Introduction to Financial

Statements

1-1

CHAPTER 1

Chapter Preview

How do you start a business? How do you determine whether your business is making or los-

ing money? How should you nance expansion—should you borrow, should you issue stock,

should you use your own funds? How do you convince banks to lend you money or investors

to buy your stock? Success in business requires making countless decisions, and decisions

require nancial information.

The purpose of this chapter is to show you what role accounting plays in providing nan-

cial information.

Feature Story

Knowing the Numbers

Many students who take this course do not plan to be ac-

countants. If you are in that group, you might be think-

ing, “If I’m not going to be an accountant, why do I need

to know accounting?” Well, consider this quote from

Harold Geneen, the former chairman of

IT&T: “To be good

at your business, you have to know the numbers—cold.”

In business, accounting and financial statements are the

means for communicating the numbers. If you don’t know

how to read financial statements, you can’t really know

your business.

The Chapter Preview describes

the purpose of the chapter and

highlights major topics.

The Feature Story helps you pic-

ture how the chapter topic relates

to the real world of accounting

and business.

© My Good Images/Shutterstock

c01IntroductionToFinancialStatements.indd Page 1-1 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-1 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

COPYRIGHTED MATERIAL

1-2 CHAPTER 1 Introduction to Financial Statements

Knowing the numbers is sometimes even a matter of cor-

porate survival. Consider the story of

Columbia Sportswear

Company, headquartered in Portland, Oregon. Gert Boyle’s

family ed Nazi Germany when she was 13 years old and then

purchased a small hat company in Oregon, Columbia Hat

Company. In 1971, Gert’s husband, who was then running the

company, died suddenly of a heart attack. Gert took over the

small, struggling company with help from her son Tim, who

was then a senior at the University of Oregon. Somehow, they

kept the company a oat. Today, Columbia has more than 4,000

employees and annual sales in excess of $1 billion. Its brands

include Columbia, Mountain Hardwear, Sorel, and Montrail.

Columbia doesn’t just focus on nancial success. Several

of its factories continue to participate in a project to increase

health awareness of female factory workers in developing

countries. Columbia is also a founding member of the Sustain-

able Apparel Coalition, which strives to reduce the environ-

mental and social impact of the apparel industry. In addition,

the company monitors all of the independent factories that

produce its products to ensure that they comply with the com-

pany’s Standards of Manufacturing Practices. These standards

address issues including forced labor, child labor, harassment,

wages and bene ts, health and safety, and the environment.

Employers such as Columbia Sportswear generally assume

that managers in all areas of the company are “ nancially lit-

erate.” To help prepare you for that, in this text you will learn

how to read and prepare nancial statements, and how to use

key tools to evaluate nancial results using basic data analytics.

Chapter Outline

LEARNING OBJECTIVES

LO 1 Identify the forms of business

organization and the uses of

accounting information.

• Forms of business organization

• Users and uses of financial

information

• Ethics in financial reporting

DO IT! 1 Business Organization

Forms

LO 2 Explain the three principal

types of business activity.

• Financing activities

• Investing activities

• Operating activities

DO IT! 2 Business Activities

LO 3 Describe the four financial

statements and how they are

prepared.

• Income statement

• Retained earnings statement

• Balance sheet

• Statement of cash flows

• Interrelationships of statements

• Other annual report elements

DO IT! 3a Financial Statements

DO IT! 3b Components of Annual

Reports

Go to the Review and Practice section at the end of the chapter for a targeted summary

and practice applications with solutions.

Visit WileyPLUS for additional tutorials and practice opportunities.

LEARNING OBJECTIVE 1

Identify the forms of business organization and the uses of accounting information.

Suppose you graduate with a business degree and decide you want to start your own business.

But what kind of business? You enjoy working with people, especially teaching them new

skills. You also spend most of your free time outdoors, kayaking, backpacking, skiing, rock

Business Organization and Accounting Information Uses

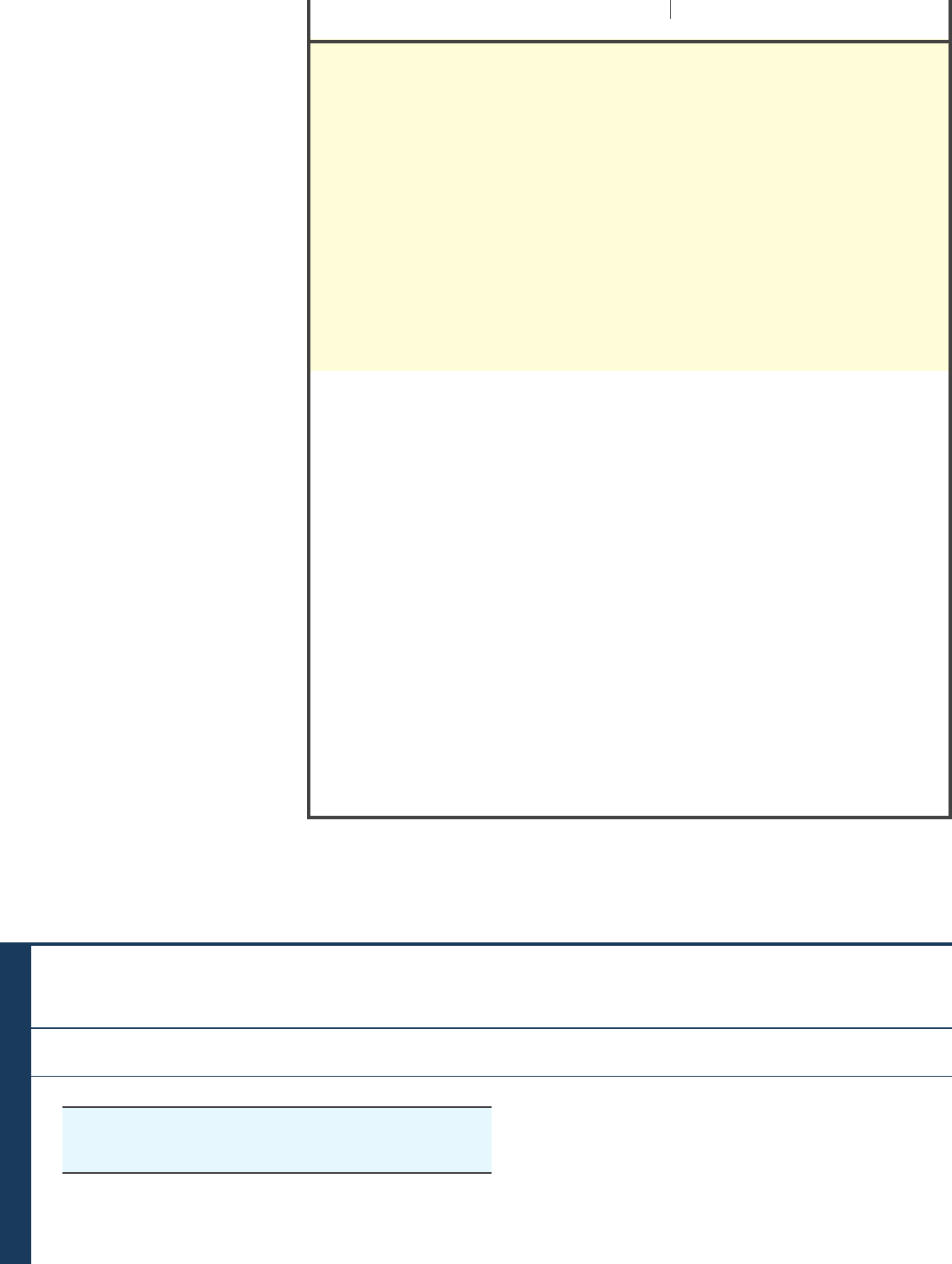

The Chapter Outline presents the chapter’s topics and subtopics, as well as practice opportunities.

c01IntroductionToFinancialStatements.indd Page 1-2 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-2 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

Business Organization and Accounting Information Uses 1-3

climbing, and mountain biking. You think you might be successful in opening an outdoor

guide service where you grew up, in the Sierra Nevada mountains.

Forms of Business Organization

Your next decision is to determine the organizational form of your business. You have three

choices—sole proprietorship, partnership, or corporation.

Sole Proprietorship

You might choose the sole proprietorship form for your outdoor guide service. A business

owned by one person is a

sole proprietorship. It is simple to set up and gives you control

over the business. Small owner-operated businesses such as barber shops, law o ces, and

auto repair shops are often sole proprietorships, as are farms and small retail stores.

Partnership

Another possibility is for you to join forces with other individuals to form a partnership. A

business owned by two or more persons associated as partners is a

partnership. Partnerships

often are formed because one individual does not have enough economic resources to ini-

tiate or expand the business. Sometimes partners bring unique skills or resources to the

partnership. You and your partners should formalize your duties and contributions in a writ-

ten partnership agreement. Retail and service-type businesses, including professional practices

(lawyers, doctors, architects, and certi ed public accountants), often organize as partnerships.

Corporation

As a third alternative, you might organize as a corporation. A business organized as a separate

legal entity owned by stockholders is a

corporation. Investors in a corporation receive shares

of stock to indicate their ownership claim. Buying stock in a corporation is often more attrac-

tive than investing in a partnership because shares of stock are easy to sell (transfer owner-

ship). Selling a proprietorship or partnership interest is much more involved. Also, individuals

can become stockholders by investing relatively small amounts of money (see

Alternative

Terminology

). Therefore, it is easier for corporations to raise funds. Successful corpo-

rations often have thousands of stockholders, and their stock is traded on organized stock

exchanges like the

New York Stock Exchange. Many businesses start as sole proprietorships

or partnerships and eventually incorporate.

Other factors to consider in deciding which organizational form to choose are taxes and

legal liability. If you choose a sole proprietorship or partnership, you generally receive more

favorable tax treatment than a corporation. However, proprietors and partners are personally

liable for all debts and legal obligations of the business; corporate stockholders are not. In

other words, corporate stockholders generally pay higher taxes but have no personal legal

liability. We will discuss these issues in more depth in a later chapter.

Finally, while sole proprietorships, partnerships, and corporations represent the main types

of business organizations, hybrid forms are now allowed in all states. These hybrid business

forms combine the tax advantages of partnerships with the limited liability of corporations.

Probably the most common among these hybrids types are limited liability companies (LLCs)

and subchapter S corporations. These forms are discussed extensively in business law classes.

The combined number of proprietorships and partnerships in the United States far exceeds

the number of corporations. However, the revenue produced by corporations is many times greater.

Most of the largest businesses in the United States—for example,

Coca-Cola, ExxonMobil,

General Motors, Citigroup, and Microsoft—are corporations. Because the majority of U.S.

business is done by corporations, the emphasis in this text is on the corporate form of organization.

Users and Uses of Financial Information

The purpose of nancial information is to provide inputs for decision-making. Accounting is

the information system that identi es, records, and communicates the economic events of an

organization to interested users.

ALTERNATIVE

TERMINOLOGY

Stockholders are some-

times called shareholders.

Alternative Terminology notes

present synonymous terms that

you may come across in practice.

