Target and Pro Forma Financial Statement Requirements for Significant

Acquisitions

US reporting companies that are planning or have completed a significant acquisition of a business may be required to file separate

target financial statements and related pro forma financial statements under Rule 3-05 and Article 11 of Regulation S-X. The specific US

Securities and Exchange Commission (“SEC”) rules and financial reporting obligations triggered by a significant acquisition can be quite

complex, requiring careful evaluation by an acquiring company. These rules may also impact the ability of registrants to access the

capital markets in a timely fashion, affecting the ability to offer securities in a registered offering, the proceeds of which would be used

to fund the acquisition or to register securities to be used as consideration for the acquisition.

This note discusses the SEC’s financial reporting and disclosure requirements triggered by a company’s significant business acquisition.

We outline key concepts and practice points helpful in determining if an acquisition is significant, which financial statements of the

target are required to be included in the registrant’s SEC filing or offering document, what related pro forma financial information is

required, when and how these target and pro forma financial statements are to be filed or updated, and relevant market practice

considerations.

We have updated this note to reflect the relevant amendments (“amendments”) adopted by the SEC on May 21, 2020, to Rule 3-05 and

Article 11 of Regulation S-X and related rules.

1

These amendments go into effect on January 1, 2021, although early adoption by

companies is permitted as long as the amendments are applied in their entirety. In this note, we refer to existing Rule 3-05 and Article

11 of Regulation S-X and related rules as the “current rules” or “existing rules,” and we refer to the amended rules as the “new rules”;

when we refer to or cite a rule without mentioning the words “current,” “existing,” or “new,” this means that the existing rule remains the

same and is unchanged by the amendments. For brevity, we do not discuss the various other rules specifically applicable to investment

companies, real estate operations, or smaller reporting companies.

Overview

In general, Rule 3-05 requires the filing of separate pre-acquisition, or historical, financial statements when the acquisition of a

significant business has occurred or is probable. This means that the acquiring company must obtain separate audited annual and

unaudited interim pre-acquisition financial statements of the target or business it acquires, if such business or acquisition is “significant”

to the acquiring company. “Significance” is determined and measured by applying three significance tests prescribed by the SEC rules.

The more significant an acquisition is, the more onerous the requirements relating to financial information of the target (e.g., years of

historical annual audited financial statements required). In addition, a registrant must also present pro forma financial statements that

give effect to the acquisition, in compliance with Article 11. As a general rule, the registrant must file these target and pro forma

financial statements within 75 days after an acquisition is consummated, with a Current Report on Form 8-K. However, a registrant that

registers or offers securities may need to provide these financial statements much earlier and include these in the relevant SEC filing or

offering document; for instance, in its registration statement, prospectus supplement or merger proxy statement, as applicable.

Furthermore, while these rules technically only apply to SEC filings and registered offerings, market practice has evolved such that

practitioners, in general, substantially adhere to them in the context of exempt offerings.

Rule 3-05 and Article 11 of Regulation S-X should be read and understood in conjunction with “Topic 2: Other Financial Statements

Required” and “Topic 3: Pro Forma Financial Information” of the Financial Reporting Manual (“FRM”)

2

of the SEC’s Division of

Corporation Finance (“Corp Fin”).

1

See adopting release, SEC Release No. 33-107861 (May 20, 2020), available at https://www.sec.gov/rules/final/2020/33-10786.pdf.

2

The FRM, last updated on July 1, 2019, is available at https://www.sec.gov/files/cf-financial-reporting-manual.pdf.

2

Threshold Questions

In determining whether Rule 3-05 financial statements will be required in connection with an acquisition, the first order of business is to

ask two threshold questions: (1) Do the assets and liabilities acquired or to be acquired by the registrant constitute a “business?” and

(2) Has the transaction been consummated or is it “probable?”

Is the Target a “Business”?

The SEC prescribes a “facts and circumstances” analysis to determine whether an acquisition constitutes the acquisition of a “business,”

rather than of just assets.

3

The focus of the inquiry is whether there is sufficient continuity of operations so that disclosure of prior

financial information is material to an understanding of future operations. There is a presumption in Rule 11-01(d) of Regulation S-X

that a separate entity, subsidiary, or division is a “business” for Rule 3-05 purposes. However, a lesser component of an entity, such as a

product line, also may be considered a business. In evaluating whether a component of an entity can be considered a business, Rule

11-01(d) requires registrants to consider (1) whether the nature of the revenue-producing activity of the component will remain

generally the same as before the transaction and (2) whether the facilities, employee base, distribution system, sales force, customer

base, operating rights, production techniques, or trade name of the component will remain with the component after the transaction.

Moreover, the SEC rules treat a group of related businesses as a single business for these purposes. Under Rule 3-05(a)(3), businesses

shall be deemed to be related if they are under common control or management or their acquisitions are dependent on each other or a

single common event or condition.

4

Finally, FRM paragraph 2010.1 cautions that what constitutes a “business” for SEC reporting

purposes (e.g., the Rule 11-01(d) definition applicable to a Rule 3-05 analysis) may be different from what constitutes a “business” for

accounting purposes (e.g., under US GAAP).

Is the Transaction “Probable”?

Rule 3-05 applies not only when an acquisition has been consummated (e.g., the business combination has closed), but also when an

acquisition is “probable.” The term “probable” is not defined in Rule 3-05. However, FRM paragraph 2005.4 provides that the

assessment of “probability” requires consideration of all available facts and that an acquisition is probable where the registrant’s

financial statements alone would not provide adequate financial information to make an investment decision. In practice, factors that

may be considered to determine whether an acquisition is “probable” include the following: (i) a signed definitive agreement; (ii) a

binding letter of intent; (iii) approval from the board of directors or shareholders of the seller and target companies; (iv) submission of

transaction terms to regulatory authorities for approval; (v) receipt of required third-party approvals or consents material to the

transaction; (vi) incurrence of financial penalties if acquisition is not consummated; and (vii) a public announcement of the acquisition.

If the acquisition by the registrant is an acquisition of a “business” and such acquisition has been consummated or is probable, then the

next query to be made in order to determine whether target financial statements are required is whether such acquisition is significant.

Significance Tests: Is the Acquisition “Significant?”

Registrants measure significance by using each of the three tests prescribed under the SEC rules: the asset test, investment test, and

income test. These tests are based on the definition of a “significant subsidiary” under Rule 1-02(w) except that, for Rule 3-05 purposes,

the 10% minimum threshold in Rule 1-02(w) is replaced by a 20% minimum threshold. For Rule 3-05 purposes, an acquisition is

considered “significant” if it exceeds 20% on any of the three tests. The significance tests compare features of the acquired business

(i.e., acquisition purchase price, the target’s assets, pre-tax income (and revenue under the new rules)) to the registrant buyer and

measure these relationships as a percentage. These significance tests, under the current rules and under the new rules, are illustrated in

the tables below. Per FRM paragraph 2015.2, as a general rule, one should use and compare the most recent pre-acquisition annual

3

See Rules 3-05 (a)(2) and 11-01(d). All rule references in this note are to Regulation S-X unless otherwise indicated.

4

See also FRM Section 2015.12.

3

financial statements of the target with the registrant buyer’s most recent pre-acquisition consolidated annual audited financial

statements to perform these tests.

