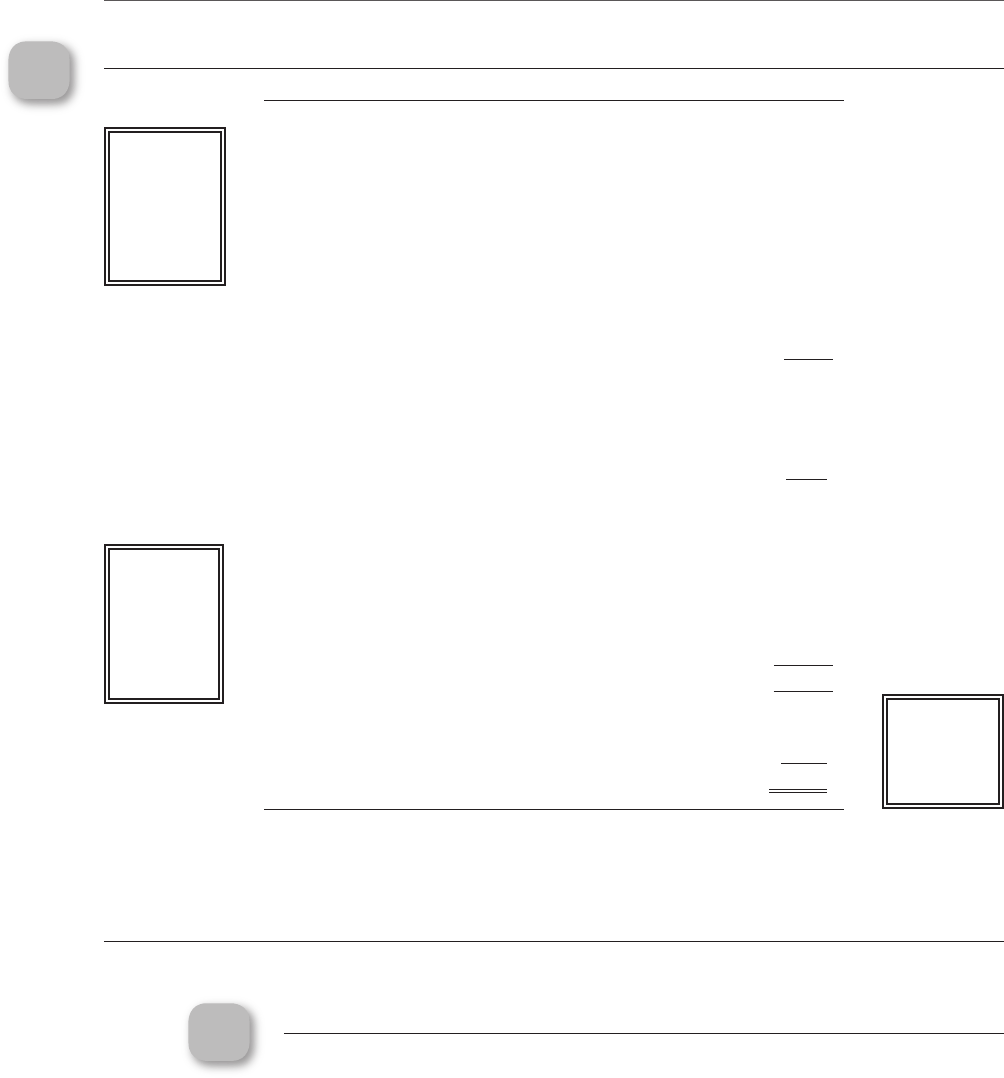

Multiple-Step Income Statement

e multiple-step income statement separates information into operating and nonop-

erating categories. e sections in the statement that do not relate to operating cash

ows are called other revenues and gains and other expenses and losses. ese catego-

ries could include gains and losses from the sale of equipment, interest revenue and

expense, or dividends received.

e multiple-step income statement has subcategories, such as cost of goods

sold (COGS); operating (selling and administrative) expenses; and other revenues,

expenses, gains, and losses. ese subcategories allow users to compare a compa-

ny’s results over time or with those of a competitor to determine the eciency with

which the entity’s scarce resources are used. Such comparisons are especially valu-

able when several years’ income statements are compared.

e multiple-step income statement oen reports subtotals for gross prot and

income from operations, which are useful for nancial statement analysis purposes.

For example, gross prot can be used to compare how competitive pressures have

aected prot margins.

Figure 1A-2 shows a multiple-step income statement.

LOS

§1.A.1.c

Figure 1A-1 Single-Step Income Statement

Robin Manufacturing Company

Income Statement

for the Year Ended December 31, Year 1

Revenues

Net sales $2,734,620

Dividend revenue 90,620

Rental revenue 67,077

Total revenues 2,892,317

Expenses

Cost of goods sold 1,823,938

Selling expenses 416,786

Administrative expenses 322,709

Interest expense 115,975

Income tax expense 61,579

Total expenses 2,740,987

Net income $151,330

Earnings per common share $1.89

To statement

of changes in

equity section

(Figure 1A-4)

→

LOS

§1.A.1.h

c01.indd 27 30-05-2015 13:53:19

28 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

Figure 1A-2 Multiple-Step Income Statement

Robin Manufacturing Company

Income Statement for the Year Ended December 31, Year 1 (Y1)

Sales Revenue

Sales $2,808,835

Less: Sales discounts $22,302

Less: Sales returns and allowances

51,913 74,215

Net sales revenue 2,734,620

Cost of Goods Sold

Merchandise inventory, Jan. 1, Y1 424,321

Purchases $1,830,518

Less: Purchase discounts

17,728

Net purchases 1,812,790

Freight and transportation—in

37, 363 1,850,153

Total merchandise available for sale 2,274,474

Less: Merchandise inventory, Dec. 31, Y1

450,536

Cost of goods sold $1,823,938

Gross profit on sales 910,682

Operating Expenses

Selling expenses

Sales salaries and commissions 186,432

Sales office salaries 54,464

Travel and entertainment 45,025

Advertising expense 35,250

Freight and transportation—out 37,912

Shipping supplies and expense 22,735

Postage and stationery 15,445

Depreciation of sales equipment 8,285

Telephone and Internet expense

11,238 416,786

Administrative expenses

Officers’ salaries 171,120

Office salaries 56,304

Legal and professional services 21,823

Utilities expense 21,413

Insurance expense 15,667

Building depreciation 16,614

Office equipment depreciation 14,720

Stationery, supplies, and postage 2,645

Miscellaneous office expenses

2,403 322,709 739,495

Income from operations 171,187

Other Revenues and Gains

Dividend revenue 90,620

Rental revenue

67,077 157,697

328,884

Other Expenses and Losses

Interest on bonds and notes 115,975

Income before income tax 212,909

Income tax 61,579

Net income for the year $151,330

Earnings per common share $1.89

LOS

§1.A.1.h

→

To statement

of change in

equity

(Figure 1A-4)