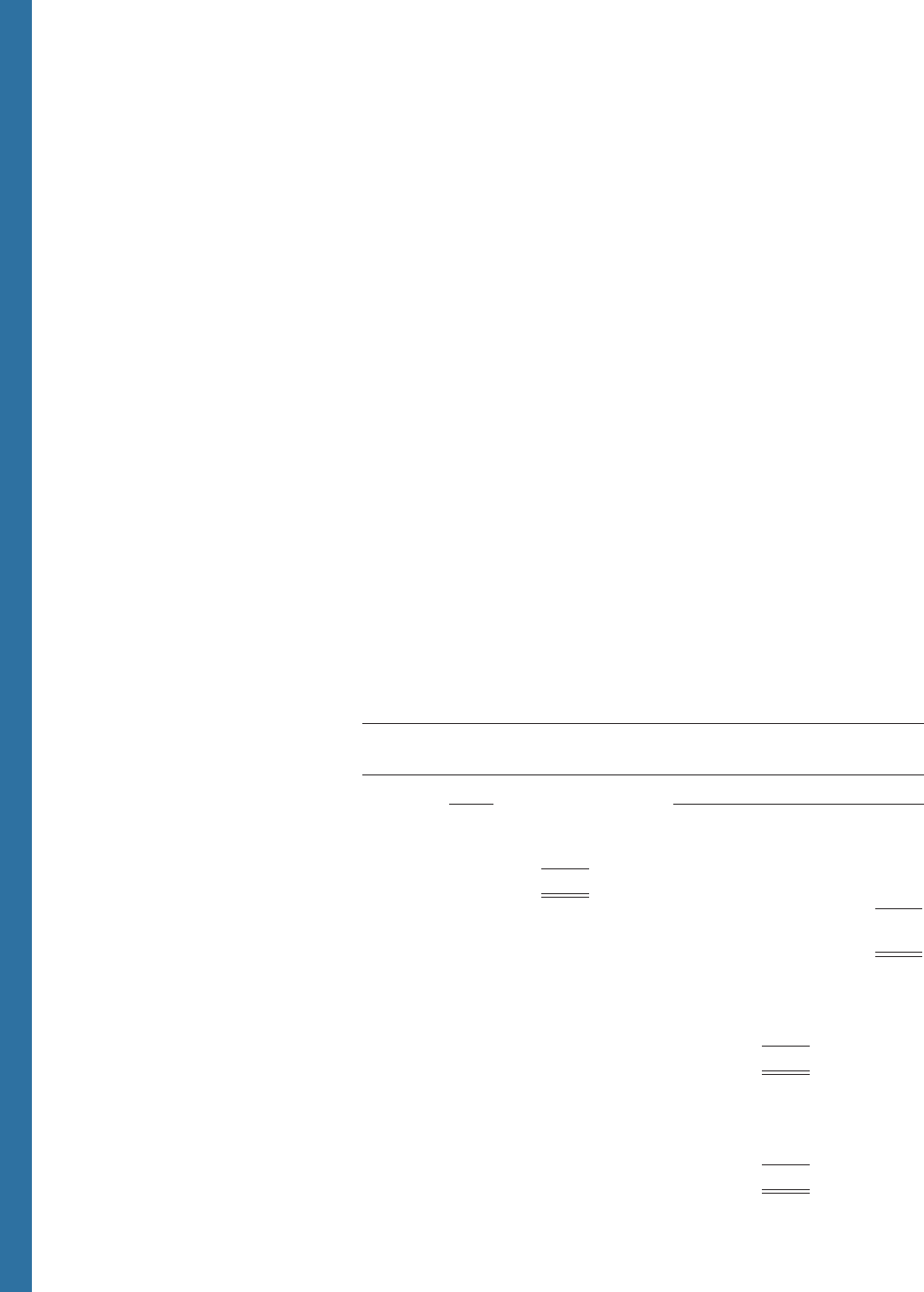

-Simple to establish

-Owner-controlled

-Tax advantages

Sole Proprietorship

-Simple to establish

-Shared control

-Broader skills and resources

-Tax advantages

Partnership

-Easier to transfer ownership

-Easier to raise funds

-No personal liability

Corporation

c01IntroductionToFinancialStatements.indd Page 1-3 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-3 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-4 CHAPTER 1 Introduction to Financial Statements

Accounting software systems collect vast amounts of data about the economic events

experienced by a company and about the parties with whom the company engages, such as sup-

pliers and customers. Business decision-makers take advantage of this wealth of data by using

data analytics to make more informed business decisions. Data analytics involves analyzing

data, often employing both software and statistics, to draw inferences. As both data access and

analytical software improve, the use of data analytics to support decisions is becoming increas-

ingly common at virtually all types of companies (see

Helpful Hint).

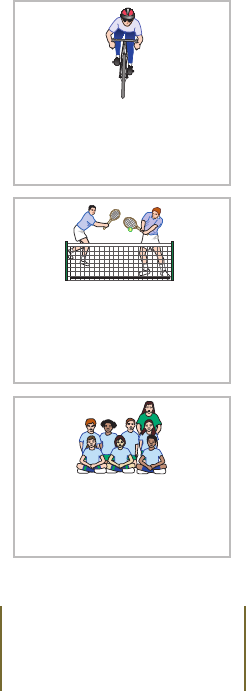

Users of accounting information can be divided broadly into two groups: internal users and

external users.

Internal Users

Internal users of accounting information are managers who plan, organize, and run a busi-

ness. These include marketing managers, production supervisors, nance directors,

and company o cers. In running a business, managers must answer many important ques-

tions, as shown in

Illustration 1.1.

HELPFUL HINT

Throughout this text, we

will highlight examples

where accounting infor-

mation is used to support

business decisions using

data analytics.

To answer these and other questions, you need detailed information on a timely basis. For

internal users, accounting provides internal reports, such as nancial comparisons of operating

alternatives, projections of income from new sales campaigns, and forecasts of cash needs for

the next year. In addition, companies present summarized nancial information in the form of

nancial statements.

Accounting Across the

Organization boxes show appli-

cations of accounting informa-

tion in various business functions.

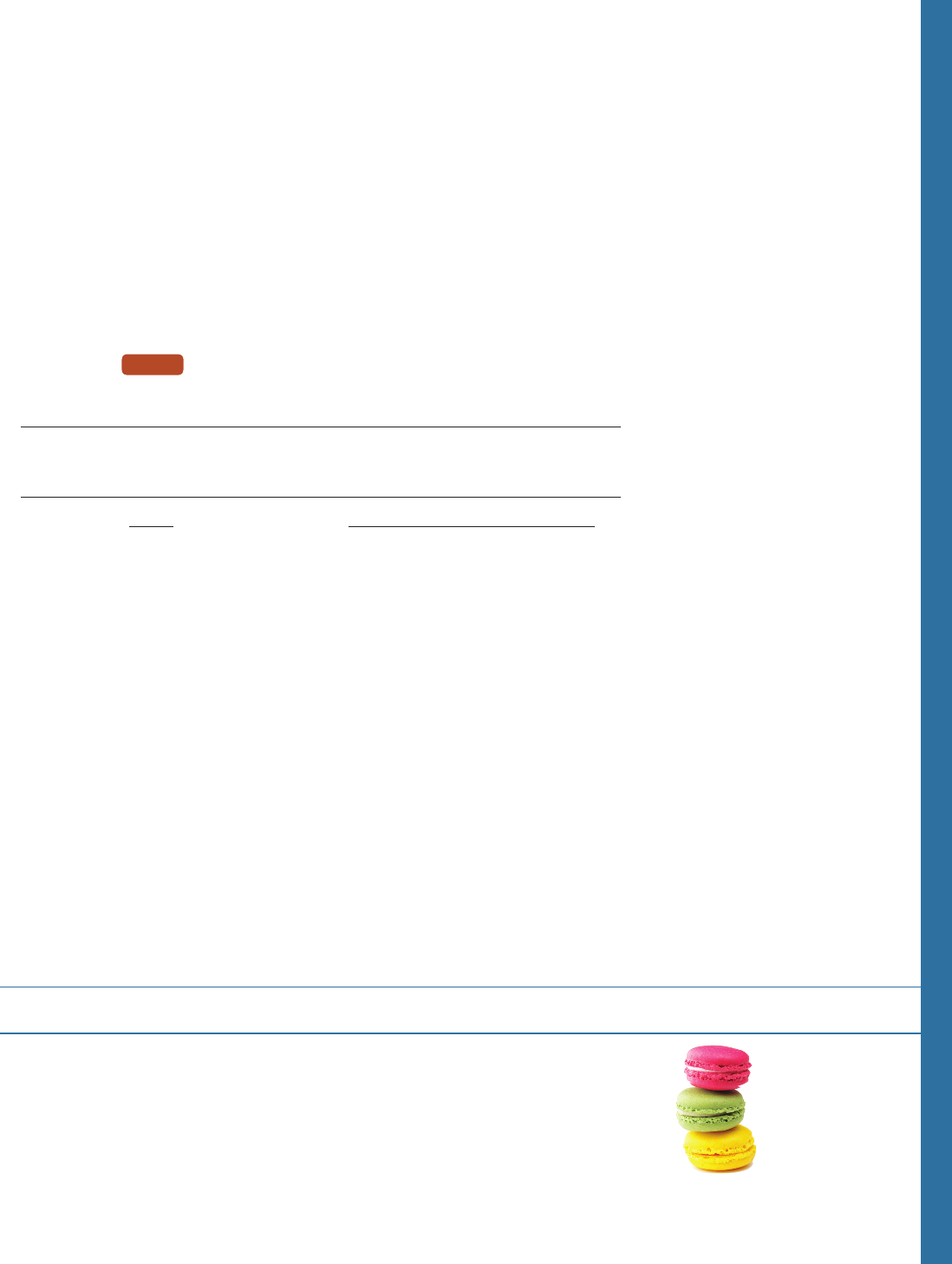

Accounting Across the Organization Clif Bar & Company

Owning a Piece of the Bar

The original Clif Bar® energy bar was cre-

ated in 1990 after six months of experimen-

tation by Gary Erickson and his mother

in her kitchen. The company has approx-

imately 1,000 employees and was named

one of Landor’s Breakaway Brands®. One of

Clif Bar & Company’s proudest moments

was the creation of an employee stock

ownership plan (ESOP). This plan gives its

employees 20% ownership of the company. The ESOP also resulted

in Clif Bar enacting an open-book management program, includ-

ing the commitment to educate all employee-owners about its -

nances. Armed with basic accounting knowledge, employees are

more aware of the nancial impact of their actions, which leads

to better decisions.

What are the bene ts to the company and to the employees

of making the nancial statements available to all employees?

(Go to WileyPLUS for this answer and additional questions.)

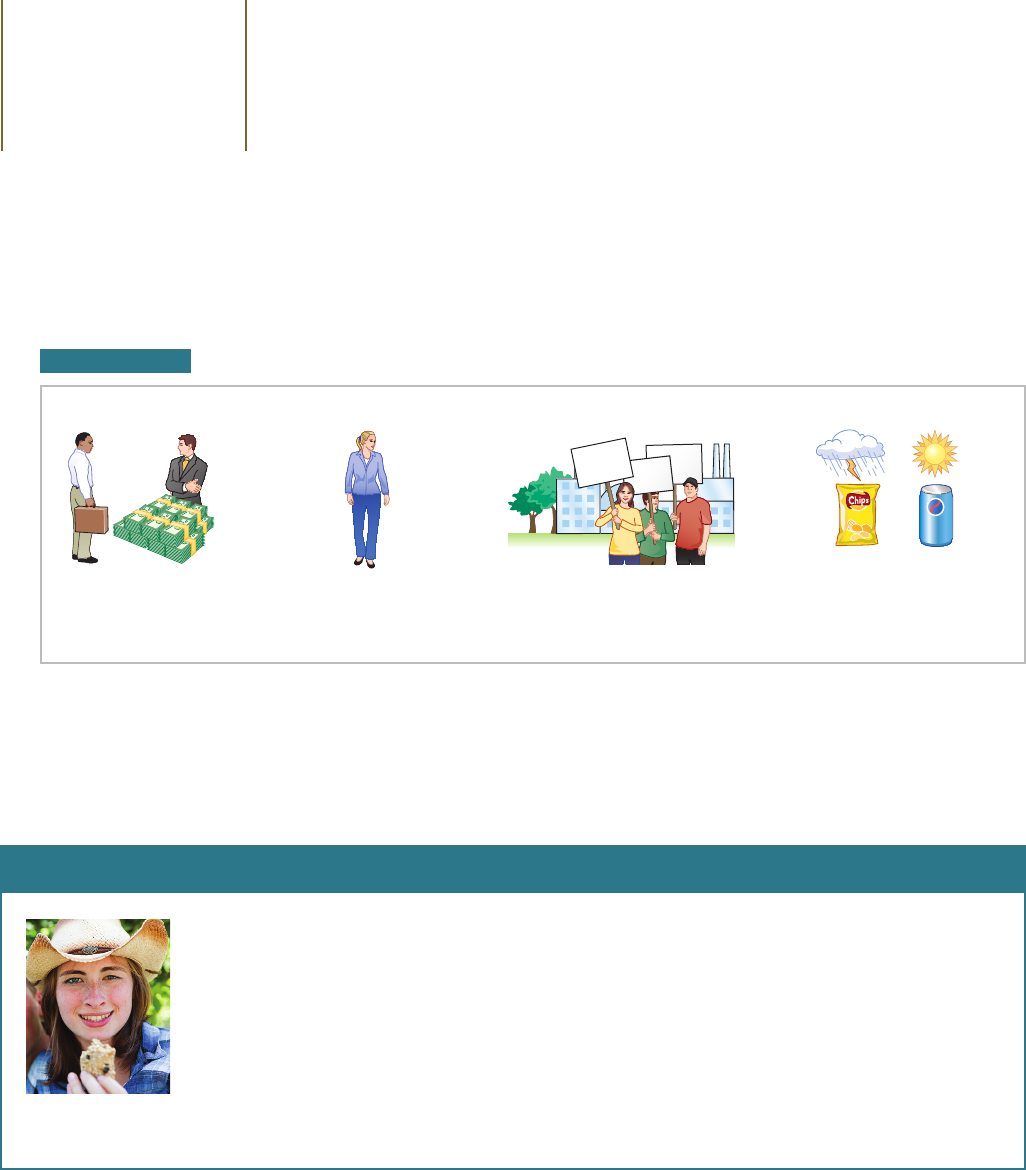

External Users

There are several types of external users of accounting information. Investors (owners)

use accounting information to make decisions to buy, hold, or sell stock. Creditors such as

suppliers and bankers use accounting information to evaluate the risks of selling on credit

or lending money. Some questions that investors and creditors may ask about a company are

shown in

Illustration 1.2.

Stock

On

Strike

On

Strike

On

Strike

Snacks Beverages

COLA

Questions Asked by Internal Users

Is cash sufcient to pay

dividends to

Microsoft stockholders?

