What you need to know

• Rule 3-05 of Regulation S-X generally requires a registrant to provide separate

audited annual and unaudited interim pre-acquisition financial statements of a

significant business that it acquired or will acquire.

• To determine the significance of an acquired or to-be-acquired business, the

registrant performs “significant subsidiary” tests under Rule 1-02(w) of Regulation

S-X (i.e., the asset test, the investment test and the income test).

• The periods for which a registrant is required to present financial statements are

based on the significant subsidiary test resulting in the highest level of significance

(e.g., a maximum of two years of audited financial statements and the latest unaudited

year-to-date interim period for an acquired business exceeding 40% significance).

• Rule 3-05 financial statements must be filed on Form 8-K, certain Securities Act

registration statements and in proxy statements, and be accompanied by pro forma

financial information.

• This publication has been updated throughout to incorporate additional SEC staff

guidance, including guidance issued since our initial publication, along with additional

illustrations and expanded discussions on selected topics.

Overview

Audited financial statements of significant acquired businesses must be reported in reports on

Form 8-K and proxy statements required by the Securities Exchange Act of 1934 (Exchange Act)

and in certain filings required by the Securities Act of 1933 (Securities Act) (e.g., Forms S-1

and S-3). However, the number of years of audited financial statements that must be presented

No. 2020-16

Updated 6 April 2023

Technical Line

Applying the SEC’s requirements for

significant acquired businesses

Registrants may

be

required to

file

separate

pre

-acquisition

financial statements

and pro forma

information for

acquired or to

-be

acquired businesses.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

2 |

Technical Line

Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

generally depends on the significance of the acquired business. Rule 3-05, Financial statements

of businesses acquired or to be acquired (Rule 3-05), under Regulation S-X describes the

Securities and Exchange Commission (SEC) requirements for registrants to provide audited

financial statements of acquired or to be acquired businesses.

The SEC rules

that went into effect 1 January 2021 for calendar-year registrants changed the

significance tests that registrants use to determine the information they need to disclose, the

periods that must be included in the financial statements and the form of pro forma financial

information that must be included in certain SEC filings.

This publication discusses the requirements and has been updated to include SEC staff

guidance issued after 2020 and additional illustrations of how to apply these requirements,

among other things.

When using this publication, a registrant should refer to the rules in Regulation S-X

(i.e., Rule 1-02(w) for significance testing, Rule 3-05 for financial statement requirements,

and Rules 11-01 and 11-02 for pro forma requirements), as well as Rule 11-01(d) for

determining whether a business has been acquired.

While registrants may also want to refer to chapters 2 and 3 of the SEC’s Division of Corporation

Finance Financial Reporting Manual, they should confirm the relevance of any guidance

labeled as updated before 21 May 2020, which is when the SEC amended the rules.

Rule 3-14, Special instructions for financial statements of real estate operations acquired or

to be acquired, includes the financial statement requirements for acquired operating real

estate properties, which are summarized in our Technical Line,

How to apply the amended

S-X Rule 3-14 to real estate acquisitions.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

3 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Contents

1 Definition of a business .................................................................................................. 4

2 Significance ................................................................................................................... 6

2.1 Asset test .......................................................................................................... 7

2.2 Investment test .................................................................................................. 8

2.3 Income test ...................................................................................................... 10

2.4 Significance tests — special circumstances ........................................................ 13

3 Filing Rule 3-05 financial statements ........................................................................... 22

3.1 Form 8-K ......................................................................................................... 22

3.2 Registration and proxy statements ................................................................... 23

3.3 Merger proxy statements (added April 2023) .................................................... 29

3.4 Registration statements on Forms S-4 and F-4 (added April 2023)..................... 31

3.5 Inability to comply with Rule 3-05 (added April 2023) ....................................... 33

4 Content of Rule 3-05 financial statements ................................................................... 34

4.1 Annual audited and unaudited interim periods ................................................... 34

5 Age of Rule 3-05 financial statements ......................................................................... 35

5.1 General requirements....................................................................................... 35

5.2 Form 8-K ......................................................................................................... 35

5.3 Registration and proxy statements ................................................................... 36

6 Regulation S-X presentation requirements .................................................................. 38

6.1 Accounting principles ....................................................................................... 38

6.2 Audit requirements and interim reviews ............................................................ 39

6.3 Financial statements of foreign acquired businesses .......................................... 39

6.4 Acquiring a component of a seller ..................................................................... 40

7 Pro forma financial information ................................................................................... 42

7.1 Overview ......................................................................................................... 42

7.2 Required statements in pro forma financial information ..................................... 42

7.3 Additional pro forma guidance and considerations (added April 2023) ............... 44

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

4 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

1 Definition of a business

To determine whether Rule 3-05 applies, a registrant must first determine whether the

assets and liabilities it is acquiring meet the SEC’s definition of a business in Rule 11-01(d)

of Regulation S-X.

Acquired assets and liabilities that do not meet the SEC’s definition of a business are not subject

to the reporting requirements of S-X Rule 3-05 or S-X Article 11, even if they meet the US GAAP

definition of a business under Accounting Standards Codification (ASC) 805, Business Combinations.

(See our Financial reporting developments (FRD) publication, Business combinations

.)

Under Rule 11-01(d), the general principle for identifying a business is that there must be

continuity of the entity’s operations before and after the transaction, and the pre-acquisition

financial information about the acquired business is, therefore, material to an understanding

of the registrant’s operations after the transaction.

There is a presumption that a separate entity, subsidiary, division or a working interest in an

oil and gas property is a business. Rule 3-05 also defines as a business an investment

accounted for using the equity method (including when the fair value option has been elected).

Other components of a selling entity, such as a product line, may also be considered a

business for SEC reporting purposes. When evaluating whether such a component is a

business, registrants should consider both of the following criteria:

• Whether the nature of the revenue-producing activity of the component generally will

remain the same as before the transaction

• Whether any of the following attributes remain with the component after the transaction:

• Customer base

• Employee base

• Market distribution system

• Operating rights

• Physical facilities

• Production techniques

• Sales force

• Trade names

The SEC staff has emphasized that the analysis of whether an acquired entity is a business focuses

primarily on the continuity of operations before and after the acquisition. However, registrants

must use judgment to evaluate the above criteria among other facts and circumstances.

Illustration 1 — Definition of a business

Registrant A is acquiring certain assets related to Product X from Company B. No employees

will move from Company B to Registrant A, and the transaction involves only the internally

generated intangible assets (e.g., brand name, manufacturing know-how) and inventory

related to Product X. Product X is not a separate entity, subsidiary or division of Company B.

After the acquisition, Registrant A will sell Product X to Company B’s customers.

The SEC staff’s

analysis of

whether

a

business

is being

acquired

focuses

primarily on

the

continuity of

operations before

and after a

transaction

.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

5 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Because the nature of the revenue-producing activity associated with Product X will remain

the same after the acquisition and multiple attributes listed in S-X Article 11 will remain

with Product X, Registrant A concludes that the transaction involves a business. Refer to

section 6.4, Acquiring a component of a seller, for a discussion of the financial statement

requirements for components such as Product X.

How we see it

If a registrant believes that it may be able to overcome the presumption that a separate

entity, subsidiary, division or a working interest in an oil and gas property is a business or

is uncertain whether the criteria in S-X Rule 11-01(d) have been met, we recommend that

the registrant contact the SEC staff to discuss whether a business has, in fact, been acquired.

When the answer is unclear, it may also be helpful to consider whether the information

conveyed in Rule 3-05 financial statements would be useful to investors.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

6 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

2 Significance

A registrant that determines that it has acquired a business is required to provide Rule 3-05

financial statements and pro formas if the business exceeds 20% significance to the registrant.

Significance is expressed as a percentage, and it is measured using the asset test, the

investment test and the income test described in S-X Rule 1-02(w) to compare the acquired

business with the registrant. The results of the tests cannot be rounded, and the registrant

uses the highest result of the three tests to determine its reporting requirements.

In most cases, significance is determined using amounts that appear in the registrant’s most

recent annual pre-acquisition audited financial statements filed with the SEC and amounts in

the financial statements of the acquired business for the same fiscal year. In certain cases,

registrants may need to obtain more recent financial statements of the acquired business

than those they will present to comply with Rule 3-05 to test significance. Although the

acquired business’s financial statements do not need to be audited to be used in the

significance tests, the acquired business may need to accelerate the preparation of its latest

annual financial statements to comply with Rule 3-05.

When a registrant acquires a business with a different fiscal year end, the registrant must test

significance using the acquired business’s pre-acquisition financial statements for the most

recent fiscal year that would have been required if the business were a reporting company

with the same filer status as the registrant. Thus, the registrant should not conform the fiscal

year ends when testing significance. For example, if a calendar year-end registrant acquires

an October year-end company on 30 May 20X3, it should compare the acquired company’s

financial statements for the year ended 31 October 20X2 with its audited annual financial

statements for the year ended 31 December 20X2.

