SEC Financial Reporting Series

Pro forma

financial

information

A guide for applying Article 11 of

Regulation S-X

November 2023

Pro forma financial information | i

Contents

1 Overview ................................................................................................................... 1

1.1 Section highlights .................................................................................................................. 1

1.2 EY publications ...................................................................................................................... 1

1.3 Other considerations .............................................................................................................. 2

1.3.1 ASC 805 pro forma requirements .................................................................................. 2

1.3.2 Pro forma financial information in non-SEC offering documents ...................................... 3

2 Events requiring pro forma financial information .......................................................... 1

2.1 Overview ............................................................................................................................... 1

2.2 Significant business acquisitions and disposals ........................................................................ 2

2.2.1 Definition of a business .................................................................................................. 3

2.2.1.1 Definition of a real estate operation ................................................................... 4

2.2.2 Measuring significance .................................................................................................. 4

2.2.2.1 Significant business acquisitions ....................................................................... 7

2.2.2.2 Related businesses........................................................................................... 7

2.2.2.3 Business acquisitions that are individually insignificant ....................................... 8

2.2.2.4 Significant business disposals ........................................................................... 8

2.2.2.5 Acquisitions of significant real estate operations ................................................ 8

2.2.2.6 Acquisition of individually insignificant real estate operations .............................. 9

2.2.2.7 Exchange transactions ..................................................................................... 9

2.3 Spin-off of a portion of an entity ............................................................................................. 9

3 Forms requiring pro forma financial information ........................................................ 10

3.1 Form 8-K ............................................................................................................................. 10

3.1.1 Exchange transaction .................................................................................................. 11

3.2 Registration statements and proxy statements ...................................................................... 11

3.3 Foreign private issuer forms ................................................................................................. 13

4 Preparation of pro forma financial information ............................................................ 14

4.1 General form and content..................................................................................................... 14

4.2 Required statements and periods presented .......................................................................... 15

4.2.1 Pro forma condensed balance sheet ............................................................................. 16

4.2.2 Pro forma condensed income statement ...................................................................... 16

4.2.2.1 Pro forma income statement required for all fiscal years presented ................... 17

4.2.2.2 Pro forma information reflects common control (or discontinued operations)

and other transactions ................................................................................... 17

4.2.2.3 Historical results include unusual events .......................................................... 18

4.2.3 Filing of a Form 10-Q or Form 10-K during the Form 8-K extension period ..................... 18

4.2.4 Combining entities with different fiscal years ................................................................ 19

4.2.5 Changes in fiscal year end ........................................................................................... 20

4.2.6 Narrative disclosure only ............................................................................................. 21

4.3 Updating pro formas ............................................................................................................ 22

Contents

Pro forma financial information | ii

4.4 Pro forma adjustments ......................................................................................................... 23

4.4.1 Transaction accounting adjustments ............................................................................ 23

4.4.1.1 Nonrecurring items ........................................................................................ 24

4.4.2 Autonomous entity adjustments .................................................................................. 25

4.4.3 Management’s adjustments ......................................................................................... 25

4.4.3.1 Identifying and quantifying the adjustments ..................................................... 26

4.4.3.2 Disclosures about each adjustment ................................................................. 27

4.4.3.3 Updating the disclosures ................................................................................ 27

4.4.3.4 Disclosing management’s adjustments elsewhere in a filing ............................... 27

4.5 Other content requirements ................................................................................................. 27

4.5.1 Introductory section .................................................................................................... 27

4.5.2 Columnar presentation ................................................................................................ 28

4.5.3 Explanatory notes ....................................................................................................... 29

4.6 Specific or unique circumstances .......................................................................................... 30

4.6.1 Pro formas involving multiple transactions ................................................................... 30

4.6.2 Transactions with range of possible results ................................................................... 31

4.6.3 Cross-border business combinations ............................................................................ 32

5 Pro forma adjustment illustrations ............................................................................ 34

5.1 Business combinations ......................................................................................................... 34

5.1.1 Calculation of purchase price ....................................................................................... 34

5.1.2 Contingent consideration ............................................................................................ 35

5.1.3 Preliminary purchase price allocation ........................................................................... 35

5.1.4 Debt ........................................................................................................................... 36

5.1.4.1 Acquired business’s debt assumed by the registrant ......................................... 36

5.1.4.2 Additional debt financing ................................................................................ 37

5.1.4.3 Obtaining new debt and refinancing acquiree debt to complete acquisition ......... 37

5.1.4.4 Bridge loan financing ...................................................................................... 38

5.1.5 Intangible assets ......................................................................................................... 39

5.1.6 Long-lived tangible assets ............................................................................................ 41

5.1.7 Transaction costs ........................................................................................................ 41

5.1.8 Gains and losses attributable to the acquisition ............................................................. 42

5.1.9 Inventory valuation ..................................................................................................... 43

5.1.10 In-process research and development .......................................................................... 43

5.1.11 Deferred tax asset valuation allowances ....................................................................... 43

5.1.12 Compensation arrangements ....................................................................................... 45

5.1.12.1 Change-in-control provisions .......................................................................... 45

5.1.12.2 New or replacement compensation agreements ............................................... 47

5.1.13 Accounting policies and financial statement presentation .............................................. 47

5.1.14 Business combinations involving foreign entities ........................................................... 49

5.1.14.1 Basis of accounting ........................................................................................ 49

5.1.14.2 Foreign currency adjustments ......................................................................... 50

5.1.15 Regulatory effects of a business combination ............................................................... 51

5.1.16 Management’s adjustments ......................................................................................... 52

5.2 Acquisition of equity method investments ............................................................................. 53

5.3 Disposals ............................................................................................................................. 54

5.4 Spin-off transactions ............................................................................................................ 56

Contents

Pro forma financial information | iii

5.5 Other transactions ............................................................................................................... 56

5.5.1 Reorganization of entities under common control ......................................................... 56

5.5.2 Emergence from bankruptcy ....................................................................................... 57

5.5.3 Use of proceeds in securities offerings ......................................................................... 59

6 Other pro forma considerations ................................................................................ 61

6.1 IPO considerations ............................................................................................................... 61

6.1.1 Planned distributions not reflected in the historical balance sheet .................................. 61

6.1.2 Distributions in excess of earnings ............................................................................... 62

6.1.3 Changes in tax status .................................................................................................. 63

6.1.4 Other changes in capitalization .................................................................................... 64

6.1.5 Example — disclosure of pro forma financial information in an IPO .................................. 64

6.2 Financial forecasts ............................................................................................................... 65

6.2.1 Presentation and disclosure requirements .................................................................... 67

6.3 Roll-up transactions ............................................................................................................. 67

6.4 Tender offers....................................................................................................................... 68

6.5 Pro forma MD&A .................................................................................................................. 69

6.6 Pro forma effects on non-GAAP financial measures of performance or liquidity ....................... 70

7 Auditor involvement ................................................................................................. 71

7.1 Comfort letters .................................................................................................................... 71

7.2 Reporting on pro forma financial information ........................................................................ 71

Pro forma financial information | 1

1 Overview

We are pleased to present this publication, Pro forma financial information: a guide for applying Article 11

of Regulation S-X. Pro forma financial information (pro formas) presents historical balance sheet and

income statement information adjusted as if a transaction had occurred at an earlier time. Pro formas are

intended to provide investors with information about the effect of a transaction by showing how a

transaction or a group of transactions might have affected historical financial statements to illustrate

the scope of the change in the registrant’s financial position and results of operations.