Finance

Can General Motors afford

to give its employees pay

raises this year?

Human Resources

Which PepsiCo product line is

the most protable? Should any

product lines be eliminated?

Management

What price should Apple charge

for an iPhone to maximize the

company's net income?

Marketing

ILLUSTRATION 1.1 Questions that internal users ask

Helpful Hints further clarify

concepts being discussed.

© Dan Moore/

iStockphoto

c01IntroductionToFinancialStatements.indd Page 1-4 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-4 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

Business Organization and Accounting Information Uses 1-5

The information needs and questions of other external users vary considerably. Tax-

ing authorities, such as the Internal Revenue Service, want to know whether the company

complies with the tax laws. Customers are interested in whether a company like

General

Motors

will continue to honor product warranties and otherwise support its product lines.

Labor unions, such as the Major League Baseball Players Association, want to know whether

the owners have the ability to pay increased wages and bene ts. Regulatory agencies, such

as the Securities and Exchange Commission or the Federal Trade Commission, want to know

whether the company is operating within prescribed rules. For example,

Enron, Dynegy,

Duke Energy, and other big energy-trading companies reported record pro ts at the same

time as California was paying extremely high prices for energy and su ering from blackouts.

This disparity caused regulators to investigate the energy traders to make sure that the pro ts

were earned by legitimate and fair practices.

Ethics in Financial Reporting

People won’t gamble in a casino if they think it is “rigged.” Similarly, people won’t “play”

the stock market if they think stock prices are rigged. At one time, the nancial press was

full of articles about nancial scandals at

Enron, WorldCom, HealthSouth, and AIG.

As more scandals came to light, a mistrust of nancial reporting in general seemed to be

developing. One article in the Wall Street Journal noted that “repeated disclosures about

questionable accounting practices have bruised investors’ faith in the reliability of earnings

reports, which in turn has sent stock prices tumbling.” Imagine trying to carry on a business

or invest money if you could not depend on the nancial statements to be honestly prepared.

Information would have no credibility. There is no doubt that a sound, well-functioning

economy depends on accurate and dependable nancial reporting.

ILLUSTRATION 1.2

Questions that external users ask

What do we do

if they catch us?

Bills

Yeah!

Questions Asked by External Users

Is General Electric earning

satisfactory income?

Investors

How does Disney compare in size

and protability with Time Warner?

Investors

Will United Airlines be able

to pay its debts as they come due?

Creditors

Accounting Across the Organization

Spinning the Career Wheel

How will the study of accounting help you?

A working knowledge of accounting is de-

sirable for virtually every eld of business.

Some examples of how accounting is used

in business careers include the following.

General management: Managers of Ford

Motors

, Massachusetts General Hospital,

California State University–Fullerton, a

McDonald’s franchise, and a Trek bike

shop all need to understand accounting data

in order to make wise business decisions.

Marketing: Marketing specialists at Procter & Gamble must

be sensitive to costs and bene ts, which accounting helps them

quantify and understand. Making a sale is meaningless unless it

is a pro table sale.

Finance: Do you want to be a banker for Citicorp, an invest-

ment analyst for

Goldman Sachs, or a stock broker for Merrill

Lynch

? These elds rely heavily on accounting knowledge

to analyze nancial statements. In fact, it is di cult to get a

good job in a nance function without two or three courses in

accounting.

Real estate: Are you interested in being a real estate broker for

Prudential Real Estate? Because a third party—the bank—is

almost always involved in nancing a real estate transaction, bro-

kers must understand the numbers involved: Can the buyer a ord

to make the payments to the bank? Does the cash ow from an

industrial property justify the purchase price? What are the tax

bene ts of the purchase?

How might accounting help you? (Go to WileyPLUS for this

answer and additional questions.)

© Josef Volavka/

iStockphoto

c01IntroductionToFinancialStatements.indd Page 1-5 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-5 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-6 CHAPTER 1 Introduction to Financial Statements

United States regulators and lawmakers were very concerned that the economy would

su er if investors lost con dence in corporate accounting because of unethical nancial

reporting. Congress passed the

Sarbanes-Oxley Act (SOX) to reduce unethical corporate

behavior and decrease the likelihood of future corporate scandals (see

Ethics Note). As a

result of SOX, top management must now certify the accuracy of nancial information. In

addition, penalties for fraudulent nancial activity are much more severe. Also, SOX increased

both the independence of the outside auditors who review the accuracy of corporate nancial

statements and the oversight role of boards of directors.

E ective nancial reporting depends on sound ethical behavior. To sensitize you to

ethical situations and to give you practice at solving ethical dilemmas, we address ethics in

a number of ways in this text. (1) A number of the Feature Stories and other parts of the text

discuss the central importance of ethical behavior to nancial reporting. (2) Ethics Insight

boxes and marginal Ethics Notes highlight ethics situations and issues in actual business

settings. (3) Many of the People, Planet, and Pro t Insight boxes focus on ethical issues that

companies face in measuring and reporting social and environmental issues. (4) At the end

of each chapter, an Ethics Case simulates a business situa tion and asks you to put yourself

in the position of a decision-maker in that case.

When analyzing these various ethics cases and your own ethical experiences, you should

apply the three steps outlined in

Illustration 1.3.

ETHICS NOTE

Circus-founder P.T. Bar-

num is alleged to have

said, “Trust everyone,

but cut the deck.” What

Sarbanes-Oxley does is to

provide measures that (like

cutting the deck of playing

cards) help ensure that

fraud will not occur.

Ethics Notes help sensitize you

to some of the ethical issues in

accounting.

Ethics Insight Dewey & LeBoeuf LLP

I Felt the Pressure—

Would You?

“I felt the pressure.” That’s what some

of the employees of the now-defunct law

rm of

Dewey & LeBoeuf LLP indi-

cated when they helped to overstate rev-

enue and use accounting tricks to hide

losses and cover up cash shortages. These

employees worked for the former nance

director and former chief nancial o cer

(CFO) of the rm. Here are some of their

comments:

• “I was instructed by the CFO to create invoices, knowing they

would not be sent to clients. When I created these invoices, I

knew that it was inappropriate.”

• “I intentionally gave the auditors incorrect information in the

course of the audit.”

What happened here is that a small group of lower-level em-

ployees over a period of years carried out the instructions of their

bosses. Their bosses, however, seemed to have no concern as evi-

denced by various e-mails with one another in which they referred

to their nancial manipulations as accounting tricks, cooking the

books, and fake income.

Sources: Ashby Jones, “Guilty Pleas of Dewey Sta Detail the Alleged

Fraud,” Wall Street Journal (March 28, 2014); and Sara Randazzo, “Dewey

CFO Escapes Jail Time in Fraud Case Sentencing,” Wall Street Journal

(October 10, 2017).

Why did these employees lie, and what do you believe

should be their penalty for these lies? (Go to WileyPLUS for

this answer and additional questions.)

Insight boxes provide examples of business situations from various perspectives—ethics, investor,

international, and corporate social responsibility. Guideline answers to the critical thinking questions,

as well as additional questions, are available in WileyPLUS.

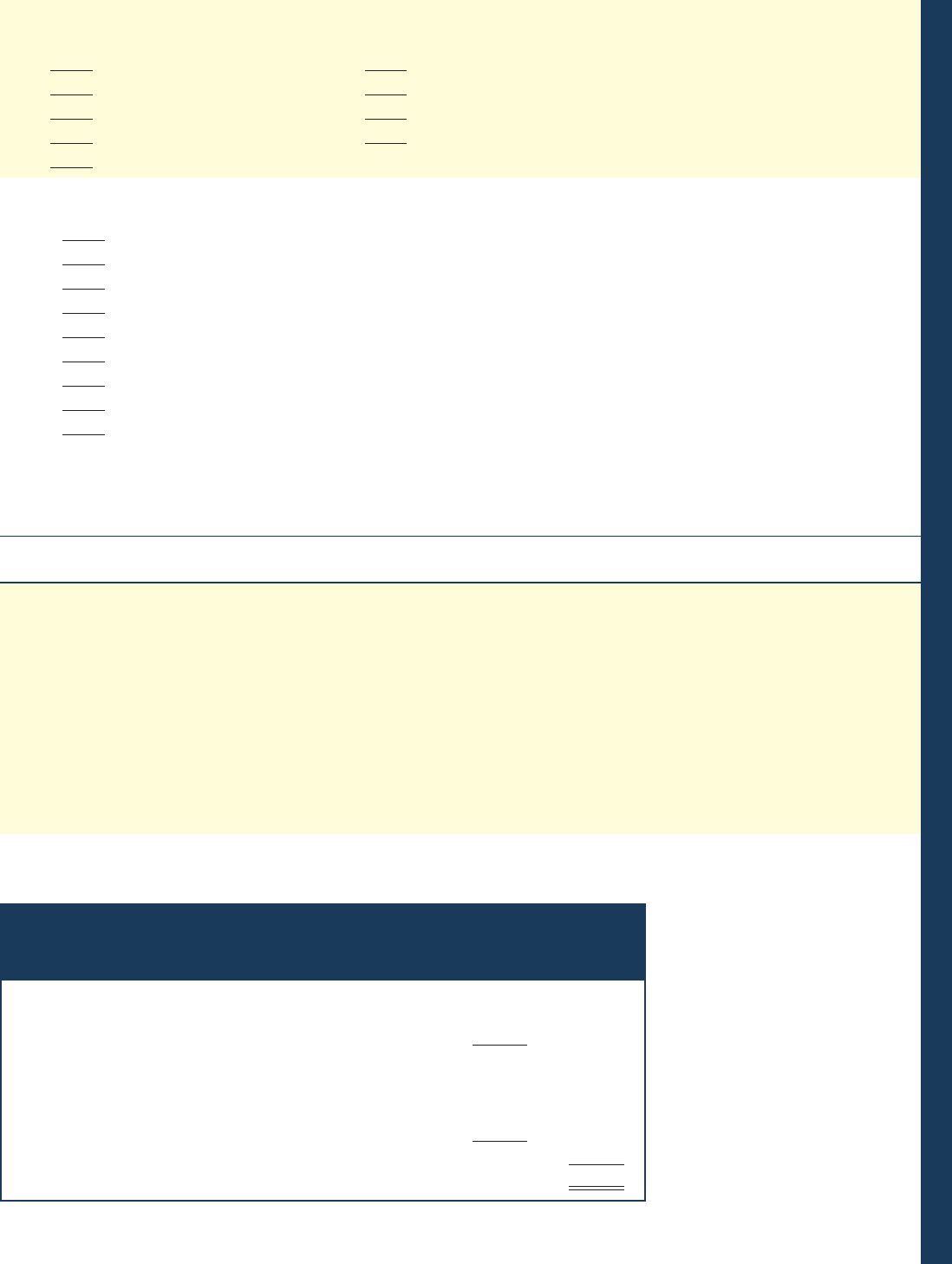

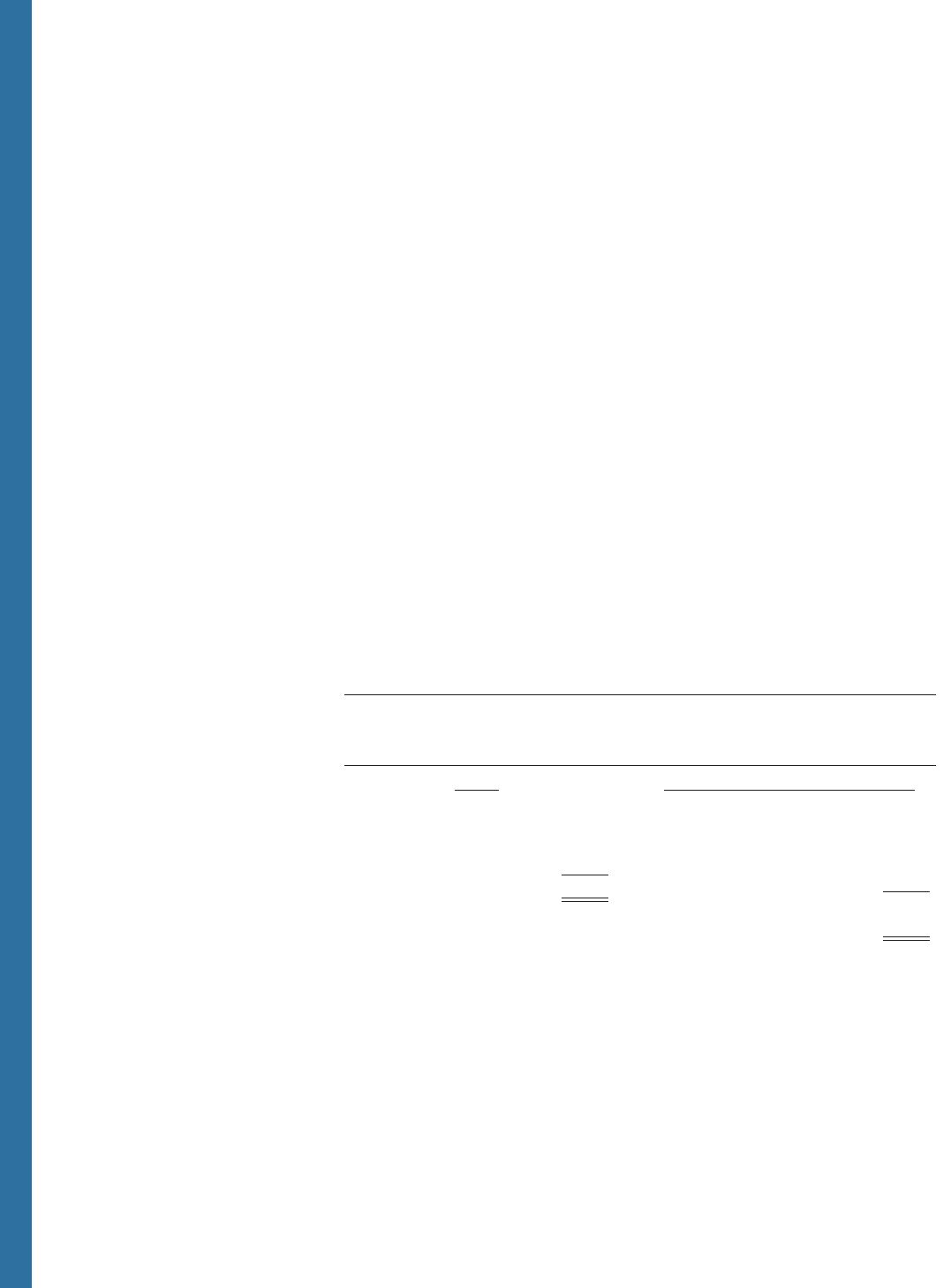

Solving an Ethical Dilemma

#1

ALT

#2

ALT

2. Identify and analyze

the principal elements

in the situation.