c01.indd 28 30-05-2015 13:53:19

Section A, Topic 1—Financial Statements 29

Additional Income Statement Presentation Items

Occasionally, companies will experience an event that requires separate reporting

below income from continuing operations. Additional items that may be located

at the end of the income statement include discontinued operations and extraor-

dinary items.

• Discontinued operations. When an entity disposes of a business component

that has clearly distinguishable operations and cash ows the item is recorded

in a separate section of the income statement aer continuing operations and

before extraordinary items. Discontinued operations are shown net of tax.

• Extraordinary items. Material items that are both unusual in nature and infre-

quent in occurrence also require a separate section in the income statement

and are shown net of tax.

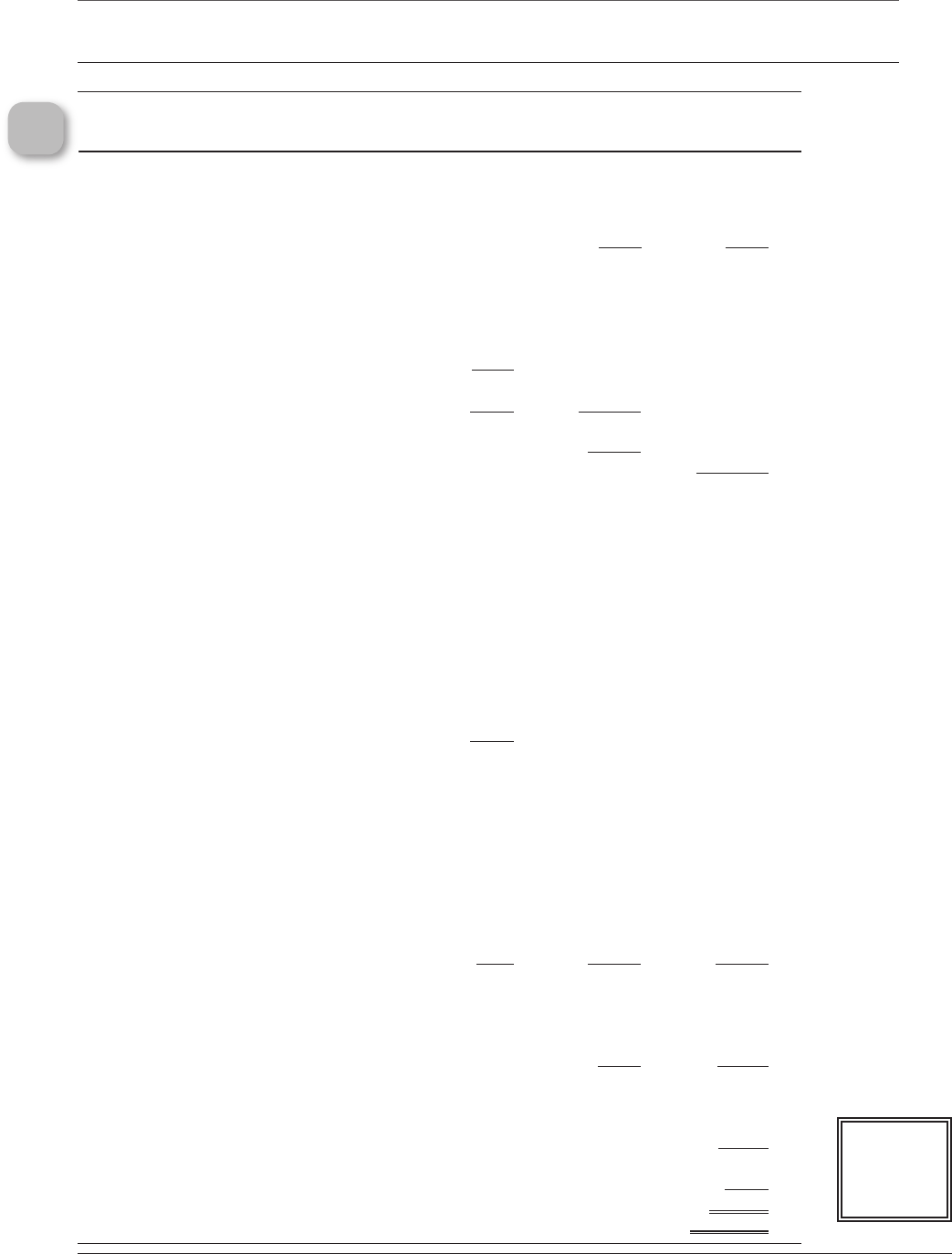

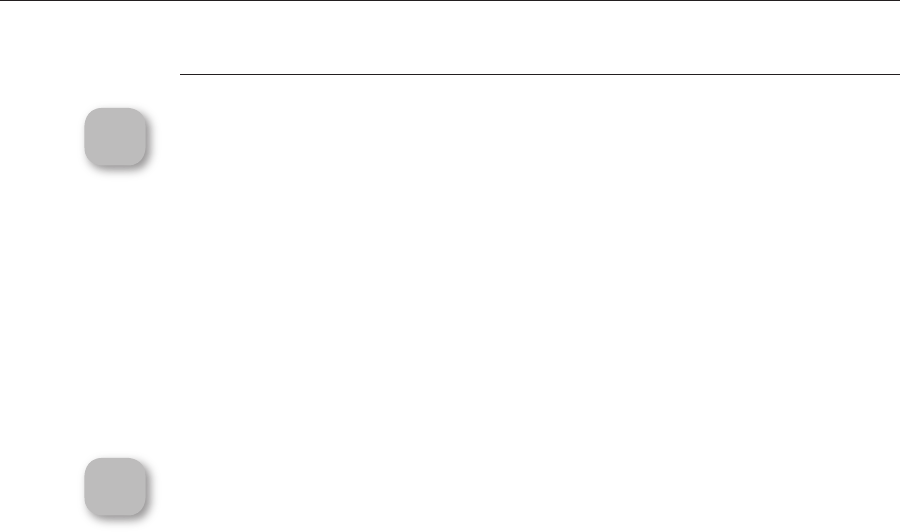

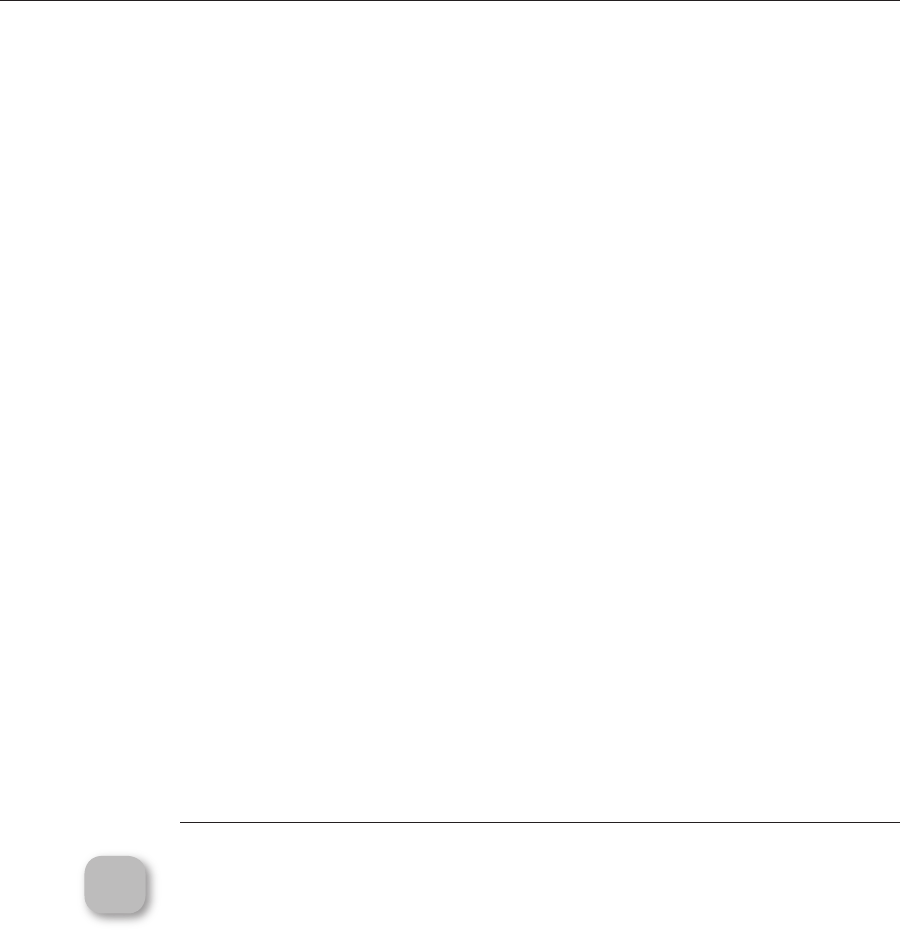

Figure 1A-3 shows how net income is determined when these items are included.

Figure 1A-3 Multistep Income Statement with Additional Income Statement Items

Statements of Change in Equity

When a balance sheet is issued, the FASB requires disclosure of the changes in

each separate shareholder’s equity account. is requirement satises the FASB’s

suggestion that complete nancial statements should include investments by and

distributions to owners during the period. e required statements of change in

equity is intended to help external users assess how changes in the company’s

nancial structure may aect its nancial exibility.

Major Components and Classifications

Shareholders’ equity includes several components: capital stock (par value of

preferred and common shares), additional paid-in capital, retained earnings, and

LOS

§1.A.1.b

LOS

§1.A.1.c

Net sales

− Cost of goods sold

Gross profit on sales

− Operating expenses

Operating income

+/− Other gains and losses

Earnings before tax

− Tax expense

Income from continuing operations

+/− Discontinued operations

+/− Extraordinary items

+/− Changes in accounting principle