If the registrant or acquired business has been in existence for less than one year, the

registrant or acquiree should not annualize its historical financial statements.

Further, financial statements used by both the registrant and the acquired business to

measure significance must be prepared in accordance with the same comprehensive basis of

accounting. For example, a registrant that files its financial statements with the SEC in

accordance with US GAAP should determine significance using amounts reported under US

GAAP for both the registrant and the acquired business even if the acquired business is based

in another country and already has financial statements available using different accounting

standards (e.g., IFRS as issued by the International Accounting Standards Board (IFRS-IASB)).

Also refer to section 2.4, Significance tests — special circumstances.

How we see it

When the registrant and the acquired business use different comprehensive bases of

accounting (e.g., the registrant reports under US GAAP and the acquired business reports

under IFRS), registrants may not need to fully convert the acquired business’s reporting

basis to their reporting basis to test significance if they have an understanding of the

differences, how the differences might impact the test and how close the percentages

calculated are to the thresholds in the rule.

Generally, each business acquired or to be acquired is evaluated individually. However, a group

of related businesses must be evaluated together as a single acquisition. Businesses are

deemed to be related if they are under common control or management, the acquisition of

one business is conditional on the acquisition of the other business, or each acquisition is

conditioned on a single common event. For example, if Registrant A acquires Companies B and C,

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

7 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

and both Companies B and C were wholly owned by the same private equity company,

Companies B and C would be evaluated as a single acquisition when performing the significance

tests since they were under common control immediately before the acquisition.

To perform the tests for the group as a whole, a registrant must aggregate the amounts for

each business, and the highest result represents the significance of the group. That is, if the

significance of the group exceeds 20% for at least one test, Rule 3-05 financial statements

and pro formas are required for each of the related businesses, even if the significance of one

or more of them is 20% or less for all three tests. In addition, as discussed in section 3.2.3,

Individually insignificant acquisitions, a registrant must consider the aggregate significance of

acquisitions that are not individually significant for Rule 3-05 reporting requirements when

filing registration and proxy statements.

How we see it

Registrants may submit requests to the Office of the Chief Accountant of the SEC’s

Division of Corporation Finance (CF-OCA) for relief from the requirement to prepare

Rule 3-05 financial statements if (1) the results of their significance tests are anomalous

and would lead to filing acquiree financial statements for periods beyond those reasonably

necessary to inform investors or (2) if the preparation of Rule 3-05 financial statements

would impose an unreasonable burden on the registrant (e.g., the effort and costs of

preparing financial statements significantly outweighs any benefit to investors).

The CF-OCA staff may exercise its delegated authority under Rule 3-13 of Regulation S-X

to waive some or all of the required acquiree financial statements or permit other financial

statements to be substituted, as long as the staff deems it to be consistent with investor

protection.

2.1 Asset test

A registrant performs the asset test by comparing its proportionate share of the acquired

business’s total assets to its consolidated total assets. For the purpose of performing the

asset test, intercompany transactions between the registrant and the acquired business

should be eliminated in the same manner they would be if the acquired business had been

consolidated. The assets of the acquired business should not be reduced for any assets not

acquired by a registrant (e.g., working capital items).

Illustration 2 — Asset test

Registrant A acquires 80% of Company B on 15 May 20X3. The most recent fiscal year end

of both companies is 31 December 20X2, and each company’s total assets reflect

intercompany eliminations:

Registrant A: $5 million

Company B: $2 million

Asset test calculation:

80% of Company B’s total assets: $ 1.6 million

Divided by Registrant A’s total assets: $ 5 million

Significance = 32%

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

8 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

2.2 Investment test

When performing the investment test, a registrant compares its investments in and advances

to the acquired business to the aggregate worldwide market value of the registrant’s voting

and non-voting common equity (WWMV), or the registrant’s total assets if WWMV is not

available (i.e., when common equity is not publicly traded, as is the case for a company

conducting an initial public offering (IPO)). However, a registrant must use its WWMV in the

investment test if the WWMV is available when the test is being performed, even if the entity

was not publicly traded as of the most recent pre-acquisition fiscal year end (i.e., the annual

financial statement period used for the asset and income tests).

The term “investments in the acquired business” refers to the fair value of the consideration

transferred for a business, adjusted to exclude the carrying value of any assets transferred by

the registrant to the acquired business that will remain with the registrant after the acquisition.

Contingent consideration is included in the consideration transferred if it is recognized at fair

value at the acquisition date for an acquisition that meets the definition of a business

combination in ASC 805. Transaction costs are excluded because they are expensed as

incurred under that guidance.

The WWMV is determined by averaging the aggregated worldwide market value calculated daily

using the shares outstanding on the last five trading days of the month ended before the earlier

of the registrant’s announcement of the transaction or the date of the acquisition agreement.

Classes of common equity that are not publicly traded are excluded from WWMV, including shares

that are exchangeable or convertible into classes of common equity that are publicly traded.

Illustration 3 — Investment test

Registrant A acquires Company B on 15 September 20X2 for $20 million in cash. Under the

agreement, Registrant A will pay the owners of Company B an additional $5 million (fair value

is $3 million) if the business achieves certain post-acquisition performance targets. Registrant A

also incurred transaction costs of $1 million. Registrant A and Company B agreed to the

transaction on 28 February 20X2, and it was announced on 1 March 20X2. Registrant A has

10 million shares of outstanding publicly traded Class A common stock and 10 million shares

of Class B stock that is not publicly traded but is convertible into common stock.

Investment test calculation:

Cash purchase price: $ 20 million

Fair value of contingent consideration: $ 3 million

Consideration transferred: $ 23 million

Divided by average WWMV of only the Class A shares for each of the last five trading days

of January (month ended before date of agreement on 28 February):

• 26 January daily average of $10.00 x 10 million shares = $100 million

• 27 January daily average of $10.50 x 10 million shares = $105 million

• 28 January daily average of $10.80 x 10 million shares = $108 million

• 29 January daily average of $11.00 x 10 million shares = $110 million

• 30 January daily average of $11.50 x 10 million shares = $115 million

WWMV = $107.6 million

Significance = 21%

A registrant that

does not have

WWMV sho

uld

use its

total

assets to

perform

the investment

test.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

9 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

When a registrant acquires assets and liabilities that do not meet the definition of a business

under ASC 805 (i.e., an asset acquisition under US GAAP), it typically recognizes contingent

consideration upon acquisition only if payment is probable and reasonably estimable.

However, contingent consideration for these transactions should be included in the

investment test, unless the likelihood of payment is remote. In addition, transaction costs are

typically capitalized and included in the numerator of the investment test.

Illustration 4 — Investment test — acquired business is not a business under ASC 805

Registrant A acquires AssetCo, a business under S-X Rule 11-01(d), for $30 million. The

transaction does not qualify as a business combination under ASC 805 and will be accounted

for as an asset acquisition under US GAAP. Registrant A will also pay an additional $4

million to the owner of AssetCo if the business achieves certain post-acquisition

performance targets during the first two years. Registrant A determined that $3 million of

the contingent consideration is reasonably likely to be paid, and the likelihood of the

remaining $1 million being paid is remote. Registrant A also incurred $1 million of

transaction costs, and its WWMV was $100 million.

Investment test calculation:

Cash purchase price: $ 30 million

Contingent consideration (more than remote): $ 3 million

Transaction costs: $ 1 million

Consideration transferred: $ 34 million

Divided by Registrant A’s WWMV $ 100 million

Significance = 34%

How we see it

A lengthy period of time (e.g., a year or more) may elapse between the date used to

calculate WWMV (i.e., when based on the registrant’s announcement of the transaction)

and the acquisition closing date (i.e., when the consideration transferred is determined).

If a registrant believes that the mechanics of the investment test require providing Rule 3-05

financial statements and pro formas for a significant business that are not necessary for

investors to make informed decisions, it should contact the SEC staff to discuss potential

relief under S-X Rule 3-13.

2.2.1 Combinations of businesses or entities under common control accounted for in a manner

similar to a pooling of interests (added April 2023)

For combinations of businesses or entities under common control that will be accounted for in

a manner similar to a pooling of interests (e.g., reorganization of entities under common

control), the investment test is performed by (1) comparing the net book value of the

acquired entity to the registrant's consolidated total assets, and (2) comparing the number of

common shares exchanged or to be exchanged by the registrant to its total common shares

outstanding at the date the combination is initiated.

If the significance of the acquired business exceeds 20% under either of these tests, Rule 3-05

financial statements and pro formas are required. See section 3.1 for Form 8-K filing

requirements and section 3.2 for registration statement and proxy statement filing requirements.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

10 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Illustration 5 — Investment test — reorganization of entities under common control

On 9 June 20X3, Registrant merged with commonly controlled Company A. The merger

will be accounted for in a manner similar to a pooling of interests. Registrant exchanged

100 shares of its common stock for all of the outstanding shares of Company A. Registrant

had 800 shares of common stock outstanding at the date the combination was initiated. At

31 December 20X2, Registrant had total assets of $1,000 and Company A had a net book

value of $300.