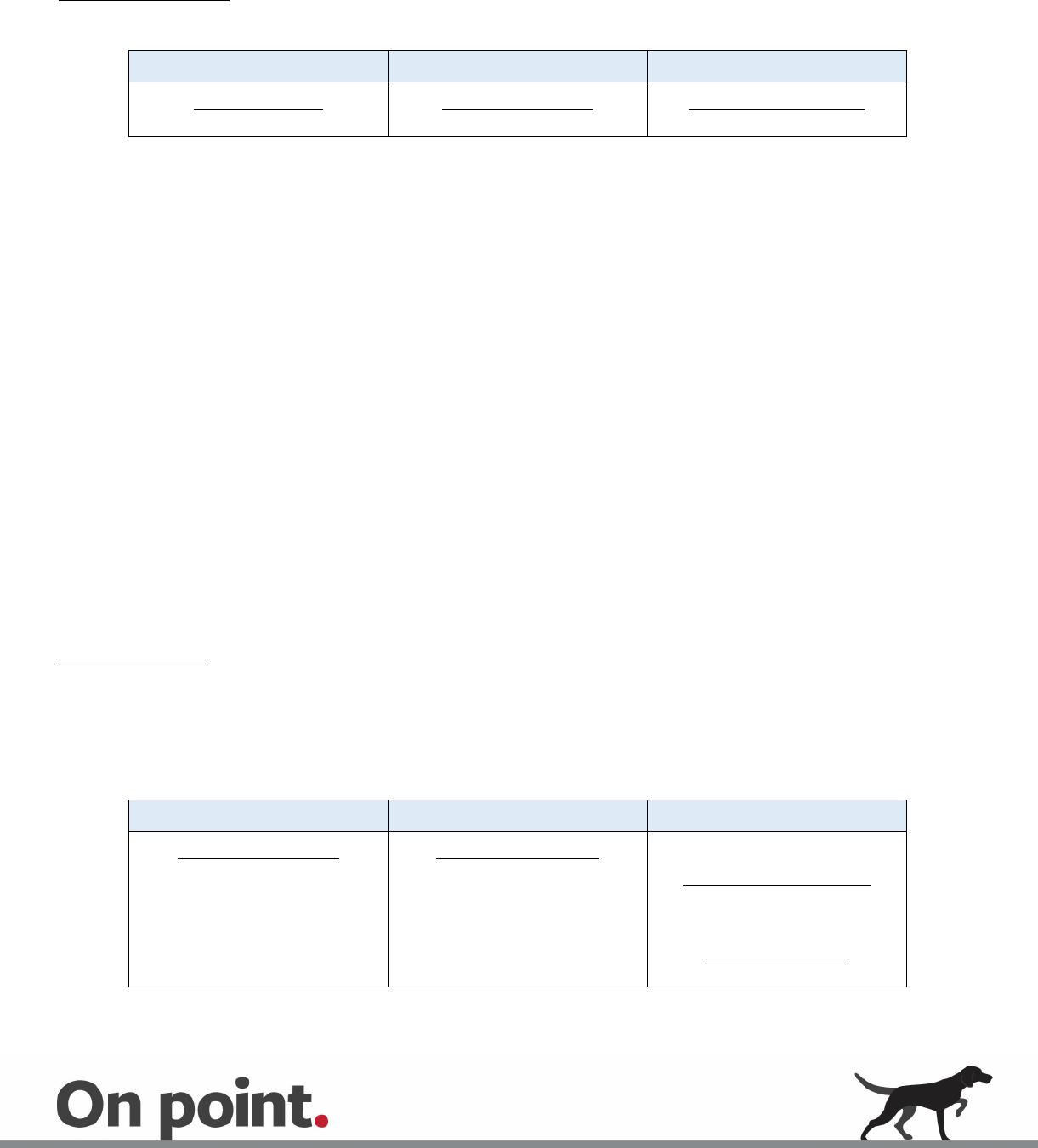

Under the Current Rules

Table 1A: Significance Tests under the Current Rules

Investment Test Asset Test Income Test

__Purchase Price___

Buyer’s Total Assets

_Target’s Total Assets_

Buyer’s Total Assets

_Target’s Pre-Tax Income_

Buyer’s Pre-Tax Income

Investment Test. An acquisition is significant if the buyer’s investments in and advances to the target exceed 20% of the

buyer’s total assets as of the end of the buyer’s most recent fiscal year.

In performing the investment test, FRM paragraph 2015.5 states that the “GAAP purchase price” of the acquired business

should be compared to the registrant’s consolidated total assets and that the term “GAAP purchase price” here refers to the

“consideration transferred” as defined in the applicable accounting standard (e.g., under SFAS 141R and IFRS 3), adjusted to

exclude the carrying value of assets transferred by the buyer to the acquired business that will remain with the combined entity

after the acquisition.

Asset Test. An acquisition is significant if the buyer’s share of the total assets of the target exceeds 20% of the buyer’s total

assets as of the end of the buyer’s most recent fiscal year.

Income Test. An acquisition is significant if the buyer’s share of “pre-tax income” from continuing operations of the target

exceeds 20% of the buyer’s pre-tax income for the most recent fiscal year.

“Pre-tax income” refers to income from continuing operations before income taxes, extraordinary items, and cumulative effect

of a change in accounting principle, exclusive of amounts attributable to any noncontrolling interests. Per FRM paragraph

2015.9, if either the buyer or the target reported a pre-tax loss while the other reported a pre-tax income, then the absolute

values must be used for purposes of the income test calculation.

After applying the three significance tests summarized above, the highest resulting percentage from among them will govern and will

be used as the significance level for the acquisition.

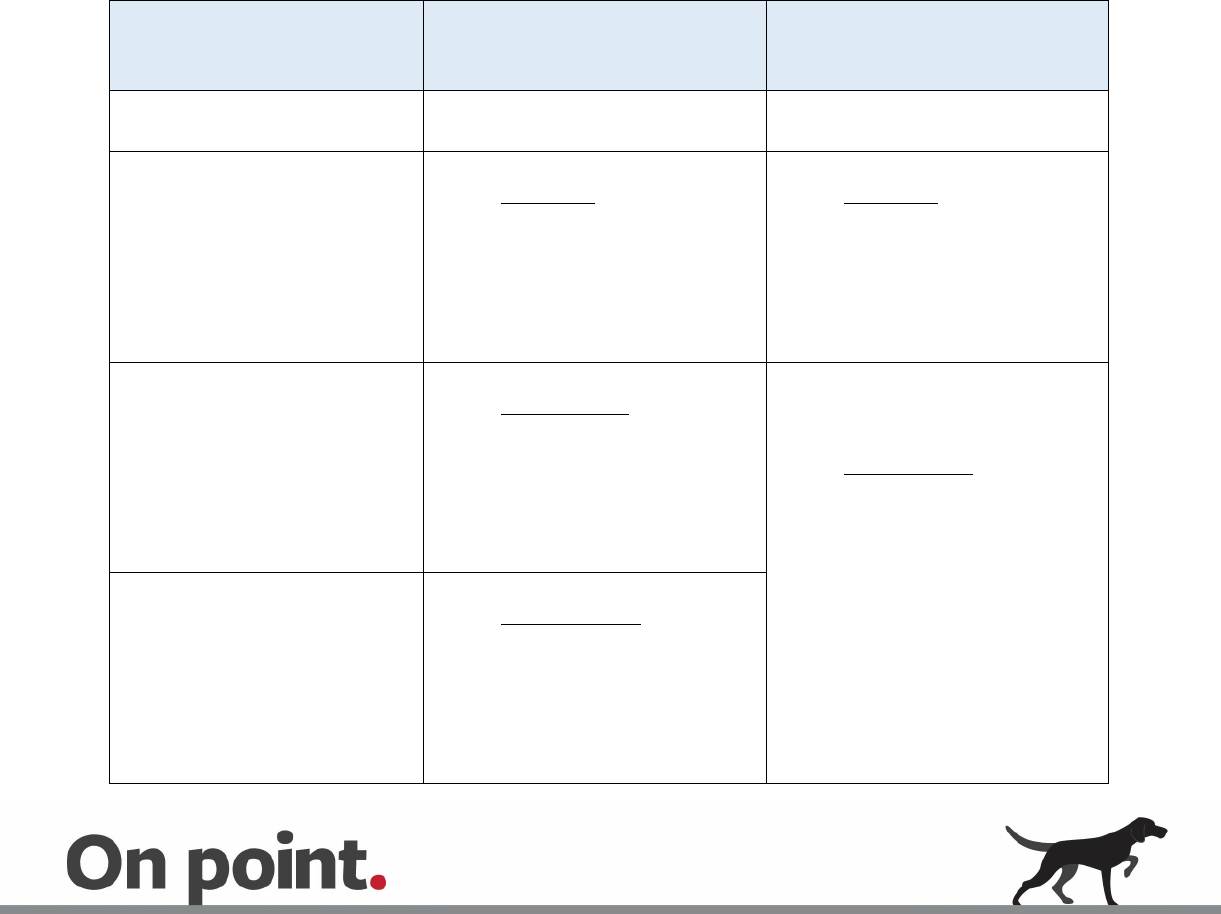

Under the New Rules

The amendments adopted by the SEC made significant modifications to the investment test and the income test, as set out below.