Net income

c01.indd 29 30-05-2015 13:53:19

30 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

accumulated other comprehensive income. Capital stock is the par value (or face

value) for the shares, and additional paid-in capital is the amount paid for the shares

in excess of par. us, these two categories combine to form contributed capital, also

called paid-in capital. Retained earnings can be subdivided into general earnings

retained for company use and appropriated earnings set aside for some purpose.

Format of Financial Information

e statement of changes in equity usually lists information in the following order:

• Beginning balance for the period

• Additions

• Deductions

• Ending balance for the period

Figure 1A-4 shows a sample statement of changes in equity. is example shows

the statement listed in a columnar format for a company with only common stock

outstanding.

Balance Sheet

e balance sheet (sometimes called a statement of nancial position) is an essential

tool in assessing the amounts, timing, and uncertainty of prospective cash ows. It

is referred to as the balance sheet because of the balance expressed by the accounting

equation:

Assets = Liabilities + Shareholders’s Equity

LOS

§1.A.1.b

Figure 1A-4 Statement of Changes in Equity

Robin Manufacturing Company

Schedule of Changes in Shareholders’ Equity

for Year Ended December 31, Year 1 (Y1)

Common

Stock,

$1 Par

Additional

Paid-In

Capital

Retained

Earnings Total

Balance, Jan. 1, Y1

$24,680

$345,520 $90,251 $460,451

Net income 151,330 151,330

Cash dividends paid (33,330) (33,330)

Common stock

issued

1,000

14,800 15,800

Balance, Dec. 31, Y1

$25,680 $360,320 $208,251 $594,251

LOS

§1.A.1.h

From

income

statement

(Figures

1A-1 and

1A-2)

→

To balance

sheet

(Figure 1A- 6)

→

c01.indd 30 30-05-2015 13:53:19

Section A, Topic 1—Financial Statements 31

Alternatively, the accounting equation can tell us that equity equals assets less

liabilities, which is also known as net assets. e balance sheet provides a snapshot

of the company’s assets and the claims on those assets at a specic point in time.