Investment test calculation:

Company A net book value: $ 300

Registrant total assets: $ 1,000

Significance = 30%

Registrant shares exchanged: 100

Registrant total common shares outstanding

at initiation date: 800

Significance = 12.5%

Registrant must file a Form 8-K by 15 June 20X3 to report the acquisition and an

amendment by 25 August 20X3 (71 days later) that includes (1) audited financial

statements of Company A as of and for the year-ended 31 December 20X2, and (2)

unaudited interim financial statements of Company A as of and for the three months ended

31 March 20X3. Because this transaction will be accounted for in a manner similar to a

pooling of interests, a pro forma income statement is required for (1) each of the three

years ending 31 December 20X2, and (2) the three months ended 31 March 20X3. A pro

forma balance sheet also is required as of 31 March 20X3.

2.3 Income test

A registrant needs to calculate both an income component and a revenue component (if

applicable) for the income test. The income component compares the registrant’s proportionate

share of the acquired business’s pretax income or loss from continuing operations, net of

amounts attributable to any noncontrolling interest, to that of the registrant. A registrant or

an acquired business may need to make adjustments, as reflected in the illustration below, to

pretax income shown in the statement of comprehensive income to arrive at the amount used

in the test.

The revenue component compares the registrant’s proportionate share of the acquired

business’s most recent annual consolidated revenue from continuing operations to that of the

registrant. If the registrant acquires 100% of another entity, it uses 100% of the entity’s

consolidated revenue in the significance test.

Intercompany transactions between the registrant and the acquired business should be

eliminated from pretax income and revenue in the same manner they would if the acquired

business had been consolidated.

Significance is measured using the lower result of the two components, but the revenue

component of the test can only be used when the acquired business and the registrant both

had material revenue during each of their past two fiscal years. The SEC staff has indicated

that the determination of material revenue should be based on separate considerations of

materiality for the registrant and the acquired business (i.e., the point isn’t to compare the

revenue of the registrant with that of the acquired business).

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

11 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

The staff has also clarified that when a registrant or acquiree is a successor to a predecessor

company, the registrant should consider revenue for the full relevant period without regard to

the separation of the predecessor and successor periods.

Illustration 6 — Income test

Registrant A acquires 60% of Company B on 15 May 20X2. Registrant A records income

from an investment that it accounts for using the equity method. Registrant A also has a

consolidated but not wholly owned subsidiary, and it allocates a portion of its income to the

noncontrolling interest in the subsidiary. Company B does not have any investments or a

noncontrolling interest. Neither company has had any discontinued operations, and both

had material revenue. Both companies have calendar year ends.

Selected items from Registrant A’s 20X1 statement of comprehensive income (in millions):

Revenue $ 100

Income before income taxes $ 10

Income taxes $ 3

Income after taxes $ 7

Income from investee (net of $1 million tax) $ 2

Net income $ 9

Net income attributable to noncontrolling interest (net of $1 million tax) ($ 3)

Net income attributable to Registrant A $ 6

Selected items from Company B’s 20X1 statement of comprehensive income (in millions)

Revenue $ 19

Income before income taxes $ 5

Income test calculation:

Income component:

60% of Company B’s income before income taxes: $ 3

Divided by Registrant A’s adjusted income before taxes:

Income before taxes $ 10

Plus pretax income from investee $ 3

Less pretax income allocated to noncontrolling interest ($ 4)

Registrant’s adjusted income before taxes $ 9

Income component significance = 33%

Revenue component:

60% of Company B’s revenue: $ 11.4

Divided by Registrant A’s revenue: $ 100

Revenue component significance = 11%.

Significance under the income test is 11%, the lower result of the two components.

When the revenue component is not available, a registrant averages its income from the last

five fiscal years. If the registrant’s income used for the income component is at least 10%

lower than its calculated average income, the registrant uses the average. If a loss was

recorded in any year, it uses the absolute value.

A registrant can

average its

income for

the

income

component of the

test only when

the

revenue

component does

not apply.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

12 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

If the registrant has less than five years of audited financial statements on the same basis of

accounting, the SEC staff will not allow income averaging. For instance, the registrant may

have experienced a change in basis of accounting due to emerging from bankruptcy or

succeeding to the reporting obligations of another reporting entity less than five years before

the last audited balance sheet used for the S-X 1-02(w) significance tests.

When registrants have five years of audited financial statements that include two or more

different bases of accounting, the SEC staff will consider a relief request by the registrant to

perform the significance test using pro forma amounts determined in accordance with S-X

Article 11 as if the predecessor had been acquired at the beginning of the fiscal year being

measured. The SEC staff generally believes that combining the historical results of the

successor and predecessor (within one year or within the five-year average) without Article

11 pro forma adjustments is not an appropriate surrogate for the significance test.

The income of the acquired business cannot be averaged.

Illustration 7 — Income averaging when the revenue component is not available

Assume the same facts as in Illustration 6, except that Company B did not have material

revenue during fiscal year 20X0, and the registrant recorded the income and loss before

taxes shown below for the four years before 20X1.

Income average calculation:

20X1: $ 9 million

20X0: ($ 10 million)*

20X9: $ 11.5 million

20X8: $ 13 million

20X7: $ 14 million

Total $ 57.5 million

Average over five years: $ 11.5 million

* Use absolute value in this calculation.

Registrant A’s 20X1 income of $9 million is at least 10% lower than $11.5 million, so the

income component is calculated by dividing Company B’s income before taxes of $3 million

by Registrant A’s average income of $11.5 million.

Income component significance = 26%

If a registrant is allowed to present abbreviated financial statements (refer to section 6.4.2,

Abbreviated financial statements), the income component should be calculated using the

acquired business’s revenue less direct expenses.

How we see it

Over the past year, the SEC staff has sought more details in its filing reviews about how

registrants concluded that separate 3-05 financial statements and pro formas were not

required. The SEC staff may also review publicly available information, other than SEC

filings, to identify any completed acquisitions for which the registrant didn’t file separate

financial statements or pro formas.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

13 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Registrants should consider maintaining contemporaneous documentation of significance

tests performed and their analysis of Rule 3-05 and Article 11 requirements, particularly

when they conclude that an acquisition is not significant.

2.4 Significance tests — special circumstances

2.4.1 Calculating significance when the Form 10-K is filed subsequent to an acquisition

As discussed above, a registrant generally measures significance using its pre-acquisition

consolidated financial statements as of the end of the most recently completed audited fiscal

year required to be filed with the SEC. However, a registrant can choose which fiscal year of

its financial statements to use when it files a new annual report on Form 10-K after completing

the acquisition of a business but before the Rule 3-05 financial statements and pro formas

would be required to be filed in a Form 8-K (see separate discussion below about Form 8-K

filing requirements and due dates). In this situation, if the registrant elects to use the new

annual report on Form 10-K, it may either use amounts from the same newly completed

period of the acquired business or continue to use the amounts from the prior period.

Illustration 8 — Financial statements used to perform the significance tests

Registrant A is a calendar year-end accelerated filer that completed the acquisition of

Company B on 28 February 20X3. Company B is significant to Registrant A when using

Registrant A’s most recent audited annual financial statements on file at consummation

(i.e., the 20X1 financial statements) and Company B’s annual financial statements for the

same period. As a result, Registrant A filed an Item 2.01 Form 8-K on 4 March and must file

an Item 9.01 Form 8-K on 14 May (i.e., 71 days after 4 March) with Rule 3-05 financial

statements and pro formas.

On 16 March 20X3, Registrant A files its 20X2 annual report and performs the significance

tests again using its 20X2 financial statements and the 20X1 financial statements for

Company B. Company B is no longer significant, and Registrant A does not need to file the

Item 9.01 Form 8-K.

A registrant also has a choice of which fiscal year of its financial statements to use for

significance when the most recently filed financial statements are not yet due at the time of

the acquisition. For example, if calendar-year Registrant B voluntarily files its 20X2 annual

report on Form 10-K early on 1 February 20X3 and acquires Company C on 5 February 20X3,

Registrant B has the option to test significance using either its 20X2 or 20X1 financial statements.

2.4.2 Registrant financial statements used to determine significance in an IPO (added April 2023)

In connection with an IPO, a registrant should use the most recent pre-acquisition financial

statements included in the registration statement to determine the significance of an

acquisition. That is, the registrant cannot use financial statements for an earlier period even if

the financial statements would have been required at the time of the acquisition had the

company been reporting under the Exchange Act.