Note that, under the new rules, the denominator of the investment test has been modified and that the income test now has a revenue

component, in addition to the pre-tax income component of the existing rule.

Table 1B: Significance Tests under the New Rules

Investment Test Asset Test Income Test

_____Purchase Price_____

Buyer’s Aggregate Worldwide

Market Value of Common Equity

__Target’s Total Assets__

Buyer’s Total Assets

The lower of:

__Target’s Pre-Tax Income__

Buyer’s Pre-Tax Income

and

__Target’s Revenue__

Buyer’s Revenue

4

Investment Test. An acquisition is significant if the buyer’s investments in and advances to the target exceed 20% of the

buyer’s aggregate worldwide market value of voting and non-voting common equity, if available (instead of the buyer’s total

assets). To determine the denominator, use the average of aggregate worldwide market value of common equity calculated

daily for the last five trading days of the registrant’s most recently completed month ending prior to the earlier of the

registrant’s announcement date or agreement date of the acquisition. If, however, the registrant has no such aggregate

worldwide market value (e.g., the registrant has no publicly traded common stock), then the denominator under the current

investment test (i.e., the buyer’s total assets as of the end of the buyer’s most recent fiscal year) should be used.

Rule 1-02(w)(i)(A)(1) now explicitly provides that the term “investments in” the target means the consideration transferred,

adjusted to exclude the carrying value of assets transferred by the registrant to the target that will remain with the combined

entity after the acquisition. The consideration transferred must include the fair value of contingent consideration if required to

be recognized at fair value by the registrant at the acquisition date under U.S. GAAP or under International Financial Reporting

Standards as issued by the International Accounting Standards Board (“IFRS-IASB”), as applicable. However, if recognition at

fair value is not required, it must include all contingent consideration, except contingent consideration for which the likelihood

of payment is remote.

Asset Test. An acquisition is significant if the buyer’s share of the consolidated total assets of the target exceeds 20% of the

buyer’s total assets as of the end of the buyer’s most recent fiscal year. The amendments do not affect the computation of the

asset test under the current rule.

Income Test. Under the new rules, the income test now has two components: a pre-tax income component (similar to the

existing rules) and a revenue component (new).

For the pre-tax income component, an acquisition is significant if the buyer’s share of “pre-tax income” from continuing

operations of the target exceeds 20% of the buyer’s pre-tax income for the most recent fiscal year. “Pre-tax income” refers to

income from continuing operations before income taxes, extraordinary items, and cumulative effect of a change in accounting

principle, attributable to controlling interests. The new rules clarify that the “absolute value” of the registrant and target’s pre-

tax income or loss should be used when computing the pre-tax income component.

For the revenue component, an acquisition is significant if the buyer’s share of the consolidated total revenue from continuing

operations of the target exceeds 20% of the buyer’s consolidated total revenue from continuing operations for the most recent

fiscal year. The revenue component does not apply if either the registrant or the target did not have material revenue in each

of the two most recently completed fiscal years. In such a case, only the pre-tax income component of the income test should

be applied.

Both components should be tested where applicable, and the lower percentage of the two components should be used as the

resulting percentage for the income test. Hence, if both components apply (e.g., both registrant and target had material

revenue for the last two fiscal years, hence the revenue component applies) and the acquisition does not exceed 20%

significance under either the pre-tax income component or revenue component test, then such acquisition is not significant

under the income test.

After applying the three significance tests summarized above, the highest resulting percentage from among them will govern and will

be used as the significance level for the acquisition.

Practical Reminders When Performing Significance Tests

Below are a few practical points to take into account when carrying out the significance tests.

No Alternative Tests. FRM paragraph 2020.1 provides that the Staff of Corp Fin ( “Staff”) will not accept alternative significance

tests in order to achieve consistent application and fair treatment across all registrants and industries. If, after performing the

5

required significance tests, a registrant believes that the tests specify periods beyond those reasonably necessary to inform

investors, it may make a written request to the Office of the Chief Accountant of Corp Fin to waive one or more years of

financial statements.

Do Not Include Target in Denominator. FRM paragraph 2015.10 provides that the acquired business is not considered part of

the registrant’s denominator in determining significance.

Use Audited Annual Financial Statements; Exceptions Allowing Use of Pro Formas in Measuring Significance. As a general rule,

when performing the significance tests, use the audited annual pre-acquisition financial statements of both the target and the

registrant buyer.

However, where the registrant has completed a previous significant acquisition for which it has previously filed target and pro

forma financial statements in a Form 8-K, then the registrant may evaluate significance (for the subsequent acquisition and

target) by using the registrant’s pro forma financial information (that gave effect to the prior significant acquisition) rather than

the historical pre-acquisition financial statements.

In addition, the amendments have expanded the circumstances in which a registrant can use pro forma financial information

for significance testing and eliminated the current requirement, in the exception immediately above, that the target and pro

forma financial statements should have been filed in a Form 8-K. Specifically, the new rules permit registrants (including IPO

companies) to measure significance using filed pro forma financial information that depicts significant business acquisitions

consummated after the latest fiscal year-end for which the registrant’s financial statements are required to be filed, provided

that: (a) the registrant has filed Rule 3-05 financial statements and Article 11 pro forma financial information required for such

acquired business with the SEC (including in initial registration statements); (b) the pro forma financial information includes

“Transaction Accounting Adjustments” but not “Management’s Adjustments” or “Autonomous Entity Adjustments”(each as

described and discussed below); and (c) if the registrant presents such pro forma amounts, then it must continue to use pro

forma amounts to determine significance of acquisitions through the filing date of its next annual report on Form 10-K.

Computing the Denominator in New Investment Test. In computing the denominator for the investment test under the new

rules, note that the buyer’s aggregate worldwide market value of voting and non-voting common equity is different from the

value used by registrants to determine accelerated filer status (including WKSI status) under Exchange Act of 1934, as amended

(the “Exchange Act”) Rule 12b-2. The former includes the value of common equity held by affiliates and is determined by

averaging the last five trading days of the registrant’s most recently completed month ending prior to the earlier of the

registrant’s announcement date or acquisition agreement date. In contrast, Exchange Act Rule 12b-2 uses the value of

common equity held by non-affiliates and is determined as of the last business day of the registrant’s most recently completed

second fiscal quarter.

Using Buyer’s Five-Year Average Pre-Tax Income for Income Test. If the registrant’s pre-tax income for the most recent fiscal

year is 10% or lower than its average pre-tax income for the last five fiscal years, then such average pre-tax income of the

registrant should be used to perform the income test (or the pre-tax income component of the income test under the new

rules). In computing this five-year average:

(a) under the current rules, a loss year (where a registrant reported a pre-tax loss instead of pre-tax income) should be

assigned a value of zero, but the denominator should be “5”. See FRM paragraph 2015.8 and the second computational note

to current Rule 1-02(w).

(b) under the new rules, and in a case where the revenue component of the income test does not apply, the absolute value of

the pre-tax loss in a loss year should be used, instead of zero, and the denominator should be “5”. See new Rule 1-

02(w)(1)(iii)(B)(2).

6

No Rounding. FRM paragraph 2015.13 provides that the results of the significance tests should not be rounded.

Intercompany transactions. FRM paragraph 2015.11 provides that, when measuring significance for all three significance tests,

intercompany transactions between the registrant and the target should be eliminated in the same way that would occur if the

target were consolidated.