Article 11 of Regulation S-X, Pro forma financial information, describes the requirements of the

Securities and Exchange Commission (SEC) for registrants to provide pro formas.

1.1 Section highlights

The following is an overview of the sections in this publication:

• Section 2 describes the events and circumstances that require registrants to present Article 11

pro formas in SEC filings.

• Section 3 discusses which SEC forms require Article 11 pro formas.

• Section 4 walks through the content requirements for pro formas, including the required historical

financial information and adjustments to the historical information.

• Section 5 shows the pro forma adjustments and disclosures typically required for common transactions.

• Section 6 highlights other considerations, including pro forma disclosure related to initial public

offering (IPO) transactions, disclosure in management’s discussion and analysis (MD&A) and the

use of non-GAAP measures.

• Section 7 covers auditors’ responsibilities and their involvement with respect to pro formas.

1.2 EY publications

Our publications provide interpretive guidance to help registrants prepare various SEC forms and

schedules. These documents are available from any EY representative.

• Technical Line, Applying the SEC’s requirements for significant acquired businesses (updated April

2023) — This publication discusses all of the disclosure requirements for reporting on common

acquisition transactions and provides examples of how to apply these requirements, among other things.

• Technical Line, How to apply the amended S-X Rule 3-14 to real estate acquisitions — This publication

explains when a registrant is in the scope of this specialized industry guidance, how to measure

significance when acquiring a real estate operation and what financial information is required.

1 Overview

Pro forma financial information | 2

1.3 Other considerations

Reading our publication is not a substitute for reading Article 11 or the applicable form instructions that

require pro formas. Registrants should also consider the following resources that describe SEC staff

views about complying with Article 11. Since the SEC staff had not yet updated its guidance to reflect

the most recent amendments

1

to Article 11, registrants should confirm the relevance of the guidance

referred to below.

• The Financial Reporting Manual (FRM) provides views on financial reporting matters from the

Division of Corporation Finance’s Office of Chief Accountant.

2

The SEC staff’s interpretations and

guidance about pro forma financial information are included in Topic 3 of the FRM.

• The highlights of meetings the Center for Audit Quality (CAQ) SEC Regulations Committee holds

periodically with the SEC staff describe the staff’s views on emerging financial reporting issues

relating to SEC rules and regulations. The highlights can be found on the CAQ’s website.

3

• Staff Accounting Bulletins (SABs) provide the SEC staff’s views on accounting-related disclosure

practices. They reflect the interpretations and policies followed by the SEC’s Division of Corporation

Finance and the Office of the Chief Accountant and are codified in the Codification of Staff Accounting

Bulletins. There are only a limited number of SABs (e.g., SAB Topics 1.B.2 and 1.B.3) that address

pro forma financial information under the legacy rules.

1.3.1 ASC 805 pro forma requirements

Accounting Standards Codification (ASC) 805-10-50-2(h) requires an entity to disclose certain pro forma

information in the footnotes to its financial statements when the entity has completed a material business

combination. ASC 805, Business Combinations, requires pro forma revenue and earnings to be disclosed

as if the business combination had occurred at the beginning of the prior annual period when comparative

financial statements are presented. Entities also must provide a narrative description of the nature and

amount of material nonrecurring adjustments.

The preparation of ASC 805 pro forma adjustments is generally consistent with the preparation of

adjustments required under Article 11, but the disclosures under ASC 805 are substantially less detailed.

Many registrants, nevertheless, will continue to apply the principles in Article 11 to prepare their ASC 805

pro forma disclosures because ASC 805 does not provide guidance on how entities should calculate the

items that must be disclosed (pro forma revenue and earnings). For example, see section 4.4.1.1,

Nonrecurring items, for details.

It is also important to note that registrants determining whether to include ASC 805 pro forma information

in the footnotes to their financial statements evaluate whether the information is material, while registrants

determining whether to present Article 11 pro formas evaluate whether the acquired business exceeds a

significance threshold (see section 2.2.2). As a result, a registrant may need to make supplemental pro

forma disclosures under ASC 805, even when Article 11 pro formas are not required.

1

The SEC most recently amended the rules with SEC Release 33-10786, Amendments to Financial Disclosures about Acquired and

Disposed Businesses, which was effective 1 January 2021 for calendar year-end companies. The amended rules (reflected herein)

changed the significance tests used to determine whether registrants need to file audited financial statements of an acquired

business and related pro formas, the periods the financial statements must cover, and the form and content of the pro formas,

among other things.

2

The FRM can be found at http://www.sec.gov/divisions/corpfin/cffinancialreportingmanual.shtml.

3

The CAQ SEC Regulations Committee highlights can be found on the CAQ website at https://www.thecaq.org/sec-regulations-

committee-highlights.

1 Overview

Pro forma financial information | 3

Refer to our Financial reporting developments (FRD) publication, Business combinations, for more

information about the pro forma requirements in ASC 805.

1.3.2 Pro forma financial information in non-SEC offering documents

Registrants may include pro formas in offering documents other than registration statements under the

Securities Act of 1933 (Securities Act) or Exchange Act of 1934 (Exchange Act). Financial statements

and other information (including pro formas) included in these offering documents (e.g., exempt offering

memoranda for Rule 144A offerings) are not subject to SEC form instructions or the requirements of

Regulation S-X. Instead, third-party broker-dealers or financial intermediaries associated with the

offering determine what information should be provided. Therefore, the requirements of Article 11 of

Regulation S-X discussed in this publication do not have to be followed in non-SEC offering documents.

However, the principles in Article 11 and the discussions in this publication may provide a helpful

framework for preparing pro formas in non-SEC offering documents.

Pro forma financial information | 1

2 Events requiring pro forma financial

information

2.1 Overview

This section describes the events and circumstances in which Article 11 pro formas should be presented

in filings with the SEC.

Excerpt from SEC rules and regulations

Regulation S-X, Article 11 Pro forma financial information

Rule 11-01, Presentation requirements

(a) Pro forma financial information must be filed when any of the following conditions exist:

(1) During the most recent fiscal year or subsequent interim period for which a balance sheet

is required by Regulation S-X Rule 3-01, a significant business acquisition has occurred

(for purposes of this section, this encompasses the acquisition of an interest in a business

accounted for by the equity method);

(2) After the date of the most recent balance sheet filed pursuant to Regulation S-X Rule 3-01,

consummation of a significant business acquisition or a combination of entities under

common control has occurred or is probable;

(3) Securities being registered by the registrant are to be offered to the security holders of a

significant business to be acquired or the proceeds from the offered securities will be applied

directly or indirectly to the purchase of a specific significant business;

(4) The disposition of a significant portion of a business either by sale, abandonment or

distribution to shareholders by means of a spin-off, split-up or split-off has occurred or is

probable and such disposition is not fully reflected in the financial statements of the

registrant included in the filing;

(5) Reserved;

(6) Pro forma financial information required by Regulation S-K Item 914 is required to be

provided in connection with a roll-up transaction as defined in Regulation S-K Item 901(c);

(7) The registrant previously was a part of another entity and such presentation is necessary to

reflect operations and financial position of the registrant as an autonomous entity; or

(8) Consummation of other transactions has occurred or is probable for which disclosure of

pro forma financial information would be material to investors.