Illustration 9 — Measuring significance in an IPO

Calendar-year Company A files an IPO registration statement on 28 February 20X3 that

includes its audited financial statements as of 31 December 20X2 and 20X1 and for each of

the three years in the period ended 31 December 20X2. Company A acquired Company B on

5 February 20X2 so it must use its financial statements as of and for the year ended 31

December 20X1 to determine significance because those are the most recent pre-acquisition

financial statements included in the registration statement.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

14 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

2.4.3 Using pro forma financial information to calculate significance

A registrant can measure significance using information contained in pro formas that reflect

significant business acquisitions and dispositions consummated after its latest fiscal year end

if the required Rule 3-05 financial statements and pro formas have already been filed in a Form 8-K

or a registration statement. However, the pro forma balance sheet used for the asset test (and

investment test, if WWMV is not available) must be as of the end of the registrant’s most recent

fiscal year, even if that balance sheet was not included in the previously filed pro formas.

Pro formas used to test significance must include all significant acquisitions and dispositions

completed since the beginning of the fiscal year and should exclude any transactions that

were included in filed pro formas but were not required to be. If the registrant chooses to

compute significance using pro formas, it must do so for all three tests and continue to do so

until it files its next annual report on Form 10-K.

Rule 11-01(b)(3)(i)(B) requires that pro formas used to test significance only include transaction

accounting adjustments for the acquisitions and dispositions included (e.g., excludes offering

proceeds). However, we understand that the SEC staff would not object to a registrant also

including transaction accounting adjustments for related transactions, other than offering

proceeds, that are considered material under S-X 11-01(a)(8) and presented as part of the

pro forma financial presentation on file (as further described in our publication,

Pro form

financial information: A guide for applying Article 11 of Regulation S-X).

A company conducting an IPO can use pro formas to test significance, including pro formas

that are included in a draft registration statement (DRS) under the SEC’s confidential filing

process. However, the first publicly filed registration statement will also need to include the

pro formas (and related Rule 3-05 financial statements). If any changes occurred between the

draft submission and the public filing, a company should reassess the significance of any

acquisitions it tested using the pro formas in the DRS. For example, if a company conducting

an IPO acquired two significant businesses after its latest fiscal year end, it would need to file

a registration statement (e.g., a DRS), including the Rule 3-05 financial statements and pro

formas, for the first acquisition in order to use the pro formas to perform the significance

tests for its second acquisition.

Illustration 10 — Using pro forma financial information filed in a Form 8-K to measure

significance

Registrant A has a calendar year end and acquires Company B on 20 May 20X3. On 3 August

20X3, Registrant A files a Form 8-K that includes Rule 3-05 financial statements for

Company B and pro formas reflecting the transaction. The pro formas include a balance

sheet as of 31 March 20X3 and income statements for the year ended 31 December 20X2

and the three months ended 31 March 20X3.

On 15 September 20X3, Registrant A acquires Company C and can test its significance

using its previously filed pro forma income statement for the year ended 31 December 20X2

and a pro forma balance sheet at 31 December 20X2 that must be prepared separately by

Registrant A solely for testing significance.

A

company

conducting an

IPO can

use

pro

formas to

test

significance.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

15 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Illustration 11 — Using pro forma financial information filed in a DRS to measure

significance

Company A is a calendar-year emerging growth company (EGC) preparing for an IPO in 20X3

and has completed two acquisitions (Target B and Target C) since its most recently

completed fiscal year (e.g., 12/31/20X2). Company A intents to submit its Form S-1 DRS in

July 20X3, which will include its audited financial statements for the two years ended 31

December 20X2 and unaudited interim financial statements for periods ended 31 March

20X3 and 20X2. Company A also expects to file publicly in December 20X3 and have its

registration statement declared effective in January 20X4.

The following table summarizes key assumptions and dates:

Event

Date

Significance based on FY22

audited financial statements

Company

A acquires Target B 2/15/20X3 25%

Company

A acquires Target C 4/15/20X3 22%

Initial confidential

submission

(DRS)

7/1/20X3 n/a

Based on the fact pattern, if Company A includes in the DRS (and the publicly filed Form S-1

in December 20X3) the S-X Rule 3-05 financial statements and pro forma financial

information for Target B, it may use the pro forma financial information that reflects the

acquisition of Target B in the DRS to test the significance of Target C.

2.4.4 Calculating significance when a consolidated subsidiary acquires a business (added April 2023)

A registrant may have a consolidated subsidiary that acquires a business. If the subsidiary is

not a registrant, the acquired business’s financial statements should be compared with the

registrant’s audited financial statements. However, if the subsidiary is also a registrant, both

the registrant and the subsidiary are required to test the significance of the acquired business.

Further, when a non-registrant subsidiary that is not wholly owned acquires a business (e.g., a

registrant consolidates a 60%-owned private operating company, which acquires 100% of an

unrelated business), the SEC staff has indicated the following with respect to performing the

three significance tests:

• When performing the asset test and calculating the revenue component of the income

test, 100% of the acquired business’s assets and revenue from continuing operations

should be used in the numerator, and 100% of the registrant’s assets and revenue should

be used in the denominator. That is, the registrant’s 60% ownership of the operating

company does not affect these calculations.

• For the investment test, if the registrant does not have an aggregate worldwide market

value of its voting and non-voting common equity, it is required to use total assets in the

denominator. In this case, the registrant should use 100% of the registrant’s assets, and the

numerator should reflect 100% of the consideration transferred by the operating company.

• For the income component of the income test, the numerator should reflect only 60% of

the acquired business’s pretax income/loss (i.e., income/loss attributable to controlling

interest). The denominator should be the registrant’s pretax income/loss attributable

from continuing operations and attributable to the controlling interest, which also

excludes pretax income/loss attributable to noncontrolling interests.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

16 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

How we see it

If a registrant believes that the mechanics of the asset test and the revenue component of

the income test in this scenario will not result in useful information provided to investors, it

should contact the SEC staff to discuss the application of the significance tests.

2.4.5 Calculating significance of an acquisition after a reverse acquisition (added April 2023)

The SEC staff has indicated that if an acquisition is made after a transaction accounted for as

a reverse acquisition of the registrant but before the audited financial statements for the

fiscal year in which the reverse acquisition occurred are filed and the audited financial

statements for the accounting acquirer have been filed with the SEC, significance should be

measured against the accounting acquirer’s (i.e., legal acquiree) financial statements.

Illustration 12 — Calculating significance of an acquisition after a reverse acquisition

On 1 April 20X3, Registrant Z, a non-accelerated filer, acquired Company A, a nonpublic

company, in a transaction to be accounted for as a reverse acquisition. Therefore, Company A

is the accounting acquirer, and Registrant Z is the accounting acquiree. Both Registrant Z

and Company A have calendar year ends. On 6 April 20X3, Registrant Z filed an Item 2.01

Form 8-K that included audited financial statements of Company A as of 31 December 20X2

and 20X1 and for each of the three years in the period ended 31 December 20X2.

On 7 October 20X3, Registrant Z acquired Company B. In this case, the significance of

Company B should be measured against the 31 December 20X2 audited financial statements

of Company A, the accounting acquirer.

If the financial statements of Company A are not filed prior to the acquisition of Company B

(e.g., during the 71-day Form 8-K extension period), significance should be measured against

the 31 December 20X2 audited financial statements of Registrant Z (legal acquirer).

2.4.6 Impact of discontinued operations on significance calculations (added April 2023)

The SEC staff has indicated that once a registrant files financial statements retrospectively

adjusted for a discontinued operation (i.e., recasted financial statements), the registrant

should use them to determine significance only for (1) probable acquisitions as of the date of

the registration statement or proxy statement, (2) calculating the aggregate effect of all

individually insignificant businesses or (3) businesses acquired after the recasted financial

statements have been filed.

For individual acquisitions consummated on or before the filing of the recasted financial

statements, registrants may measure significance using either (1) the financial statements

filed before the recasted financial statements, generally those in the registrant's previous SEC

annual report or (2) the recasted financial statements for the most recently completed fiscal

year. A registrant must consistently use the financial statements it chooses (i.e., either (1) or

(2)) to measure significance of all individual acquisitions completed on or before the filing

date of the recasted financial statements.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

17 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Illustration 13 — Measuring significance with discontinued operations

Calendar-year Registrant Z, an accelerated filer, acquired Company A on 8 March 20X3 and

acquired Company B on 22 September 20X3. In April 20X3, Registrant Z disposed of a

component that was reported as a discontinued operation in Registrant Z’s 30 June 20X3

Form 10-Q. On 26 August 20X3, Registrant Z filed a registration statement that incorporated

by reference its 30 June 20X3 Form 10-Q and an Item 8.01 Form 8-K that reflected its

recasted financial statements as of 31 December 20X2 and 20X1 and for each of the three

years in the period ended 31 December 20X2.