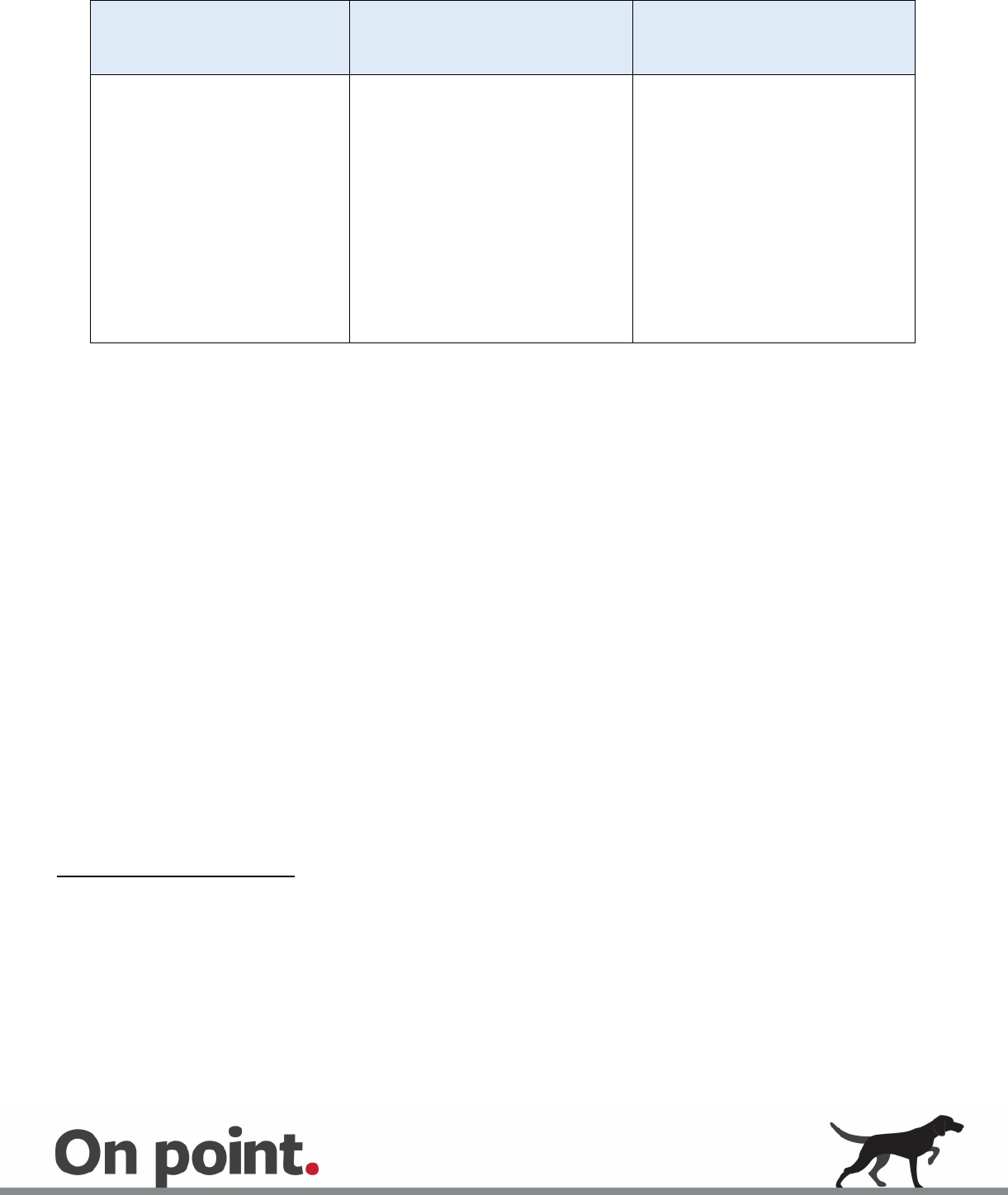

Significance Levels and Rule 3-05 Historical Financial Statements Required

Depending on the significance of the acquisition, under the current rules, the registrant must produce one to three years of the target’s

audited historical financial statements and, in all cases of significance, unaudited interim financial statements for the last interim period

and for the corresponding interim period of the prior year.

In contrast, under the new rules, depending on the significance of the acquisition, the registrant must produce (i) one to two years of

the target’s audited historical financial statements; (ii) in all cases of significance, unaudited interim financial statements for the last

interim period; and (iii) only in cases of significance exceeding the 40% significance level, unaudited interim financial statements for the

corresponding interim period of the prior year.

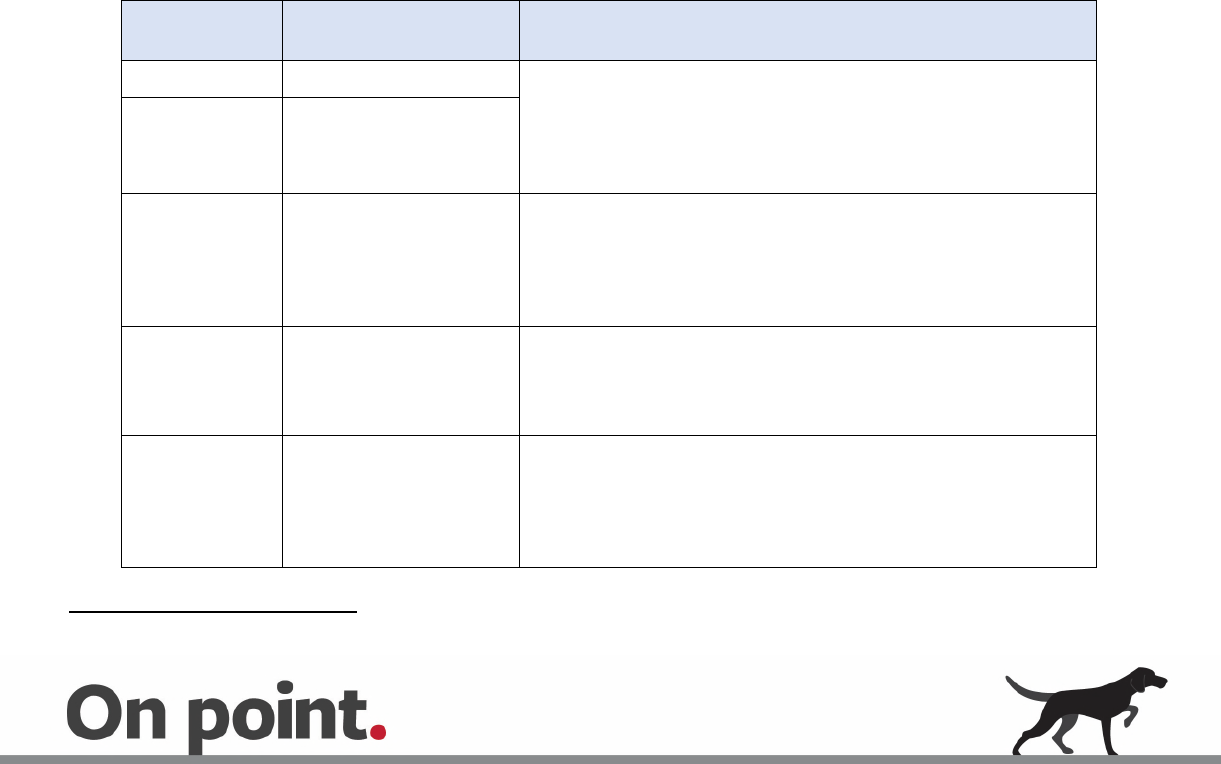

Table 2 below summarizes the required target financial statements corresponding to a significance level of a completed acquisition

under the current rules and the new rules.