Identify the stakeholders—

persons or groups who may

be harmed or beneted. Ask

the question: What are the

responsibilities and obligations

of the parties involved?

3. Identify the alternatives,

and weigh the impact of

each alternative on various

stakeholders.

Select the most ethical

alternative, considering all the

consequences. Sometimes there

will be one right answer. Other

situations involve more than

one right solution; these

situations require you to

evaluate each alternative and

select the best one.

1. Recognize an ethical

situation and the ethical

issues involved.

Use your personal ethics to

identify ethical situations and

issues. Some businesses and

professional organizations

provide written codes of

ethics for guidance in some

business situations.

ILLUSTRATION 1.3 Steps in analyzing ethics cases

Alliance/Shutterstock

c01IntroductionToFinancialStatements.indd Page 1-6 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-6 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Three Types of Business Activity 1-7

DO IT! 1 Business Organization Forms

In choosing the organizational form for your outdoor guide service, you should consider the pros

and cons of each. Identify each of the following organizational characteristics with the organiza-

tional form or forms with which it is associated.

1. Easier to raise funds. 4. Tax advantages.

2. Simple to establish. 5. Easier to transfer ownership.

3. No personal legal liability.

ACTION PLAN

• Know which organiza-

tional form best matches

the business type, size,

and preferences of the

owner(s).

Solution

1. Easier to raise funds: Corporation.

2. Simple to establish: Sole proprietorship and partnership.

3. No personal legal liability: Corporation.

4. Tax advantages: Sole proprietorship and partnership.

5. Easier to transfer ownership: Corporation.

Related exercise material: BE1.1 and DO IT! 1.1.

DO IT! exercises prompt you to stop and review the key points you have just studied. The Action Plan

o ers you tips about how to approach the problem.

LEARNING OBJECTIVE 2

Explain the three principal types of business activity.

All businesses are involved in three types of activity— nancing, investing, and operating.

For example, Gert Boyle’s parents, the founders of

Columbia Sportswear, obtained cash

through nancing to start and grow their business. Some of this nancing came from

personal savings, and some likely came from outside sources like banks. The family then

invested the cash in equipment to run the business, such as sewing equipment and delivery

vehicles. Once this equipment was in place, they could begin the operating activities of mak-

ing and selling clothing.

The accounting information system keeps track of the results of each of the various

business activities— nancing, investing, and operating. Let’s look at each type of business

activity in more detail.

Financing Activities

It takes money to make money. The two primary sources of outside funds for corporations are

borrowing money (debt nancing) and issuing (selling) shares of stock in exchange for cash

(equity nancing).

Columbia Sportswear may borrow money in a variety of ways. For example, it can take

out a loan at a bank or borrow directly from investors by issuing debt securities called bonds.

Persons or entities to whom Columbia owes money are its creditors. Amounts owed to

creditors—in the form of debt and other obligations—are called

liabilities. Speci c names

are given to di erent types of liabilities, depending on their source. Columbia may have a note

Financing

B

o

n

d

S

t

o

c

k

The Three Types of Business Activity

c01IntroductionToFinancialStatements.indd Page 1-7 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-7 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-8 CHAPTER 1 Introduction to Financial Statements

payable to a bank for the money borrowed to purchase delivery trucks. Debt securities sold to

investors that must be repaid at a particular date some years in the future are bonds payable.

Corporations also obtain funds by selling shares of stock to investors.

Common stock is

the term used to describe the total amount paid in by stockholders for the shares they purchase.

The claims of creditors di er from those of stockholders. If you loan money to a company,

you are one of its creditors. In lending money, you specify a payment schedule (e.g., payment at

the end of three months). As a creditor, you have a legal right to be paid at the agreed time. In

the event of nonpayment, you may legally force the company to sell property to pay its debts. In

the case of nancial di culty, creditor claims must be paid before stockholders’ claims.

Stockholders, on the other hand, have no claim to corporate cash until the claims of cred-

itors are satis ed. Suppose you buy a company’s stock instead of loaning it money. You have

no legal right to expect any payments from your stock ownership until all of the company’s

creditors are paid amounts currently due. However, many corporations make payments to

stockholders on a regular basis as long as there is su cient cash to cover required payments

to creditors. These cash payments to stockholders are called

dividends.

Investing Activities

Once the company has raised cash through nancing activities, it uses that cash in investing

activities. Investing activities involve the purchase of the resources a company needs in

order to operate. A growing company purchases many resources, such as computers, delivery

trucks, furniture, and buildings. Resources owned by a business are called

assets. Di erent

types of assets are given di erent names. For example, Columbia Sportswear’s sewing equip-

ment is a type of asset referred to as property, plant, and equipment (see

Alternative

Terminology

).

Cash is one of the more important assets owned by Columbia or any other business. If a

company has excess cash that it does not need for a while, it might choose to invest in securities

(stocks or bonds) of other corporations. Investments are another example of an investing activity.

Operating Activities

Once a business has the assets it needs to get started, it begins operations. Columbia Sports-

wear is in the business of selling outdoor clothing and footwear. It sells TurboDown jackets,

Millenium snowboard pants, Sorel® snow boots, Bugaboots™, rainwear, and anything else

you might need to protect you from the elements. We call amounts earned on the sale of these

products revenues.

Revenue is the increase in assets or decrease in liabilities resulting from

the sale of goods or the performance of services in the normal course of business. For exam-

ple, Columbia records revenue when it sells a footwear product.

Revenues arise from di erent sources and are identi ed by various names depending on

the nature of the business. For instance, Columbia’s primary source of revenue is the sale of

sportswear. However, it also generates interest revenue on debt securities held as investments.

Sources of revenue common to many businesses are sales revenue, service revenue, and

interest revenue.

The company purchases its longer-lived assets through investing activities as described

earlier. Other assets with shorter lives, however, result from operating activities. For example,

supplies are assets used in day-to-day operations. Goods available for future sales to cus-

tomers are assets called inventory. Also, if Columbia sells goods to a customer and does not

receive cash immediately, then the company has a right to expect payment from that customer

in the near future. This right to receive money in the future is called an account receivable.

Before Columbia can sell a single Sorel® boot, it must purchase wool, rubber, leather,

metal lace loops, laces, and other materials. It then must process, wrap, and ship the nished

product. It also incurs costs like salaries, rents, and utilities. All of these costs, referred to as

expenses, are necessary to produce and sell the product. In accounting language,

expenses

are the cost of assets consumed or services used in the process of generating revenues.

Expenses take many forms and are identi ed by various names depending on the type

of asset consumed or service used. For example, Columbia keeps track of these types of

MS

MS

MS

Investing

ALTERNATIVE

TERMINOLOGY

Property, plant, and equip-

ment is sometimes called

xed assets.

Operating

c01IntroductionToFinancialStatements.indd Page 1-8 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-8 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Four Financial Statements 1-9

expenses: cost of goods sold (such as the cost of materials), selling expenses (such as the

cost of salespersons’ salaries), marketing expenses (such as the cost of advertising), admin-

istrative expenses (such as the salaries of administrative sta , and telephone and heating

costs incurred at the corporate o ce), interest expense (amounts of interest paid on various

debts), and income tax expense (corporate taxes paid to the government).

Columbia may also have liabilities arising from these expenses. For example, it may

purchase goods on credit from suppliers. The obligations to pay for these goods are called

accounts payable. Additionally, Columbia may have interest payable on the outstanding

amounts owed to the bank. It may also have wages payable to its employees and sales taxes

payable, property taxes payable, and income taxes payable to the government.

Columbia compares the revenues of a period with the expenses of that period to deter-

mine whether it earned a pro t. When revenues exceed expenses,

net income results. When

expenses exceed revenues, a

net loss results.

DO IT! 2 Business Activities

Classify each item as an asset, liability, common stock, revenue, or expense.

1. Cost of renting property. 4. Issuance of ownership shares.

2. Truck purchased. 5. Amount earned from performing service.

3. Notes payable. 6. Amounts owed to suppliers.

ACTION PLAN

• Classify each item

based on its economic

characteristics. Proper

classi cation of items

is critical if accounting

is to provide useful

information.

Solution

1. Cost of renting property: Expense.

2. Truck purchased: Asset.

3. Notes payable: Liability.

4. Issuance of ownership shares: Common stock.

5. Amount earned from performing service: Revenue.

6. Amounts owed to suppliers: Liability.

Related exercise material: BE1.3, DO IT! 1.2, and E1.4.

LEARNING OBJECTIVE 3

Describe the four financial statements and how they are prepared.

Assets, liabilities, expenses, and revenues are of interest to users of accounting information.

This information is arranged in the format of four di erent nancial statements, which

form the backbone of nancial accounting (see

International Note):

• To show how successfully your business performed during a period of time, you report its

revenues and expenses in an income statement.

• To indicate how much of previous income was distributed to you and the other owners

of your business in the form of dividends, and how much was retained in the business to

allow for future growth, you present a retained earnings statement.

• To present a picture at a point in time of what your business owns (its assets) and what it

owes (its liabilities), you prepare a balance sheet.

The Four Financial Statements

International Note

The primary types of nan-

cial statements required

by International Financial

Reporting Standards (IFRS)

and U.S. generally accepted

accounting principles

(GAAP) are the same. Nei-

ther IFRS nor GAAP is very

speci c regarding format

requirements for the pri-

mary nancial statements.

However, in practice, some

format di erences do exist

in presentations commonly

employed by IFRS compa-

nies as compared to GAAP

companies.

International Notes highlight di erences between

U.S. and international accounting standards.

c01IntroductionToFinancialStatements.indd Page 1-9 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-9 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-10 CHAPTER 1 Introduction to Financial Statements

• To show where your business obtained cash during a period of time and how that cash

was used, you present a statement of cash ows.

To introduce you to these statements, we have prepared the nancial statements for your

outdoor guide service, Sierra Corporation, after your rst month of operations. To summarize,

you o cially started your business in Truckee, California, on October 1, 2022. Sierra provides

guide services in the Lake Tahoe area of the Sierra Nevada mountains. Its promotional mate-

rials describe outdoor day trips, such as rafting, snowshoeing, and hiking, as well as multi-day

backcountry experiences. To minimize your initial investment, at this point the company has

limited outdoor equipment for customer use. Instead, your customers either bring their own

equipment or rent equipment through local out tters. The nancial statements for Sierra’s

rst month of business are provided in the following pages.

Income Statement

The income statement reports a company’s revenues and expenses and resulting net income

or loss for a period of time (see

Decision Tools). To indicate that its income statement reports

the results of operations for a speci c period of time, Sierra Corporation dates the income

statement “For the Month Ended October 31, 2022.” The income statement lists the company’s

revenues followed by its expenses. Finally, Sierra determines the net income (or net loss) by

deducting expenses from revenues. Sierra’s income statement is shown in

Illustration 1.4

(see

Helpful Hint). Congratulations, you are already showing a pro t!

Why are nancial statement users interested in net income? Investors are interested

in a company’s past net income because it provides useful information for predicting

future net income. Investors buy and sell stock based on their beliefs about a company’s

future performance. If investors believe that Sierra will be successful in the future and that

this will result in a higher stock price, they will buy its stock.