While the balance sheet does not claim to show the value of the entity, it should

allow external users to make their own estimates of the entity’s value when used

in conjunction with the other nancial statements and other relevant information.

e balance sheet helps users evaluate the capital structure of the entity and

assess the entity’s liquidity, solvency, nancial exibility, and operating capability.

e balance sheet is also essential in understanding the income statement

because revenues and expenses reect changes in assets and liabilities, so an ana-

lyst must evaluate both statements together.

Major Components and Classifications

e balance sheet is divided into three sections: assets, liabilities, and shareholders’

equity. ese classications are designed to group similar items together so they can

be analyzed more easily. Assets are listed with the most liquid items rst and the least

liquid last. Liabilities are listed in the order in which they become due. In the case of

equity, the items that have most claim to the equity are listed before items with less

claim. Figure 1A-5 summarizes the general subdivisions of each category.

LOS

§1.A.1.c

Figure 1A-5 Balance Sheet Components

Assets Current assets (cash, accounts receivable

[A/R], inventory, etc.)

Long-term investments

Property, plant, and equipment (PP&E)

Intangible assets (patents, goodwill,

etc.)

Other assets

Liabilities Current liabilities (accounts payable [A/P],

interest payable, current portion of long-

term debt, etc.)

Long-term liabilities (bonds,

mortgages, etc.)

Other liabilities

Shareholders’ equity Capital stock

Treasury stock (contra equity)

Additional paid-in capital

Accumulated other comprehensive

income

Retained earnings

e components of assets, liabilities, and equity are more thoroughly discussed

in Topic 2 of this section.

Format of Financial Information

e two most common formats for the balance sheet are the account form and

the report form. All styles of balance sheets break down the assets, liabilities, and

shareholders’ equity into the categories listed in Figure 1A-5 (current assets, etc.).

e account form lists assets on the le side and liabilities and shareholders’ equity

c01.indd 31 30-05-2015 13:53:19

32 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

on the right side. e report form, shown in Figure 1A-6, lists assets at the top and

liabilities and shareholders’ equity at the bottom. Outside the United States, other

balance sheet formats are used, such as the nancial position form, which deducts

current liabilities from current assets to show working capital.

In Figure 1A-6, the assets and liabilities are also categorized by their levels of

nancial exibility. For example, current assets are shown separately from xed

assets.

Figure 1A-6 Balance Sheet

Robin Manufacturing Company

Balance Sheet

December 31, Year 1

Assets

Current assets:

Cash and short-term investments $24,628

Trade receivables, net of $30K allowance 552,249

Other receivables 18,941

Note receivable—related party 80,532

Inventory 252,567

Prepaid insurance 7,500

Total current assets 936,417

Fixed assets:

Property and equipment 209,330

Less: Accumulated depreciation (75,332)

Net fixed assets 133,998

Total assets $1,070,415

Liabilities and Equity

Current liabilities

Accounts payable $175,321

Accrued expenses 2,500

Current portion of long-term debt 36,000

Line of credit 145,000

Total current liabilities 358,821

Long-term debt 117,343

Total current and long-term liabilities 476,164

Shareholders’ equity:

Common stock, par 25,680

Additional paid-in capital 360,320

Retained earnings 208,251

Total shareholders’ equity 594,251

Total liabilities and shareholders’ equity $1,070,415

LOS

§1.A.1.h

From

statement

of change

in equity

(Figure 1A- 4)

→

→

→

→

c01.indd 32 30-05-2015 13:53:20

Section A, Topic 1—Financial Statements 33

Statement of Cash Flows

Cash is a company’s most liquid resource, and therefore it aects liquidity, operating

capability, and nancial exibility. FASB ASC Topic 230, Statement of Cash Flows

(formerly SFAS No. 95), says that a statement of cash ows “must report on a

company’s cash inows, cash outows, and net change in cash from its operating,

nancing, and investing activities during the accounting period, in a manner that

reconciles the beginning and ending cash balances.” e statement helps interested

parties determine if an entity needs external nancing or if it is generating positive

cash ows to meet its obligations and pay dividends. Keep in mind that a company

could have high income but still have negative cash ow.

Components and Classifications

Cash receipts and cash payments are classied in the statement of cash ows as

related to operating, investing, or nancing activities.

Operating Activities

Cash ows from operating activities are those related to the normal course of

business. Any transaction that does not qualify as an investing or nancing

activity is included in the operating activity section. Examples of cash inows

include cash receipts from sales of any kind, collection of A/R, collection of

interest on loans, and receipts of dividends. Cash outows include cash paid to

employees, suppliers, and the Internal Revenue Service (IRS) and to lenders for

interest.

Statements that are compliant with generally accepted accounting principles

(GAAP) use accrual accounting, so net income includes noncash revenues (e.g.,

uncollected credit sales) and noncash expenses (e.g., unpaid expenses). Other

items that are included in accrual accounting are depreciation, depletion, amorti-

zation, and other costs that were incurred in prior periods but are being charged

to expenses in the current period. ese items reduce net income but do not aect

cash ows for the current period. erefore, these items are added back when deter-

mining net cash ow from operating activities.

Examples of noncash expense and revenue items that must be added back to

net income include those listed next.

• Depreciation expense and amortization of intangible assets

• Amortization of deferred costs, such as bond issue costs

• Changes in deferred income taxes

• Amortization of a premium or discount on bonds payable

• Income from an equity method investee

To determine operating cash ows, FASB ASC Topic 230, Statement of Cash

Flows, allows entities to use either the indirect method or the direct method.

LOS

§1.A.1.b

LOS

§1.A.1.c

c01.indd 33 30-05-2015 13:53:20

34 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

Indirect Method

e indirect method, or reconciliation method, is the most popular method of con-

verting net income to net cash ow from operating activities. It starts with net

income and then adjusts it by adding back noncash expenses and paper losses and

subtracting noncash revenues and paper gains that have no eect on current period

operating cash ows. Additional adjustments are made for changes in current asset

and liability accounts related to operations by adding or subtracting amounts, as

shown in Figure 1A-7. For example, an increase in A/R (a current asset) would be

subtracted from net income to arrive at operating cash ows because it means that

the amount of cash collected from customers is less than the amount of accrual rev-

enue reported. See Figure 1A-7 for an example of the indirect method.