Table 2: Periods of Required Target Financial Statements for Completed Acquisitions

Significance Level

(Individual acquisition or multiple

acquisitions of related businesses)

Required Historical Financial

Statements of the Target

Under Current Rules

Required Historical Financial

Statements of the Target

Under New Rules

At or below 20% significance No separate financial statements

needed

No separate financial statements

needed

Exceeds 20% significance but less

than or equal to 40%

Audited financial statements for

the most recent fiscal year

Unaudited interim financial

statements for latest completed

period that precedes the

acquisition and for the

corresponding interim period of

the prior year

Audited financial statements for

the most recent fiscal year

Unaudited interim financial

statements for latest completed

period that precedes the

acquisition (corresponding interim

period of the prior year is not

required)

Exceeds 40% significance but less

than or equal to 50%

Audited financial statements for

the two most recent fiscal years

Unaudited interim financial

statements for the latest

completed period that precedes

the acquisition and for

corresponding interim period of

the prior year

Audited financial statements for

the two most recent fiscal years

Unaudited interim financial

statements for the latest

completed period that precedes

the acquisition and for

corresponding interim period of

the prior year

Exceeds 50% significance Audited financial statements for

the three most recent fiscal years

Unaudited interim financial

statements for the latest

completed period that precedes

the acquisition and for

corresponding interim period of

the prior year

7

Significance Level

(Individual acquisition or multiple

acquisitions of related businesses)

Required Historical Financial

Statements of the Target

Under Current Rules

Required Historical Financial

Statements of the Target

Under New Rules

o Exception: If target had net

revenues below $100 million in

its most recent fiscal year, the

audited financials for the earliest

of the three fiscal years may be

omitted

o Exception: If registrant is an

emerging growth company

(“EGC”), it may present, in its

initial registration statement,

only two years of audited

financial statements of the

target

As discussed in more detail below, notwithstanding the chart above, no financial statements need to be filed yet if the acquired business

does not exceed the 50% significance level and the acquirer is in the 74-day grace period. An acquirer is within the 74-day grace period

if the date of the final prospectus or prospectus supplement for the offering (or the mailing date in case of a proxy statement) is no

more than 74 days after the acquisition is completed and the financial statements of the acquired business have not yet been filed.

However, in many instances, it may be advisable to file the financial statements earlier in order to complete a financing.

With respect to a probable acquisition (as opposed to a completed acquisition), historical financial statements described in the row

immediately above are only required if such acquisition exceeds the 50% significance level.

Target financial statements are not required if the significance level is at or below the 50% significance level and the acquisition has not

yet been completed.

Note that the chart sets out general rules only, and there are a number of exceptions and considerations that may apply depending on

the particular filing or offering document, level of significance, or timing.

5

Before we discuss some of these particular SEC filings,

however, we first take a look at the pro forma financial statements required under Article 11, as these would need to be presented as

well to accompany the required Rule 3-05 target historical financial statements.

Pro Forma Financial Information

As a rule, where a significant recent or probable acquisition triggers the need for Rule 3-05 target historical financial statements, then

pro forma financial information that gives effect to the acquisition is also required to be presented under Article 11 of Regulation S-X.

Article 11 pro forma financial information is intended to provide investors with information about the continuing impact of a particular

transaction by showing how the transaction might have affected historical financial statements if the transaction had been

5

In particular, new Rule 3-05(e) allows the filing of abbreviated target financial statements (in the form of statements of assets acquired and liabilities

assumed and statements of revenues and expenses), in lieu of full target financial statements, for an acquisition of net assets that constitute a business

(such as an acquired or to be acquired product line), provided certain qualifying and presentation conditions are met. The qualifying conditions are that:

(a) the total assets and total revenues of the acquired business constitute 20% or less of such corresponding amounts of the seller and its subsidiaries

consolidated as of the most recently completed fiscal year; (b) separate financial statements for the business have not previously been prepared; (c) the

acquired business was not a separate entity, subsidiary, operating segment (as defined in U.S. GAAP or IFRS-IASB) or division during the periods for

which the acquired business financial statements would be required; and (d) the seller has not maintained the distinct and separate accounts necessary

to present required Rule 3-05 financial statements and it is impracticable to prepare such financial statements. The presentation conditions include,

among others, that the statement of comprehensive income must include expenses incurred by the acquired business during the pre-acquisition financial

statement periods to be presented including costs of sales or services, selling, distribution, marketing, general and administrative, depreciation and

amortization, and research and development, but may otherwise omit corporate overhead expense, interest expense for debt that will not be assumed by

the registrant, and income tax expense.

8

consummated at an earlier time. The pro forma financial statements are intended to assist investors in analyzing the future prospects of

the registrant by illustrating the possible scope of the change in the registrant’s financial position and results of operations caused by

the transaction.

6

Rule 11-02(b) of the current rule and Rule 11-02(a)(1) of the new rules provide that pro forma financial information should consist of a

pro forma condensed balance sheet, pro forma condensed statements of income, and accompanying explanatory notes. In particular,

Rule 11-02(d) of the current rule and Rule 11-02(c)(1) and (2) of the new rules require:

a pro forma condensed balance sheet as of the end of the most recent period for which a consolidated balance sheet of the

acquirer is required, unless the transaction is already reflected in that balance sheet; and

pro forma condensed income statements for the acquirer’s most recently completed fiscal year and the most recent interim

period, unless the historical income statement reflects the transaction for the entire period.

The pro forma financial information should be accompanied by an introductory paragraph briefly setting forth a description of (i) the

transaction, (ii) the entities involved, and (iii) the periods for which the pro forma information is presented.

7

Under the Current Rules

Pro forma financial information should be presented in columnar form, with separate columns presenting historical results, pro forma

adjustments, and pro forma results.

8

With respect to adjustments:

9

Pro forma adjustments related to the pro forma condensed balance sheet should be computed assuming the transaction was

consummated on the date of the latest balance sheet included in the filing. Adjustments should give effect to events that are

directly attributable to each specific transaction and factually supportable. Adjustments should include those items that have

a continuing impact and also those that are nonrecurring.

Pro forma adjustments related to the pro forma condensed income statement should be computed assuming the transaction

was consummated at the beginning of the fiscal year presented and carried forward through any interim period presented.

Adjustments should give effect to events that are (i) directly attributable to the transaction, (ii) expected to have a continuing

impact on the registrant, and (iii) factually supportable.

Under the New Rules

The new rules modify the criteria for pro forma adjustments in the existing rule and provide three new categories of permitted

adjustments, as follows:

“Transaction Accounting Adjustments,” which reflect only the application of required accounting to the acquisition, linking the

effects of the acquired business to the registrant’s audited historical financial statements. These adjustments reflect the

accounting for the transaction under US GAAP or IFRS-IASB, as applicable, regardless of whether the impact is expected to be

continuing or non-recurring.

“Autonomous Entity Adjustments,” which are adjustments necessary to reflect the operations and financial position of the

registrant as an autonomous entity when the registrant was previously part of another entity.

6

See current Rule 11-02(a). The amendments deleted the language of Rule 11-02(a) of the existing rule, which describes the objectives of the

preparation requirements, “to avoid confusion and focus registrants on the requirements of the rule.”

7

See current Rule 11-02(b)(2) and new Rule 11-02(a)(2).

8

See current Rule 11-02(b)(4).

9

See current Rule 11-02(b)(6).

9

“Management’s Adjustments,” which are adjustments depicting synergies and dis-synergies of the acquisition for which pro

forma effect is being given and may only be presented if, in management’s opinion, such adjustments would enhance an

understanding of the pro forma effects of the transaction and certain conditions are met. Such conditions are that (a) there is

a reasonable basis for each such adjustment; (b) the adjustments are limited to the effect of such synergies and dis-synergies

on the historical financial statements that form the basis for the pro forma statement of comprehensive income as if the

synergies and dis-synergies existed as of the beginning of the fiscal year presented; (c) if such adjustments reduce expenses,

the reduction must not exceed the amount of the related expense historically incurred during the pro forma period

presented; and (d) the pro forma financial information reflects all Management’s Adjustments that are, in the opinion of

management, necessary to a fair statement of the pro forma financial information presented and a statement to that effect is

disclosed. Moreover, when synergies are presented, any related dis-synergies must also be presented.

Under the new rules, Transaction Accounting Adjustments and Autonomous Entity Adjustments are mandatory, while Management’s

Adjustments are optional, in the presentation of pro forma financial information under Article 11. Transaction Accounting Adjustments

and Autonomous Entity Adjustments must be presented in separate columns in the pro forma financial statements, while Management’s

Adjustments, if presented, should be presented in the explanatory notes to the pro forma financial information in the form of

reconciliations of pro forma net income from continuing operations attributable to the controlling interest and the related pro forma

earnings per share data after giving effect to Management’s Adjustments. The explanatory notes for Management’s Adjustments must

also include disclosure of the basis for and material limitations of each Management’s Adjustment, including any material assumptions

or uncertainties of such adjustment, an explanation of the method of the calculation of the adjustment, if material, and the estimated

time frame for achieving the synergies and dis-synergies of such adjustment. Any forward-looking information supplied in

Management’s Adjustments are covered by existing safe harbor rules under Rule 175 under the Securities Act of 1933, as amended (the

“Securities Act”) and Rule 3b-6 under the Exchange Act.