Companies must present Article 11 pro formas when certain transactions occur or become probable, including:

• Significant acquisitions of businesses, including equity method investments, those that meet the

definition of a real estate operation and a combination of entities under common control (refer to

section 5.1, Business combinations, section 5.2, Acquisition of equity method investments, and

section 5.5.1, Reorganization of entities under common control, for further discussion)

2 Events requiring pro forma financial information

Pro forma financial information | 2

• Significant disposals of businesses, including real estate operations (refer to section 5.3, Disposals,

for further discussion)

• Spin-offs (refer to section 5.4, Spin-off transactions, for further discussion)

• Roll-up transactions (refer to section 6.3, Roll-up transactions, for further discussion)

• Any other transaction that has occurred or is probable for which disclosure of pro formas would be

material to investors

Materiality for this purpose depends on the facts and circumstances of the event or transaction and can

also include the following:

• Repayment or refinancing of debt (refer to section 5.1.4, Debt, for further discussion)

• Emergence from bankruptcy (refer to section 5.5.2, Emergence from bankruptcy, for further discussion)

• Receipt and application of offering proceeds (refer to section 5.5.3, Use of proceeds in securities

offerings, for further discussion)

• Declaring dividends after the most recent balance sheet date (refer to section 6.1.1, Planned

distributions not reflected in the historical balance sheet, and section 6.1.2, Distribution in excess of

earnings, for further discussion)

• Changes in tax status, such as converting a subchapter S corporation or partnership to a C

corporation (refer to section 6.1.3, Changes in tax status, for further discussion)

• Changes in capitalization at or prior to closing of an IPO (refer to section 6.1.4, Other changes in

capitalization, for further discussion)

2.2 Significant business acquisitions and disposals

Article 11 pro formas are required if a significant acquisition of a business or real estate operation,

including equity method investments, has occurred in the latest fiscal year or subsequent interim period or

is probable. Significant acquisitions include any transaction or event that results in the registrant obtaining

control (e.g., consolidation by contract) as well as the acquisition of a significant equity method investment.

Article 11 pro formas are also required if a disposal of a significant business (including disposition of a

significant equity method investment) or real estate operation by sale, abandonment or distribution to

shareholders has occurred or is probable.

The requirements to provide pro formas are triggered when an acquisition or disposal is more than 20%

significant to a registrant. See section 2.2.2 for details of how significance is measured. Because a

transaction involving a business that also meets the definition of a real estate operation is treated

differently under Regulation S-X than one involving a business that doesn’t meet the definition of a real

estate operation, this type of transaction is discussed separately below. See also our Technical Line,

How to apply the amended S-X Rule 3-14 to real estate acquisitions.

In general, whenever audited historical financial statements of an acquired business or real estate

operation are required, Article 11 pro formas also must be presented. Article 11 pro formas also may be

necessary if an acquired business or real estate operation of the registrant consummated a significant

acquisition of its own during the year (i.e., a second-tier acquisition) if that information would be material

for investors to understand the registrant or vote on a transaction.

2 Events requiring pro forma financial information

Pro forma financial information | 3

Generally, the SEC staff considers presenting separate financial statements of an acquired business or

real estate operation without accompanying pro formas to be misleading. Likewise, pro formas are not

required to be presented for an acquisition if separate financial statements are not required in the filing,

except in certain cases involving individually insignificant acquisitions that are significant in the

aggregate. See sections 2.2.2.3 and 2.2.2.6 for more about these situations.

2.2.1 Definition of a business

To determine whether S-X Article 11 applies, a registrant must first determine whether the assets and

liabilities it is acquiring or disposing of meet the SEC’s definition of a business in S-X Rule 11-01(d).

Under Rule 11-01(d), the general principle for identifying a business is that there must be continuity of the

revenue-producing activity before and after the transaction, and the pre-acquisition financial information

about the acquired or disposed business is, therefore, material to an understanding of the registrant’s

operations after the transaction. There is a presumption that a separate entity, subsidiary, division or

working interest in an oil and gas property is a business. S-X Rule 11-01(a)(1) also defines as a business an

investment accounted for using the equity method (including when the fair value option has been elected).

Other components of a selling entity, such as a product line, may also be considered a business for SEC

reporting purposes. When evaluating whether such a component is a business, registrants must consider

the criteria in S-X Rule 11-01(d). However, these attributes are not all-inclusive.

Excerpt from SEC rules and regulations

Regulation S-X, Article 11 Pro forma financial information

Rule 11-01, Presentation requirements

(d) For purposes of this rule, the term business should be evaluated in light of the facts and

circumstances involved and whether there is sufficient continuity of the acquired entity’s operations

prior to and after the transactions so that disclosure of prior financial information is material to an

understanding of future operations. A presumption exists that a separate entity, a subsidiary, or a

division is a business. However, a lesser component of an entity may also constitute a business.

Among the facts and circumstances which should be considered in evaluating whether an

acquisition of a lesser component of an entity constitutes a business are the following:

(1) Whether the nature of the revenue-producing activity of the component will remain generally

the same as before the transaction; or

(2) Whether any of the following attributes remain with the component after the transaction:

(i) Physical facilities,

(ii) Employee base,

(iii) Market distribution system,

(iv) Sales force,

(v) Customer base,

(vi) Operating rights,

(vii) Production techniques, or

(viii) Trade names.

2 Events requiring pro forma financial information

Pro forma financial information | 4

The SEC staff has emphasized that the analysis of whether a set of assets and liabilities constitutes a

business focuses primarily on the continuity of operations before and after the transaction. Therefore,

registrants must use judgment to evaluate the above criteria among other facts and circumstances.

Illustration 1-1 — Definition of a business in an acquisition

Registrant A is acquiring certain assets related to Product X from Company B. No employees will move

from Company B to Registrant A, and the transaction involves only the internally generated intangible

assets (e.g., brand name, manufacturing know-how) and inventory related to Product X. Product X is

not a separate entity, subsidiary or division of Company B. After the acquisition, Registrant A will sell

Product X to Company B’s customers.

Because the nature of the revenue-producing activity associated with Product X will remain the same

after the acquisition and multiple attributes listed in S-X Article 11 will remain with Product X,

Registrant A concludes that the transaction involves a business.

If a registrant believes that it may be able to overcome the presumption that a separate entity, subsidiary,

division or working interest in an oil and gas property is a business or is uncertain whether the criteria in

S-X Rule 11-01(d) have been met, we recommend that the registrant contact the SEC staff to discuss

whether a business has, in fact, been acquired. When the answer is unclear, it may also be helpful to

consider whether the information conveyed in Rule 3-05 financial statements would be useful to investors.

The SEC’s definition of a business differs from the US GAAP definition in ASC 805; therefore, it is possible

to reach a different conclusion about whether a business has been acquired under Article 11 and ASC 805.