Figure 1A-7 Cash Flows from Operating Activities—Indirect Method

LOS

§1.A.1.h

Net income

+ Noncash expenses (typically depreciation and amortization expenses)

− Gains from investing and financing activities

+ Losses from investing and financing activities

+ Decreases in current assets

− Increases in current assets

+ Increases in current liabilities

− Decreases in current liabilities

+ Amortization of discounts on bonds

− Amortization of premiums on bonds

Operating cash flow

Direct Method

In the direct method, or income statement method, net cash provided by operating

activities is calculated by converting revenues and expenses from the accrual basis

to the cash basis. Although the FASB encourages the use of the direct method, it is

rarely used. Furthermore, if the direct method is used, the FASB requires that the

reconciliation of net income to net cash ow from operating activities be disclosed in

a separate schedule. Figure 1A-8 shows how a direct method statement is arranged.

(e gure includes sample amounts for illustration.)

Investing Activities

Most items in the investing activities section come from changes in long-term asset

accounts. Investing cash inows result from sales of PP&E, sales of investments in

another entity’s debt or equity securities, or collections of the principal on loans to

another entity. (Interest is included in operating cash ows.) Investing cash outows

c01.indd 34 30-05-2015 13:53:20

Section A, Topic 1—Financial Statements 35

result from purchases of PP&E, purchases of other companies’ debt or equity secu-

rities, and the granting of loans to other entities.

Financing Activities

Most items in the nancing activities section come from changes in long-term lia-

bility or equity accounts. Financing cash inows come from the sale of the entity’s

equity securities or issuance of debt, such as bonds or notes. Cash outows consist

of payments to stockholders for dividends and payments to reacquire capital stock

or redeem a company’s outstanding debt. In other words, investing activities involve

the purchase or sale of xed assets and investments in another company’s securi-

ties, while nancing activities involve the issuance and redemption of a company’s

own equity and debt securities.

Footnotes

e statement of cash ows requires footnote disclosure of any signicant noncash

investing and nancing activities, such as the issuing of stock for xed assets or

the conversion of debt to equity. In addition, when the indirect method for cash

ow from operations is used, both interest paid and income taxes paid need to be

disclosed.

Example of a Statement of Cash Flows

e statement of cash ows shown in Figure 1A-9 illustrates the more commonly

used indirect approach for calculating operating cash ows. Cash ows from each

category (operating, investing, and nancing) are separately classied and totaled.

e sum of cash inows (or outows if negative) from these three categories equals

the net increase or decrease in cash for the period. is net cash inow (outow) is

added to (subtracted from) the cash balance at the beginning of the year to obtain

the cash balance at the end of the year (highlighted in gray). us the cash ow

statement explains the net change in the amount of cash and cash equivalents

(short-term, highly liquid investments that are close to maturity) from the begin-

ning to the ending balance sheet.

Figure 1A-8 Cash Flows from Operating Activities—Direct Method

Cash received from customers $100,000

Cash paid to suppliers (40,000)

Cash paid for interest (5,000)

Cash paid for taxes (10,000)

Cash paid for operating expenses (25,000)

Cash provided by operating activities $20,000

c01.indd 35 30-05-2015 13:53:20

36 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

Figure 1A-9 Statement of Cash Flows—Indirect Method

Operating Activities

Net income $151,330

Adjustments to convert net income to a cash basis:

Depreciation and amortization charges* 75,332

Decrease (increase) in accounts receivable (31,445)

Increase (decrease) in merchandise inventory (4,165)

Increase (decrease) in accounts payable 6,740

Increase (decrease) in accrued wages and salaries payable 4,543

Increase (decrease) in accrued income taxes payable 3,984

Increase (decrease) in deferred income taxes (4,950)

Gain on sale of store

†

(1,255)

Net cash provided by operating activities 200,114

Investing Activities

Additions to property, buildings, and equipment (123,730)

Proceeds from sale of store

3,980

Net cash used in investing activities (119,750)

Financing Activities

Increase (decrease) in notes payable 1,100

Increase (decrease) in additional paid-in capital 14,800

Increase (decrease) in long-term debt (50,500)

Increase (decrease) in common stock 1,000

Cash dividends paid

(33,330)

Net cash used in financing activities

(66,930)

Net increase in cash and cash equivalents 13,434

Cash and cash equivalents at beginning of year 11,194

Cash and cash equivalents at end of year

$24,628

Note: Changes in various asset and liability accounts (e.g., increases/decreases) can be

obtained by comparing two consecutive years’ balance sheets.

* Depreciation and amortization charges are included in the income statement as part

of administrative expenses.

†

Gain on sale of store is included in the income statement as part of other revenue.

LOS

§1.A.1.h

From

income

statement

(Figures

1A-1 and

1A-2)

→

From

statement

of change

in equity

(Figure

1A-4)

→

→

→

To balance

sheet

(Figure

1A-6)

→

Limitations of the Financial Statements

e following items describe the limiting characteristics of nancial statements.

• Historical cost. Most asset accounts of a nonnancial nature are reported at

historical cost. While historical cost measures are considered reliable because

the amounts can be veried, they are also considered less relevant than fair

value or current market value measures would be for assessing a rm’s current

nancial position.

• Dierent accounting methods. Employing dierent accounting methods will

yield dierent net incomes. Each choice of two or more accounting methods

LOS

§1.A.1.d

c01.indd 36 30-05-2015 13:53:20

Section A, Topic 1—Financial Statements 37

will further change the results reported, making the task of comparing dier-

ent entities very dicult, even when these methods are disclosed.

• Omit nonobjective items of value. Financial statements exclude valuable assets

that are of nancial importance but cannot be objectively expressed in num-

bers. For example, the value of human resources, intangibles such as brand

recognition and reputation, or the value of the entity’s customer base cannot

be exactly or reliably estimated, so they are not included on the balance sheet.

erefore, the balance sheet does not pretend to measure the value of the com-

pany as a whole.

• Use of estimates and judgments. Financial statements incorporate the use of

numerous estimates and professional judgments. Dierences in estimates mean

that the income statements for two or more entities may be dicult to compare.

Common estimates include the amount of receivables allocated to an allow-

ance for doubtful accounts and the useful life and salvage value of a piece of

equipment.