Target and Pro Forma Financial Statements Required in SEC Filings

In connection with a significant completed or probable acquisition, a registrant may be required to include Rule 3-05 historical financial

statements and Article 11 pro forma financial statements in different SEC filings, including in a Form 8-K, registration statements,

prospectus supplements, and proxy materials for a business combination. We discuss these in more detail below. Note that, in all

instances, the target’s financial statements must satisfy the usual age of financial statement requirements or “staleness” deadlines,

which, in turn, depend on the target’s filer status.

Requirements Under Form 8-K

A significant acquisition usually triggers the requirement to file a Form 8-K at three different periods: (1) a signing 8-K to be filed after

the acquisition agreement is signed; (2) a closing 8-K to be filed after the acquisition closes; and (3) a Form 8-K/A to be filed within

approximately 75 days of the closing of the acquisition.

Signing 8-K. Item 1.01 of Form 8-K requires a registrant to disclose in a Form 8-K its entry into a material definitive agreement

not made in the ordinary course of business. The Form 8-K should be filed within four business days from the signing of such

agreement and should disclose, among other things, the date of the agreement, identity of the parties, and a brief description

of the material terms and conditions of the agreement. No financial statements (either target or pro forma) are required to be

included in this Form 8-K.

Closing 8-K. Item 2.01 of Form 8-K requires a registrant to disclose in a Form 8-K that it has completed the acquisition of a

significant amount of assets, otherwise than in the ordinary course of business. The Form 8-K should be filed within four

business days from the closing of the acquisition and should disclose, among other things, the date of completion of the

acquisition, a brief description of the assets involved, the identity of the parties, and the nature and amount of consideration

10

given or received. As a general rule, no financial statements (either target or pro forma) are required to be included in this

Form 8-K.

Form 8-K/A. Items 9.01(a) and (b) of Form 8-K require the registrant to file the required Rule 3-05 historical target financial

statements and Article 11 pro forma financial information, either in the Closing 8-K described above or in an amendment to

such Closing 8-K, not later than 71 calendar days after the required filing date of the Closing 8-K (approximately 75 days from

the completion of the acquisition). Note that, for purposes of applying the staleness rules to the financial statements filed in

the Form 8-K/A, FRM paragraph 2045.13 provides that the age of such financial statements should be determined by reference

to the filing date of the Form 8-K initially reporting consummation of the acquisition. This means that the target financial

statements included in the Form 8-K/A would be deemed current if they would have met the permitted age requirements on

the filing date of the Closing 8-K.

As previously mentioned, as a general rule, a reporting company that has completed a significant acquisition must file these target and

pro forma financial statements within 75 days after the acquisition is consummated on a Form 8-K/A. However, a registrant that

registers or offers securities may need to provide these financial statements much earlier and include them in the relevant SEC filing or

offering document.

Registration Statements other than those on Form S-4

When Required

In general, a registrant is required to file target and pro forma financial statements of a significant business acquisition that was

completed 75 or more days before a registration statement is filed or declared effective. Such financial statements are also required if

an acquisition is probable and exceeds the 50% significance level. The financial statements can be included in the registration

statement itself or incorporated therein by reference (for instance, from the previously filed Form 8-K/A that contains the target and pro

forma financial statements).

When Not Required

No target or pro forma financial statements are required if the business acquisition does not exceed the 50% significance level and

either (1) the acquisition is probable or has not yet been completed or (2) the acquisition was completed less than 75 days before the

registration is filed or declared effective (stated otherwise, the date of the final prospectus or the prospectus supplement filed with the

SEC is no more than 74 days from the consummation of the acquisition) and the financial statements of the acquired business have not

yet been filed.

Special Rules When Significance Exceeds 50%

FRM paragraph 2050.5 provides that, if significance exceeds 50% and the financial statements of the acquired business have not yet

been filed, then new registration statements and post-effective amendments to such registration statements will not be declared

effective. In this scenario, at the more than 50% significance level, a registrant will need to file the required target and pro forma

financial statements in the new registration statement or an amendment to an existing one, even if such acquisition is only probable or

has closed only within the past 74 days. FRM paragraph 2060 provides a flowchart overview of Rule 3-05. This flowchart illustrates

when target financial statements are required in a registration statement for an acquisition that has occurred or is probable.

Omission of Rule 3-05 Financial Statements in Registration Statements and Proxy Statements once Acquired Businesses have been included

in Registrant’s Financial Statements

The new rules eliminate the requirement to provide Rule 3-05 Financial Statements in registration statements and proxy statements, as

long as the acquired business is reflected in filed post-acquisition financial statements of the registrant for a period of either nine

11

months (for acquired businesses with significance greater than 20% but not in excess of 40%) or a complete fiscal year (for acquired

businesses with significance in excess of 40%).

10

Considerations Applicable to Shelf Takedowns and Prospectus Supplements

A registrant may utilize a prospectus supplement to effect a takedown of securities under an existing, currently effective registration

statement. However, a registrant must be mindful of certain rules under Rule 3-05 that may impact its ability to utilize an existing,

effective shelf registration statement for a takedown.

FRM paragraph 2045.3 provides that offerings pursuant to effective registration statements cannot proceed if the significance of an

acquisition exceeds 50% and financial statements have not been filed. FRM paragraph 2050.3

11

further provides that, if the significance

exceeds 50% and the financial statements of the acquired business have not been filed, registrants should not make offerings pursuant

to effective registration statements or pursuant to Rule 506 of Regulation D if any purchasers are not accredited investors until the

required audited financial statements are filed. As an exception, however, the following offerings and sales of securities may proceed

during the grace period notwithstanding that the financial statements of the acquired business have not been filed:

offerings or sales of securities upon the conversion of outstanding convertible securities or upon the exercise of outstanding

warrants or rights;

dividend or interest reinvestment plans;

employee benefit plans;

transactions involving secondary offerings; and

sales of securities pursuant to Rule 144.

The Staff has clarified that FRM paragraphs 2045.3 and 2050.3 above only apply to completed business acquisitions. They do not

apply to probable business acquisitions, unless management determines that such probable business acquisition constitutes a

“fundamental change.”

FRM paragraph 2045.3 provides that, in general, after the effectiveness of a registration statement, a domestic registrant has no specific

obligation to update the prospectus (e.g., by filing an amendment to the prospectus or a prospectus supplement) except as stipulated

by Section 10(a)(3) of the Securities Act and Item 512(a) of Regulation S-K with respect to any “fundamental change.” If an acquisition

would be significant under Rule 3-05, management should consider whether the probability of consummation of the transaction would

represent a fundamental change to its business. It is the responsibility of management to determine what constitutes a fundamental

change. The registrant should also consider whether individually insignificant acquisitions occurring subsequent to effectiveness, when

combined with individually insignificant acquisitions that occurred after the most recent audited balance sheet in the registration

statement but prior to effectiveness, may be of such significance in the aggregate that an amendment is necessary.

Registration Statement on Form S-4

A registrant may prepare a registration statement on Form S-4 in order to register securities to be offered to the security holders of a

business to be acquired. FRM paragraph 2200.3 provides that, in general, the determination of the number of periods for which target

company financial statements need be included in a Form S-4 should be made by reference to the requirements of Form S-4, not S-X 3-

05. The financial statement and audit requirements for Form S-4 filings may be different from the Rule 3-05 requirements outlined

above, depending on a number of facts and circumstances. These factors include, among others, (1) whether the registrant’s

shareholders are required to vote on the potential acquisition and (2) whether the target is an SEC reporting entity. In particular, as

FRM paragraph 2200.1 illustrates:

10

See new Rule 3-05(b)(4)(iii).

11

See similar requirement in the Instruction to Item 9.01 of Form 8-K.

12

the target company financial statement periods to present depend on whether (i) the target is a reporting company; (ii) the

target is a non-reporting company and the issuer’s shareholders are voting; (iii) the target is a non-reporting company and the

issuer’s shareholders are not voting; (iv) the target is a smaller reporting company; (v) the acquirer is an EGC; or (vi) the

acquirer is a shell company.

the need to audit the target company’s financial statements depends on whether (i) the target is a reporting company or (ii)

the target is a non-reporting company (irrespective of whether the issuer’s shareholders are voting).