2.2.1.1 Definition of a real estate operation

Rule 3-14 of Regulation S-X, Special instructions for financial statements of real estate operations acquired

or to be acquired, requires registrants to present the audited financial statements and Article 11 pro formas

of significant consummated and probable acquisitions of real estate operations. In addition, Article 11

requires pro formas when a registrant disposes of a significant real estate operation.

A real estate operation is a business that generates substantially all of its revenues through the leasing of

real property. A registrant must evaluate a property’s rental history in order to determine whether it meets

the definition. The SEC staff has said that it is not necessary to provide financial statements or pro formas

for an acquired property that has less than three months of history (including newly constructed properties

or previously owner-occupied properties) or a rental property that will be demolished and replaced with

a new rental property, regardless of its rental history. The definition of a real estate operation also

encompasses an investment in a real estate operation accounted for using the equity method.

Please refer to our Technical Line, How to apply the amended S-X Rule 3-14 to real estate acquisitions,

for further explanations of what constitutes a real estate operation, how to measure significance and

what financial information is required when a registrant acquires a significant real estate operation.

2.2.2 Measuring significance

Significance is expressed as a percentage using the asset test, the investment test and the income test

applicable to the transaction as described in S-X Rule 1-02(w). The results of the tests cannot be rounded,

and the registrant uses the highest result of the three tests to determine its reporting requirements.

More details about how the tests should be applied are included in Article 11 and Rules 3-05 and 3-14 for

acquisitions of businesses and real estate operations, respectively.

2 Events requiring pro forma financial information

Pro forma financial information | 5

Excerpt from SEC rules and regulations

Regulation S-X, Article 1 Application of Regulation S-X

Rule 1-02, Definitions of terms used in Regulation S-X

(w) Significant subsidiary.

(1) The term significant subsidiary means a subsidiary, including its subsidiaries, which meets any

of the conditions in paragraphs (w)(1)(i), (ii), or (iii) of this section; however if the registrant is

a registered investment company or a business development company, the tested subsidiary

meets any of the conditions in paragraph (w)(2) of this section instead of any of the conditions

in paragraph (w)(1) of this section. A registrant that files its financial statements in accordance

with or provides a reconciliation to US GAAP must use amounts determined under US GAAP.

A foreign private issuer that files its financial statements in accordance with International

Financial Reporting Standards as issued by the International Accounting Standards Board

(IFRS-IASB) must use amounts determined under IFRS-IASB.

(i) Investment test.

(A) For acquisitions, other than those described in paragraph (B), and dispositions this

test is met when the registrant’s and its other subsidiaries’ investments in and

advances to the tested subsidiary exceed 10 percent

1

of the aggregate worldwide

market value of the registrant’s voting and non-voting common equity, or if the

registrant has no such aggregate worldwide market value the total assets of the

registrant and its subsidiaries consolidated as of the end of the most recently

completed fiscal year.

(1) For acquisitions, the “investments in” the tested subsidiary is the consideration

transferred, adjusted to exclude the registrant’s and its other subsidiaries’

proportionate interest in the carrying value of assets transferred by the registrant

and its subsidiaries consolidated to the tested subsidiary that will remain with the

combined entity after the acquisition. It must include the fair value of contingent

consideration if required to be recognized at fair value by the registrant at the

acquisition date under US GAAP or IFRS-IASB, as applicable; however if recognition

at fair value is not required, it must include all contingent consideration, except

contingent consideration for which the likelihood of payment is remote.

(2) For dispositions, the “investments in” the tested subsidiary is the fair value of the

consideration, including contingent consideration, for the disposed subsidiary

when comparing to the aggregate worldwide market value of the registrant’s

voting and non-voting common equity, or, when the registrant has no such

aggregate worldwide market value, the carrying value of the disposed subsidiary

when comparing to total assets of the registrant.

(3) When determining the aggregate worldwide market value of the registrant’s

voting and non-voting common equity, use the average of such aggregate

worldwide market value calculated daily for the last five trading days of the

registrant’s most recently completed month ending prior to the earlier of the

registrant’s announcement date or agreement date of the acquisition or disposition.

(B) For a combination between entities or businesses under common control, this test is

met when either the net book value of the tested subsidiary exceeds 10 percent of

the registrant’s and its subsidiaries’ consolidated total assets or the number of

common shares exchanged or to be exchanged by the registrant exceeds 10 percent

of its total common shares outstanding at the date the combination is initiated.

2 Events requiring pro forma financial information

Pro forma financial information | 6

(C) In all other cases, this test is met when the registrant’s and its other subsidiaries’

investments in and advances to the tested subsidiary exceed 10 percent of the total

assets of the registrant and its subsidiaries consolidated as of the end of the most

recently completed fiscal year.

(ii) Asset test. This test is met when the registrant’s and its other subsidiaries’ proportionate

share of the tested subsidiary’s consolidated total assets (after intercompany eliminations)

exceeds 10 percent

1

of such total assets of the registrant and its subsidiaries consolidated

as of the end of the most recently completed fiscal year.

(iii) Income test.

(A) This test is met when:

(1) The absolute value of the registrant’s and its other subsidiaries’ equity in the tested

subsidiary’s consolidated income or loss from continuing operations before income

taxes (after intercompany eliminations) attributable to the controlling interests

exceeds 10 percent of the absolute value of such income or loss of the registrant

and its subsidiaries consolidated for the most recently completed fiscal year; and

(2) The registrant’s and its other subsidiaries’ proportionate share of the tested

subsidiary’s consolidated total revenue from continuing operations (after

intercompany eliminations) exceeds 10 percent of such total revenue of the

registrant and its subsidiaries consolidated for the most recently completed fiscal

year. This component does not apply if either the registrant and its subsidiaries

consolidated or the tested subsidiary did not have material revenue in each of the

two most recently completed fiscal years.

(B) When determining the income component in paragraph (w)(1)(iii)(A)(1) of this section:

(1) If a net loss from continuing operations before income taxes (after intercompany

eliminations) attributable to the controlling interest has been incurred by either

the registrant and its subsidiaries consolidated or the tested subsidiary, but not

both, exclude the equity in the income or loss from continuing operations before

income taxes (after intercompany eliminations) of the tested subsidiary

attributable to the controlling interest from such income or loss of the registrant

and its subsidiaries consolidated for purposes of the computation;

(2) Compute the test using the average described in this paragraph (w)(1)(iii)(B)(2)

if the revenue component in paragraph (w)(1)(iii)(A)(2) of this section does not

apply and the absolute value of the registrant’s and its subsidiaries’ consolidated

income or loss from continuing operations before income taxes (after intercompany

eliminations) attributable to the controlling interests for the most recent fiscal

year is at least 10 percent lower than the average of the absolute value of such

amounts for each of its last five fiscal years; and

(3) Entities reporting losses must not be aggregated with entities reporting income where

the test involves combined entities, as in the case of determining whether summarized

financial data must be presented or whether the aggregate impact specified in S-X

Rules 3-05(b)(2)(iv) and 3-14(b)(2)(i)(C) is met, except when determining whether

related businesses meet this test for purposes of Rules 3-05 and 8-04.

(2) [Omitted from this publication]

__________________________

1

The significant subsidiary tests in Regulation S-X Rule 1-02(w) are referenced in several SEC rules and regulations and the

threshold to determine significance may vary from one rule to another. For example, under Regulation S-X Rule 3-05 and for

Article 11, an acquired business is significant when the results of any of the three significance tests (i.e., asset, investment

and income) exceeds 20%.