•O–balance sheet information. Transactions may be recorded in a way that

avoids reporting liabilities and assets on the balance sheet, for example, with

an operating lease. e Sarbanes-Oxley Act of 2002 (SOX) requires publicly

traded rms to disclose o–balance sheet information in their lings with

the SEC.

• Noncash transactions. e statement of cash ows omits noncash transactions,

such as the exchange of stock for a property, exchanges of nonmonetary assets,

conversion of preferred stock or debt to common stock, or issuing equity secu-

rities to retire a debt. Disclosure of any noncash transactions that aect assets

or liabilities would be reported in a note or a supplemental schedule.

Footnotes/Disclosures to Financial Statements

Footnotes or disclosures to nancial statements are used when parenthetical expla-

nations would not suce to describe situations particular to the entity. Typical

disclosures include contingencies, contractual situations, accounting policies, and

subsequent events.

Contingencies

Contingencies are material events with an uncertain outcome dependent on the

occurrence or nonoccurrence of one or more future events. Contingencies can be

either gain contingencies or loss contingencies. Income recognition is not given to

gain contingencies; however, loss contingencies must be recognized when it is both

probable that a loss has been incurred and the amount of the loss is reasonably esti-

mable. Other material loss contingencies should be disclosed in the footnotes to the

nancial statements; gain contingencies may also be disclosed.

Loss contingencies result from situations such as pending litigation, war-

ranty and premium costs, environmental liabilities, and self-insurance risks. Gain

LOS

§1.A.1.f

c01.indd 37 30-05-2015 13:53:20

38 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

contingencies result from pending litigation (where the outcome is favorable to the

company), possible refunds of disputed tax amounts, and tax loss carryforwards.

Contractual Situations

Contractual agreements, such as pension obligations, lease contracts, and stock

option plans, are required to be disclosed in the notes to nancial statements. Other

signicant items should also be included. Contractual situations may require an

entity to restrict certain funds, for example, and analysts need to understand how

such provisions will aect the entity’s nancial exibility.

Accounting Policies

Whenever GAAP or industry-specic regulations allow a choice between two or

more accounting methods, the method selected should be disclosed. FASB ASC

Topic 235, Notes to Financial Statements (formerly Accounting Principles Board

[APB] Opinion No. 22), states that “a description of all signicant accounting poli-

cies of the reporting entity should be included as an integral part of the nancial

statements.”

ASC Topic 235 notes that three types of accounting disclosures related to rec-

ognition and asset allocation should be made:

1. Selection between acceptable alternatives

2. Selection of industry-specic methods

3. Unusual or innovative applications of GAAP

Most companies prepare a separate note, “Summary of Signicant Accounting

Policies,” in which they report on the methods used to recognize revenue, calculate

depreciation, value inventory, and measure other amounts reported on the nan-

cial statements.

Subsequent Events

It may take weeks or even months to issue the annual report aer the accounting

period has closed, and signicant business events and transactions may occur during

this period. A subsequent event is an event occurring between the balance sheet date

and the issuance date of the annual report. If the event provides additional evidence

about conditions that existed as of the balance sheet date and alters the estimates used

in preparing the nancial statements, then the nancial statements should be adjusted.

Subsequent events that provide evidence regarding conditions that did not exist

on the balance sheet date should be disclosed in a note, supplemental schedule, or

pro forma statement.