For instance, where the issuer’s shareholders are required to vote on the transaction and the target is an SEC reporting entity, the

following target financial statements would be required, regardless of significance under Rule 3-05: (i) balance sheets as of the two most

recent fiscal years (audited); (ii) statements of operations, comprehensive income, cash flows, and changes in shareholders’ equity for

the three most recent fiscal years (audited); (iii) required interim information (unaudited), if applicable; and (iv) financial statements of

the target’s significant acquired or to-be-acquired business under Rule 3-05.

As another example, if the target is a reporting company, all target company fiscal years presented must be audited, whether or not the

issuer’s shareholders are voting.

12

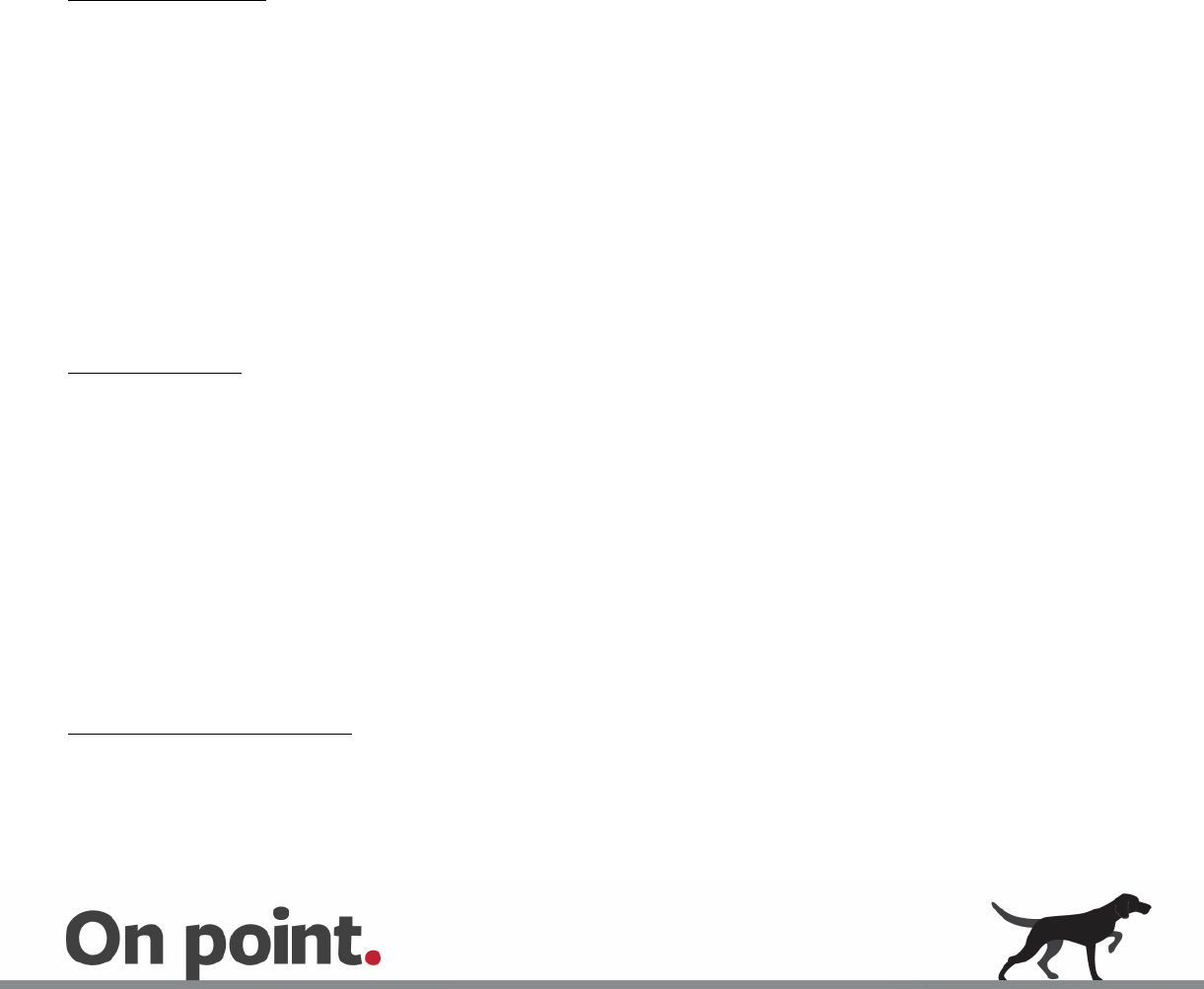

Merger Proxy Statement

FRM paragraph 1140.3 provides that the requirement for acquirer and target financial statements in a merger proxy statement depends

on whose proxies are solicited and the nature of the consideration. If the consideration to be issued in a business combination includes

registered securities, the registrant must comply with the financial statement requirements of Form S-4 described above. The following

table, which is derived from the table found in FRM paragraph 1140.3, outlines when financial statements are required for transactions

that do not involve registered securities.

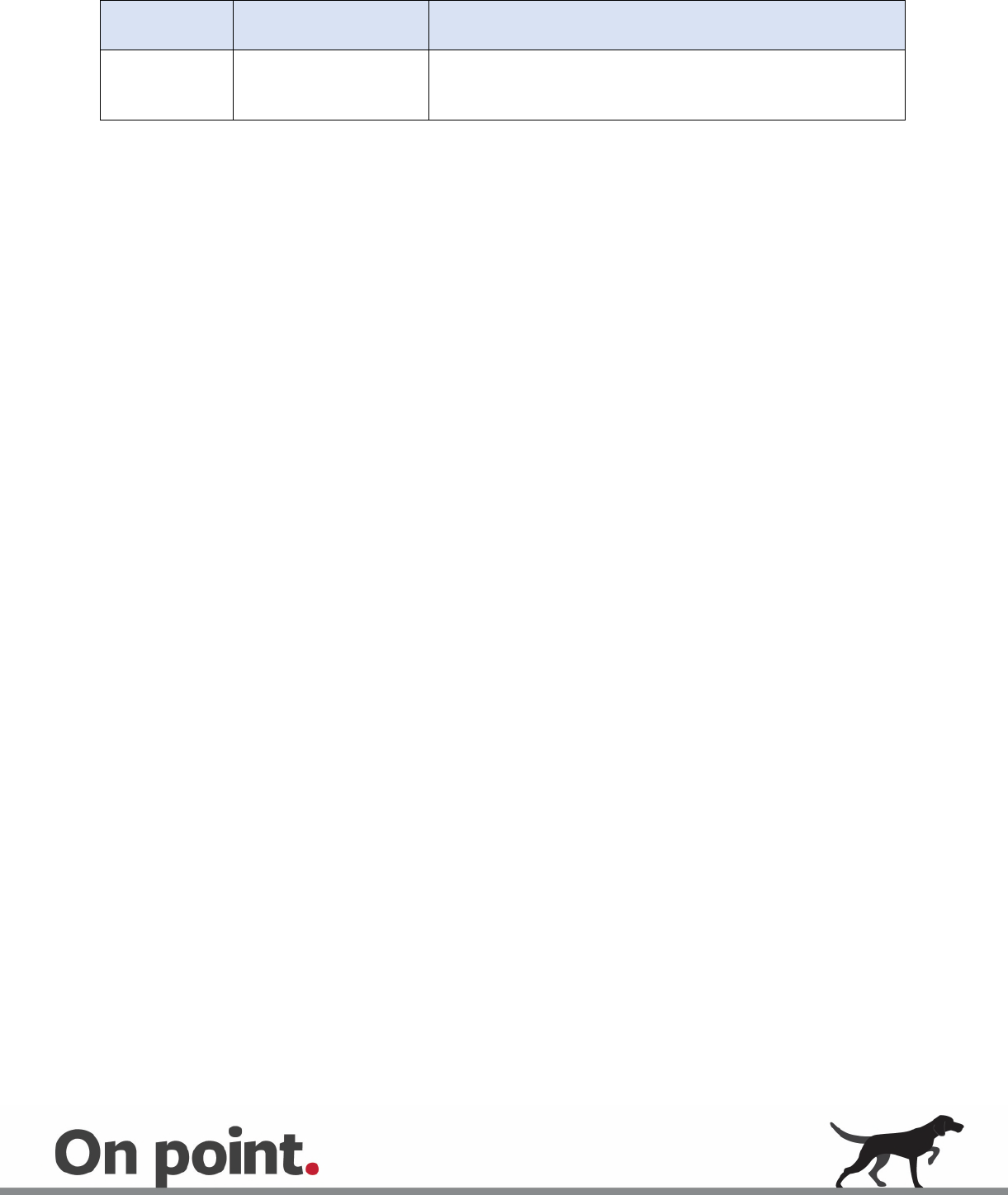

Table 3: When Financial Statements Are Required for Merger Proxy Statements

Solicited

Shareholders Consideration Financial Statements

Acquirer Only Cash only

Financial statements of the target are required.