2 Events requiring pro forma financial information

Pro forma financial information | 7

2.2.2.1 Significant business acquisitions

In most cases, the significance tests described below are performed using amounts that appear in the

registrant’s most recent annual pre-acquisition audited financial statements filed with the SEC and amounts

in the financial statements of the acquired business for the same fiscal year. The financial statements of

the acquired business do not need to be audited to be used in the significance test. The following

summarizes each of the three significance tests.

• Asset test — Significance is measured by comparing the registrant’s proportionate share of the

acquired business’s total assets (after intercompany eliminations) to its consolidated total assets.

• Investment test — Significance is measured by comparing the registrant’s investments in and advances

to the acquired business (i.e., consideration transferred, typically consistent with US GAAP) to the

aggregate worldwide market value of the registrant’s voting and non-voting common equity (WWMV),

or the registrant’s total assets if WWMV is not available (i.e., when common equity is not publicly

traded, as is the case for a company conducting an IPO).

• Income test — Significance is measured using the lower result of the following two components unless

either the registrant or the acquired business did not have material revenue during each of their past

two years, in which case only the income component is used:

• Income component — This component compares the registrant’s proportionate share of the

acquired business’s pretax income or loss from continuing operations, net of amounts attributable

to any noncontrolling interest, to that of the registrant.

• Revenue component — This component compares the registrant’s proportionate share of the

acquired business’s most recent annual consolidated revenue from continuing operations to that

of the registrant.

Refer to our Technical Line, Applying the SEC’s requirements for significant acquired businesses

(updated April 2023), for further discussions (including examples) about measuring significance for

business acquisitions.

2.2.2.2 Related businesses

Generally, each business acquired or to be acquired is evaluated individually. However, a group of related

businesses must be treated as a single acquisition. Businesses are considered related if they are under

common control or management, the acquisition of one business is conditional on the acquisition of each

other business, or each acquisition is conditioned on a single common event.

To perform the tests for the group as a whole, a registrant must aggregate the amounts for each business,

and the highest result represents the significance of the group. That is, if the significance of the group

exceeds 20% for at least one test, Rule 3-05 financial statements and pro formas are required for each of

the related businesses, even if the significance of one or more of them is 20% or less for all three tests.

Companies should include related acquisitions that have occurred in the period after the latest audited

fiscal year end and, for registration statements, include related acquisitions that are probable.

While the related businesses must be combined for purposes of determining significance, the financial

statements of the related businesses, if required, may be presented on a combined basis only if they are

under common control or common management as specified in ASC 810, Consolidation.

2 Events requiring pro forma financial information

Pro forma financial information | 8

2.2.2.3 Business acquisitions that are individually insignificant

Registrants must also consider the aggregate significance of acquisitions that do not individually trigger a

requirement to include Rule 3-05 financial statements and pro formas in a registration statement or

proxy statement. Significance is calculated as if the acquisitions were a single acquisition and include:

• Acquisitions consummated after the registrant’s most recent audited balance sheet date that are

20% or less significant

• Probable acquisitions that are 50% or less significant

• Completed acquisitions that are more than 20% but not more than 50% significant for which Rule 3-05

financial statements and pro formas are not yet required because the filing or effective date of a

registration statement (or mailing date of a proxy) falls within 74 days of consummation

If the aggregate significance of these acquisitions exceeds 50% for any of the three tests, the rules

require a registrant to include in a registration or proxy statement pro formas that depict the aggregate

effect of all individually insignificant acquisitions in all material respects. Rule 3-05 financial statements

(covering the most recent fiscal year and interim period) for any of these acquisitions that exceed 20%

must also be included.

Refer to our Technical Line, Applying the SEC’s requirements for significant acquired businesses

(updated April 2023), for further discussion and examples of how to calculate aggregate significance of

individually insignificant acquisitions.

2.2.2.4 Significant business disposals

Significance for business disposals is calculated using the three tests specified for disposals in S-X 1-

02(w)(1). These tests are consistent with the tests used for acquired businesses, except the numerator

of the investment test is the fair value of the consideration received, including contingent consideration.

If a registrant does not have WWMV, the denominator would be the registrant’s total assets and the

numerator should be the carrying value of the portion of business disposed.

When a disposal is achieved in the form of a spin-off transaction, a registrant performs the investment

test by comparing the carrying value of the disposed business to the total assets of the registrant (even if

the registrant has WWMV).

The SEC staff has said that the numerator for the income test is calculated based on the income

statement effects that would be removed from the registrant’s income statement during the tested

period, similar to the requirements for presenting discontinued operations under ASC 205- 20-45, and

not on pretax income on a carve-out basis using the principles of SAB Topic 1.B.1.

The denominator of the income test should not include the results of the business that is disposed of if it

already has been reported as a discontinued operation because S-X Rule 1-02(w) specifies that the

denominator must equal the registrant’s pretax income or loss from continuing operations.

Refer to section 3.1 for additional considerations related to Form 8-K when reporting disposals.

2.2.2.5 Acquisitions of significant real estate operations

Significance for acquisitions of real estate operations is determined using the investment test used for

acquisitions of a business. However, the numerator must include any debt secured by the property that is

assumed by the registrant when WWMV is not available and total assets are used as the denominator.

2 Events requiring pro forma financial information

Pro forma financial information | 9

Related real estate operations are treated the same way as related businesses. Special tests can be used

when a registrant conducts a “blind pool” offering or enters into a transaction to form a real estate

investment trust. Refer to our Technical Line, How to apply the amended S-X Rule 3-14 to real estate

acquisitions, for further discussion.

2.2.2.6 Acquisition of individually insignificant real estate operations

When filing a registration statement or proxy statement, a registrant must also calculate the aggregate

significance of acquisitions that do not individually trigger a requirement to include Rule 3-14 financial

statements and pro formas. The real estate operations are identified in the same way that individually

insignificant businesses are, as described in section 2.2.2.3.

If the aggregate significance of these acquisitions exceeds 50% for any of the three tests, a registrant is

required to include in a registration statement or proxy statement pro formas that depict the aggregate

impact of all individually insignificant acquisitions in all material respects. Rule 3-14 financial statements

for any of these acquisitions that exceed 20% significance must also be included.

If the registrant acquires both businesses subject to Rule 3-05 and real estate operations subject to

Rule 3-14, the registrant must use the significance tests that apply to each type of transaction. When

aggregating significance, the registrant must include both the businesses and the real estate operations.

Please refer to our Technical Line, How to apply the amended S-X Rule 3-14 to real estate acquisitions,

for further discussion.

2.2.2.7 Exchange transactions

In an exchange transaction, the registrant and another party contribute businesses to a joint venture in

exchange for an equity interest. To determine whether pro forma financial information is required, the

registrant should measure the significance of the business being disposed of (i.e., contributed by the

registrant) and separately measure the significance of the business being acquired (i.e., contributed by the

other party). The significance of the business being acquired should be calculated based only on the

portion of the business being acquired, and the significance of the business being disposed of should be

calculated based only on the portion of the business being disposed of.