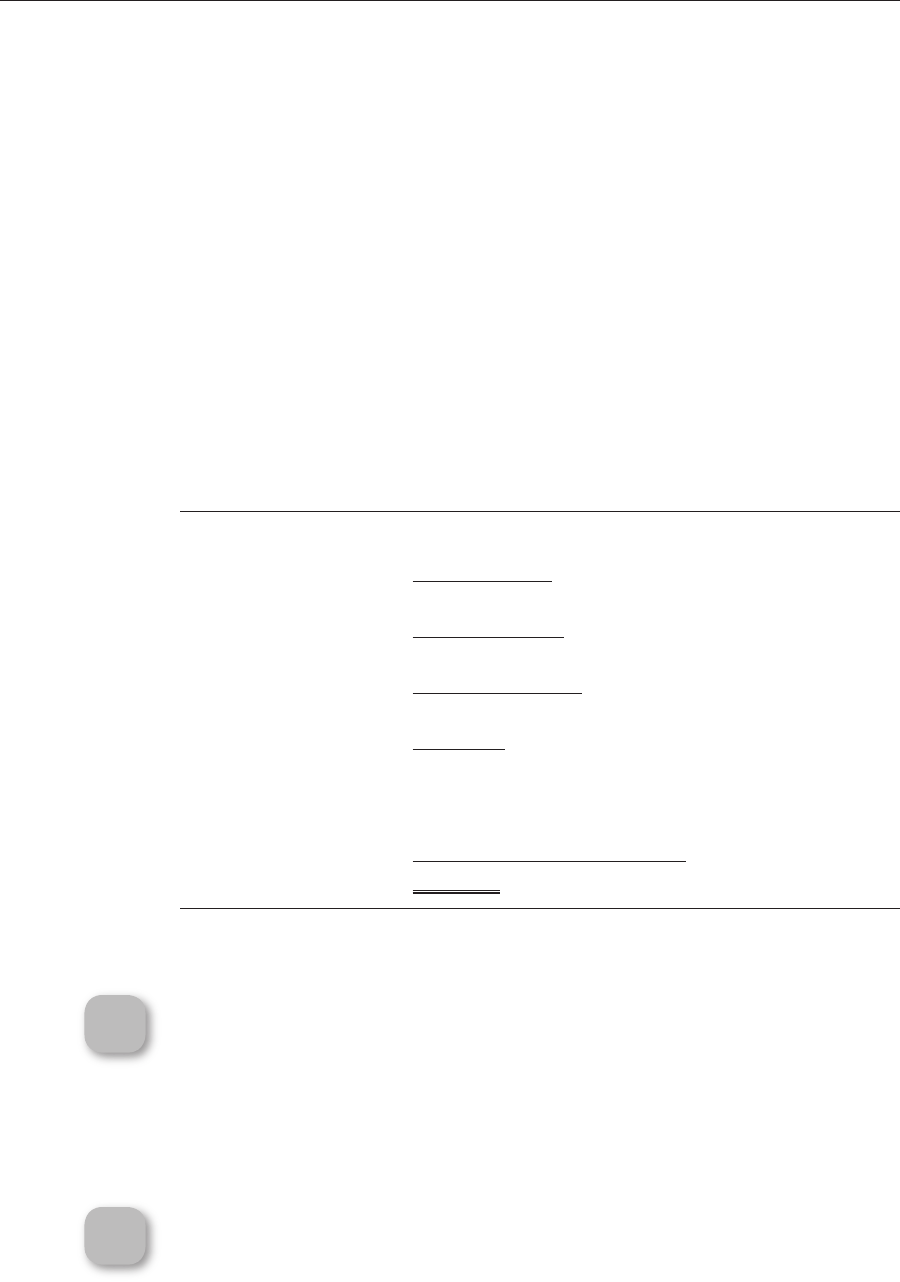

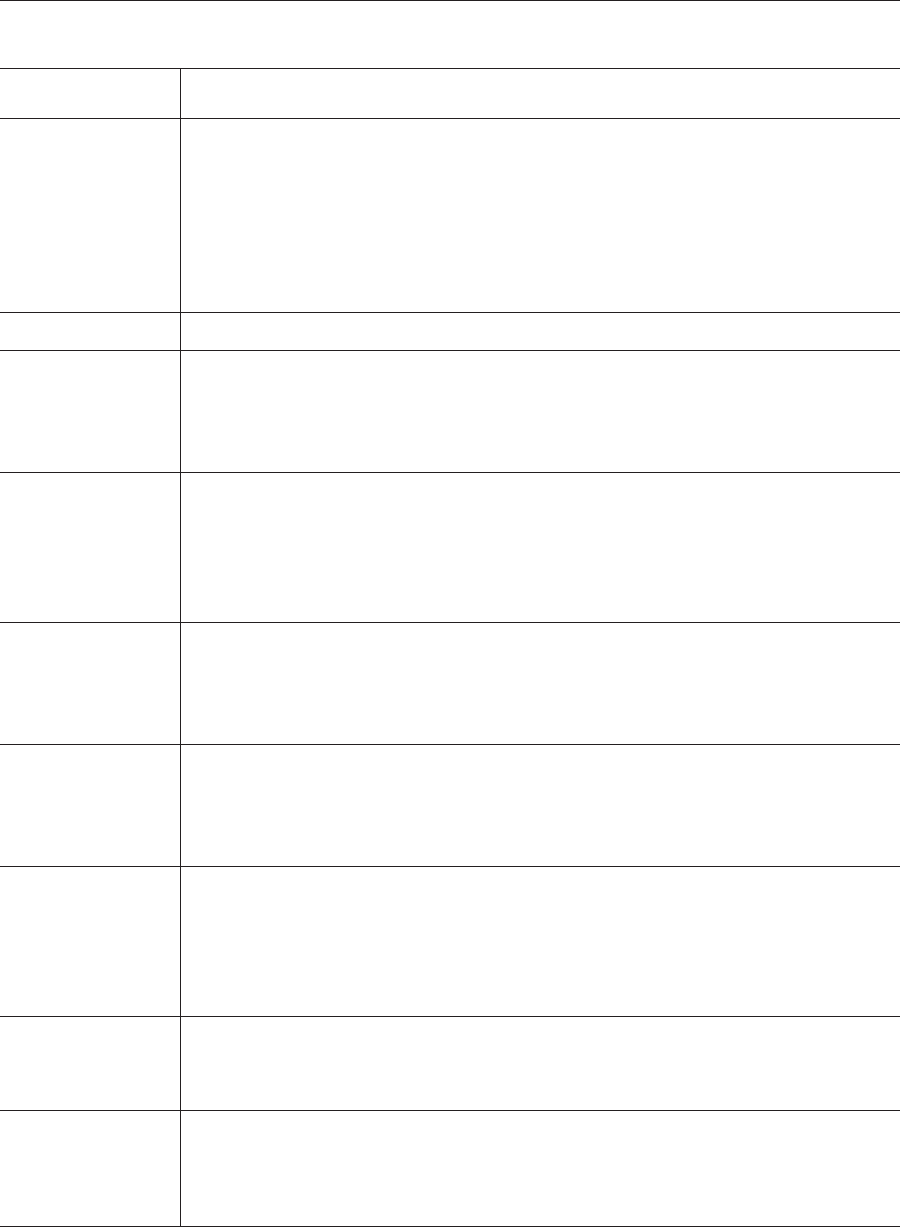

In addition to the disclosures mentioned already, Figure 1A-10 lists other major

areas that require some form of disclosure beyond the information presented in the

nancial statements.

ese disclosures are covered in more detail throughout the rest of this book.

c01.indd 38 30-05-2015 13:53:20

Section A, Topic 1—Financial Statements 39

Figure 1A-10 Summary of Required Footnotes/Disclosures

Category Footnote/Disclosure

Inventories Valuation basis (net realizable value, cost, lower of cost or market)

Cost flow assumption (specific identification; average cost; first in, first out [FIFO]; last in, first

out [LIFO])

Inventory classifications (purchases, raw materials, work-in-process accounts, finished goods,

supplies); classified separately only if significant

Product financing arrangements, if any

FIFO equivalent if the company uses LIFO

Revenue Policy on revenue recognition

Accounts receivable Collectibility

Collection policy

Determination of bad debt

Allowance for bad debt

PP&E Valuation basis

Depreciation expenses for the period

Accumulated depreciation at the balance sheet date

Depreciable asset balances by major class (either by nature or function)

General description of the depreciation methods used by major class of depreciable asset

Intangibles

(e.g., patents)

Description of the nature of the intangible

Amount of amortization expense for the period

Method and period of amortization

Remaining useful life of the intangible

Bonds payable Par value

Stated and effective interest rate

Call provisions

Maturity date

Preferred stock Par or stated value

Changes in the number of shares authorized, issued, and outstanding for the period

Dividend rate

Special features of the preferred stock (convertible, cumulative, participating)

Dividends in arrears

Common stock Par or stated value

Changes in the number of shares authorized, issued, and outstanding for the period

Dividends declared (amount and type)

Other Amount, nature, duration, and other significant provisions of any restrictions on retained

earnings

Prior period adjustments

Employee plans, such as employee stock option plans (ESOPs)

c01.indd 39 30-05-2015 13:53:20

40 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

Users of Financial Statements

Financial statements are intended to aid in decision making. e most ecient

companies will attract investors or will be granted credit rst and will also be more

likely to produce a higher return on investment. Moreover, a company becomes

ecient partly through the proper allocation of its internal resources to those

areas most likely to produce a prot. Financial statements are an integral part

of the decision-making process for users both internal to the organization and

external to it.