Financial statements of the acquirer are not required unless they

are material to an informed voting decision.

Pro forma financial information is required if it is material to a

voting decision.

Acquirer Only

Exempt securities only or

a combination of exempt

securities and cash

Target Only Cash only

Financial statements of the target are not required unless it is a

going private transaction.

Financial statements of the acquirer are not required unless they

are material to an informed voting decision.

No pro forma information is required.

Target Only Exempt securities only or a

combination of exempt

securities and cash

Financial statements of the target are not required unless it is a

going private or roll-up transaction.

Financial statements of the acquirer are generally required.

Pro forma financial information is required, if material.

Acquirer and

Target

Cash only

Financial statements of the target are required.

Financial statements of the acquirer are not required unless they

are material to an informed voting decision.

Pro forma financial information is required if it is material to a

voting decision.

12

See also FRM paragraph 2200.6.

13

Solicited

Shareholders Consideration Financial Statements

Acquirer and

Target

Exempt securities only or

a combination of exempt

securities and cash

Financial statements of the target are required.

Financial statements of the acquirer are generally required.

Pro forma financial information is required, if material.

Exempt Offerings – Rule 144A Transactions and Offering Memoranda

The target and pro forma financial statement requirements under Rule 3-05 and Article 11 also become relevant in Rule 144A offerings

as a result of market convention. While these SEC requirements do not technically apply to Rule 144A offerings, it has become standard

practice for practitioners to substantially adhere to these requirements as much as possible in their exempt offerings. Initial purchasers

and QIBs have come to expect that the financial disclosures in a Rule 144A offering memorandum (in particular, the inclusion of target

and pro forma financial statements in connection with a significant acquisition) would in all material respects be consistent with the

needed financial disclosures in a registration statement. This is particularly the case where security holders have been granted

registration rights or an A/B exchange offer would follow a Rule 144A notes offering, since, in these situations, compliance with the SEC

requirements will then apply, at the back-end, to the registered offering. Inclusion of such financial statements in the Rule 144A

offering memorandum assists the issuer and financial intermediaries in presenting investors with full and fair disclosure about the

issuer’s financial condition and results of operations and mitigates possible claims from investors that the offering document contained

material misstatements or material omissions.

Since the SEC rules under Rule 3-05 and Article 11 do not technically apply to Rule 144A offerings, practitioners are afforded a certain

degree of flexibility in a Rule 144A deal. For instance, it is not uncommon for practitioners to decide that two years of target audited

financial statements would suffice, instead of the three years that may be required by current SEC rules, if such omission does not

materially alter the total mix of information available to investors. Marketing considerations also come into play. For instance, in the

case of a probable significant acquisition that exceeds 20% significance but not 40% significance, it is not uncommon for practitioners

to decide to include target and pro forma financial statements in the offering memorandum, notwithstanding that these would not be

required to be included in a registration statement, since the significance has not exceeded the 50% significance level applicable to

probable acquisitions.

Rule 3-13 Waiver Requests

Finally, registrants that wish to seek relief from complying with Rule 3-05 and Article 11 financial statement requirements should

remember and consider making Rule 13-3 waiver requests. Rule 3-13 of Regulation S-X allows the SEC, upon the informal request of a

registrant and where consistent with investor protection, to permit the omission of financial statements otherwise required by the SEC

rules or their substitution by financial statements of a comparable character.

Note that, in July 2017, SEC Chair Jay Clayton stated that, under Rule 3-13, issuers can request modifications to their financial reporting

requirements in certain circumstances where disclosures are burdensome to generate but may not be material to the total mix of

information available to investors. Chair Clayton encouraged companies to consider whether such modifications may be helpful in

connection with their capital raising activities and assured them that Staff is placing a high priority on responding with timely guidance.

Echoing Mr. Clayton’s earlier remarks, then Corp Fin Chief Accountant Mark Kronforst also remarked in November 2017 that Rule 3-13 is

intended to facilitate capital information and allows companies to be granted relief where consistent with investor protection. The SEC

has also reiterated in the final release adopting the new rules, that Rule 3-13 waiver requests are available, and that Corp Fin, in the

exercise of its delegated authority and consistent with investor protection, can grant these requests to relieve financial statement

burdens imposed by Regulation S-X.

14

Conclusion

A significant business acquisition represents an important event in the life cycle of a registrant. Because a significant acquisition

oftentimes results in significant changes to a registrant’s financial position, results of operations, and future prospects, the SEC rules

require registrants to include in their filings and disclose to investors historical financial statements of the target and pro forma financial

statements giving effect to the acquisition under Rule 3-05 and Article 11. Understanding these rules is essential for registrants to

discharge their reporting obligations and to carry out any contemplated securities offerings in a timely fashion. While this note

provides an overview of the financial statement requirements under Rule 3-05 and Article 11, it is important to remember that the SEC’s

financial reporting and disclosure requirements triggered by a company’s significant business acquisition are technical in nature and are

subject to many exceptions and special cases, especially in light of the significant amendments recently passed by the SEC. In particular,

companies should assess how the new rules would impact their existing disclosures and determine if voluntary early adoption of the

new rules, ahead of the mandatory compliance date, would be advantageous, recognizing that early compliance means full compliance.

Registrants should therefore carefully review the rules, evaluate the applicable facts and circumstances, and work with counsel and

auditors in carrying out their significance analysis and financial reporting presentations.

Contact

The Free Writings & Perspectives blog provides news and views on securities regulation and capital

formation. The blog provides up-to-the-minute information regarding securities law developments,

particularly those related to capital formation. FW&Ps also offers commentary regarding

developments affecting private placements, mezzanine or “late stage” private placements, PIPE transactions, IPOs and the IPO market,

new financial products and any other securities-related topics that pique our and our readers’ interest. Our blog is available at:

www.freewritings.law.

Mayer Brown is a global legal services provider advising many of the world’s largest companies, including a significant portion of Fortune 100, FTSE 100,

CAC 40, DAX, Hang Seng and Nikkei index companies and more than half of the world’s largest banks. Our legal services include banking and finance;

corporate and securities; litigation and dispute resolution; antitrust and competition; US Supreme Court and appellate matters; employment and benefits;

environmental; financial services regulatory and enforcement; government and global trade; intellectual property; real estate; tax; restructuring,

bankruptcy and insolvency; and private clients, trusts and estates.

Please visit www.mayerbrown.com for comprehensive contact information for all Mayer Brown offices.

Mayer Brown is a global services provider comprising legal practices that are separate entities, including Tauil & Chequer Advogados, a Brazilian law partnership with which

Mayer Brown is associated (collectively the “Mayer Brown Practices”), and affiliated non-legal service providers, which provide consultancy services (the “Mayer Brown

Consultancies”). The Mayer Brown Practices and Mayer Brown Consultancies are established in various jurisdictions and may be a legal person or a partnership. Details of the

individual Mayer Brown Practices and Mayer Brown Consultancies can be found in the Legal Notices section of our website. “Mayer Brown” and the Mayer Brown logo are the

trademarks of Mayer Brown. © 2020 The Mayer Brown Practices. All rights reserved. Attorney advertising. Prior results do not guarantee a similar outcome.

Ryan Castillo

New York

T: (212) 506-2645

E: rcastillo@mayerbrown.com