Refer to our Technical Line, Applying the SEC’s requirements for significant acquired businesses

(updated April 2023), for further discussion and an example of how to calculate significance of an

exchange transaction.

2.3 Spin-off of a portion of an entity

Article 11 pro forma information is necessary to reflect the operations and financial position of a

registrant that was previously part of another entity as a standalone entity after a transaction commonly

referred to as a spin-off. In this case, the historical financial statements typically do not reflect the

operations of the ongoing entity. The pro forma balance sheet should include pro forma adjustments to

remove assets and liabilities that are not part of the spin-off. In addition, the effects of major distribution

agreements, cost-sharing or management agreements, and compensation or benefit plans should be

reflected if they qualify as autonomous entity adjustments. Refer to section 4.4.2 for further discussion.

Pro forma financial information | 10

3 Forms requiring pro forma financial

information

Generally, pro forma financial information is required in Form 8-K, registration statements, and proxy

statements for significant acquisitions and disposals. Pro formas for other transactions are generally

required only in registration statements and proxy statements. Periodic reporting Forms 10-K and 10-Q

do not require Article 11 pro formas.

3.1 Form 8-K

Form 8-K requires pro forma financial information under Article 11 or Rule 8-05 of Regulation S-X for

smaller reporting companies for acquisitions and disposals

4

of significant businesses and real estate

operations, including significant equity method investments. These transactions must be reported under

Item 2.01 of Form 8-K within four business days of completion of the transaction. For counting purposes,

day one is the first business day after the day on which the transaction occurred.

If a registrant is unable to provide the required pro formas for a significant acquisition when the Item 2.01

Form 8-K is filed (e.g., because audited financial statements of the acquired business are not available),

an automatic extension of 71 calendar days is available (Form 8-K Item 9.01(a)(3)). However, the

registrant must state in the initial Form 8-K that it will file them within 71 days. If either of these due

dates occurs on a weekend or a holiday, the registrant can file on the next business day.

The 71-day extension allowed by Item 9.01(a)(3) of Form 8-K is not available for disposals because

separate audited financial statements are not required. That is, the pro formas reflecting the disposal must

be provided within four business days of its completion.

While each significant acquisition or disposal triggers separate disclosure under Item 2.01 of Form 8-K and

the filing of pro formas under Item 9.01 of Form 8-K, companies typically provide cumulative pro formas

when they make subsequent significant acquisitions or disposals in the same year. The SEC staff

encourages this presentation because it provides more comprehensive disclosure.

For example, consider a registrant that completes a significant acquisition during the first quarter of its

current fiscal year and reports timely pro forma and historical financial statements for that acquisition

under Item 9.01 of Form 8-K within the 71-day grace period. If the registrant completes another significant

acquisition in the third quarter of the same fiscal year, the instructions in Item 9.01(b) of Form 8-K would

only require the registrant to file pro formas reflecting the second acquisition. However, the registrant

may decide to include both transactions in the pro forma information filed in the second Form 8-K to

provide more comprehensive disclosure.

A registrant that reflects both acquisitions in such cumulative pro formas should refer to section 4.6.1,

Pro formas involving multiple transactions.

4

While the discussion herein refers to significant dispositions of a business, the Form 8-K instructions also require disclosure

under Item 2.01 for a significant asset disposition (greater than 10% significance) that doesn't meet the definition of a business.

However, in this instance the registrant is only required to provide the disclosures (e.g., a brief description of the assets involved)

as required under Item 2.01 Form 8-K, but it is not required to file Article 11 pro formas.

3 Forms requiring pro forma financial information

Pro forma financial information | 11

General Instruction A of Form 8-K allows a registrant to skip filing an Item 9.01 Form 8-K containing

Rule 3-05 financial statements and pro formas if the registrant already included the information in a

registration statement, and the information in the Form 8-K would be “substantially the same” as what

is presented in that registration statement. This instruction generally allows a registrant to skip filing

an Item 9.01 Form 8-K if the Rule 3-05 financial statements and pro formas it would need to provide in

the Form 8-K would need only one additional interim quarter based on the financial statement age

requirements. However, a registrant will need to file an Item 9.01 Form 8-K if it previously filed third-

quarter financial information and pro formas of an acquired business and the Form 8-K requires audited

financial statements and pro formas for the latest annual period.

3.1.1 Exchange transaction

As discussed in section 2.2.2.7, a registrant may need to report both the acquisition of the equity

method investment and the disposal of the business(es) it contributed in an exchange transaction. In

these cases, the registrant may be unable to present a pro forma income statement depicting the joint

venture formation at the time of the initial Form 8-K filing because the financial statements of the

business(es) contributed by the other party are not available.

If that’s the case, the SEC staff will not object to the registrant filing complete pro forma information

depicting the effects of the exchange of interests (i.e., its disposal of the business(es) it contributed and

its acquisition of the equity interest in the joint venture) at the time that the audited financial statements

of the business contributed by the other party are filed (within the 71-calendar-day extension) if the initial

Form 8-K reporting the transaction includes a description of the effects of the disposal and quantifies

those effects, if practicable.

3.2 Registration statements and proxy statements

Article 11 pro forma financial information must be provided in registration statements and certain proxy

statements when a significant transaction or event listed in section 2.1 is probable or has occurred during

the latest annual period or in the period since the latest annual balance sheet on file. However, the

requirements and due dates are different from those for Form 8-K as discussed above, and a registrant

may need to provide disclosures about additional acquired businesses.

A registrant can omit pro formas from registration statements and certain proxy statements when, under

S-X Rules 3-05 and 3-14, it can also omit the separate financial statements of an acquired business or

real estate operation that has been included in the registrant’s audited results for at least nine months.

Acquisitions that exceed 40% significance must be reflected in the registrant’s audited results for a full

fiscal year before being omitted.

If the registrant has multiple significant transactions (or multiple acquisitions that are individually

insignificant but significant in the aggregate), such transactions may all need to be included in the pro

formas in a registration or proxy statement. Accordingly, the pro formas required in registration or proxy

statements may include more transactions than those filed by the registrant in its most recent Form 8-K

reporting a significant transaction.

Furthermore, some registrants voluntarily include insignificant transactions that they are not required to

reflect in the pro formas in a registration or proxy statement to illustrate more fully the consequences of

recent transactions. A registrant that elects to reflect such transactions needs to consider whether the

pro forma financial information would be misleading if it excludes other individually insignificant transactions.