Internal and External Users

Internal Users

Internal users need nancial statements and other sources of information for inter-

nal decision making. e information is used to plan and control operations on

both a short-term and long-term basis. e quality of these decisions will have an

impact on how internal resources are allocated, the prots that are realized, and,

ultimately, whether the organization will survive. Internal users of nancial state-

ments include executives, managers, management accountants, and other employ-

ees including those with stock options or investments in the organization. Unlike

external users, internal users may request or generate any type of information that

is available in their accounting system. e potential for misuse of such information

requires an organization to place internal controls on the use and access to such

information, but not to the extent that the internal decision makers cannot access

the information needed in a timely manner.

External Users

External users are any interested parties who must rely on the published nan-

cial statements and other publicly available information of an entity when making

investment decisions. Some external users, such as lending institutions, may be in a

position to demand additional information from an entity that is not publicly avail-

able. As mentioned earlier, the FASB denes external users as current and potential

investors and creditors and their advisors who have a reasonable understanding of

business and economics and who are willing to study the information with reason-

able diligence. Investors, creditors, unions, analysts, nancial advisors, competitors,

and government agencies are all external users of information. Investors include

individuals and other corporations. Creditors include lending institutions and sup-

pliers of raw materials and other goods.

Needs of External Users

Creditors and investors comprise the two main sources of capital for publicly traded

entities, so primary focus of nancial statements is the needs of these two types of

users. According to the FASB, nancial reporting should provide information that

LOS

§1.A.1.a

c01.indd 40 30-05-2015 13:53:20

Section A, Topic 1—Financial Statements 41

is useful to external users in making reasoned choices among alternative invest-

ment, credit, and similar decisions. Users cannot absorb innite amounts of data,

and too much information may obscure the most relevant measures of the success

of a business. erefore, the goal of accounting is to summarize the vast amount of

information into understandable reports and disclosures. e FASB’s statements

are intended to require a minimum level of disclosure, but it is still up to each entity

to make this information user friendly.

Needs of Investors and Creditors

Financial information must be relevant and reliable for it to be useful, and relevance

means that it must also be presented in a timely fashion. Investors and lenders are

interested in both a return of their investment and a return on their investment.

ey receive a return of their investment only if the organization can maintain its

capital. ey receive a return on their investment through dividends and interest.

Investors in the stock market receive a return on their investment if the market

perceives that the company is doing well. Actual or potential investors who have

or are considering a direct ownership stake in an entity need nancial information

primarily to decide whether to initiate or continue this relationship (i.e., buy, hold,

or sell the rm’s securities).

Actual or potential creditors are interested in the ability of the entity to com-

ply with debt covenants. e four decisions they are concerned with are to extend

credit, maintain credit, deny credit, or revoke credit. Creditors are also interested

in nancial statements to determine the risk level of their loan. Lending institu-

tions expect a higher return on investment for more risky endeavors and will make

low-return investments only when the risk is similarly low. erefore, the entity’s

credit rating is of particular importance. e credit rating is based primarily on

the entity’s liquidity, solvency, and nancial exibility, all of which are determined

from the entity’s nancial statements and other disclosures.

Other users of nancial statements include stock exchanges (for rule making,

listings, and cancellations), unions (for negotiating wages), and analysts (for advis-

ing others).

c01.indd 41 30-05-2015 13:53:20

42 CMAexcel Self-Study Part 1: Financial Reporting, Planning, Performance, and Control

Knowledge Check:

Financial Statements

The next questions are intended to help you check your understanding and recall of

the material presented in this topic. They do not represent the type of questions that

appear on the CMA exam.

Directions: Answer each question in the space provided. Correct answers and

section references appear after the knowledge check questions.

1. On the statement of cash fl ows, which of the following is included in the

operating activities section?

◻

a. Purchase of equipment

◻

b. Purchase of treasury stock

◻

c. Issuing 1,000 shares of common stock

◻

d. Income taxes paid

2. On the balance sheet, which of the following accurately describes the order

in which items are listed?

◻

a. Assets are listed from most to least liquid; liabilities are listed in the

order in which they become due.

◻

b. Assets and liabilities are listed in the order in which they become

due; equity is listed from least to most liquid.

◻

c. Assets are listed from least to most liquid; liabilities are listed in the

order in which they become due.

◻

d. Assets and liabilities are listed from most to least liquid; equity is

listed in the order in which the items are used.

3. True or false? The balance sheet does not show the value of the entity.

◻

a. True

◻

b. False

4. True or false? The income statement presents the following items net of tax:

gains and losses from discontinued operations, and extraordinary items.

◻

a. True

◻

b. False

c01.indd 42 30-05-2015 13:53:21

Section A, Topic 1—Financial Statements 43

Knowledge Check Answers:

Financial Statements

1. On the statement of cash fl ows, which of the following is included in the

operating activities section? [See Statement of Cash Flows.]

◻

a. Purchase of equipment

◻

b. Purchase of treasury stock

◻

c. Issuing 1,000 shares of common stock

d. Income taxes paid

2. On the balance sheet, which of the following accurately describes the order

in which items are listed? [See Balance Sheet.]

a. Assets are listed from most to least liquid; liabilities are listed in the

order in which they become due.

◻

b. Assets and liabilities are listed in the order in which they become

due; equity is listed from least to most liquid.

◻

c. Assets are listed from least to most liquid; liabilities are listed in the

order in which they become due.

◻

d. Assets and liabilities are listed from most to least liquid; equity is

listed in the order in which the items are used.

3. True or false? The balance sheet does not show the value of the entity. [See

Balance Sheet.]

a. True

◻

b. False

4. True or false? The income statement presents the following items net of tax:

gains and losses from discontinued operations and extraordinary items. [See

Income Statement.]

a. True

◻

b. False

c01.indd 43 30-05-2015 13:53:21

c01.indd 44 30-05-2015 13:53:21