Creditors also use the income statement to predict future earnings. When a bank loans

money to a company, it believes that it will be repaid in the future. If it didn’t think it would be

repaid, it wouldn’t loan the money. Therefore, prior to making the loan the bank loan o cer

uses the income statement as a source of information to predict whether the company will be

pro table enough to repay its loan. Thus, reporting a strong pro t will make it easier for Sierra

to raise additional cash either by issuing shares of stock or borrowing.

Amounts received from issuing stock are not revenues, and amounts paid out

as dividends are not expenses. As a result, they are not reported on the income statement.

For example, Sierra Corporation does not treat as revenue the $10,000 of cash received from

issuing new stock (see Illustration 1.7), nor does it regard as a business expense the $500 of

dividends paid (see Illustration 1.5) (see

Ethics Note).

ETHICS NOTE

When companies nd

errors in previously released

income statements, they

restate those numbers.

Perhaps because of the

increased scrutiny shortly

after Sarbanes-Oxley was im-

plemented, companies led

a record 1,195 restatements.

Decision Tools that are useful

for business decision-making are

highlighted throughout the text.

A summary of the Decision Tools

is also provided in each chapter.

Decision Tools

The income statement

helps users determine if

the company’s operations

are pro table.

Sierra Corporation

Income Statement

For the Month Ended October 31, 2022

Revenues

Service revenue $10,600

Expenses

Salaries and wages expense $5,200

Rent expense 900

Supplies expense 1,500

Depreciation expense 40

Interest expense 50

Insurance expense 50

Total expenses 7,740

Net income

$ 2,860

ILLUSTRATION 1.4

Sierra Corporation’s income

statement

HELPFUL HINT

The nancial statement

heading identi es the com-

pany, the type of statement,

and the time period cov-

ered. Sometimes, another

line indicates the unit of

measure, e.g., “in thou-

sands” or “in millions.”

c01IntroductionToFinancialStatements.indd Page 1-10 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-10 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Four Financial Statements 1-11

Retained Earnings Statement

If Sierra Corporation is pro table, at the end of each period it must decide what portion of

pro ts to pay to shareholders in dividends. In theory, it could pay all of its current-period prof-

its, but few companies do this. Why? Because they want to retain part of the pro ts to allow

for further expansion. High-growth companies, such as

Google and Facebook, often pay no

dividends.

Retained earnings is the net income retained in the corporation.

The

retained earnings statement shows the amounts and causes of changes in retained

earnings for a speci c time period (see

Decision Tools). The time period is the same as that

covered by the income statement. The beginning retained earnings amount appears on the

rst line of the statement. Then, the company adds net income and deducts dividends

to determine the retained earnings at the end of the period. If a company has a net loss, it

deducts (rather than adds) that amount in the retained earnings statement.

Illustration 1.5

presents Sierra’s retained earnings statement (see

Helpful Hint).

By monitoring the retained earnings statement, nancial statement users can evaluate

dividend payment practices. Some investors seek companies, such as

Dow Chemical, that

have a history of paying high dividends. Other investors seek companies, such as

Amazon.

com

, that reinvest earnings to increase the company’s growth instead of paying dividends.

Lenders monitor their corporate customers’ dividend payments because any money paid in

dividends reduces a company’s ability to repay its debts.

Balance Sheet

The balance sheet reports assets and claims to assets at a speci c point in time (see Decision

Tools

). Claims to assets are subdivided into two categories: claims of creditors and claims of

owners. As noted earlier, claims of creditors are called liabilities. The owners’ claim to assets

is called

stockholders’ equity.

Illustration 1.6 shows the relationship among the categories on the balance sheet in

equation form. This equation is referred to as the

basic accounting equation.

Decision Tools

The balance sheet helps

users determine if the

company relies on debt

or stockholders’ equity to

nance its assets.

This relationship is where the name “balance sheet” comes from. Assets must balance with

the claims to assets.

As you can see from looking at Sierra Corporation’s balance sheet in

Illustration 1.7,

the balance sheet presents the company’s nancial position as of a speci c date—in this

case, October 31, 2022 (see

Helpful Hint). It lists assets rst. Assets are listed in the order

of their liquidity, that is, how quickly they could be converted to cash. Assets are followed

by liabilities and stockholders’ equity (see

Alternative Terminology). Stockholders’ equity

is comprised of two parts: (1) common stock and (2) retained earnings. As noted earlier,

common stock results when the company sells new shares of stock; retained earnings is the

ALTERNATIVE

TERMINOLOGY

Liabilities are also referred

to as debt.

Decision Tools

The retained earnings

statement helps users

determine the company’s

policy toward dividends

and growth.

Sierra Corporation

Retained Earnings Statement

For the Month Ended October 31, 2022

Retained earnings, October 1 $ 0

Add: Net income 2,860

2,860

Less: Dividends 500

Retained earnings, October 31 $2,360

ILLUSTRATION 1.5

Sierra Corporation’s retained

earnings statement

HELPFUL HINT

The heading of this

statement identi es the

company, the type of

statement, and the time

period covered by the

statement.

Assets = Liabilities + Stockholders’ Equity

ILLUSTRATION 1.6

Basic accounting equation

c01IntroductionToFinancialStatements.indd Page 1-11 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-11 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-12 CHAPTER 1 Introduction to Financial Statements

Creditors analyze a company’s balance sheet to determine the likelihood that they will be

repaid. They carefully evaluate the nature of the company’s assets and liabilities. In operat-

ing Sierra’s guide service, the balance sheet will be used to determine whether cash on hand

is su cient for immediate cash needs. The balance sheet will also be used to evaluate the

relationship between debt and stockholders’ equity to determine whether the company has a

satisfactory proportion of debt and common stock nancing.

Statement of Cash Flows

The primary purpose of a statement of cash ows is to provide nancial information about

the cash receipts and cash payments of a business for a speci c period of time (see

Decision

Tools

). To help investors, creditors, and others in their analysis of a company’s cash position,

the statement of cash ows reports the cash e ects of a company’s operating, investing, and

nancing activities. In addition, the statement shows the net increase or decrease in cash

during the period, and the amount of cash at the end of the period.

Users are interested in the statement of cash ows because they want to know what is

happening to a company’s most important resource. The statement of cash ows provides

answers to these simple but important questions:

• Where did cash come from during the period?

• How was cash used during the period?

• What was the change in the cash balance during the period?

The statement of cash ows for Sierra Corporation, in

Illustration 1.8, shows that

cash increased $15,200 during the month (see

Helpful Hint). This increase resulted be-

cause operating activities (services to clients) increased cash $5,700, and nancing activities

increased cash $14,500. Investing activities used $5,000 of cash for the purchase of equipment.

Decision Tools

The statement of cash

ows helps users

determine if the company

generates enough cash

from operations to fund its

investing activities.

Sierra Corporation

Balance Sheet

October 31, 2022

Assets

Cash $15,200

Accounts receivable 200

Supplies 1,000

Prepaid insurance 550

Equipment, net 4,960

Total assets

$21,910

Liabilities and Stockholders’ Equity

Liabilities

Notes payable $ 5,000

Accounts payable 2,500

Unearned service revenue 800

Salaries and wages payable 1,200

Interest payable 50

Total liabilities $ 9,550

Stockholders’ equity

Common stock 10,000

Retained earnings 2,360

Total stockholders’ equity 12,360

Total liabilities and stockholders’ equity

$21,910

ILLUSTRATION 1.7

Sierra Corporation’s balance

sheet

HELPFUL HINT

The heading of a balance

sheet must identify the

company, the statement,

and the date.

net income retained in the corporation. Sierra has common stock of $10,000 and retained

earnings of $2,360, for total stockholders’ equity of $12,360.

c01IntroductionToFinancialStatements.indd Page 1-12 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-12 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Four Financial Statements 1-13