Because the acquisition of Company A was consummated before the recasted financial

statements were filed, significance should be measured using the financial statements in

Registrant Z’s 31 December 20X2 Form 10-K. However, because the acquisition of

Company B was consummated after the recasted financial statements were filed,

significance may be measured using either the financial statements in the Form 10-K or

the recasted financial statements.

2.4.7 Calculating significance for an exchange transaction (added April 2023)

A registrant and another party each may contribute businesses to a Newco (or joint venture),

receiving in exchange an equity interest in the combined company. In this transaction, the

registrant is giving the other party an interest in a formerly consolidated business in exchange

for an equity interest in the other party’s business. Dispositions and acquisitions effected

through exchange transactions each need to be reported as indicated in Instruction 2 to Item

2.01 of Form 8-K. Item 2.01 specifies separate thresholds for determining when each

transaction is significant. The significance of the disposition and acquisition should be

evaluated separately in determining whether pro forma information about the disposition (and

receipt of an equity investment) is required, and whether audited financial statements of the

business contributed by the other party are required, in which case pro forma information

related to the acquisition also would be required.

Significance of the disposition should be calculated based on the net disposed percentage of

the business contributed to the joint venture (that is, total equity transferred net of the equity

interest retained). The net disposed percentage of the pretax earnings (losses), revenues and

total assets of the disposed business would be compared to the corresponding amounts in the

registrant’s annual financial statements on file before the disposition.

If the net portion of the disposed business exceeds 20% under any of the significance tests,

the disposition is considered significant and pro forma financial information must be furnished

to reflect the effects of the disposition of a controlling interest in the business.

As discussed above, the acquisition of an interest in a business to be accounted for using the

equity method is deemed an acquisition of a business. Therefore, if the interest in the joint

venture will be accounted for using the equity method, financial statements of the business or

businesses contributed by the other party are required under S-X Rule 3-05 or S-X Rule 3-14

if that business exceeds 20% significance.

In this situation, all three significance tests should be based on the acquired percentage of the

other party’s business compared to the registrant’s historical financial statements (without

adjustment for the related disposition of the business contributed by the registrant to the joint

venture). Regardless of whether the transaction is accounted for at fair value, the investment

test should be based on the fair value of the consideration given up or the consideration

received, whichever is more reliably determinable.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

18 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Illustration 14 — Measuring significance in an exchange transaction

On 15 July 20X3, calendar-year Registrant Z contributes Division A-1 to a joint venture in

exchange for a 50% ownership interest. On that date, Company B contributes Division B-1

to the same joint venture in exchange for a 50% ownership interest. Company B also has a

calendar year end.

To determine its reporting requirements, Registrant Z must calculate the significance of

the disposition of Division A-1 and the acquisition of a 50% interest in Division B-1

separately. Below is pertinent financial information of Registrant Z, Division A-1, and

Division B-1. Assume that the fair value of Division B-1 is more reliably determinable than

the fair value of Division A-1, and that the revenue component of the income test was

higher than the income component.

Pre-tax

Income excluding

Noncontrolling

Interest

Average

WWMV

Total

Assets

Book Value

of Net Assets

Fair Value of

Net Assets

Registrant

Z

Division A

-1

Division B

-1

$1,000

$250

$220

$15,000

N/A

N/A

$10,000

$4,100

$4,200

N/A

$800

$1,100

N/A

$1,200

$1,500

Significance of disposition of Division A-1:

Income Test: ($250 x 50%) / $1,000 = 12.5%

Asset Test: ($4,100 x 50%) / $10,000 = 20.5%

Investment Test: ($1,500 x 50%) / $15,000 = 5.0%

Because the significance of the disposition of Division A-1 exceeds 20%, Registrant Z must

report the disposition under Item 2.01 of Form 8-K and furnish Article 11 pro forma financial

information under Item 9.01 of Form 8-K within four business days of the disposal. For

purposes of calculating the investment test, the fair value of Division B-1 was used because

it was concluded to be more reliably determinable than the fair value of Division A-1.

Significance of acquisition of Division B-1:

Because the significance of the acquisition of Division B-1 exceeds 20% based on the asset

test, Registrant Z must report the acquisition under Item 2.01 of Form 8-K and furnish

(1) audited financial statements of Division B-1 as of and for the year ended 31 December

20X2, (2) unaudited interim financial statements of Division B-1 as of and for the three months

ended 31 March 20X3 and statements of income and cash flows for the corresponding

interim period of the prior fiscal year, and (3) related pro forma financial information.

In this example, the pro forma financial information would reflect both the disposition of a

net 50% interest in Division A-1 and the acquisition of a 50% interest in Division B-1 through

the joint venture interest.

Ordinarily, pro forma financial information depicting a significant disposition must be filed

within four business days of the disposition. However, if reporting both the disposition and the

acquisition are required by Form 8-K, a registrant may be unable to present a pro forma

income statement depicting the joint venture formation because financial statements of the

business contributed by the other party are not available. In this case, the acquired business

financial statements and related pro forma financial information need not be filed until 71

days after the original Item 2.01 Form 8-K due date.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

19 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

The initial Form 8-K reporting the transaction should include a narrative description of the

effects of the disposition, quantified to the extent practicable. The amended Form 8-K should

include complete pro forma information depicting the effects of the exchange of interests and

the audited financial statements of the acquired business.

The acquisition or disposition of securities (e.g., common stock) is deemed to be the indirect

acquisition or disposition of the assets represented by such securities if it results in the

acquisition or disposition of control, as indicated in general Instruction 3 to Item 2.01 of

Form 8-K. Therefore, one might conclude that if the investment in the joint venture will not be

consolidated by the registrant, the registrant has not acquired (indirectly) the assets of the

joint venture and no Item 2.01 Form 8-K would be required. However, the SEC staff has not

interpreted the instruction in this manner for the formation of joint ventures and generally will

require the registrant to file an Item 2.01 Form 8-K and appropriate Item 9.01 information if

either the registrant’s disposition or proportionate acquisition is significant.

2.4.8 Calculating significance for an acquisition by a shell company after a forward acquisition

(added April 2023)

When a shell company registrant (or registrant with minimal operating activity) acquires a

business after it has previously acquired an entity deemed to be the shell registrant’s

predecessor (but not accounted for as a reverse acquisition or recapitalization), the SEC staff

has indicated that significance should be measured using the historical financial statements of

the shell company registrant.

Illustration 15 — Acquisition by a shell company after a forward acquisition

Calendar-year shell Registrant Z was incorporated on 19 October 20X1 and has had no

activity since its date of inception.

On 18 August 20X3, shell Registrant Z acquired for cash Company A, that was deemed its

predecessor. The transaction was not accounted for as a reverse acquisition or recapitalization.

On 22 August 20X3, shell Registrant Z filed a Form 8-K containing (1) Company A’s audited

financial statements as of 31 December 20X2 and 20X1 and for each of the three years in

the period ended 31 December 31 20X2, (2) its unaudited interim financial statements as of

and for the six months ended 30 June 20X3 and 20X2, (3) related pro forma financial

information, and (4) all of the information required by Item 2.01(f) of Form 8-K

(i.e., disclosure consistent with a Form 10 Exchange Act registration). On 15 September

20X3, shell Registrant Z acquired Company B, a calendar-year company.

Significance must be determined by comparing the most recent annual pre-acquisition

audited financial statements of Company B (i.e., 31 December 20X2) to shell Registrant Z’s

most recent annual pre-acquisition audited financial statements (i.e., 31 December 20X2),

not the 20X2 financial statements of the predecessor (i.e., Company A) filed in the Form 8-K.

2.4.9 Calculating significance for a step acquisition (added April 2023)

The SEC staff has indicated that when a registrant increases its investment in an entity relative

to the prior year, significance should be based on the additional interest acquired, as opposed to

the cumulative interest to date. However, the significance of step acquisitions that are part of

a single plan to be completed within a 12-month period should be aggregated.

The SEC staff also has indicated that when a registrant increases its investment in an entity

that is already consolidated, financial statements of that subsidiary ordinarily are not required.

However, significance still must be calculated to determine whether pro forma financial

information for the acquisition of the noncontrolling interest will be required in a Form 8-K.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

20 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

Illustration 16 — Acquisition of additional interest in a consolidated subsidiary

Calendar-year Registrant Z acquired a 60% interest in Company A on 15 May 20X1. On

12 June 20X3, Registrant Z acquired the remaining 40% interest in Company A for cash

consideration of $150. At 31 December 20X2, Registrant Z had total assets of $500, a

WWMV of $600, and pretax income from continuing operations of $1,000. At 31 December

20X2, Company A had total assets of $300 and pretax income from continuing operations of

$800. There were no intercompany transactions between Registrant Z and Company A, and

the revenue component of the income test was higher than the income component.