3 Forms requiring pro forma financial information

Pro forma financial information | 12

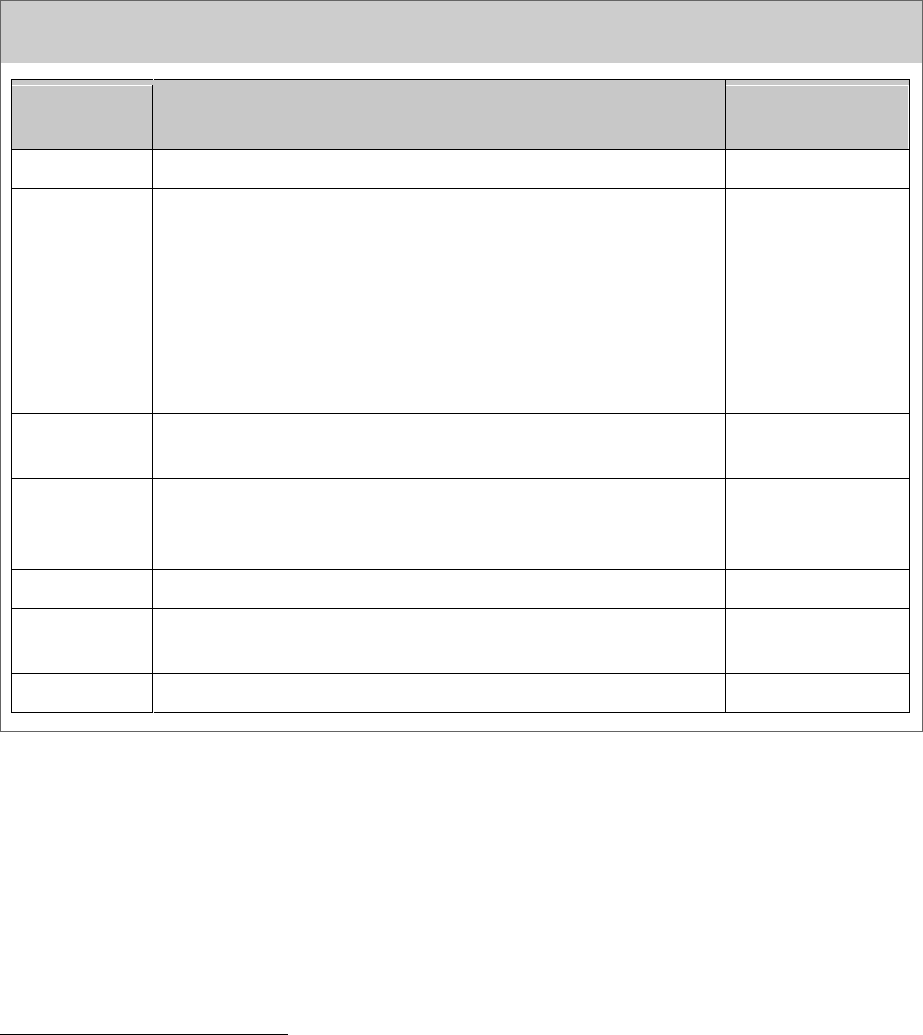

Registration statements

The following table outlines the pro forma requirements applicable to significant transactions in the most

common domestic registration statements:

Illustration 3-1: Domestic registration statement requirements for pro forma financial

information

Registration

statement

Pro forma financial information required?

Form Item

Form S-1

5

Yes — pro forma disclosures must be provided, when applicable.

Item 11(e)

Form S-3

Yes — registrants may choose to:

• Include pro forma information in the Form S-3 prospectus

• Incorporate pro forma information by reference into the

Form S-3 prospectus from:

(1) Recent Exchange Act filing, such as Form 8-K

(2) Proxy or information statement

(3) Previously filed prospectus

Item 11(b)(i)

Form S-4

Yes — pro forma disclosures relating to the transaction must

be included in the prospectus.

Item 5

Form S-4

The registrant and/or the company being acquired may have

to present pro forma information unrelated to the transaction

for which securities are being registered in the Form S-4.

6

Item 10(b) and

Item 12(c)

Form S-8

No — pro forma disclosures are not required.

N/A

Form S-11

Yes — pro forma disclosures must be provided in the

prospectus, when applicable.

Item 27

Form 10

Yes — pro forma disclosures must be provided, when applicable.

Item 13

Proxy statements

A proxy statement filed on Schedule 14A may require Article 11 pro forma information in Item 13 when

it is used to solicit a shareholder vote to:

• Authorize or issue additional securities under Item 11 of Schedule 14A (e.g., securities to be issued

for cash in a public offering)

• Modify or exchange outstanding securities under Item 12 of Schedule 14A

5

An emerging growth company (EGC) is permitted to omit pro forma financial information otherwise required by Article 11 of

Regulation S-X from the registration statement for its IPO on Form S-1 or Form F-1 if the EGC reasonably believes that the pro

forma information will not be required at the time of the offering. An EGC’s IPO registration statement may not omit interim pro

forma information that will become part of the pro forma financial information for a longer period required to be included at the

time of offering. See the SEC staff’s FRM Section 10220.5.

6

Such unrelated pro forma information must be presented with, but clearly distinguished from, the pro forma information relating

to the transaction. See section 4.6.1 for additional discussion and an example about how to present multiple transactions.

3 Forms requiring pro forma financial information

Pro forma financial information | 13

Pro forma financial information may be omitted if it is “not material to the exercise of prudent judgment.”

For example, Item 13 of Schedule 14A presumes pro forma information would be material to the decision

to authorize or issue a material amount of senior securities. However, the information usually is not

material if shareholders are being asked to authorize or issue common stock (except in an exchange,

merger, consolidation, acquisition or similar transaction); authorize preferred stock that the registrant

has no specific plans to issue; or authorize preferred stock to be issued for cash at fair value.

Pro forma information may be required in Item 14 of Schedule 14A if shareholders are voting on any

transaction involving:

• The merger or consolidation of the registrant into or with any other company or of any other

company into or with the registrant

• The acquisition by the registrant of securities of another company

• The acquisition by the registrant of any other business or of the assets of another business

• The sale or other transfer of all or any substantial part of the assets of the registrant

• The liquidation or dissolution of the registrant

The requirements for pro forma information (for the registrant and/or acquiree) in these circumstances

under Item 14 are similar to the requirements in a Form S-4 filing, which are shown in the table above.

Shelf registration statements

Rule 3-05 financial statements and pro formas for a completed or probable acquisition of a business or

real estate operation that is more than 50% significant must always be included in a registration

statement, including a new or amended shelf registration statement, unless the results of the acquired

business have been included in a registrant’s post-acquisition audited financial statements for the full

12 months as described above. Further, if the significance of a completed acquisition exceeds 50%, a

registrant is required to file Rule 3-05 financial statements and pro forma financial information before

completing an offering from its existing shelf registration statement.

However, before conducting a shelf offering, a registrant must also consider whether a completed

acquisition of a business or real estate operation that is 50% or less significant, for which financial statements

and pro formas have not been filed, represents a “fundamental change” as defined by Rule 512 of

Regulation S-K. Probable acquisitions must also be considered. If the completed or probable acquisition

represents a fundamental change, the financial statements and pro formas must be filed before the

registrant conducts the offering. While such acquisitions are rarely determined to be a fundamental

change, the determination is a legal matter that a registrant should discuss with its legal counsel.

3.3 Foreign private issuer forms

A foreign private issuer (FPI) is not required to file Form 8-K. Rather, Form 6-K is available for FPIs to

furnish certain information to the SEC that is (1) made public or is required to be made public pursuant to

the laws of the FPI’s country of domicile or under which the FPI is incorporated, (2) filed with and made

public by a stock exchange on which the FPI’s securities are traded or (3) distributed to the FPI’s security

holders. Depending on the local law and stock exchange requirements, this information may include certain

financial information about acquisitions or disposals. However, Form 6-K does not include an item analogous

to Item 2.01 of Form 8-K.