Interrelationships of Statements

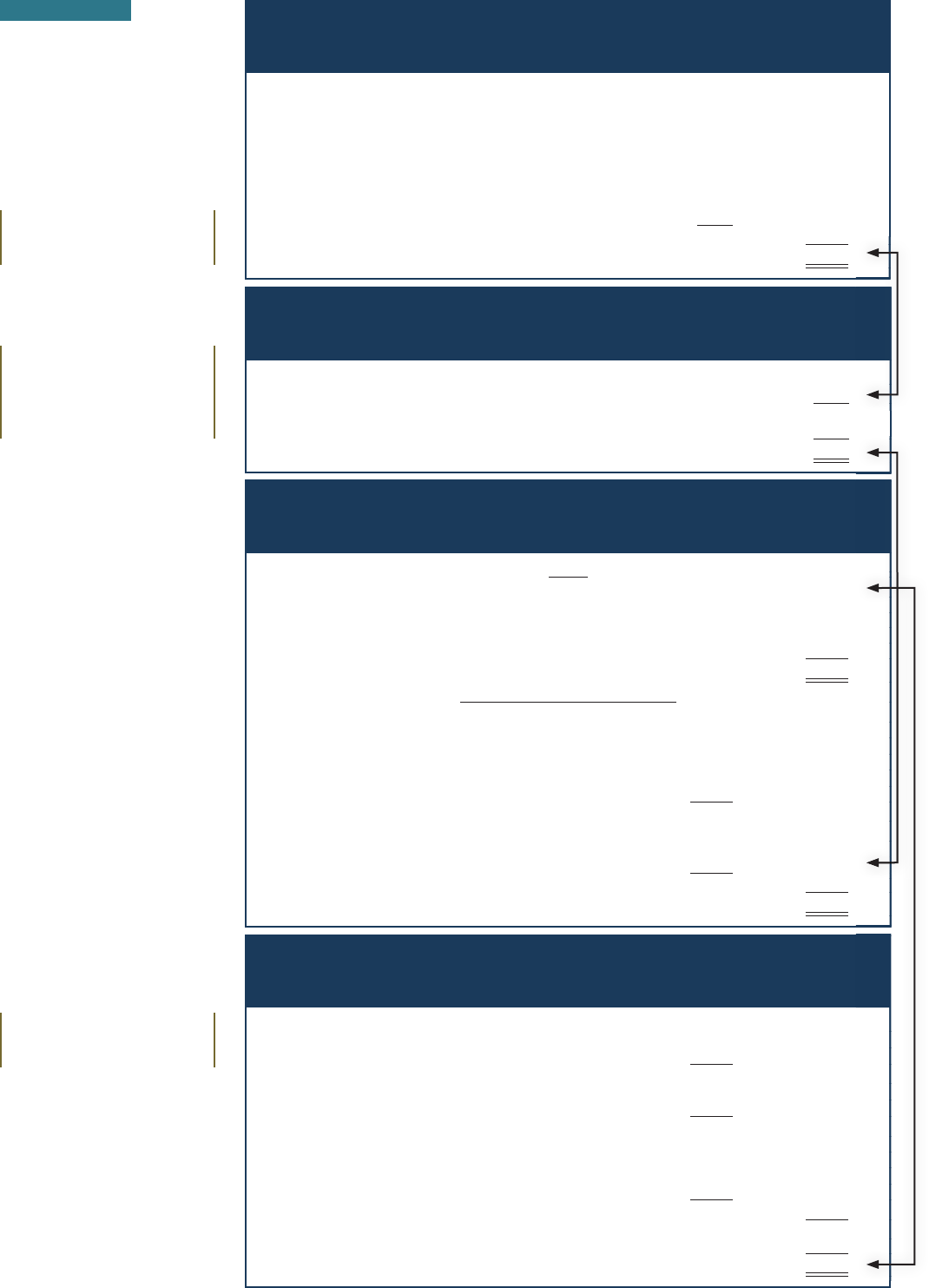

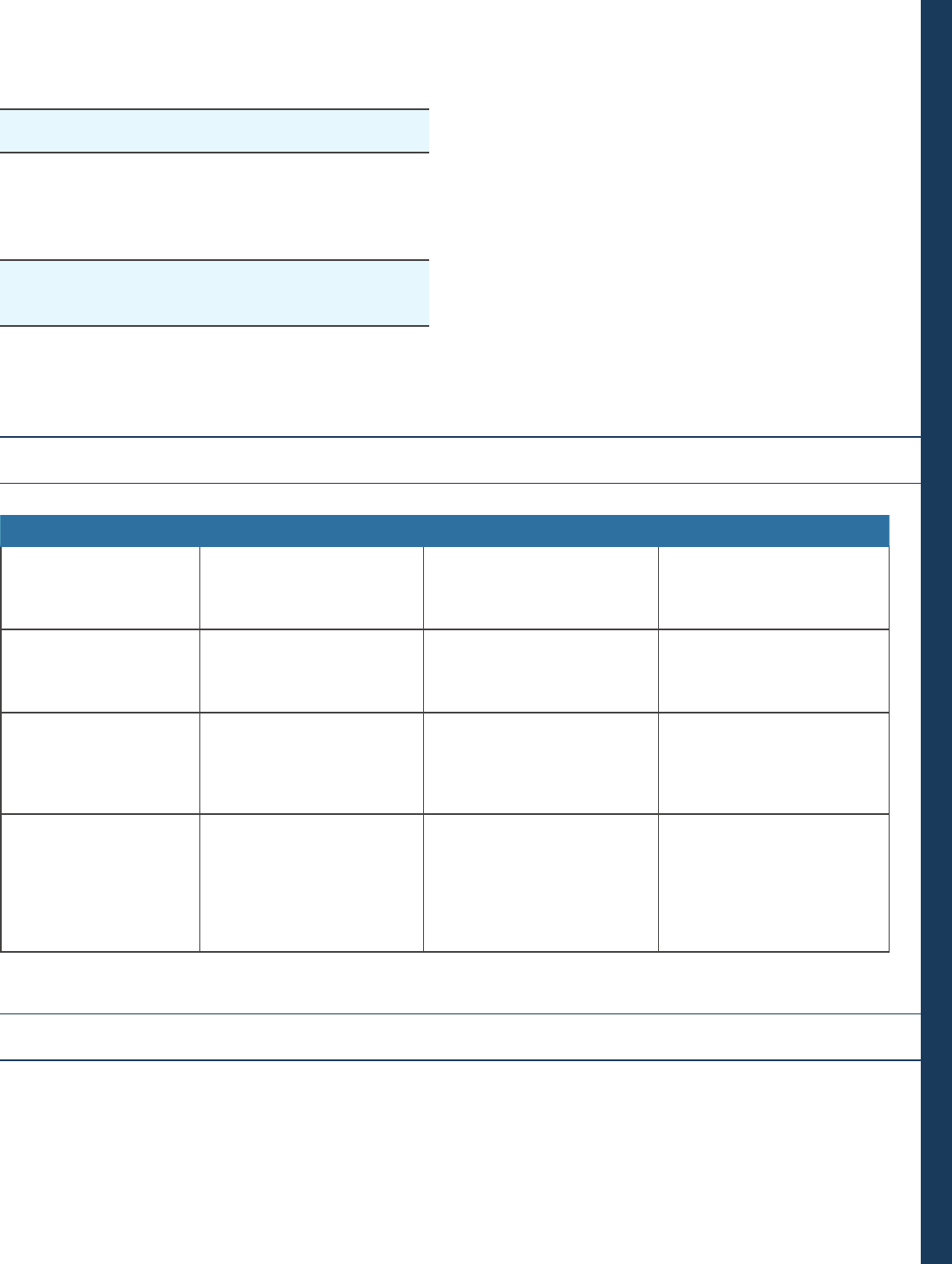

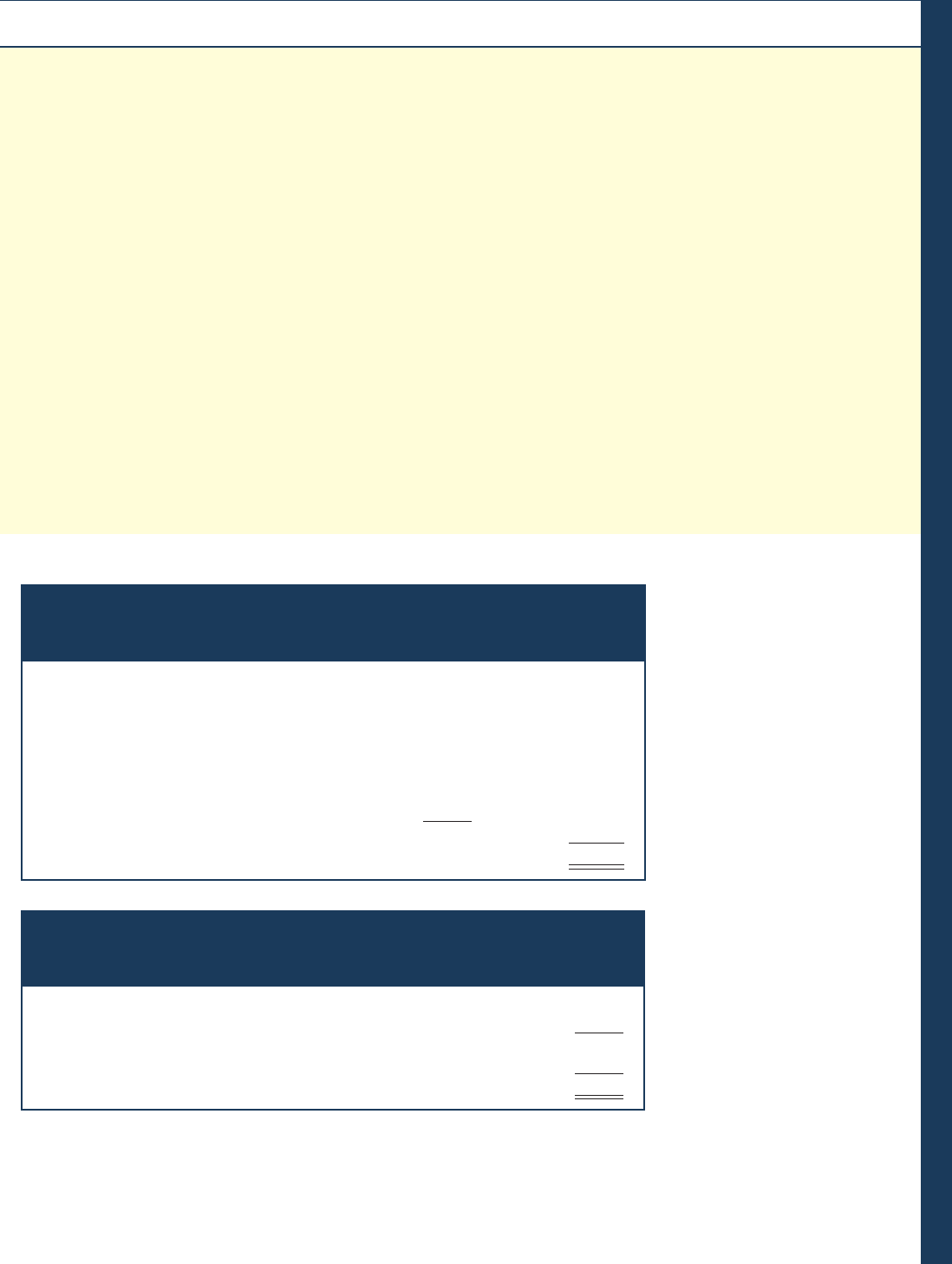

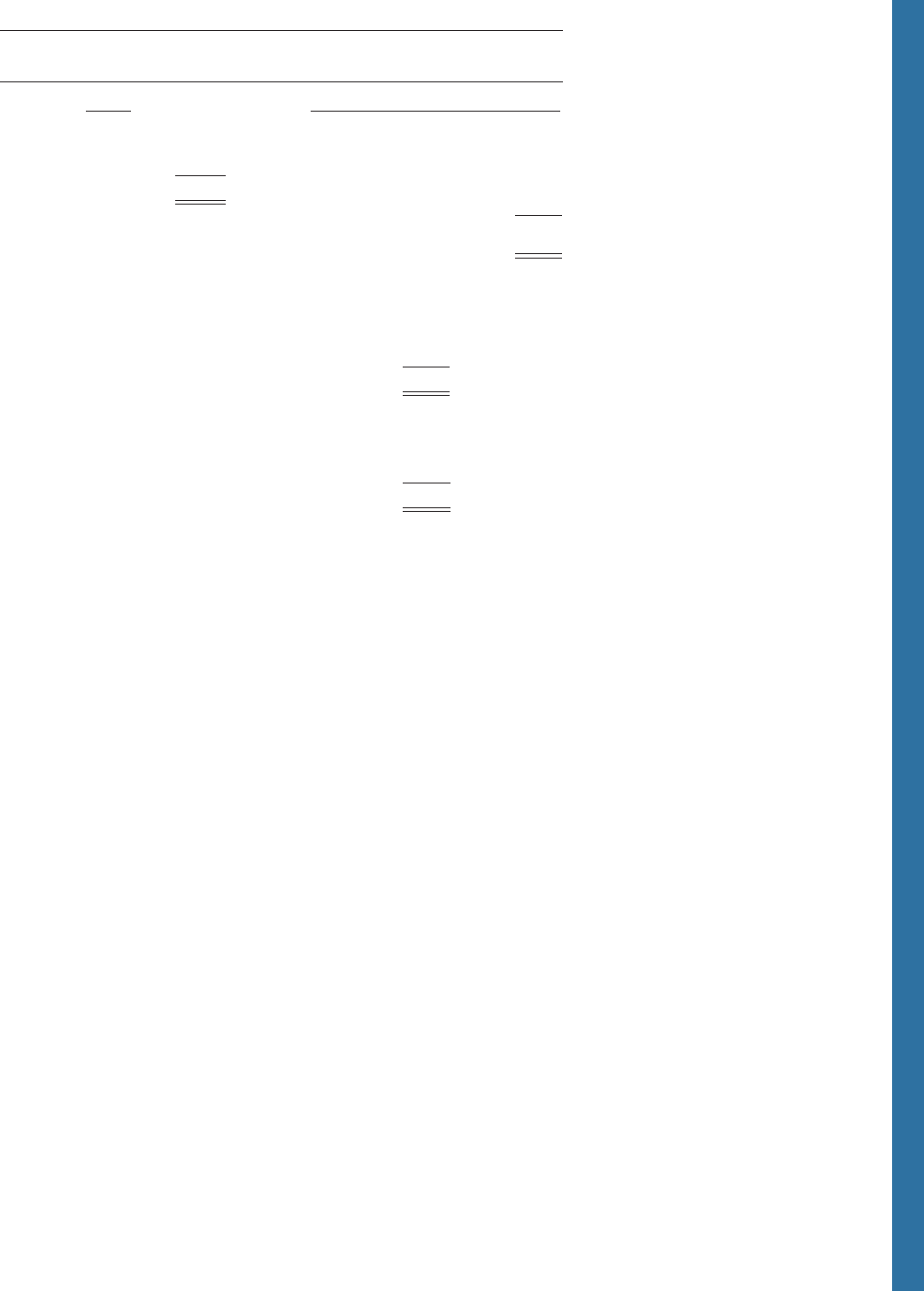

Illustration 1.9 shows the nancial statements of Sierra Corporation (see Helpful Hints). Be-

cause the results on some nancial statements become inputs to other statements, the statements

are interrelated. These interrelationships can be seen in Sierra’s nancial statements, as follows.

1. The retained earnings statement uses the results of the income statement. Sierra reported

net income of $2,860 for the period. Net income is added to the beginning amount of

retained earnings to determine ending retained earnings.

2. The balance sheet and retained earnings statement are also interrelated. Sierra reports

the ending amount of $2,360 on the retained earnings statement as the retained earnings

amount on the balance sheet.

3. Finally, the statement of cash ows relates to information on the balance sheet. The state-

ment of cash ows shows how the Cash account changed during the period. It shows the

amount of cash at the beginning of the period, the sources and uses of cash during the

period, and the $15,200 of cash at the end of the period. The ending amount of cash shown

on the statement of cash ows must agree with the amount of cash on the balance sheet.

Study these interrelationships carefully. To prepare financial statements, you must

understand the sequence in which these amounts are determined and how each

statement impacts the next.

Sierra Corporation

Statement of Cash Flows

For the Month Ended October 31, 2022

Cash ows from operating activities

Cash receipts from operating activities $11,200

Cash payments for operating activities (5,500)

Net cash provided by operating activities $ 5,700

Cash ows from

investing activities

Purchased o ce equipment (5,000)

Net cash used by investing activities (5,000)

Cash ows from

nancing activities

Issuance of common stock 10,000

Issuance of note payable 5,000

Payment of dividend (500)

Net cash provided by nancing activities 14,500

Net increase in cash 15,200

Cash at beginning of period 0

Cash at end of period

$15,200

HELPFUL HINT

The heading of this state-

ment identi es the com-

pany, the type of statement,

and the time period covered

by the statement. Negative

numbers are shown in

parentheses.

ILLUSTRATION 1.8

Sierra Corporation’s statement

of cash ows

People, Planet, and Profit Insight

A socially responsible business does not exploit or endanger

any group of individuals. It follows fair trade practices, provides safe

environments for workers, and bears responsibility for environ-

mental damage. Granted, measurement of these factors is di cult.

How to report this information is also controversial. But many

interesting and useful e orts are underway. Throughout this text,

we provide additional insights into how companies are attempting

to meet the challenge of measuring and reporting their contribu-

tions to society, as well as their nancial results, to stockholders.

Why might a company’s stockholders be interested in its en-

vironmental and social performance? (Go to WileyPLUS for

this answer and additional questions.)

Beyond Financial Statements

Should we expand our nancial statements

beyond the income statement, retained

earnings statement, balance sheet, and

statement of cash ows? Some believe we

should take into account ecological and

social performance, in addition to nancial

results, in evaluating a company. The argument is that a com-

pany’s responsibility lies with anyone who is in uenced by its

actions. In other words, a company should be interested in ben-

e ting many di erent parties, instead of only maximizing stock-

holders’ interests.