The significance tests for the acquisition of the additional 40% equity interest would be

computed as follows:

Investment test:

Cost of additional 40% interest: $ 150

Registrant Z’s WWMV: $ 600

Significance = 25%

Asset test:

Registrant Z’s additional share of Company A's assets (40% * 300): $ 120

Registrant Z total assets: $ 500

Significance = 24%

Income test:

Registrant Z’s additional share of Company A’s pre-tax income (40% * 800): $ 320

Registrant Z’s pre-tax income attributable to controlling interests: $ 1,000

Significance = 32%

Even though the acquisition of the remaining noncontrolling interest exceeds 20%

significance, Registrant Z need not provide Company A’s audited financial statements on

Form 8-K because Company A previously has been consolidated by Registrant Z. However,

Registrant Z must report on Form 8-K by 16 June 20X3 (i.e., within four business days of the

acquisition date) pro forma financial information. If the pro forma impact of the transaction

only affects the amounts attributable to non-controlling interests, the SEC staff typically

accepts a more abbreviated or narrative presentation.

2.4.10 Calculating significance for a “put-together” transaction (added April 2023)

SEC Staff Accounting Bulletin (SAB) Topic 2.A.8 addresses when two or more businesses

combine in a single business combination just prior to or contemporaneously with an IPO. The

SEC staff believes that the combination of two or more businesses should be accounted for in

accordance with ASC 805. Therefore, even when no combining company’s shareholders

obtain more than 50% of the combined company’s outstanding shares, one of the combining

companies must be identified as the accounting acquirer.

The SEC staff has indicated that significance in a “put-together” transaction should be

measured against the accounting acquirer, regardless of whether the accounting acquirer is a

newly formed entity (Newco).

If there are three or more entities involved in a put-together transaction, all of the non-

accounting acquirer businesses are considered related under S-X Rule 3-05(a)(3), and they

must be treated as a single acquisition for purposes of measuring significance against the

accounting acquirer.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

21 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

If a new acquisition occurs after a put-together IPO but before the filing of the registrant’s

first Form 10-K, the SEC staff has indicated that the registrant should measure significance

using the audited financial statements of the accounting acquirer for the most recent fiscal

year included in the IPO registration statement. However, the registrant may also use pro

formas filed in its IPO registration statement to test significance.

If a new acquisition occurs after the filing of the registrant’s first Form 10-K, the SEC staff has

indicated that the registrant should measure significance using the audited financial

statements of the registrant for the most recent fiscal year in the Form 10-K.

In some cases, such as when the IPO occurs close to the registrant’s fiscal year end, the

registrant’s financial statements presented in Form 10-K only may include operations for a

very short period of time. Upon written request and depending on the proximity of the put-

together transaction to the balance sheet date, the SEC staff will consider whether relief from

the literal application of S-X Rule 3-05 is appropriate. For example, a registrant may request

to use pro forma results as the basis for determining significance.

2.4.11 Determining significance using abbreviated and carve-out financial statements

(added April 2023)

If a registrant is allowed to present abbreviated Rule 3-05 financial statements (see section

6.4.2), the abbreviated financial statements can be used to test significance. For example, the

income component of the income test would compare the acquired business’s revenue less

direct expenses with the registrant’s income or loss from continuing operations before taxes,

net of amounts attributable to any noncontrolling interest. Financial statements of the

business component that reflect cost allocations required or permitted by SAB Topic 1.B

(carve-out financial statements) may be used in determining the significance of the business

under the income test (see section 6.4.1).

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

22 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

3 Filing Rule 3-05 financial statements

Rule 3-05 financial statements must be filed on Form 8-K, in certain Securities Act registration

statements and proxy statements as described below. The pro formas must accompany these

financial statements and are addressed in section 7, Pro forma financial information.

3.1 Form 8-K

A registrant must report the acquisition of a significant business under Item 2.01, Completion of

Acquisition or Disposition of Assets, of Form 8-K by the fourth business day after consummation.

However, if the acquisition occurs within four business days of filing a Form 10-Q or Form 10-K

,

the acquisition may be initially reported in that periodic report.

The registrant also must file Rule 3-05 financial statements and pro formas under Item 9.01,

Financial Statements and Exhibits, of Form 8-K by the 71st calendar day after the Item 2.01

due date. If the Rule 3-05 financial statements and pro formas are not included in the initial

Form 8-K, the registrant must state in the initial report that it will file them within 71 days.

If

either of these due dates occurs on a weekend or a holiday, a registrant can file on the next

business day.

General Instruction A of Form 8-K allows a registrant to skip filing an Item 9.01 Form 8-K containing

Rule 3-05 financial statements and pro formas if the registrant already included the information in

a registration statement, and the information in the Form 8-K would be “substantially the same”

as what is presented in that registration statement. This instruction generally allows registrants

to skip filing an Item 9.01 Form 8-K if the Rule 3-05 financial statements it would need to

provide in the Form 8-K would need only one additional interim quarter based on the financial

statement age requirements discussed below. However, registrants will need to file an Item 9.01

Form 8-K if they previously filed third-quarter financial information of an acquired business and

the Form 8-K requires audited financial statements for the latest annual period.

3.1.1 Consolidation of a legal entity (added April 2023)

Instruction 2 to Item 2.01 of Form 8-K includes consolidations in the definition of acquisitions.

Accordingly, when a registrant consolidates a legal entity (including a variable interest entity or a

voting interest entity pursuant to ASC 810, Consolidations), the registrant should consider whether

the initial consolidation represents a significant business acquisition that should be reported under

Item 2.01 of Form 8-K, even though the registrant might have issued no consideration.

If the entity meets the SEC’s definition of a business and its significance exceeds 20%, the registrant

must report the consolidation as an acquisition under Item 2.01 of Form 8-K and file Rule 3-05

financial statements and pro formas under Item 9.01 of Form 8-K as discussed above. If the entity

is not a business, the consolidation should be reported as an asset acquisition under Item 2.01 of

Form 8-K if its significance exceeds 10%.

Similarly, a registrant also should consider whether it has a Form 8-K reporting obligation for the

disposal of a significant business or assets when an entity is deconsolidated.

3.1.2 Voluntary reporting (added April 2023)

Registrants may voluntarily file a Form 8-K to report a business acquisition when the level of

significance does not exceed 20%. In that case, the acquisition should be reported under Item 8.01,

Other Events, of Form 8-K, rather than under Items 2.01 and 9.01 of Form 8-K.

Rule 3-05 financial statements and pro formas are not required when a registrant voluntarily

reports a business acquisition under Item 8.01 of Form 8-K. However, this information may

be required in a registration statement if the aggregate significance of individually

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

23 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

insignificant acquisitions acquired since the registrant’s most recent audited balance sheet

date exceeds 50% (see section 3.2.3) or the aggregate significance of a group of related

acquired businesses exceeds 20% (see section 2).

3.1.3 Related businesses (added April 2023)

In contrast to registration and proxy statements, Form 8-K is not required to report

acquisitions of individually insignificant businesses, unless such businesses are related

businesses and are significant in the aggregate. Related businesses are treated as if they are

a single business for the purpose of Form 8-K, and aggregate significance will increase as the

businesses are acquired if the acquisitions are not consummated at the same time.

Separate or combined financial statements (depending on the application of ASC 810) of the

related businesses must be reported on Form 8-K once the cumulative significance exceeds

20% and may need to be updated in additional Form 8-K filings.