Pro forma financial information must be provided in or incorporated by reference into FPI registration

statements (i.e., F-1, F-3, F-4, registration statements on Form 20-F) consistent with the respective

requirements above for domestic registration statements. Similar to domestic registrants, FPIs are not

required to provide pro forma financial information in annual reports on Form 20-F.

Pro forma financial information | 14

4 Preparation of pro forma financial

information

4.1 General form and content

Excerpt from SEC rules and regulations

Regulation S-X, Article 11 Pro Forma Financial Information

Rule 11-02(a), Preparation requirements, Form and content

(1) Pro forma financial information must consist of a pro forma condensed balance sheet, pro forma

condensed statements of comprehensive income, and accompanying explanatory notes. In

certain circumstances (i.e., where a limited number of pro forma adjustments are required and

those adjustments are easily understood), a narrative description of the pro forma effects of the

transaction may be disclosed in lieu of the statements described in this paragraph (a)(1).

(2) The pro forma financial information must be accompanied by an introductory paragraph which

briefly sets forth a description of (i) each transaction for which pro forma effects is being given,

(ii) the entities involved, (iii) the periods for which the pro forma financial information is presented,

and (iv) an explanation of what the pro forma presentation shows.

(3) The pro forma condensed financial information need only include major captions (i.e., the

numbered captions) prescribed by the applicable sections of Regulation S-X. Where any major

balance sheet caption is less than 10 percent of total assets, the caption may be combined with

others. When any major statement of comprehensive income caption is less than 15 percent of

average net income attributable to the registrant for the most recent three fiscal years, the caption

may be combined with others. In calculating average net income attributable to the registrant,

loss years should be excluded unless losses were incurred in each of the most recent three years,

in which case the average loss must be used for purposes of this test. Notwithstanding these

tests, de minimis amounts need not be shown separately.

(4) Pro forma statements will ordinarily be in columnar form showing condensed historical

statements, pro forma adjustments, and the pro forma results.

(5) The pro forma condensed statement of comprehensive income must disclose income (loss) from

continuing operations and income or loss from continuing operations attributable to the

controlling interest.

Article 11 pro formas generally consist of an introductory section, pro forma condensed balance sheet,

pro forma condensed statements of comprehensive income and explanatory notes. Pro forma statements of

cash flows or shareholders’ equity are not required. While Article 11 uses the term “pro forma statement

of comprehensive income,” pro forma financial information is not required for other comprehensive

income (OCI),

7

so Article 11 effectively requires the equivalent of an income statement through income

(loss) from continuing operations. Accordingly, we have used the term “income statement” throughout this

publication to refer to the statement of comprehensive income required under Article 11.

7

The statement of comprehensive income usually includes all components of net income and OCI. OCI includes all nonowner changes in

equity that are included in comprehensive income but excluded from net income (e.g., unrealized gains/losses on available-for-

sale securities, foreign currency translation adjustments, gains/losses associated with pension or other post-retirement benefits).

4 Preparation of pro forma financial information

Pro forma financial information | 15

The pro forma financial statements are presented in columnar form with separate columns depicting the

historical financial information of the registrant, the historical financial information of the businesses that

have been acquired or disposed of (if applicable), the pro forma adjustments (as described in section 4.4)

and a total or combined column.

The requirements of Article 11 apply to all registrants, although smaller reporting companies can

condense the information in accordance with Regulation S-X 8-03(a).

4.2 Required statements and periods presented

A registrant’s pro formas typically include the most recent condensed balance sheet and condensed

income statement for its most recent annual and year-to-date interim period. These statements must

include the captions required by Article 5 of Regulation S-X but can be condensed as described below.

De minimis amounts do not need to be shown separately.

The age of the pro forma balance sheet and income statements are determined at the earlier of the filing

or due date of the initial Item 2.01 Form 8-K for a significant acquisition or disposal and at the filing and

effective date of a registration statement (or mailing date of a proxy statement) for all transactions.

Excerpt from SEC rules and regulations

Regulation S-X, Article 11 Pro forma financial information

Rule 11-02(c), Preparation requirements, Periods to be presented

(1) A pro forma condensed balance sheet as of the end of the most recent period for which a

consolidated balance sheet of the registrant is required by Regulation S-X Rule 3-01 must be filed

unless the transaction is already reflected in such balance sheet.

(2) (i) Pro forma condensed statements of comprehensive income must be filed for only the most

recent fiscal year, except as noted in paragraph (c)(2)(ii) of this section, and for the period

from the most recent fiscal year end to the most recent interim date for which a balance

sheet is required. A pro forma condensed statement of comprehensive income may be filed

for the corresponding interim period of the preceding fiscal year. A pro forma condensed

statement of comprehensive income must not be filed when the historical statement of

comprehensive income reflects the transaction for the entire period.

(ii) For transactions required to be accounted for under US GAAP or, as applicable, IFRS-IASB by

retrospectively revising the historical statements of comprehensive income (e.g., combination

of entities under common control and discontinued operations), pro forma statements of

comprehensive income must be filed for all periods for which historical financial statements of

the registrant are required. Retrospective revisions stemming from the registrant’s adoption of

a new accounting principle must not be reflected in pro forma statements of comprehensive

income until they are depicted in the registrant’s historical financial statements.

(3) Pro forma condensed statements of comprehensive income must be presented using the

registrant’s fiscal year end. If the most recent fiscal year end of any other entity involved in the

transaction differs from the registrant’s most recent fiscal year end by more than one fiscal

quarter, the other entity’s statements of comprehensive income must be brought up to within one

fiscal quarter of the registrant’s most recent fiscal year end, if practicable. This updating could be

accomplished by adding subsequent interim period results to the most recent fiscal year end

information and deducting the comparable preceding year interim period results. Disclosure must

be made of the periods combined and of the sales or revenues and income for any periods which

were excluded from or included more than once in the condensed pro forma statements of

comprehensive income (e.g., an interim period that is included both as part of the fiscal year and

the subsequent interim period).

4 Preparation of pro forma financial information

Pro forma financial information | 16

Instruction 1 to paragraph (c)(3) In circumstances where different fiscal year ends exist,

Regulation S-X Rule 3-12 may require a registrant to include in the pro forma financial information

an acquired or to be acquired foreign business historical period that would be more current than

the periods included in the required historical financial statements of the foreign business.

(4) Whenever unusual events enter into the determination of the results shown for the most recently

completed fiscal year, the effect of such unusual events should be disclosed and consideration

should be given to presenting a pro forma condensed statements of comprehensive income for

the most recent twelve-month period in addition to those required in paragraph (c)(2)(i) of this

section if the most recent twelve-month period is more representative of normal operations.

4.2.1 Pro forma condensed balance sheet

A registrant must include a pro forma condensed balance sheet as of the end of the most recent annual or

interim period filed or required to be filed by S-X Rule 3-01. If financial statements for the registrant’s most

recently completed annual or interim period are not yet required or included in the filing, the pro forma

financial information would be as of the most recent balance sheet included in the filing.

Generally, the historical balance sheet of an acquired business included in a pro forma presentation should

be as of the same date unless the business has a different fiscal year end (refer to section 4.2.4, Combining

entities with different fiscal years).

If the transaction is already reflected in the registrant’s latest balance sheet included in the filing, a

pro forma balance sheet is not required. For example, a pro forma balance sheet reflecting a significant