© Marek Uliasz/

iStockphoto

c01IntroductionToFinancialStatements.indd Page 1-13 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-13 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

Sierra Corporation

Income Statement

For the Month Ended October 31, 2022

Revenues

Service revenue $10,600

Expenses

Salaries expense $5,200

Rent expense 900

Supplies expense 1,500

Depreciation expense 40

Interest expense 50

Insurance expense 50

Total expenses 7,740

Net income

$ 2,860

Sierra Corporation

Retained Earnings Statement

For the Month Ended October 31, 2022

Retained earnings, October 1 $ 0

Add: Net income

2,860

2,860

Less: Dividends 500

Retained earnings, October 31 $2,360

HELPFUL HINT

Note that nal sums are

double-underlined.

Sierra Corporation

Balance Sheet

October 31, 2022

Assets

Cash $15,200

Accounts receivable 200

Advertising supplies 1,000

Prepaid insurance 550

Equipment, net 4,960

Total assets

$21,910

Liabilities and Stockholders’ Equity

Liabilities

Notes payable $ 5,000

Accounts payable 2,500

Unearned service revenue 800

Salaries and wages payable 1,200

Interest payable 50

Total liabilities $ 9,550

Stockholders’ equity

Common stock 10,000

Retained earnings

2,360

Total stockholders’ equity 12,360

Total liabilities and stockholders’ equity

$21,910

Sierra Corporation

Statement of Cash Flows

For the Month Ended October 31, 2022

Cash ows from operating activities

Cash receipts from operating activities $11,200

Cash payments for operating activities (5,500)

Net cash provided by operating activities $ 5,700

Cash ows from investing activities

Purchased o ce equipment (5,000)

Net cash used by investing activities (5,000)

Cash ows from nancing activities

Issuance of common stock 10,000

Issuance of note payable 5,000

Payment of dividend (500)

Net cash provided by nancing activities 14,500

Net increase in cash 15,200

Cash at beginning of period 0

Cash at end of period

$15,200

HELPFUL HINT

The arrows in this illustra-

tion show interrelation-

ships of the four nancial

statements.

HELPFUL HINT

Negative amounts are

presented in parentheses.

ILLUSTRATION 1.9

Sierra Corporation’s nancial

statements

1-14

c01IntroductionToFinancialStatements.indd Page 1-14 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-14 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Four Financial Statements 1-15

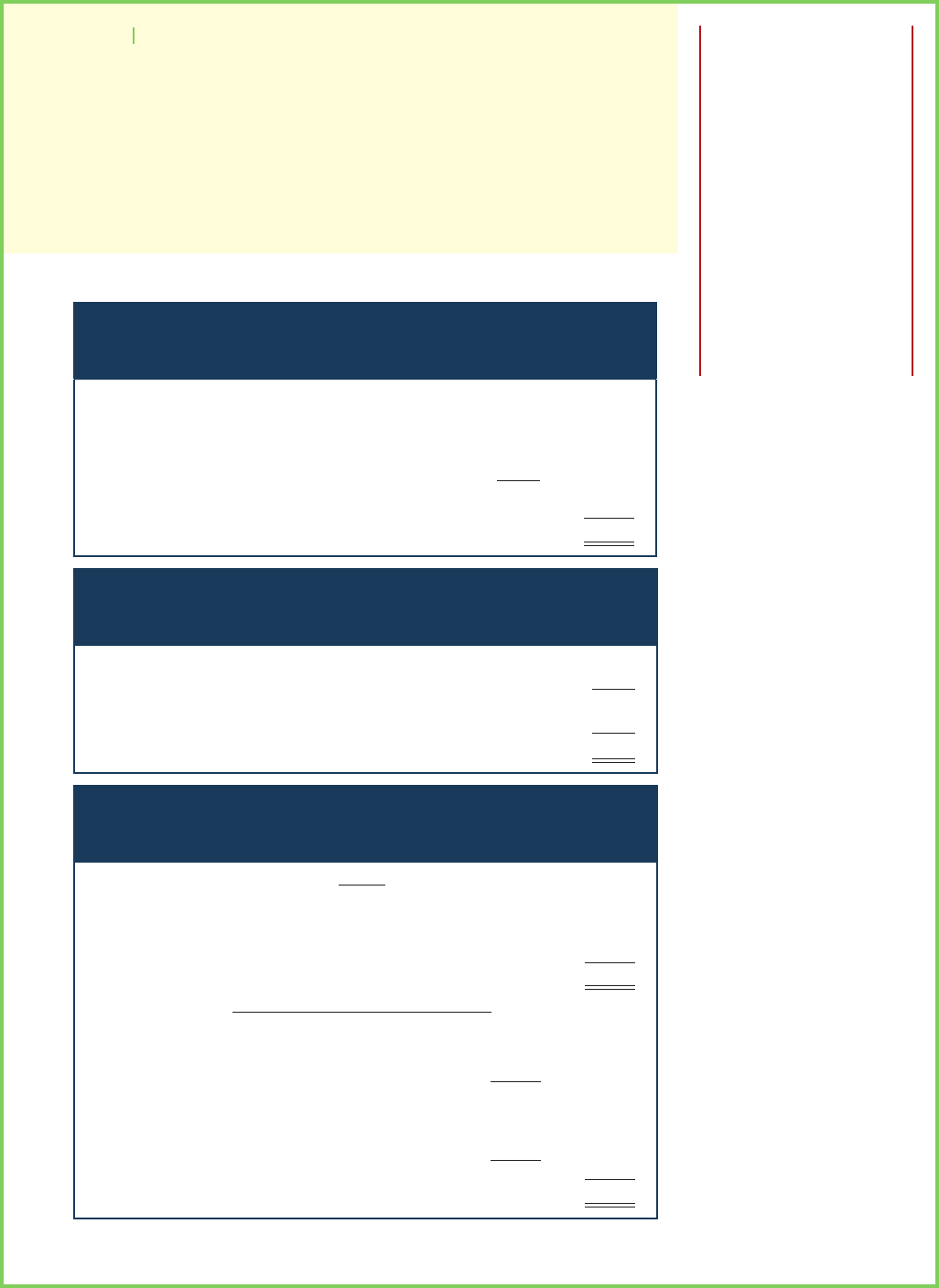

DO IT! 3a Financial Statements

CSU Corporation began operations on January 1, 2022. The following information is available for

CSU on December 31, 2022:

Accounts receivable 1,800 Retained earnings ? Supplies expense 200

Accounts payable 2,000 Equipment 16,000 Cash 1,400

Rent expense 9,000 Insurance expense 1,000 Dividends 600

Notes payable 5,000 Service revenue 17,000

Common stock 10,000 Supplies 4,000

Prepare an income statement, a retained earnings statement, and a balance sheet.

ACTION PLAN

• Report the revenues and

expenses for a period

of time in an income

statement.

• Show the amounts and

causes (net income and

dividends) of changes

in retained earnings

during the period in

the retained earnings

statement.

• Present the assets and

claims to those assets

(liabilities and equity) at

a speci c point in time

in the balance sheet.

Solution

CSU Corporation

Income Statement

For the Year Ended December 31, 2022

Revenues

Service revenue $17,000

Expenses $9,000

Rent expense 1,000

Insurance expense 200

Supplies expense

Total expenses 10,200

Net income

$ 6,800

CSU Corporation

Retained Earnings Statement

For the Year Ended December 31, 2022

Retained earnings, January 1 $ 0

Add: Net income 6,800

6,800

Less: Dividends 600

Retained earnings, December 31

$6,200

CSU Corporation

Balance Sheet

December 31, 2022

Assets

Cash $ 1,400

Accounts receivable 1,800

Supplies 4,000

Equipment 16,000

Total assets

$23,200

Liabilities and Stockholders’ Equity

Liabilities

Notes payable $ 5,000

Accounts payable 2,000

Total liabilities $ 7,000

Stockholders’ equity

Common stock 10,000

Retained earnings 6,200

Total stockholders’ equity 16,200

Total liabilities and stockholders’ equity

$23,200

Related exercise material: BE1.5, BE1.6, BE1.7, BE1.8, BE1.9, BE1.10, DO IT! 1.3a, E1.5, E1.6, E1.7, E1.8, E1.9,

E1.10, E1.11, E1.12, E1.13, E1.14, E1.15, and E1.18.

c01IntroductionToFinancialStatements.indd Page 1-15 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-15 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-16 CHAPTER 1 Introduction to Financial Statements

Other Elements of an Annual Report

Publicly traded U.S. companies must provide shareholders with an annual report. The an-

nual report always includes the nancial statements introduced in this chapter. The annual

report also includes other important information such as a management discussion and

analysis section, notes to the nancial statements, and an independent auditor’s report. No

analysis of a company’s nancial situation and performance is complete without a review

of these items.

Management Discussion and Analysis

The management discussion and analysis (MD&A) section presents management’s

views on the company’s ability to pay near-term obligations, its ability to fund opera-

tions and expansion, and its results of operations. Management must highlight favorable

or unfavorable trends and identify signi cant events and uncertainties that a ect these three

factors. This discussion obviously involves a number of subjective estimates and opinions.

A brief excerpt from the MD&A section of

Columbia Sportswear’s annual report, which

addresses its liquidity requirements, is presented in

Illustration 1.10.

Notes to the Financial Statements

Explanatory notes and supporting schedules accompany every set of nancial statements

and are an integral part of the statements. The

notes to the nancial statements clarify

the nancial statements and provide additional detail. Information in the notes does not

have to be quanti able (numeric). Examples of notes are descriptions of the signi cant

accounting policies and methods used in preparing the statements, explanations of uncer-

tainties and contingencies, and various statistics and details too voluminous to be included

in the statements. The notes are essential to understanding a company’s operating perfor-

mance and nancial position.

Illustration 1.11 is an excerpt from the notes to Columbia Sportswear’s nancial

statements. It describes the methods that the company uses to account for revenues.

Columbia Sportswear Company

Management’s Discussion and Analysis of

Seasonality and Variability of Business

Our operations are a ected by seasonal trends typical in the outdoor apparel and footwear industry

and have historically resulted in higher sales and pro ts in the third and fourth calendar quarters.

This pattern has resulted primarily from the timing of shipments of fall season products to whole-

sale customers in the third and fourth quarters and proportionally higher sales in our direct-to-

consumer channels in the fourth quarter, combined with an expense base that is spread more

consistent throughout the year. We believe that our liquidity requirements for at least the next

12 months will be adequately covered by existing cash, cash provided by operations and existing

short-term borrowing arrangements.

Real

World

ILLUSTRATION 1.10

Columbia Sportswear’s

management discussion and

analysis

Columbia Sportswear Company

Notes to Financial Statements

Revenue Recognition

We record wholesale, distributor, e-commerce and licensed product revenues when title passes and

the risks and rewards of ownership have passed to the customer. Title generally passes upon ship-

ment to or upon receipt by the customer depending on the terms of sale with the customer. Retail

store revenues are recorded at the time of sale.

Real

World

ILLUSTRATION 1.11

Notes to Columbia Sports-

wear’s nancial statements

c01IntroductionToFinancialStatements.indd Page 1-16 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-16 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

The Four Financial Statements 1-17

Auditor’s Report

An auditor’s report is prepared by an independent outside auditor. It states the auditor’s

opinion as to the fairness of the presentation of the nancial position and results of operations

and their conformance with generally accepted accounting principles.

An auditor is an accounting professional who conducts an independent examina-

tion of a company’s nancial statements. Only accountants who meet certain criteria and

thereby attain the designation

certi ed public accountant (CPA) may perform audits. If

the auditor is satis ed that the nancial statements provide a fair representation of the com-

pany’s nancial position and results of operations in accordance with generally accepted

accounting principles, then the auditor expresses an unquali ed opinion. If the auditor

expresses anything other than an unquali ed opinion, then readers should only use the

nancial statements with caution. That is, without an unquali ed opinion, we cannot have

complete con dence that the nancial statements give an accurate picture of the company’s

nancial health. For example,

Blockbuster, Inc.’s auditor at one time stated that its nan-

cial situation raised “substantial doubt about the Company’s ability to continue as a going

concern.”

Illustration 1.12 is an excerpt from the auditor’s report from Columbia Sportswear’s

2016 annual report. Columbia received an unquali ed opinion from its auditor,

Deloitte &

Touche

.

Columbia Sportswear Company

Excerpt from Auditor’s Report

In our opinion, such consolidated nancial statements present fairly, in all ma terial respects, the

nancial position of Columbia Sportswear Company and subsidiaries as of December 31, 2016 and

2015, and the results of their operations and their cash ows for each of the three years in the period

ended December 31, 2016, in conformity with accounting principles generally accepted in the

United States of America. Also, in our opinion, such nancial statement schedules, when consid-

ered in relation to the basic consolidated nancial statements taken as a whole, presents fairly, in

all material respects, the information set forth therein.

Real

World

ILLUSTRATION 1.12

Excerpt from auditor’s report

on Columbia Sportswear’s

nancial statements

DO IT! 3b Components of Annual Reports

State whether each of the following items is most closely associated with the management discus-

sion and analysis (MD&A), the notes to the nancial statements, or the auditor’s report.