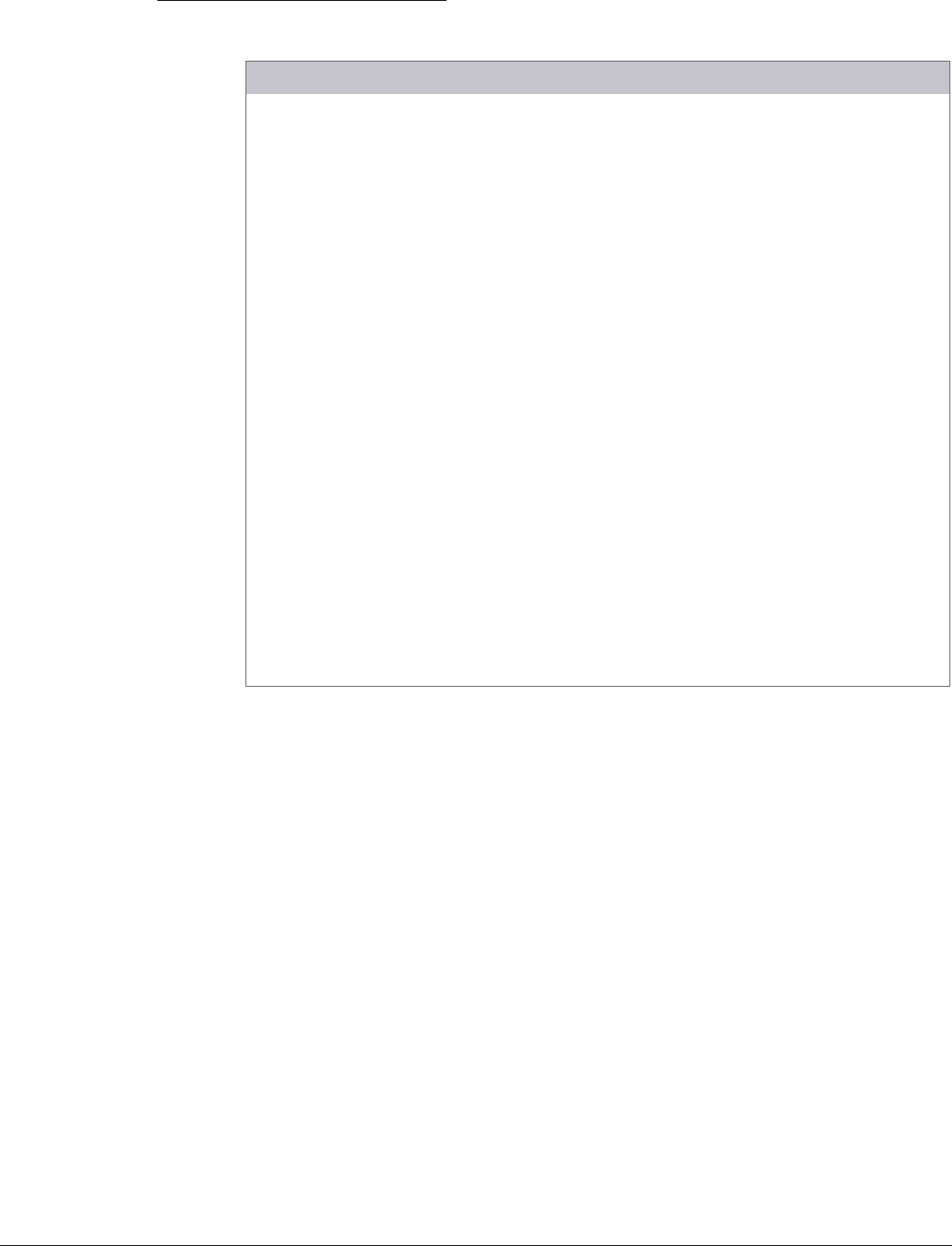

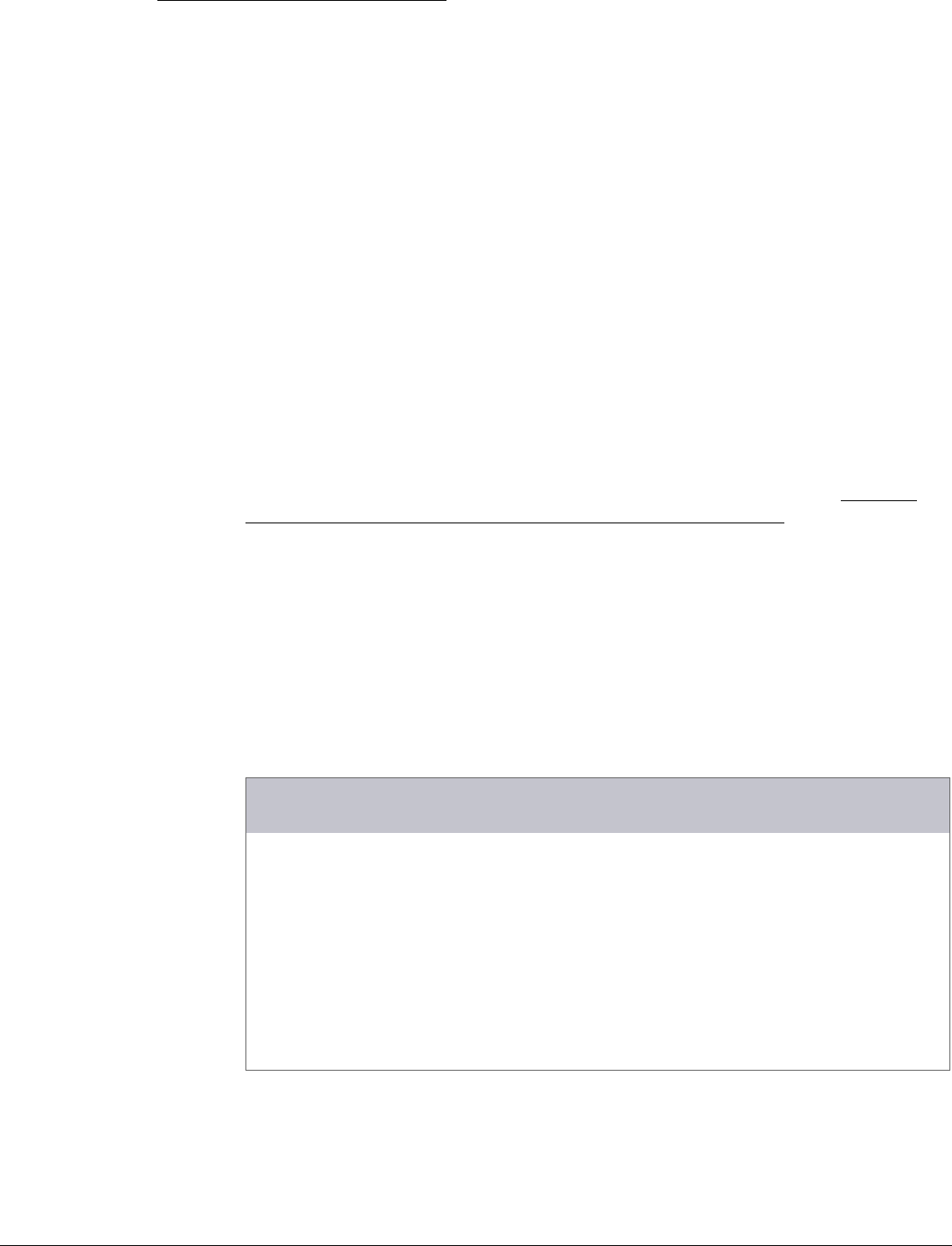

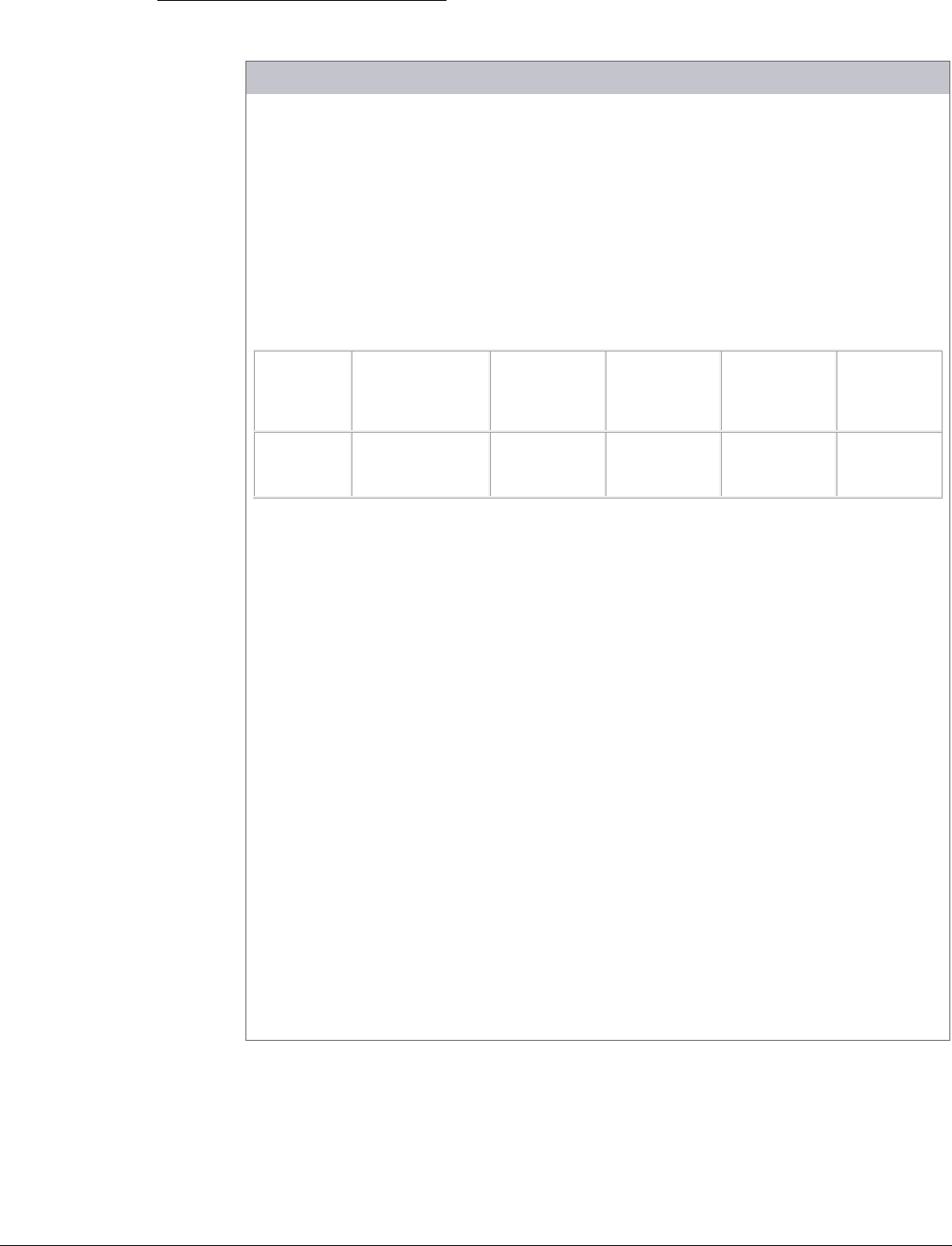

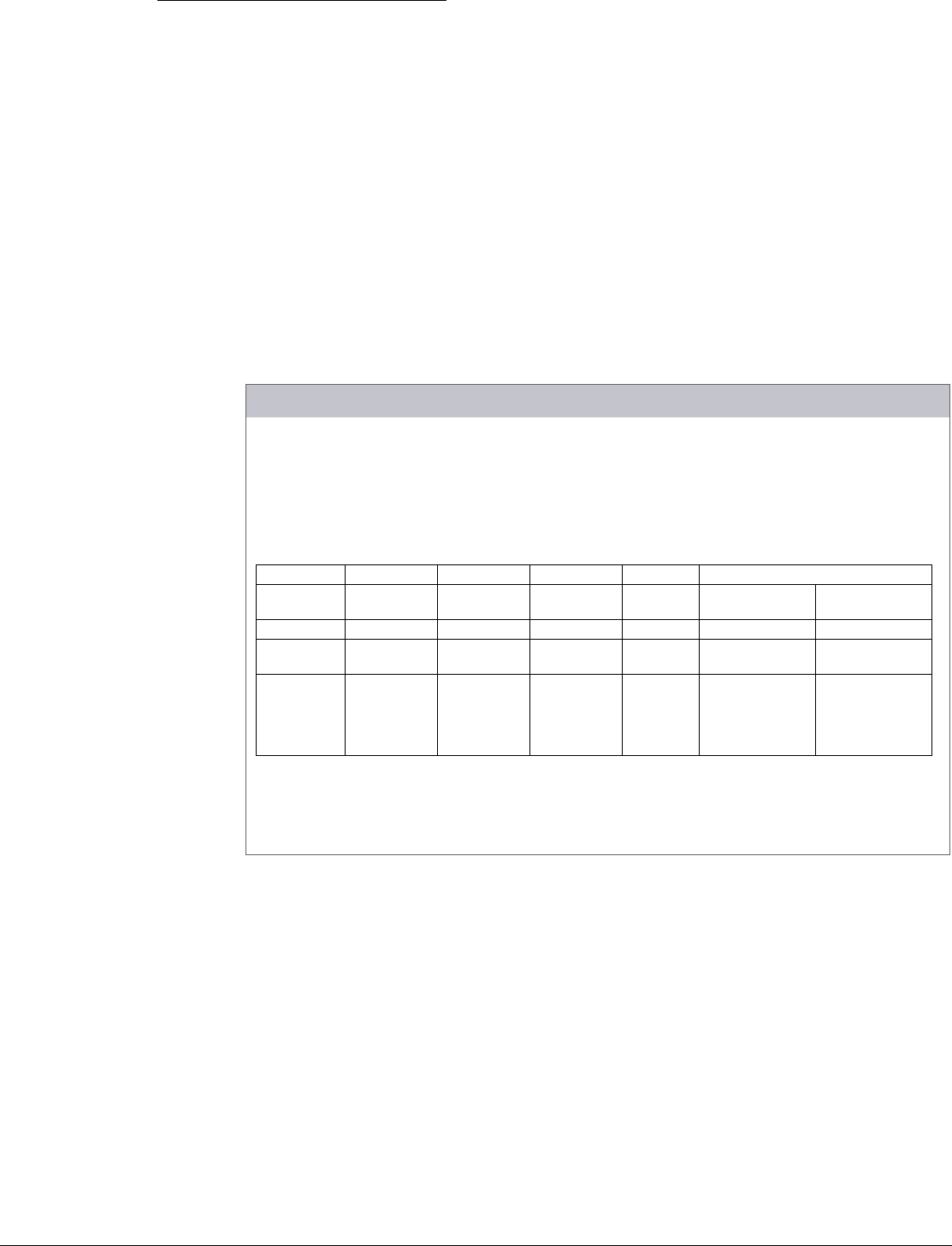

Illustration 17 — Reporting acquisition of significant related businesses on Form 8-K

Registrant Z acquired calendar-year Companies A, B and C on various dates in 20X2. The

acquisition of each business was conditioned on a single common event. Companies A, B and

C are not under common control or management. Because the acquisition of each business

was conditioned on a single common event, Companies A, B and C are related businesses.

Below is a summary of the Form 8-K filing requirements.

Rule 3-05 Financial statements

Company

Acquisition

Date

Individual

significance

Cumulative

significance

Form 8-K

required?

Audited annual

Unaudited

interim

A

3/25/20X2

18%

18%

No

N/A

N/A

B 5/13/20X2 14% 32% Yes

A - 20X1

B - 20X1

A - N/A

B - 3/31/20X2

C 6/18/20X2 19% 51% Yes

A** - 20X1,

20X0

B** - 20X1,

20X0

C - 20X1, 20X0

A - N/A

B* -

3/31/20X2,

3/31/20X1

C - 3/31/20X2,

3/31/20X1

* A comparative interim period is not required for Company B when cumulative significance is 32%. However,

once cumulative significance rises above 40%, the comparative period is required.

** Audited financial statements for one year are required for Companies A and B when cumulative significance is 32%.

However, once cumulative significance rises above 40%, two years of audited financial statements are required.

3.2 Registration and proxy statements

In registration statements (except as provided otherwise for filings on Forms S-4 or F-4) or

proxy statements (except for merger proxies), a registrant must also provide Rule 3-05

financial statements and pro formas. However, the requirements and due dates are different

from those for Form 8-K, and a registrant may need to provide disclosures about additional

acquired businesses.

See sections 3.3 and 3.4 for a discussion of financial statement requirements of merger proxy

statements and registration statements on Forms S-4 or F-4, respectively.

3.2.1 Completed individual acquisitions

Rule 3-05 financial statements and pro formas must be included in a registration statement for a

significant business that has already been acquired unless all of the following conditions are met:

• The business is 50% significant or less.

EY AccountingLink |

ey.com/en_us/assurance/accountinglink