1. Descriptions of signi cant accounting policies.

2. Unquali ed opinion.

3. Explanations of uncertainties and contingencies.

4. Description of ability to fund operations and expansion.

5. Description of results of operations.

6. Certi ed public accountant (CPA).

Solution

1. Descriptions of signi cant accounting policies: Notes.

2. Unquali ed opinion: Auditor’s report.

3. Explanations of uncertainties and contingencies: Notes.

4. Description of ability to fund operations and expansion: MD&A.

5. Description of results of operations: MD&A.

6. Certi ed public accountant (CPA): Auditor’s report.

Related exercise material: BE1.11, DO IT! 1.3b, and E1.21.

ACTION PLAN

• Realize that nancial

statements provide

information about a

company’s performance

and nancial position.

• Be familiar with the

other elements of

the annual report in

order to gain a fuller

understanding of a

company.

c01IntroductionToFinancialStatements.indd Page 1-17 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-17 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-18 CHAPTER 1 Introduction to Financial Statements

There is a good chance that you may have never heard of VF Corporation. There is also a very

good chance that you are wearing one of VF’s products right now. VF owns North Face, Lee, Vans,

Nautica, Wrangler, Timberland, and numerous other brands. VF is a direct competitor to

Columbia

Sportswear

. Suppose that you are considering investing in shares of VF’s common stock.

Instructions

Answer these questions related to your decision whether to invest.

a. What nancial statements should you evaluate?

b. What should these nancial statements tell you?

c. Do you care if the nancial statements have been audited? Explain.

d. Appendix B contains nancial statements for Columbia, and Appendix C contains those for

VF. You can make many comparisons between Columbia and VF in terms of their respective

results from operations and nancial position. Compare their respective total assets, total

revenues, and net cash provided by operating activities for 2016.

USING THE DECISION TOOLS VF Corporation

Solution

a. Before you invest, you should evaluate the income statement, retained earnings statement,

balance sheet, and statement of cash ows.

b. You would probably be most interested in the income statement because it tells about past

performance and thus gives an indication of future performance. The retained earnings

statement provides a record of the company’s dividend history. The balance sheet reveals

the relationship between assets and liabilities. The statement of cash ows reveals where the

company is getting and spending its cash. This is especially important for a company that

wants to grow.

c. You would want audited nancial statements. These statements indicate that a CPA (certi-

ed public accountant) has examined and expressed an opinion that the statements present

fairly the nancial position and results of operations of the company. Investors and creditors

should not make decisions without studying audited nancial statements.

d. Many interesting comparisons can be made between the two companies (all numbers are

in thousands). Columbia is smaller, with total assets of $2,013,894 versus $9,739,287 for VF,

and it has lower revenue—$2,377,045 versus $12,019,003 for VF. In addition, Columbia’s net

cash provided by operating activities of $275,167 is less than VF’s $1,477,919. However, while

useful, these basic measures are not enough to determine whether one company is a better

investment than the other. In later chapters, you will learn tools that will allow you to com-

pare the relative pro tability and nancial health of these and other companies.

Using the Decision Tools com-

prehensive exercises ask you to

apply business information and

the decision tools presented in

the chapter. Most of these exercis-

es are based on the companies

highlighted in the Feature Story.

The Review and Practice section provides opportunities for students to review key

concepts and terms as well as complete multiple-choice questions, brief exercises,

exercises, and a comprehensive problem. Detailed solutions are also included.

Review and Practice

Learning Objectives Review

1 Identify the forms of business organization and the uses

of accounting information.

A sole proprietorship is a business owned by one person. A partner-

ship is a business owned by two or more people associated as partners.

A corporation is a separate legal entity for which evidence of owner-

ship is provided by shares of stock.

Internal users are managers who need accounting informa-

tion to plan, organize, and run business operations. The primary

external users are investors and creditors. Investors (stockholders)

use accounting information to decide whether to buy, hold, or sell

c01IntroductionToFinancialStatements.indd Page 1-18 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-18 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

Glossary Review 1-19

shares of a company’s stock. Creditors (suppliers and bankers) use

accounting information to assess the risk of granting credit or loan-

ing money to a business. Other groups who have an indirect interest

in a business are taxing authorities, customers, labor unions, and

regulatory agencies.

2 Explain the three principal types of business activity.

Financing activities involve collecting the necessary funds to support

the business. Investing activities involve acquiring the resources nec-

essary to run the business. Operating activities involve putting the re-

sources of the business into action to generate a pro t.

3 Describe the four financial statements and how they are

prepared.

An income statement presents the revenues and expenses of a com-

pany for a speci c period of time. A retained earnings statement

summarizes the changes in retained earnings that have occurred for

a speci c period of time. A balance sheet reports the assets, liabilities,

and stockholders’ equity of a business at a speci c date. A statement

of cash ows summarizes information concerning the cash in ows

(receipts) and out ows (payments) for a speci c period of time.

Assets are resources owned by a business. Liabilities are the debts

and obligations of the business. Liabilities represent claims of credi-

tors on the assets of the business. Stockholders’ equity represents the

claims of owners on the assets of the business. Stockholders’ equity

is subdivided into two parts: common stock and retained earnings.

The basic accounting equation is Assets = Liabilities + Stockholders’

Equity.

Within the annual report, the management discussion and anal-

ysis provides management’s interpretation of the company’s results

and nancial position as well as a discussion of plans for the future.

Notes to the nancial statements provide additional explanation or

detail to make the nancial statements more informative. The audi-

tor’s report expresses an opinion as to whether the nancial state-

ments present fairly the company’s results of operations and nancial

position.

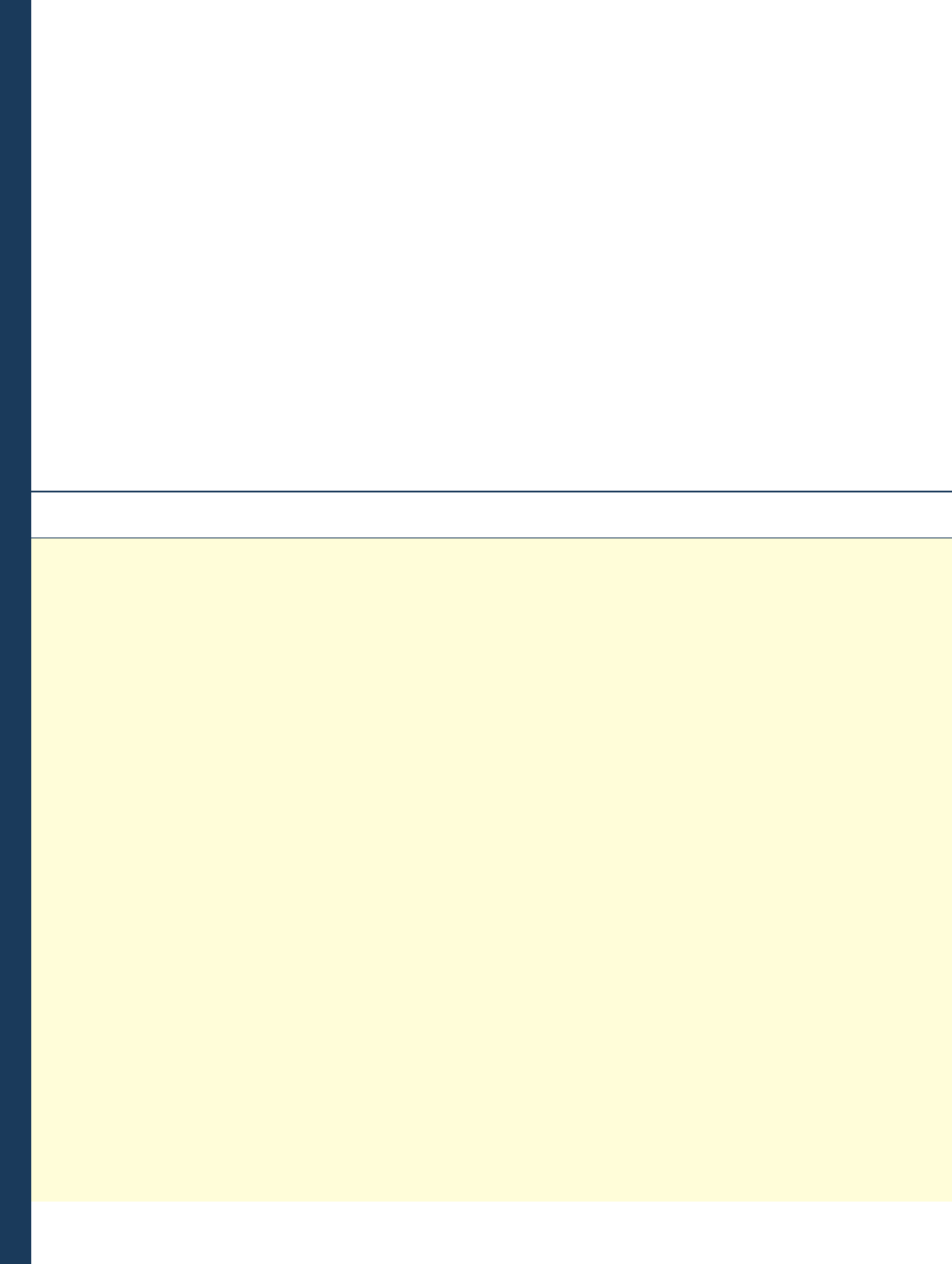

Decision Tools Review

Decision Checkpoints Info Needed for Decision Tool to Use for Decision How to Evaluate Results

Are the company’s

operations pro table?

Income statement The income statement reports a

company’s revenues and expenses

and resulting net income or loss

for a period of time

If the company’s revenues exceed

its expenses, it will report net

income; otherwise, it will report

a net loss.

What is the company’s

policy toward dividends

and growth?

Retained earnings

statement

The retained earnings statement

reports how much of this year’s

income the company paid out in

dividends to shareholders

A company striving for rapid

growth will pay a low (or no)

dividend.

Does the company rely

primarily on debt or stock-

holders’ equity to nance its

assets?

Balance sheet The balance sheet reports the

company’s resources and claims

to those resources; there are two

types of claims: liabilities and

stockholders’ equity

Compare the amount of debt

versus the amount of stockholders’

equity to determine whether the

company relies more on creditors

or owners for its nancing.

Does the company generate

su cient cash from

operations to fund its

investing activities?

Statement of cash ows The statement of cash ows shows

the amount of net cash provided

or used by operating activities,

investing activities, and nancing

activities

Compare the amount of net cash

provided by operating activities

with the amount of net cash

used by investing activities. Any

de ciency in cash from operating

activities must be made up with

cash from nancing activities.

Glossary Review

Accounting The information system that identi es, records, and

communicates the economic events of an organization to interested

users. (p. 1-3).

Annual report A report prepared by corporate management that pres-

ents nancial information including nancial statements, a management

discussion and analysis section, notes, and an independent auditor’s

report. (p. 1-16).

Assets Resources owned by a business. (p. 1-8).

Auditor’s report A report prepared by an independent outside auditor

stating the auditor’s opinion as to the fairness of the presentation of the

nancial position and results of operations and their conformance with

generally accepted accounting principles. (p. 1-17).

Balance sheet A nancial statement that reports the assets and claims

to those assets at a speci c point in time. (p. 1-11).

c01IntroductionToFinancialStatements.indd Page 1-19 02/11/18 10:08 AM F-0590 c01IntroductionToFinancialStatements.indd Page 1-19 02/11/18 10:08 AM F-0590 /208/WB02470/XXXXXXXXXXXX/ch01/text_s/208/WB02470/XXXXXXXXXXXX/ch01/text_s

1-20 CHAPTER 1 Introduction to Financial Statements

Basic accounting equation Assets = Liabilities + Stockholders’

Equity. (p. 1-11).

Certified public accountant (CPA) An individual who has met cer-

tain criteria and is thus allowed to perform audits of corporations. (p. 1-17).

Common stock Term used to describe the total amount paid in by

stockholders for the shares they purchase. (p. 1-8).

Corporation A business organized as a separate legal entity owned by

stockholders. (p. 1-3).

Dividends Payments of cash from a corporation to its stockholders.

(p. 1-8).

Expenses The cost of assets consumed or services used in the process of

generating revenues. (p. 1-8).

Income statement A nancial statement that reports a company’s

revenues and expenses and resulting net income or net loss for a speci c

period of time. (p. 1-10).

Liabilities Amounts owed to creditors in the form of debts and other

obligations. (p. 1-7).

Management discussion and analysis (MD&A) A section of the

annual report that presents management’s views on the company’s ability

to pay near-term obligations, its ability to fund operations and expansion,

and its results of operations. (p. 1-16).

Net income The amount by which revenues exceed expenses. (p. 1-9).

Net loss The amount by which expenses exceed revenues. (p. 1-9).

Notes to the financial statements Notes clarify information

presented in the nancial statements and provide additional detail.

(p. 1-16).

Partnership A business owned by two or more persons associated as

partners. (p. 1-3).

Retained earnings The amount of net income retained in the corpo-

ration. (p. 1-11).

Retained earnings statement A nancial statement that summa-