24 | Technical Line Applying the SEC’s requirements for significant acquired businesses Updated 6 April 2023

• The registration statement is filed or declared effective no more than 74 days after

consummation (interpreted as one day before the Item 9.01 Form 8-K due date).

• The financial statements have not already been filed by the registrant.

Rule 3-05 financial statements and pro formas for a completed acquisition that is more than

20% significant but no more than 50% significant may be omitted from a registration statement

that is filed or becomes effective within 70 calendar days of the Item 2.01 Form 8-K due date.

However, the registrant is still required to file Rule 3-05 financial statements and pro formas

in an Item 9.01 Form 8-K by the 71st day.

Illustration 18 — Omitting an acquired business that is 50% or less significant

On Monday, 4 March 20X3, Registrant A completes the acquisition of Company B (30%

significant). The Item 2.01 Form 8-K is due on 8 March, and the Item 9.01 Form 8-K is due

on 19 May. Through 18 May, Registrant A can file or have a registration statement

declared effective without Rule 3-05 financial statements and pro formas that reflect the

acquisition of Company B.

Rule 3-05 financial statements and pro formas for a completed acquisition that is more than

50% significant must always be included in a registration statement, unless the results of the

acquired business have been included in a registrant’s post-acquisition results for 12 months

as described further below. These requirements also apply to offerings conducted under a

shelf registration statement on Form S-3 (shelf offering) that is already effective. However,

the following securities offerings may proceed under an effective registration statement even

though financial statements of the acquired business have not yet been filed: (1) offerings or

sale of securities upon the conversion of outstanding convertible securities or upon the exercise

of outstanding warrants or rights, (2) dividend or interest reinvestment plans, (3) employee

benefit plans, (4) secondary offerings and (5) sales of securities pursuant to Rule 144.

Before conducting a shelf offering, a registrant must also consider whether a completed

acquisition of a business that is 50% or less significant, for which Rule 3-05 financial

statements and pro formas have not been filed, represents a “fundamental change” in

accordance with Rule 512 of Regulation S-K. If the acquisition represents a fundamental